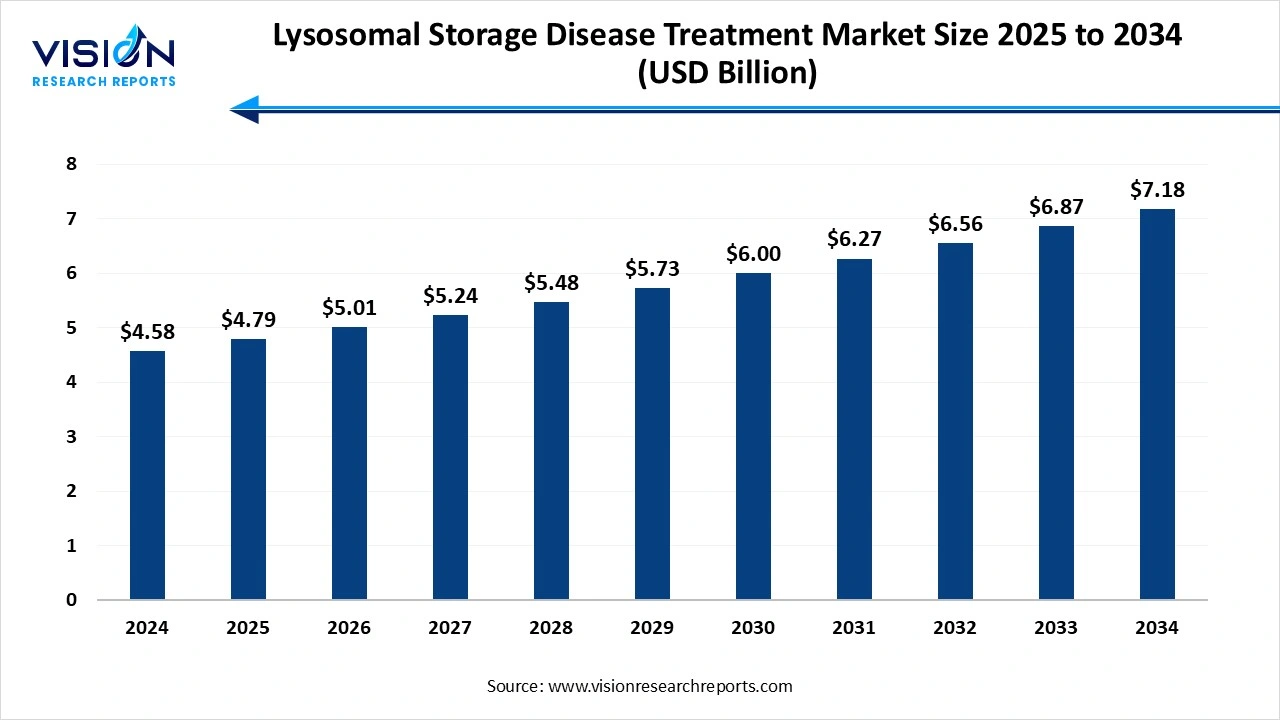

The global lysosomal storage disease treatment market size was estimated at USD 4.58 billion in 2024, expected to grow to USD 4.79 billion in 2025, and projected to exceed USD 7.18 billion by 2034, with a CAGR ranging from 4.6% over the forecast period.The market growth is driven by increasing awareness of rare genetic disorders, the Lysosomal Storage Disease Treatment Market is experiencing growth due to advancements in enzyme replacement therapies and gene therapy innovations.

Lysosomal storage diseases or disorders (LSDs) are rare genetic conditions that cause a buildup of toxic materials in your body’s cells. People with LSDs lack certain substances that helps the enzymes work. Without functioning enzymes, your body is unable to break down fats and sugars. If those build up in your body, they can be quite harmful. Lysosomal storage diseases usually appear during pregnancy or soon after birth.

The lysosomal storage disease (LSD) treatment market is experiencing steady growth, driven by increasing awareness, advancements in enzyme replacement therapies (ERT) and rising diagnostic capabilities. Although these disorders are rare, the growing global prevalence due to improved screening techniques has created a significant demand for innovative treatments.

The lysosomal storage disease (LSD) treatment market is primarily driven by advancements in therapeutic technologies such as enzyme replacement therapy (ERT), gene therapy, and substrate reduction therapy. These innovations have significantly improved the management of various LSDs, offering longer life expectancy and better quality of life for patients. Additionally, the increased availability of genetic testing and newborn screening programs has led to earlier diagnosis, allowing for prompt and more effective treatment interventions.

Regulatory support through orphan drug incentives, fast-track approvals, and growing awareness among healthcare providers and patients are further accelerating market growth. The expansion of healthcare infrastructure and increasing investments in rare disease research, especially in emerging economies, are also contributing to market expansion.

Increasing Prevalence of LSDs

The increasing incidence of lysosomal storage diseases (LSDs) on a global level is a key driver in the Lysosomal Storage Diseases Treatment Market. With an estimated prevalence of almost 1 in 7,700 births for certain LSDs, the demand for effective therapies is always on the rise. This situation is particularly evident in regions that have improved diagnostic capabilities, thus leading to earlier detection and treatment. As awareness about childcare and genetics grows, healthcare systems are increasingly prioritizing the management and treatment of such rare diseases, expanding the market’s potential.

Another major key driver is the advancement of newborn screening programs across the world, which has led to earlier diagnosis of various LSDs. Countries are progressively expanding their recommended panels to include conditions such as Pompe disease and MPS I. Early detection enables the timely initiation of treatment, significantly improving long-term disease outcomes. As more and more countries implement such measures, this will enhance proactive management and align industry strategies with early therapeutic interventions.

Complications in Diagnosis

Lysosomal storage diseases (LSDs) are rare genetic disorders that present significant diagnostic challenges. Their symptoms are often non-specific, and their severity varies widely among individuals, making it difficult for healthcare providers to accurately diagnose the condition without specialized testing.

Further complicating diagnosis is the lack of well-defined biomarkers and the variability in the age of symptom onset. With multiple causative genes involved, genetic testing becomes complex, and access to specialized diagnostic tools remains limited in certain regions and healthcare settings.

Patient Advocacy Groups and Regulatory Agencies

Patient advocacy groups and healthcare organizations have also contributed to raising public awareness, creating key opportunities for the market and encouraging individuals to seek medical attention, thus increasing diagnosis rates. Efforts to develop novel therapeutic approaches including gene therapy, substrate reduction therapy and small molecule drugs are ongoing. Innovative treatments like enzyme replacement therapy and gene editing technologies further contribute to the expansive range of available options for managing and treating lysosomal storage diseases.

Regulatory agencies are another such key opportunity. These agencies are increasingly supportive of the development of therapies for rare diseases, including lysosomal storage disorders. Initiatives such as orphan drug designations and detailed review processes help to encourage pharmaceutical companies in investing in this niche market. This regulatory environment fosters innovation and boosts the availability of new treatments, thus leading to market growth and development.

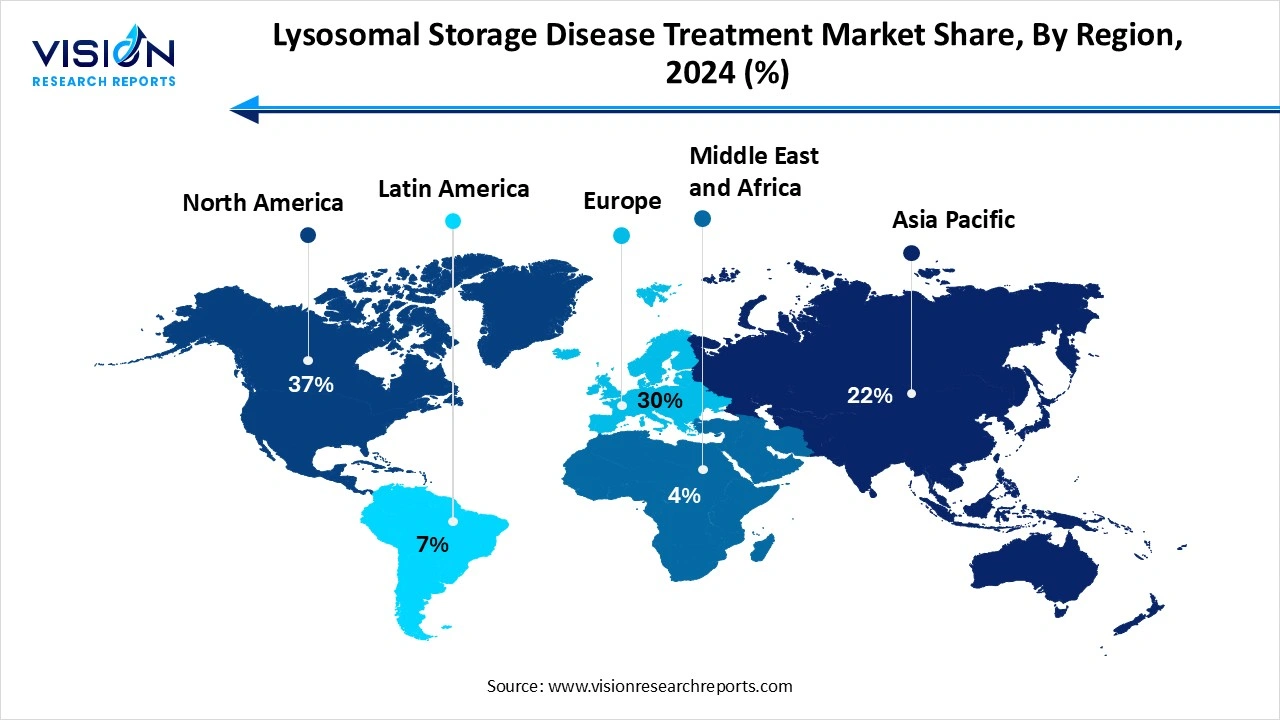

North America accounted for the largest share of the lysosomal storage disease (LSDs) treatment market in 2024, capturing 37% of the total market. This is because the region benefits from favorable regulatory frameworks such as orphan drug incentives, which support the development and commercialization of therapies for rare diseases like LSDs. Additionally, the availability of advanced treatment options, comprehensive insurance coverage and active patient advocacy networks contribute to the region’s market dominance. Additionally, the region is home to major pharmaceutical companies that continue to actively invest in clinical research and novel enzyme therapies. High awareness among physicians and patients also supports the rapid adoption of such treatments..

Asia Pacific is expected to witness the fastest growth rate during the forecast period. The region’s rapid growth is fueled by rising healthcare investments, growing awareness of rare diseases and the gradual improvement in diagnostic and therapeutic infrastructure. Countries all across the region are improving the process of rare disease detection by adopting advanced genetic testing technologies. Pharmaceutical firms are also entering into strategic alliances in order to boost therapy availability and scale distribution. Rising healthcare expenditure and urbanization are also contributing to better access to specialist care.

Which treatment type held the largest market share in 2024?

The enzyme replacement therapy segment led the market, accounting for the largest revenue share of 84% in 2024. This type of treatment works by delivering a functional version of the missing or defective enzyme to the patient's body, helping to break down the accumulated substrates within cells. This leads to significantly improved clinical outcomes for various LSDs, such as Gaucher disease, Fabry disease and Pompe disease. Despite its high cost, ERT continues to be widely adopted, especially in developed markets where reimbursement policies and healthcare infrastructure support its use.

The substrate reduction therapy segment is anticipated to experience the fastest growth. This therapy works by limiting the production of substrates that accumulate due to enzyme deficiencies, thus reducing the burden on the lysosomal system. This oral treatment option is gaining popularity due to its ease of administration and potential to improve patient compliance.

Which disease type dominated the market in 2024?

The fabry disease held the largest revenue share in 2024, accounting for 30% of the market. This type of disease is caused by a deficiency of the enzyme alpha-galactosidase A, leading to the accumulation of globotriaosylceramide in blood vessels, kidneys, heart and nervous system. The disease affects both males and females, although symptoms tend to be more severe in males. Over the years, increased awareness and improved diagnostic capabilities have led to early detection and timely intervention.

The Pompe disease segment is expected to witness rapid growth. This disorder can present itself at any time, whether in infancy or adulthood, with infantile-onset Pompe disease being more severe and rapidly progressive. The availability of enzyme replacement therapy has significantly improved survival rates and quality of life, especially when treatment begins early.

By Treatment Type

By Disease Type

By Regional

Lysosomal Storage Disease Treatment Market

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Lysosomal Storage Disease Treatment Market

5.1. COVID-19 Landscape: Lysosomal Storage Disease Treatment Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Lysosomal Storage Disease Treatment Market, By Treatment Type

8.1. Lysosomal Storage Disease Treatment Market, by Treatment Type, 2024-2034

8.1.1. Enzyme Replacement Therapy

8.1.1.1. Market Revenue and Forecast (2024-2034)

8.1.2. Substrate Reduction Therapy

8.1.2.1. Market Revenue and Forecast (2024-2034)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2024-2034)

Chapter 9. Global Lysosomal Storage Disease Treatment Market, By Disease Type

9.1. Lysosomal Storage Disease Treatment Market, by Disease Type, 2024-2034

9.1.1. Gaucher Disease

9.1.1.1. Market Revenue and Forecast (2024-2034)

9.1.2. Mucopolysaccharidoses

9.1.2.1. Market Revenue and Forecast (2024-2034)

9.1.3. Pompe Disease

9.1.3.1. Market Revenue and Forecast (2024-2034)

9.1.4. Fabry Disease

9.1.4.1. Market Revenue and Forecast (2024-2034)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2024-2034)

Chapter 10. Global Lysosomal Storage Disease Treatment Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Treatment Type

11.1.2. Market Revenue and Forecast, by Disease Type

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Treatment Type

11.1.4.2. Market Revenue and Forecast, by Disease Type

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Treatment Type

11.1.5.2. Market Revenue and Forecast, by Disease Type

11.2. Europe

11.2.1. Market Revenue and Forecast, by Treatment Type

11.2.2. Market Revenue and Forecast, by Disease Type

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Treatment Type

11.2.4.2. Market Revenue and Forecast, by Disease Type

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Treatment Type

11.2.5.2. Market Revenue and Forecast, by Disease Type

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Treatment Type

11.2.6.2. Market Revenue and Forecast, by Disease Type

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Treatment Type

11.2.7.2. Market Revenue and Forecast, by Disease Type

11.3. APAC

11.3.1. Market Revenue and Forecast, by Treatment Type

11.3.2. Market Revenue and Forecast, by Disease Type

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Treatment Type

11.3.4.2. Market Revenue and Forecast, by Disease Type

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Treatment Type

11.3.5.2. Market Revenue and Forecast, by Disease Type

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Treatment Type

11.3.6.2. Market Revenue and Forecast, by Disease Type

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Treatment Type

11.3.7.2. Market Revenue and Forecast, by Disease Type

11.4. MEA

11.4.1. Market Revenue and Forecast, by Treatment Type

11.4.2. Market Revenue and Forecast, by Disease Type

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Treatment Type

11.4.4.2. Market Revenue and Forecast, by Disease Type

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Treatment Type

11.4.5.2. Market Revenue and Forecast, by Disease Type

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Treatment Type

11.4.6.2. Market Revenue and Forecast, by Disease Type

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Treatment Type

11.4.7.2. Market Revenue and Forecast, by Disease Type

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Treatment Type

11.5.2. Market Revenue and Forecast, by Disease Type

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Treatment Type

11.5.4.2. Market Revenue and Forecast, by Disease Type

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Treatment Type

11.5.5.2. Market Revenue and Forecast, by Disease Type

Chapter 11. Company Profiles

11.1. Takeda Pharmaceutical Company Limited

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. BioMarin Pharmaceutical Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Amicus Therapeutics, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Pfizer Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Johnson & Johnson

11.5. Intermountain Life Sciences

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Alexion Pharmaceuticals, Inc. (AstraZeneca)

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Avrobio, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Actelion Pharmaceuticals Ltd

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Protalix BioTherapeutics, Inc.

11.9. Evoqua Water Technologies

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others