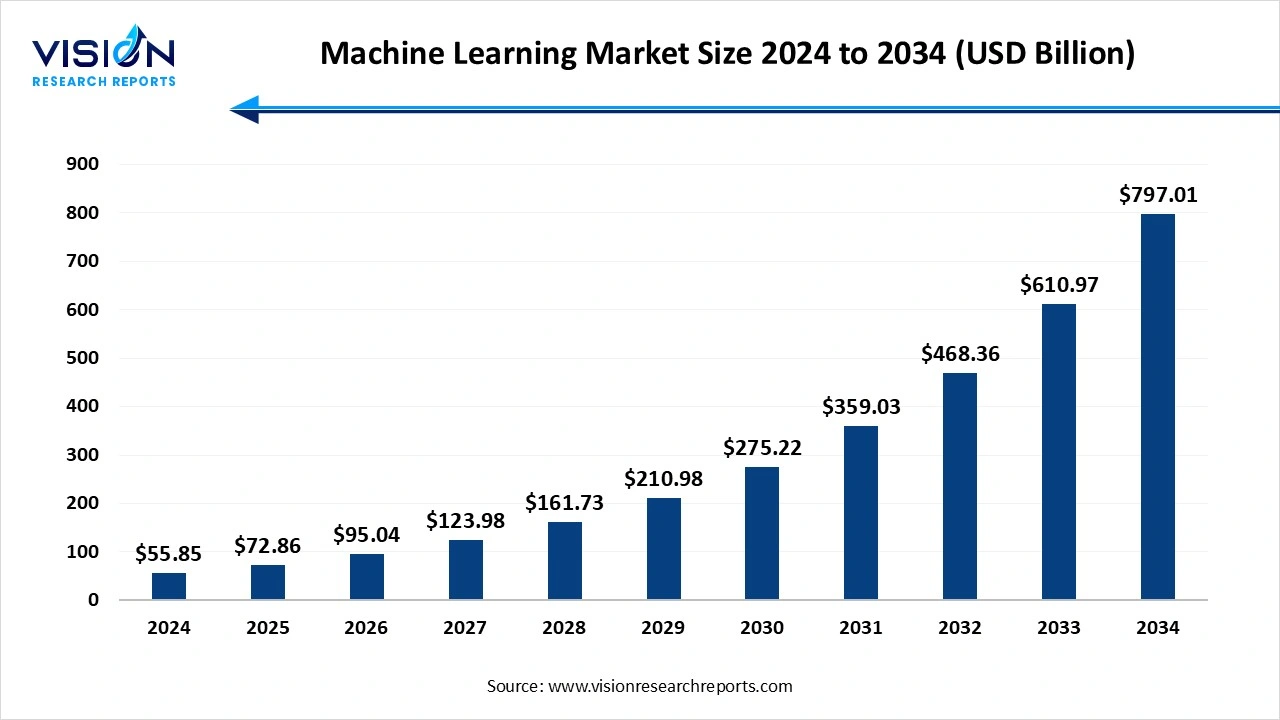

The global machine learning market size stood at USD 55.85 billion in 2024 and is estimated to reach USD 72.86 billion in 2025. It is projected to hit USD 797.01 billion to reach by 2034, growing at a CAGR of 30.45% from 2025 to 2034.

Key Pointers

Key PointersThe global machine learning (ML) market is experiencing robust growth as organizations increasingly integrate data-driven intelligence into core operations. Demand is rising across industries such as healthcare, finance, retail, manufacturing, and cybersecurity, driven by the need for automation, predictive analytics, and real-time decision-making. Advancements in deep learning, cloud computing, and scalable data infrastructure are accelerating ML adoption, while the expansion of big data and IoT ecosystems continues to generate new opportunities. Enterprises are investing heavily in ML-powered solutions to enhance efficiency, improve customer engagement, and gain competitive advantage. As a result, the market is expected to witness sustained expansion, supported by technological innovation, growing enterprise AI maturity, and the increasing availability of pre-trained models and automated ML tools.

The growth of the machine learning market is driven by the exponential increase in data generation across various industries is fueling demand for advanced analytics capabilities provided by machine learning algorithms. These algorithms are increasingly vital for extracting actionable insights from large datasets, enhancing decision-making processes, and driving operational efficiencies. Secondly, advancements in deep learning techniques and neural networks are significantly improving the accuracy and efficiency of machine learning models. This progress is expanding the applicability of machine learning across sectors such as healthcare, finance, retail, and automotive, where complex data analysis and predictive capabilities are crucial. Thirdly, the availability of cloud computing resources is democratizing access to machine learning tools, enabling businesses of all sizes to leverage scalable AI solutions without substantial upfront investments in infrastructure.

| Report Coverage | Details |

| Market Size in 2024 | USD 55.85 Billion |

| Revenue Forecast by 2034 | USD 797.01 Billion |

| Growth rate from 2025 to 2034 | CAGR of 30.45% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Amazon Web Services, Inc.; Baidu Inc.; Google Inc.; H2O.ai; Hewlett Packard Enterprise Development LP; Intel Corporation; International Business Machines Corporation; Microsoft Corporation; SAS Institute Inc.; SAP SE. |

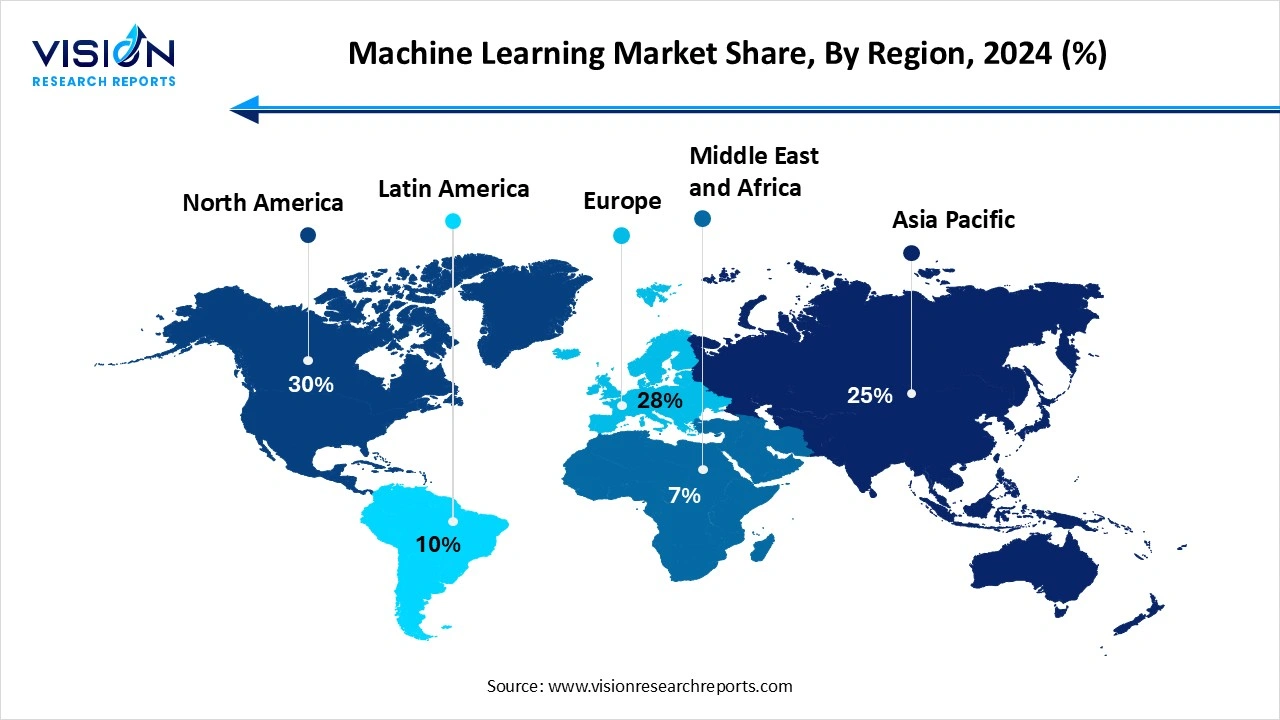

North America dominated the market in 2024, capturing a revenue share of 30%. The region places a strong emphasis on ethical AI and responsible AI practices, ensuring fairness, transparency, and accountability in machine learning models and algorithms. Efforts are underway to mitigate biases, protect privacy, and address ethical concerns related to AI applications through regulatory frameworks, guidelines, and industry standards.

Asia Pacific is witnessing rapid adoption of machine learning and AI technologies, particularly in countries like China, India, and South Korea. These emerging economies are leveraging AI to boost productivity, drive economic growth, and address societal challenges.

Asia Pacific is witnessing rapid adoption of machine learning and AI technologies, particularly in countries like China, India, and South Korea. These emerging economies are leveraging AI to boost productivity, drive economic growth, and address societal challenges.

Government initiatives, investments in research and development, and robust technological ecosystems are fostering growth in the region's machine learning industry. For instance, Baidu Inc. announced plans in January 2023 to introduce an AI-powered chatbot service similar to OpenAI's ChatGPT, highlighting the region's advancements in AI technology adoption.

In 2024, the service segment dominated the market, capturing a significant revenue share of 55%. The machine learning market is segmented into hardware, software, and service components. Over the forecast period, the hardware segment is expected to achieve the highest compound annual growth rate (CAGR). This growth can be attributed to the increasing adoption of machine learning-optimized hardware. Companies are developing specialized silicon processors with enhanced AI and ML capabilities, driving the uptake of hardware solutions. Industry growth is further supported by innovations from firms like SambaNova Systems, which are advancing processing devices with greater computational power.

The software segment is anticipated to maintain a modest market share. Growth in this segment is bolstered by improved cloud infrastructure and hosting capabilities, facilitating the adoption of cloud-based applications. Cloud-based software enables seamless transitions from machine learning to deep learning applications. Additionally, there is a rising demand for machine learning services, where managed services enable customers to manage their ML tools and handle diverse dependency stacks efficiently.

Large enterprises dominated the market in 2024, commanding a revenue share. The machine learning market categorizes enterprises into Small and Medium Enterprises (SMEs) and large enterprises based on size. Large enterprises are increasingly leveraging cloud-based machine learning platforms and services. Scalable and cost-effective cloud infrastructure enables these enterprises to train and deploy machine learning models effectively. Services such as Amazon Web Services (AWS), Google Cloud AI Platform, and Microsoft Azure Machine Learning provide pre-built models, distributed training capabilities, and infrastructure management, enabling large enterprises to adopt machine learning without significant infrastructure investments.

The adoption of machine learning is rapidly increasing among small and medium-sized enterprises (SMEs). Despite resource constraints, SMEs benefit from machine learning platforms and technologies that automate data analysis processes. This automation enables SMEs to extract valuable insights from their data, enhancing understanding of consumer behavior, optimizing inventory management, refining marketing strategies, and making data-driven decisions with minimal human intervention.

In 2024, the advertising & media segment held the largest market share. Machine learning algorithms are pivotal in hyper-personalization, analyzing vast user data volumes to create highly personalized and relevant advertisements that enhance engagement and conversion rates. Cross-channel optimization is another key trend, where machine learning algorithms optimize advertising campaigns across multiple channels by planning budgets and adjusting bidding strategies. Additionally, there is growing adoption of machine learning for ad fraud detection, ensuring the effectiveness of ad campaigns and safeguarding budgets by identifying and mitigating fraudulent activities like click and impression fraud.

The legal segment is expected to witness the highest CAGR during the forecast period. Machine learning is transforming legal practices by enhancing task handling, information processing, and decision-making for legal professionals. Predictive analytics is a prominent trend, where machine learning algorithms analyze extensive legal data to predict case outcomes, assess risks, and support legal strategies. This trend empowers lawyers to make informed decisions based on data, thereby improving case management efficiency and driving segment growth.

By Component

By Enterprise Size

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Component Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Machine Learning Market

5.1. COVID-19 Landscape: Machine Learning Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Machine Learning Market, By Component

8.1. Machine Learning Market, by Component,

8.1.1 Hardware

8.1.1.1. Market Revenue and Forecast

8.1.2. Software

8.1.2.1. Market Revenue and Forecast

8.1.3. Services

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Machine Learning Market, By Enterprise Size

9.1. Machine Learning Market, by Enterprise Size,

9.1.1. SMEs

9.1.1.1. Market Revenue and Forecast

9.1.2. Large Enterprises

9.1.2.1. Market Revenue and Forecast

Chapter 10. Global Machine Learning Market, By End-use

10.1. Machine Learning Market, by End-use,

10.1.1. Healthcare

10.1.1.1. Market Revenue and Forecast

10.1.2. BFSI

10.1.2.1. Market Revenue and Forecast

10.1.3. Law

10.1.3.1. Market Revenue and Forecast

10.1.4. Retail

10.1.4.1. Market Revenue and Forecast

10.1.5. Advertising & Media

10.1.5.1. Market Revenue and Forecast

10.1.6. Automotive & Transportation

10.1.6.1. Market Revenue and Forecast

10.1.7. Agriculture

10.1.7.1. Market Revenue and Forecast

10.1.8. Manufacturing

10.1.8.1. Market Revenue and Forecast

10.1.9. Others

10.1.9.1. Market Revenue and Forecast

Chapter 11. Global Machine Learning Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Component

11.1.2. Market Revenue and Forecast, by Enterprise Size

11.1.3. Market Revenue and Forecast, by End-use

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Component

11.1.4.2. Market Revenue and Forecast, by Enterprise Size

11.1.4.3. Market Revenue and Forecast, by End-use

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Component

11.1.5.2. Market Revenue and Forecast, by Enterprise Size

11.1.5.3. Market Revenue and Forecast, by End-use

11.2. Europe

11.2.1. Market Revenue and Forecast, by Component

11.2.2. Market Revenue and Forecast, by Enterprise Size

11.2.3. Market Revenue and Forecast, by End-use

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Component

11.2.4.2. Market Revenue and Forecast, by Enterprise Size

11.2.4.3. Market Revenue and Forecast, by End-use

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Component

11.2.5.2. Market Revenue and Forecast, by Enterprise Size

11.2.5.3. Market Revenue and Forecast, by End-use

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Component

11.2.6.2. Market Revenue and Forecast, by Enterprise Size

11.2.6.3. Market Revenue and Forecast, by End-use

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Component

11.2.7.2. Market Revenue and Forecast, by Enterprise Size

11.2.7.3. Market Revenue and Forecast, by End-use

11.3. APAC

11.3.1. Market Revenue and Forecast, by Component

11.3.2. Market Revenue and Forecast, by Enterprise Size

11.3.3. Market Revenue and Forecast, by End-use

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Component

11.3.4.2. Market Revenue and Forecast, by Enterprise Size

11.3.4.3. Market Revenue and Forecast, by End-use

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Component

11.3.5.2. Market Revenue and Forecast, by Enterprise Size

11.3.5.3. Market Revenue and Forecast, by End-use

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Component

11.3.6.2. Market Revenue and Forecast, by Enterprise Size

11.3.6.3. Market Revenue and Forecast, by End-use

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Component

11.3.7.2. Market Revenue and Forecast, by Enterprise Size

11.3.7.3. Market Revenue and Forecast, by End-use

11.4. MEA

11.4.1. Market Revenue and Forecast, by Component

11.4.2. Market Revenue and Forecast, by Enterprise Size

11.4.3. Market Revenue and Forecast, by End-use

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Component

11.4.4.2. Market Revenue and Forecast, by Enterprise Size

11.4.4.3. Market Revenue and Forecast, by End-use

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Component

11.4.5.2. Market Revenue and Forecast, by Enterprise Size

11.4.5.3. Market Revenue and Forecast, by End-use

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Component

11.4.6.2. Market Revenue and Forecast, by Enterprise Size

11.4.6.3. Market Revenue and Forecast, by End-use

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Component

11.4.7.2. Market Revenue and Forecast, by Enterprise Size

11.4.7.3. Market Revenue and Forecast, by End-use

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Component

11.5.2. Market Revenue and Forecast, by Enterprise Size

11.5.3. Market Revenue and Forecast, by End-use

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Component

11.5.4.2. Market Revenue and Forecast, by Enterprise Size

11.5.4.3. Market Revenue and Forecast, by End-use

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Component

11.5.5.2. Market Revenue and Forecast, by Enterprise Size

11.5.5.3. Market Revenue and Forecast, by End-use

Chapter 12. Company Profiles

12.1. Amazon Web Services, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Baidu Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Google Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. H2O.ai

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Intel Corporation

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. International Business Machines Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Hewlett Packard Enterprise Development LP

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Microsoft Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. SAS Institute Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. SAP SE.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others