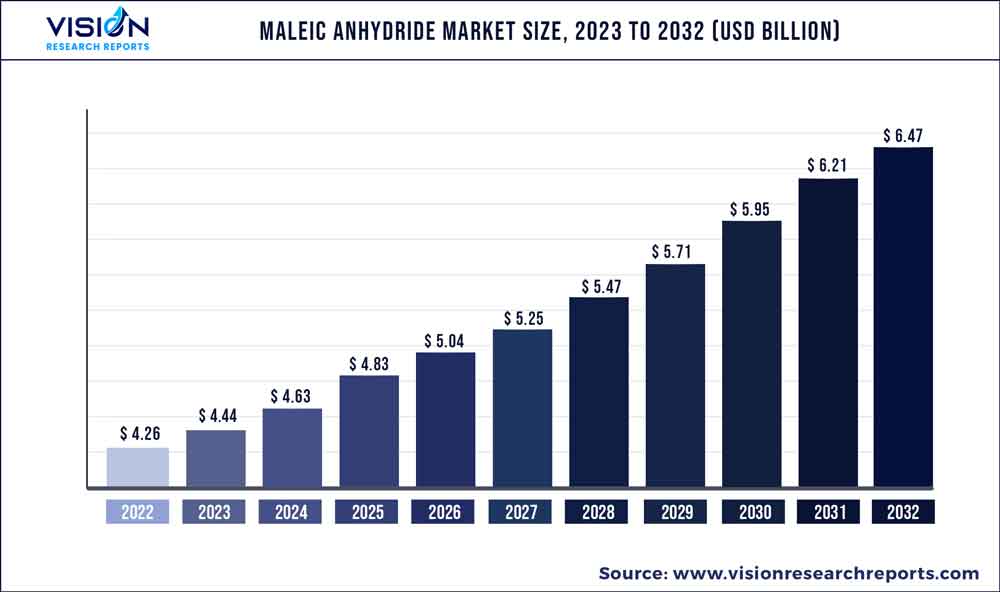

The global maleic anhydride market size was estimated at around USD 4.26 billion in 2022 and it is projected to hit around USD 6.47 billion by 2032, growing at a CAGR of 4.27% from 2023 to 2032. The maleic anhydride market in the United States was accounted for USD 0.7 billion in 2022.

Key Pointers

Report Scope of the Maleic Anhydride Market

| Report Coverage | Details |

| Revenue Share of Asia-Pacific in 2022 | 51.73% |

| Revenue Forecast by 2032 | USD 6.47 billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.27% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Cepsa; INEOS; Huntsman International LLC; Lanxess A.G.; Mitsubishi Chemical Corporation; MOL Hungarian Oil & Gas Plc; Nippon Shokubai Co.; Ltd.; Polynt Group; Thirumalai Chemicals Ltd.; Jiangyin Shunfei; Tianjin Bohai Chemicals |

The industry growth is majorly driven by the rising demand for unsaturated polyester resins (UPR) in the global construction industry coupled with the flourishing automotive industry which is a major end use industry for the product market.

UPR possesses excellent resistance to chemicals, corrosion, abrasion, and heat, superior structural strength, excellent compressive strength, and high impact strength. Thus, it is widely used in the construction industry as concrete and sealant. In addition to the aforementioned properties, UPR is extensively used as a coating owing to its excellent aesthetic appeal. Moreover, as these composites can be pigmented without losing their structural properties, the demand for these composites is on the rise, and the trend is expected to continue over the forecast period.

According to Global Construction Perspectives and Oxford Economics, the global construction market is expected to reach USD 8 trillion by 2030, driven by the U.S., China, and India. Thus, the growth of the global construction industry, coupled with an increasing demand for UPR composites, coatings, and mortars, is expected to drive the growth of the UPR market over the predicted timeframe which in turn will drive the demand for maleic anhydride.

N-butane and benzene are the primary feedstock used to manufacture maleic anhydride. Globally, the prices of benzene and n-butane depend on the price trend of crude oil and naphtha. Volatility in crude oil prices has been the major reason for the high fluctuation in benzene prices. Crude oil pricing and downstream demand highly influence the global petroleum derivatives industry.

Application Insights

Unsaturated polyester resins (UPR) in application segment dominated the market with a revenue share of 50.12% in 2022.This growth is attributed to unsaturated polymer resin being one of the most popular thermostat polymers utilized as a matrix in various application industries such as aerospace and construction. Unsaturated polymer resin possesses excellent resistance to abrasion, corrosion, chemicals, and heat; superior structural strength; high impact strength; and excellent compressive strength along with environment-friendly characteristics, which makes it an excellent choice for application in the marine, construction, transport, wind energy, and electrical industries.

1,4-butanediol (BDO) is another application anticipated to witness fastest growth over the forecast period. 1, 4-butanediol (BDO) is manufactured from maleic anhydride by Davy Process Technology (DPT). BDO is further used as an intermediate chemical to produce polybutylene terephthalate (PBT), polytetramethylene ether glycol (PTMEG), tetrahydrofuran (THF), gamma-butyrolactone (GBL), and polyurethane (PU). These chemicals are used in engineering plastics, medicines, fibers, cosmetics, pesticides, artificial leather, hardeners, solvents, plasticizers, and rust removers.

Additives in the application segment is also witnessing growth over the period due to growing automotive industry worldwide. Additives are primarily used to improve the fuel efficiency of gasoline, diesel, distillate fuels, and others; modify burn and combustion rates under high temperatures and reduce harmful emissions. Growing environmental concerns towards toxic gaseous emissions have prompted regulatory agencies across the globe to mandate various norms such as the Clean Fuel Program in the U.S. Such mandates have further prompted oil marketers to blend specialty fuel additives in transportation fuel.

Regional Insights

Asia Pacific emerged as the dominating region with a revenue share of 51.73% in 2022. This growth is attributed to the advancing pharmaceuticals, construction, and personal care & cosmetics industries in the region. In the construction and pharmaceutical industries, maleic anhydride is used in the form of unsaturated polymer resin, whereas in the personal care & cosmetics industry, it is used in hair fixative and styling formulas. According to the National Investment Promotion & Facilitation Agency, the personal care & cosmetic market in India is the eighth largest in the world, accounting for USD 15 billion, which is further anticipated to grow at a CAGR of 12% to 16% in the coming years. As per the Hong Kong Trade Development Council, China is the 2nd largest consumer of cosmetics & personal care products, accounting for around 17.3% of the total global consumption. Thus, the growing personal care & cosmetics industry is further anticipated to drive the demand for maleic anhydride over the forecast period.

Middle East & Africa is another region witnessing strong growth over the forecasted period. The growing demand for maleic anhydride in the MEA can be attributed to the growing end-use industries, such as agriculture and construction, in the region. According to the International Monetary Fund, the UAE launched 50 new economic initiatives to boost the country’s economic growth and attract FDI worth USD 150 billion in 2021. Additionally, around 47 construction contracts amounting to USD 3 billion were awarded to both foreign and local companies during the Dubai Expo 2021, thus promoting the growth of the construction industry in the country.

The advancing automotive and construction industries are expected to drive the demand for maleic anhydride in the Europe region as it is majorly used in the production of unsaturated polymer resins, which further finds usage in the automobile, construction, and pharmaceutical industries. According to the International Trade Administration, in 2021 Italy has the 11th largest construction market globally. Moreover, as per the European Construction Industry Federation, the construction industry in Germany witnessed an increase of 3.2% in 2021 with investment in the construction sector reaching USD 411.97 billion. In addition, construction orders in the country witnessed an increase of 9.4% in 2021 compared to the previous year. Thus, the advancing construction industry in the region is aiding the increased demand for maleic anhydride.

Maleic Anhydride Market Segmentations:

By Application

By Regional

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on Maleic Anhydride Market

5.1. COVID-19 Landscape: Maleic Anhydride Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Global Maleic Anhydride Market, By Application

8.1.Maleic Anhydride Market, by Application Type, 2023-2032

8.1.1. Unsaturated Polyester Resins (UPR)

8.1.1.1.Market Revenue and Forecast (2020-2032)

8.1.2. 1,4-Butanediol (BDO)

8.1.2.1.Market Revenue and Forecast (2020-2032)

8.1.3. Additives (Lubricants & Oil)

8.1.3.1.Market Revenue and Forecast (2020-2032)

8.1.4. Copolymers

8.1.4.1.Market Revenue and Forecast (2020-2032)

8.1.5. Others

8.1.5.1.Market Revenue and Forecast (2020-2032)

Chapter 9. Global Maleic Anhydride Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Application (2020-2032)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Application (2020-2032)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Application (2020-2032)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Application (2020-2032)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Application (2020-2032)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Application (2020-2032)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Application (2020-2032)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Application (2020-2032)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Application (2020-2032)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Application (2020-2032)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Application (2020-2032)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Application (2020-2032)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Application (2020-2032)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Application (2020-2032)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Application (2020-2032)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Application (2020-2032)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Application (2020-2032)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Application (2020-2032)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Application (2020-2032)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Application (2020-2032)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Application (2020-2032)

Chapter 10.Company Profiles

10.1. Cepsa

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2. INEOS

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3. Huntsman International LLC

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4. Lanxess A.G.

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5. Mitsubishi Chemical Corporation

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6. Abbot

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7. Nippon Shokubai Co., Ltd.

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8. Polynt Group

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9. Thirumalai Chemicals Ltd.

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10. Jiangyin Shunfei

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others