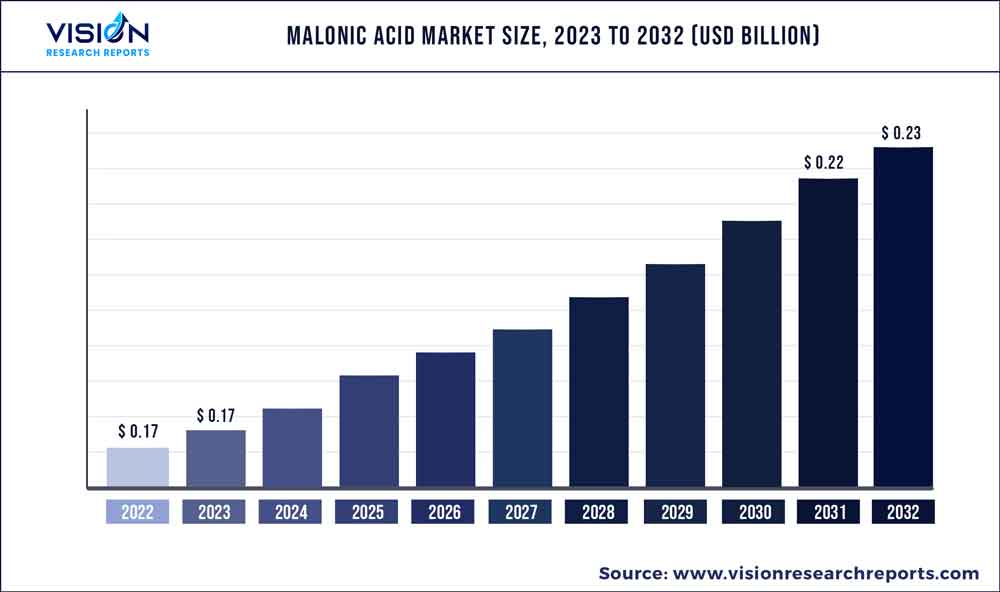

The global malonic acid market was surpassed at USD 0.17 billion in 2022 and is expected to hit around USD 0.23 billion by 2032, growing at a CAGR of 2.94% from 2023 to 2032. The malonic acid market in the United States was accounted for USD 13.3 million in 2022.

Key Pointers

Report Scope of the Malonic Acid Market

| Report Coverage | Details |

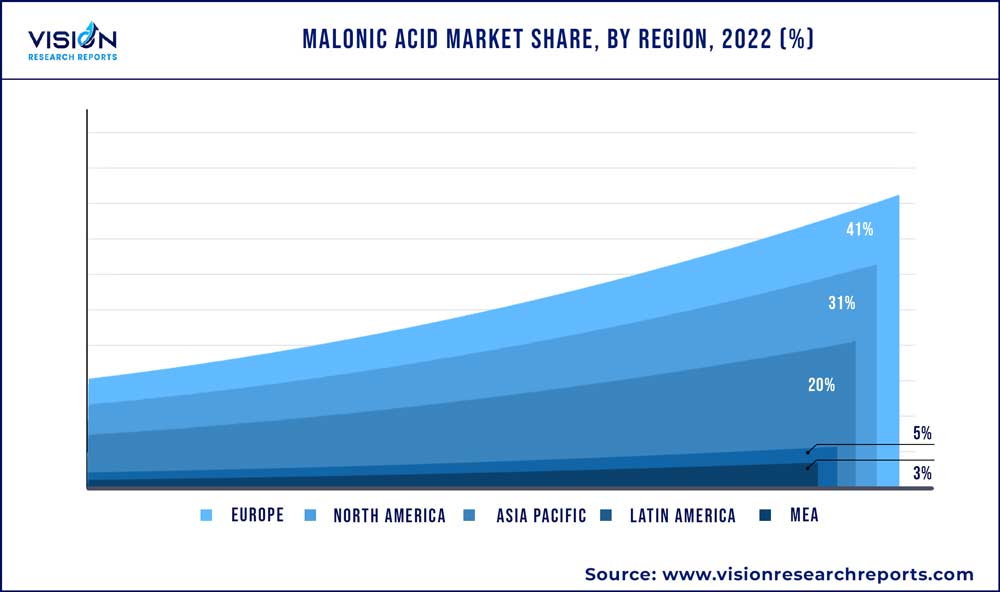

| Revenue Share of Europe in 2022 | 41% |

| Revenue Forecast by 2032 | USD 0.23 billion |

| Growth Rate from 2023 to 2032 | CAGR of 2.94% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Lonza Group; Wuhan Kemi-Works Chemical Co., Ltd.; Shanghai Nanxiang Reagent Co., Ltd.; Columbus Chemical Industries, Inc.; TATEYAMA KASEI Co., Ltd; Trace Zero LLC; Medical Chem (Yancheng) Manuf.Co., Ltd.; J&K Scientific Ltd.; Lygos, Inc.; Hefei TNJ Chemical Industry Co., Ltd. |

Malonic acid is a type of dicarboxylic acid characterized by the chemical formula C3H4O4. It is a crystalline powder with a sharp taste; it is soluble in both water and ethanol. This compound is heavily utilized in various industries, such as pharmaceuticals, food and beverage, and agriculture.The market for malonic acid has witnessed increased demand because of rising agricultural demand.

Malonic acid, a decarboxylated organic compound, finds widespread application in the agricultural industry owing to its role as a precursor for synthesizing a range of herbicides, insecticides, and fungicides. Additionally, its effectiveness as a pH adjuster and buffer in agriculture formulations makes it a valuable component in crop protection products. This, in turn, is expected to positively impact the overall industry growth in the coming years.

The U.S. is one of the major markets for malonic acid globally. The demand for malonic acid is expected to surge due to rising demand for pharmaceutical, food additives, and cosmetic sectors. Notably, there is a surfacing trend in utilizing renewable raw materials for incorporating malonic acid in industrial processes, thereby reflecting an increasing inclination towards sustainable and eco-friendly practices in the chemical industry.

This has prompted the emergence of novel production methods and technologies that are both eco-friendly and efficient. Moreover, the U.S. market's growth is anticipated to endure in the upcoming years, thanks to the advancement of these improved production methods and technologies.

End-use Insights

The food & beverage end-use segment dominated the market with a revenue share of 29% in 2022. It is attributed to the rising production of food additives and flavoring agents such as malonates, which are commonly used in the food and beverage industry to enrich the taste and preserve freshness. Malonic acid is a highly valued acidulant and flavoring agent in the food processing industry, it has excellent blending abilities and its capacity to enhance flavors.

The food and beverage industry has witnessed a surge in demand for its products, with particular emphasis on Asian and Middle Eastern markets. The increasing domestic consumption of food and beverage products is a direct consequence of various factors, including population growth, product diversification through new product launches, and a robust network of retail outlets that facilitates product accessibility and distribution.

The increasing usage of malonic acid derivatives in the pharmaceutical sector as a fundamental building block for synthesizing several drugs is expected to drive market demand. In the pharmaceutical industry, malonic acid serves as a crucial precursor for producing essential drugs, including barbiturates, vitamin B1, and non-steroidal anti-inflammatory drugs (NSAIDs).

The demand for malonic acid is substantial in the production of plant growth regulators that exert the capability to inhibit or stimulate plant growth. These regulators are essential for improving crop yield, quality, and stability against environmental stressors. The formulation of malonic acid can further enhance the delivery of critical micronutrients such as zinc, manganese, and iron to crops, resulting in overall improved plant growth and enhanced yield. These developments have profound implications in terms of fostering the production of foods in the market.

Application Insights

The flavor enhancer application segment dominated the market with a revenue share of 27% in 2022. This high share is attributed to the usage of malonic acid as a flavoring agent and acidulant within the food and beverage industry has resulted in a significant boost in demand, and this growth is projected to persist over the forecasted period.

The growing use of malonic acid as a flavoring agent and acidulant in the food and beverage industry has resulted in substantial expansion opportunities for manufacturers. In addition, it is used as an acidity controller, food preservative, and pharmaceutical excipient, as well as a precursor to polyesters and an active component in alkyd resins.

Regional Insights

The Europe region dominated the market with a revenue share of 41% in 2022 due to the presence of several end-use industries includingfood & beverage, pharmaceutical,agriculture, plastics, paints & coatings, and other applications the growth of these industries is expected to fuel the demand for the product over the forecasted years.

In developed countries, utilization of the product in various end-use sectors like food & beverages, pharmaceuticals, personal care & cosmetics is more widespread, and this trend is anticipated to augment the market in North America in the near future. The North American region stands out due to the presence of significant food & beverage and pharmaceutical industries such as Abbott; Pfizer Inc.; Merck Sharp & Dohme Corp.; and Bristol-Myers Squibb Company Furthermore, the thriving pharmaceutical sector in countries like Mexico and the U.S. is projected to increase demand for the products.

China, India, and Japan represent the predominant manufacturing nations in the region. The escalating population levels in countries such as China and India, alongside the increasing income levels and purchasing power parities of the populace, have resulted in a substantial surge in product demand in the food and beverage industry. The proliferation of food and beverage start-ups, particularly in India, is expected to further contribute to this trend, propelling industry demand across several industries in the foreseeable future.

Malonic Acid Market Segmentations:

By Application

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Malonic Acid Market

5.1. COVID-19 Landscape: Malonic Acid Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Malonic Acid Market, By Application

8.1. Malonic Acid Market, by Application, 2023-2032

8.1.1. Flavor Enhancer

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. API

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Additive

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. pH Controller

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Precurser

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Other Applications

8.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Malonic Acid Market, By End-use

9.1. Malonic Acid Market, by End-use, 2023-2032

9.1.1. Food & Beverage

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Pharmaceutical

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Agriculture

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Plastics

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Paints & Coatings

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Other End-use

9.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Malonic Acid Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Application (2020-2032)

10.1.2. Market Revenue and Forecast, by End-use (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.1.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.1.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Application (2020-2032)

10.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.5.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.5.4.2. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 11. Company Profiles

11.1. Lonza Group

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Wuhan Kemi-Works Chemical Co., Ltd.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Shanghai Nanxiang Reagent Co., Ltd.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Columbus Chemical Industries, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. TATEYAMA KASEI Co., Ltd

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Trace Zero LLC

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Medical Chem (Yancheng) Manuf.Co., Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. J&K Scientific Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Lygos, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Hefei TNJ Chemical Industry Co., Ltd.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others