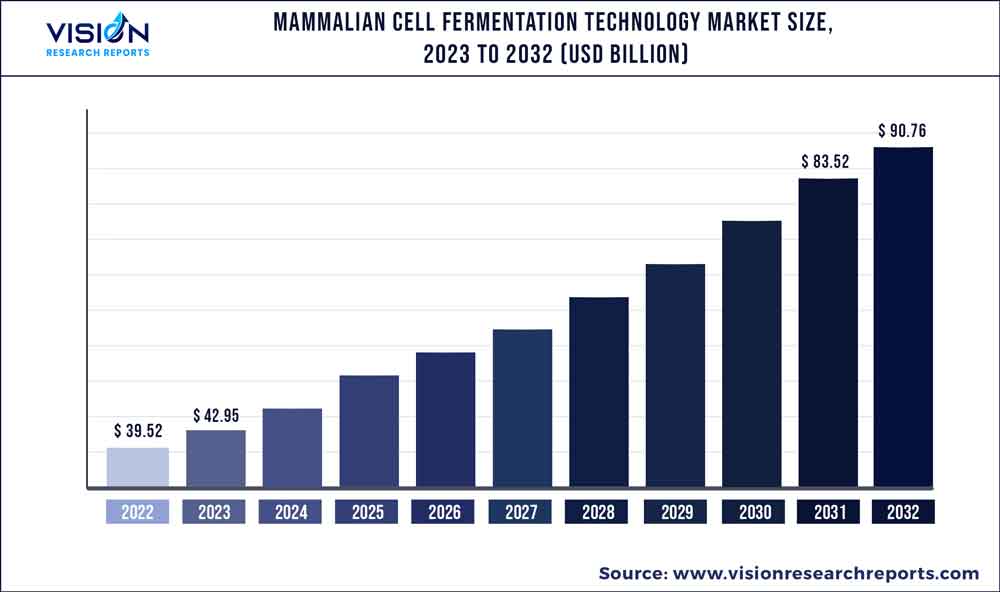

The global mammalian cell fermentation technology market was surpassed at USD 39.52 billion in 2022 and is expected to hit around USD 90.76 billion by 2032, growing at a CAGR of 8.67% from 2023 to 2032. The mammalian cell fermentation technology market in the United States was accounted for USD 2.9 billion in 2022.

Key Pointers

Report Scope of the Mammalian Cell Fermentation Technology Market

| Report Coverage | Details |

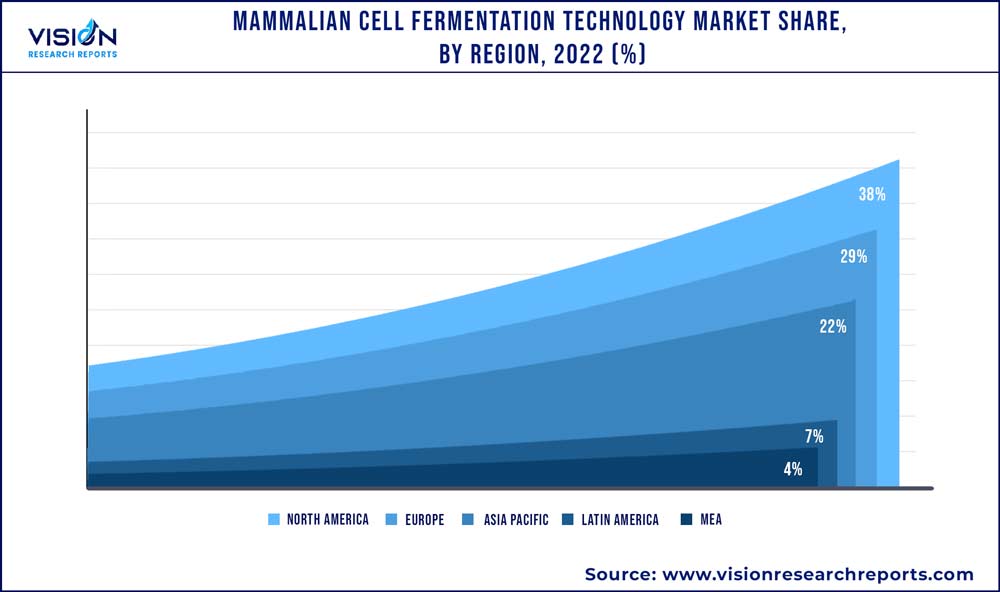

| Revenue Share of North America in 2022 | 38% |

| CAGR of Asia Pacific from 2023 to 2032 | 10.69% |

| Revenue Forecast by 2032 | USD 90.76 billion |

| Growth Rate from 2023 to 2032 | CAGR of 8.67% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Thermo Fisher Scientific, Inc.; Merck KGaA; Danaher; Lonza; F. Hoffmann-La Roche Ltd; Sartorius AG; AstraZeneca; Bristol-Myers Squibb; Amgen; Gilead Sciences; Moderna, Inc.; Regeneron Pharmaceuticals |

Mammalian cells are commonly used for manufacturing therapeutic proteins such as monoclonal antibodies, vaccines, and other biologics, along with several source materials such as Chinese Hamster Ovary (CHO) cells, Human Embryonic Kidney (HEK) cells, and others. The increasing prevalence of chronic diseases coupled with the growing demand for biologics is fueling the demand for fermentation technologies. After the COVID-19 outbreak, many companies have shifted their focus to manufacturing COVID-19 vaccines and therapies. This has had a significant impact on the mammalian cell fermentation business due to increased demand for mammalian cells for R&D activities. For instance, mammalian cell fermentation technology was used in the Pfizer-BioNTech COVID-19 vaccine to synthesize the mRNA required to make the spike protein of the SARS-CoV-2 virus.

The market for mammalian cell fermentation technology is experiencing a significant surge due to the rising demand for biologics and biosimilars. These treatments have become crucial in managing various ailments, including cancer, autoimmune conditions, and infectious diseases. As pharmaceutical companies increasingly invest in the development of new biologics, interest in mammalian cell fermentation technology continues to grow. A recent example of this growth is Lonza's company expansion of its biologics manufacturing facility in Switzerland.

Technological developments in cell culture are another driver boosting the market for the fermentation of mammalian cells. Higher yields of recombinant proteins and other biologics may now be produced by serum-free media and advancements in bioreactor technologies, which have completely changed the industry.

The market for mammalian cell fermentation technology has expanded as a result of the rise in chronic diseases like diabetes, heart disease, and cancer. There is a constant need for mammalian cell fermentation tools because many illnesses necessitate long-term therapy, frequently with biologics. Overall, it is anticipated that the market for mammalian cell fermentation technology will expand over the next several years because of the continuous need for biologics and biosimilars, as well as developments in an increase in chronic diseases.

Type Insights

Chinese Hamster Ovary (CHO) cell fermentation segment is dominating the market in 2022 with a market share of 66%, this is due to their capacity to generate significant amounts of recombinant proteins and their well-understood genetic and biochemical characteristics, Chinese hamster ovary (CHO) cell have gained popularity in the biopharmaceutical sector for the synthesis of therapeutic proteins. The industry has embraced CHO cell technology largely because it is well-established, has undergone considerable research, and has been optimized. This equipment is a great place to produce proteins because of its high productivity, affordability, and regulatory acceptability by organizations like the US FDA. For instance, the FDA's approval of Semglee in 2020 is a recent example of the effectiveness of CHO cell fermentation technology. Semglee, a biosimilar version of insulin glargine, was produced using technology for CHO cells and is expected to provide a more cost-effective alternative to existing insulin products, hence through this the market of mammalian cell culture is growing.

Human Embryonic Kidney (HEK) cell fermentation finds applications in biotechnology and pharmaceutical research due to the ability of HEK cells to multiply quickly and generate large amounts of recombinant proteins. The segment is expected to grow at the fastest CAGR of 12% by 2032. The simplicity of HEK cell growth and culture maintenance further makes them a desirable option for extensive fermentation activities. Due to its high productivity, scalability, and affordability, the HEK cells fermentation technology market is rapidly expanding, making it the fastest-growing sector in the mammalian cells fermentation technology market. As a result, it is anticipated that the HEK cell fermentation segment will keep growing quickly.

Application Insights

Monoclonal antibodies segment had a dominating presence in the market in 2022 with a share of 43%, as these antibodies have become a crucial component in the production of biologics. This technology has the capability to effectively generate significant quantities of high-quality proteins that exhibit potent biological activity. Monoclonal antibodies are widely utilized due to their effectiveness in treating various diseases. The significance of monoclonal antibodies as a therapeutic alternative for infectious disorders has been brought to light by the COVID-19 pandemic. Therapies using monoclonal antibodies have been created to combat the COVID-19-causing SARS-CoV-2 virus. Mammalian cell fermentation technology can be used to produce these monoclonal antibodies using effective and scalable manufacturing methods.

Recombinant proteins segment is expected to grow at a significant CAGR of 10% over the forecast period as these proteins are crucial to produce pharmaceuticals, biologics, and diagnostic tools. Recombinant proteins, which are created by inserting foreign genes into mammalian cells, provide high purity, specialized activities, and functions for a range of clinical and medical research applications, making it the fastest-growing sector in the mammalian cells fermentation technology market. Genetic engineering has quickly expanded and will likely continue to do so in the coming years because of improvements in cell culture and genetic engineering technology that have made it a low-cost, high-throughput technique.

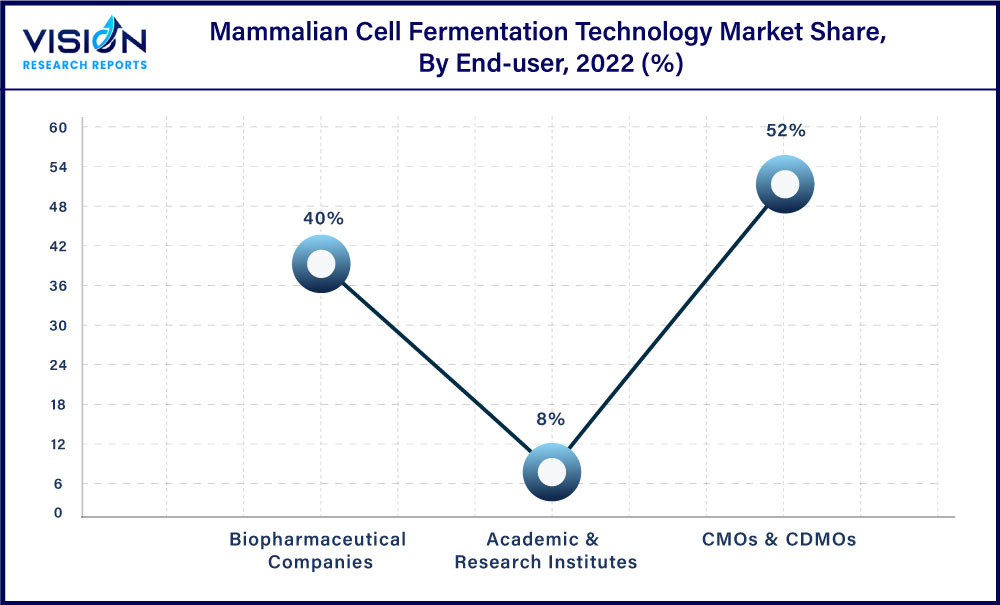

End-use Insights

The CMOs & CDMOs segment dominated the market with a share of 52% in 2022. The dominance is due to their ability to offer comprehensive services to pharmaceutical and biotech companies, including process development, and large-scale manufacturing, and to provide flexible business models to their clients. For instance, in 2021 PPD, a renowned CDMO, was purchased by Thermo Fisher Scientific for USD 17.4 billion. This acquisition demonstrates the rising demand for CDMO services, which is being fueled by the need for adaptable and scalable manufacturing solutions, which CDMOs can offer, as well as the complexity of biologics development.

The biopharmaceutical industry has experienced substantial growth in recent years and is expected to grow at a CAGR of 7.78% by 2032. One significant factor is the increasing demand for advanced therapies and personalized medicine, which require the use of biopharmaceuticals. The production of biopharmaceuticals using this method has also become simpler and more affordable thanks to developments in mammalian cell fermentation technology. As a result, the sector of biopharmaceuticals is expanding, and numerous businesses are making investments in this area to take advantage of the rising demand. As a result, compared to the market for mammalian cell fermentation technology, the biopharmaceuticals firms’ segment has experienced significant expansion.

Regional Insights

North America accounted for the largest share of the mammalian cell fermentation technology market in 2022 and held around 38% of the market size. The region has a highly developed healthcare infrastructure, favorable government policies, and a strong presence of major biopharmaceutical companies, driving the growth of the market. Additionally, the increasing prevalence of chronic diseases and rising demand for biologics and biosimilars have also contributed to the growth of the market in the region. For instance, in 2020 Merck's expansion of its Antibody-Drug Conjugate (ADC) manufacturing facility in Madison, Wisconsin is expected to boost the growth of the mammalian cells fermentation technology market in the region. The expansion will increase the capacity of biologics, including ADCs, to meet the growing demand for cancer therapies.

Asia Pacific region is estimated to grow at the fastest rate during the forecast period and is expected to grow at a CAGR of 10.69% by 2032. This can be attributed to the expansion of mammalian cell fermentation technology industry in the region due to the favorable regulatory environment, rising investments by multinational corporations, and the accessibility of trained staff at a reduced cost. The expansion of Samsung Biologics' manufacturing facility in Incheon, South Korea, is one recent example of the growth of mammalian cell fermentation technology in the growing area. The market for mammalian cell fermentation technology in the Asia Pacific area is anticipated to increase because of these investments in the future years.

Mammalian Cell Fermentation Technology Market Segmentations:

By Type

By Application

By End-Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Mammalian Cell Fermentation Technology Market

5.1. COVID-19 Landscape: Mammalian Cell Fermentation Technology Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Mammalian Cell Fermentation Technology Market, By Type

8.1. Mammalian Cell Fermentation Technology Market, by Type, 2023-2032

8.1.1 Chinese Hamster Ovary (CHO) Cell Fermentation

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Human Embryonic Kidney (HEK) Cell Fermentation

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Baby Hamster Kidney (BHK) Cell Fermentation

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Murine Myeloma Cell Fermentation

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Mammalian Cell Fermentation Technology Market, By Application

9.1. Mammalian Cell Fermentation Technology Market, by Application, 2023-2032

9.1.1. Monoclonal Antibodies

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Recombinant Proteins

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Vaccines

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Hormones

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Enzymes

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Mammalian Cell Fermentation Technology Market, By End-Use

10.1. Mammalian Cell Fermentation Technology Market, by End-Use, 2023-2032

10.1.1. Biopharmaceutical Companies

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. CMOs & CDMOs

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Academic & Research Institutes

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Mammalian Cell Fermentation Technology Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End-Use (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End-Use (2020-2032)

Chapter 12. Company Profiles

12.1. Thermo Fisher Scientific, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Merck KGaA

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Danaher

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Lonza

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. F. Hoffmann-La Roche LtdF. Hoffmann-La Roche Ltd

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Sartorius AG

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. AstraZeneca

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Bristol-Myers Squibb

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Amgen

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Gilead Sciences

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others