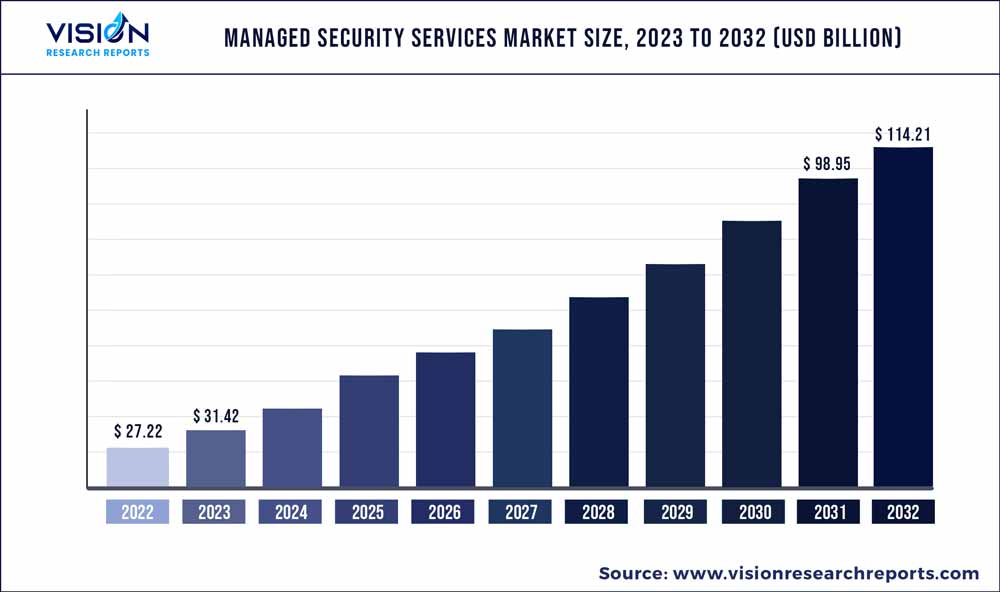

The global managed security services market was surpassed at USD 27.22 billion in 2022 and is expected to hit around USD 114.21 billion by 2032, growing at a CAGR of 15.42% from 2023 to 2032. The managed security services market in the United States was accounted for USD 7.6 billion in 2022.

Key Pointers

Report Scope of the Managed Security Services Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 35% |

| CAGR of Asia Pacific from 2023 to 2032 | 18.22% |

| Revenue Forecast by 2032 | USD 114.21 billion |

| Growth Rate from 2023 to 2032 | CAGR of 15.42% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | AT&T; BAE Systems, Inc.; Cisco; Check Point Software Technologies; Fortinet, Inc.; Fujitsu; IBM; Palo Alto Networks; Rapid 7; Verizon; Wipro |

The growth of the managed security services industry is driven by the increased number of new threats, government regulations, and the proliferation of data generated by consumers. The digital movement has created a plethora of new opportunities for cyber-attacks. The diversification of technology and the shortage of skilled cybersecurity laborers has created new avenues for managed security services providers. Moreover, the growing cyber threat landscape and ransomware have propelled the demand for managed security services over the forecast period.

The managed security services capabilities include exposure assessment, detection and response, security monitoring, and operational services specific to security technology implementation and consulting. MSS providers offer a wide range of engagement models with technology-based management-driven experience. Managed security services have become the systematic approach to growing business requirements. Outsourcing has become prevalent and viable for many SMEs and large enterprises.

IT enterprises continuously install new technologies such as cloud computing, artificial intelligence, machine learning, DevOps, and many more to sustain and maintain balance with evolving modes. As a result, outsourcing services from managed security vendors helps organizations curtail cybersecurity threats. Moreover, managed security services encapsulate various features that enable organizations to manage and protect digital assets from cyber threats. Managed security services often integrate features, such as including 24/7 threat detection, rapid threat response, remote wipes, threat hunting capabilities, device encryption, and app management, to enhance security and compliance management.

Moreover, the COVID-19 pandemic has pressured digital ecosystems to safeguard data from malicious attackers. The threat landscape is shifting dynamically, and the continuous rise in cyberattacks coupled with a shortage of trained workforce and complexity is pushing organizations to outsource security-related services. As per IDC security services, 60% of organizations have adopted cloud technology services and migrated towards outsourcing managed security services.

The shift toward cloud technology has opened new ventures for managed security services market. For a few decades, Bring Your Own Device has been gaining a slow momentum in enterprises, and the advancement of Industry 4.0 is driving the expansion of managed security services. Post pandemic scenario has underlined the importance of stringent government regulations to strengthen digital security services. For instance, in SepteWipro collaborated with Palo Alto Networks to provide end-to-end security and next-generation security to secure critical data by offering easy-to-manage solutions.

Security Insights

The security market is segmented into four components: cloud security, endpoint security, network security, and data security. The data security segment led the market in 2022 with more than USD 6.47 billion in revenue. Data security in IT firms is reaching new dimensions in managing who can access sensitive data. Enterprises can mitigate the theft risk by training employees and improving access control.

The cloud security segment is expected to mark the highest CAGR of about 18.02% over the forecast period. Modern business is expected to gain transition as enterprises are shifting toward cloud adoption. Moreover, organizations are adopting cloud technologies to scale up with emerging technologies such as IoT, Artificial Intelligence, Machine learning, and others by providing more data storage and safety measures.

Service Insights

The managed DDoS segment is anticipated to witness a CAGR of more than 18.73 % over the forecast period. The increasing demand for specialized skills, cost-effectiveness, scalability, and the capacity to keep up with the changing threat landscape drives the development of DDoS-managed security services. In recent years, DDoS attacks have increased in frequency and complexity. Hackers are constantly inventing new methods and resources for planning effective attacks. DDoS attacks must be efficiently addressed with specialized expertise and resources. Many businesses lack the internal knowledge and skilled security staff to prevent such attacks. Managed security service companies aim to launch dedicated staff members with in-depth knowledge of DDoS mitigation, providing a higher level of security than businesses can accomplish independently.

The managed risk and compliance segment has dominated the market with the second-highest revenue of 4.34 billion in 2022 and is expected to keep leading the market segment over the forecast period. The segment's dominance can be attributed to the increasing number of cyberattacks across the globe and the stringent implementation of government regulations. The risk and compliance segment has gained traction as the organization can design strategies and implement regulations to overcome the challenges related to cyber theft.

Enterprise Insights

The SMEs segment is expected to attain the highest CAGR of 18.15% over the forecast period. Due to its increased adoption of managed security services. SMEs have smaller budgets than larger companies but still need data security help. Cybersecurity companies aim to offer simple, scalable solutions to cater to SMEs' IT competence levels SMEs need more resources to monitor their systems regularly, leaving them open to intrusions outside regular business hours. Managed security providers are coping by offering round-the-clock monitoring and rapid incident response to ensure that potential security incidents are instantly identified and fixed.

The large enterprise segment has the highest market share of 58% in 2022. Large enterprises are majorly inclined towards outsourcing services. The rise in cyberattacks, which makes large firms susceptible to unexpected losses in revenue and reputation, is another crucial market factor driving market growth. Large organizations are inclined towards managed services to lower phishing attacks, the risk of data breaches, and other cyber threats. Large organizations aim to focus more on security governance and compliance as data security and privacy rules become more important. The managed security services facilitate the development of regulations and procedures to govern access to sensitive information and access while maintaining regulatory compliance.

Vertical Insights

The BFSI segment held the second-largest revenue share in 2022, accounting for around 15% of the overall market. The proliferation in the IT infrastructure and rapid industrialization worldwide are some of the key areas driving the demand for managed security services. Cloud technology has become a center for BFSI firms’ future growth and innovation strategy because of the dramatic shift toward the digital platform of engagement and transactions; banks have outsourced security services catering to their requirements.

The healthcare segment held the third-largest revenue share in 2022, accounting for around 14.64% of the overall market. Post-Pandemic healthcare organizations aim to fill in gaps in their security program and secure their vital systems and data throughout the broader IT ecosystem. The healthcare providers are teaming with a Managed Security Service Provider to bolster their security teams with the appropriate procedures, personnel, and tools. In the healthcare sector, breaches and cyberattacks are on the rise, and the truth is that patient-sensitive data and, more crucially, lives are at risk.

Regional Insights

North America accounted for over 35% revenue share of the market in 2022 and is expected to grow steadily during the forecast period. The region is expected to remain dominant due to the increased demand for outsourcing services from several tech giants. Managed service offerings to better meet individual needs and the increasing demand for cloud computing, network security, and data security are further expected to support regional growth. The growing number, variety, and complexity of cyber threats targeted at expanding exposure footprint drive market demand.

The Asia Pacific market is expected to register the highest CAGR of 18.22% from 2023 to 2032 due to the increasing demand for outsourcing services from third parties. MSS's growth is also primarily driven by the APAC region's shortage of skilled cyber professionals. Many large organizations have established their own Security Operations Centers (SOCs) but need more human resources to staff. These centers optimally as they are outsourcing services from MSSP vendors. SMEs typically do not have financial flexibility; hence, they rely on outsourcing their cybersecurity management and operations at a reasonable price range.

Managed Security Services Market Segmentations:

By Security

By Services

By Enterprise Size

By Vertical

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Managed Security Services Market

5.1. COVID-19 Landscape: Managed Security Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Managed Security Services Market, By Security

8.1. Managed Security Services Market, by Security, 2023-2032

8.1.1. Cloud Security

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Endpoint Security

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Network Security

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Data Security

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Managed Security Services Market, By Services

9.1. Managed Security Services Market, by Services, 2023-2032

9.1.1. Managed SIEM

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Managed UTM

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Managed DDoS

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Mnaged XDR

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Managed IAM

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Managed Risk & Compliance

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Managed Security Services Market, By Enterprise Size

10.1. Managed Security Services Market, by Enterprise Size, 2023-2032

10.1.1. Small and medium-sized enterprises

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Large enterprises

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Managed Security Services Market, By Vertical

11.1. Managed Security Services Market, by Vertical, 2023-2032

11.1.1. BFSI

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Healthcare

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Manufacturing

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. IT and Telecom

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Retail

11.1.5.1. Market Revenue and Forecast (2020-2032)

11.1.6. Defense/Government

11.1.6.1. Market Revenue and Forecast (2020-2032)

11.1.7. Others

11.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Managed Security Services Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Security (2020-2032)

12.1.2. Market Revenue and Forecast, by Services (2020-2032)

12.1.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.1.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Security (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Services (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.1.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Security (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Services (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.1.6.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Security (2020-2032)

12.2.2. Market Revenue and Forecast, by Services (2020-2032)

12.2.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Security (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Services (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Security (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Services (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.6.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Security (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Services (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.7.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Security (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Services (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.8.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Security (2020-2032)

12.3.2. Market Revenue and Forecast, by Services (2020-2032)

12.3.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Security (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Services (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Security (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Services (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.6.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Security (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Services (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.7.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Security (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Services (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.8.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Security (2020-2032)

12.4.2. Market Revenue and Forecast, by Services (2020-2032)

12.4.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Security (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Services (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Security (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Services (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.6.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Security (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Services (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.7.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Security (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Services (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.8.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Security (2020-2032)

12.5.2. Market Revenue and Forecast, by Services (2020-2032)

12.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Security (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Services (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.5.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Security (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Services (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.5.6.4. Market Revenue and Forecast, by Vertical (2020-2032)

Chapter 13. Company Profiles

13.1. AT&T

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. BAE Systems, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Cisco

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Check Point Software Technologies

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Fortinet, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Fujitsu

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. IBM

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Palo Alto Networks

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Rapid 7

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Verizon

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others