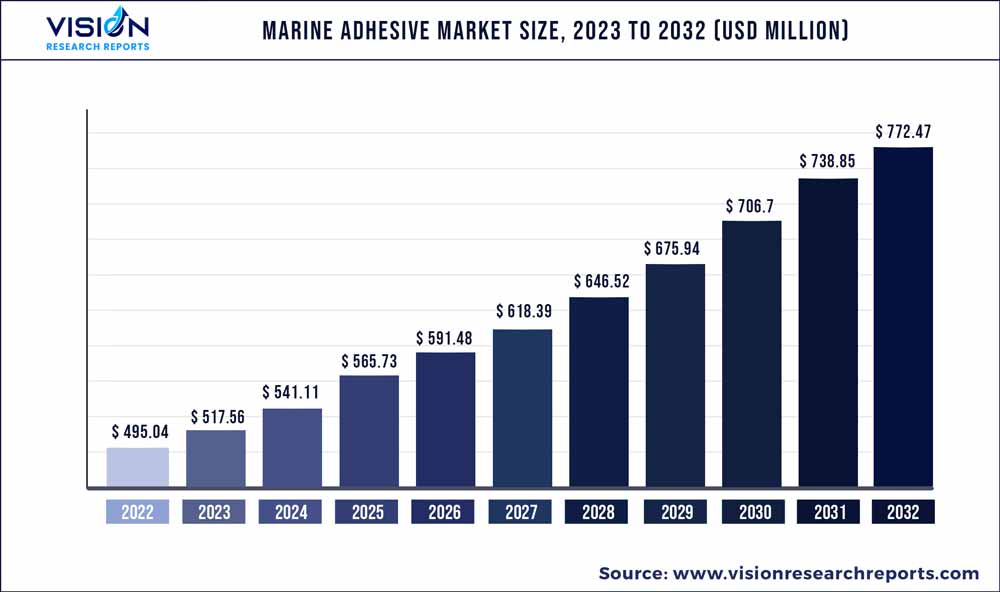

The global marine adhesive market was surpassed at USD 495.04 million in 2022 and is expected to hit around USD 772.47 million by 2032, growing at a CAGR of 4.55% from 2023 to 2032.

Key Pointers

Report Scope of the Marine Adhesive Market

| Report Coverage | Details |

| Market Size in 2022 | USD 495.04 million |

| Revenue Forecast by 2032 | USD 772.47 million |

| Growth rate from 2023 to 2032 | CAGR of 4.55% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Henkel; 3M; Sika; Huntsman International; Ashland Inc.; AVERY DENNISON CORPORATION; Dow; Exxon Mobil Corporation; H.B. Fuller; Scott Bader Company Ltd. |

The industry growth is majorly driven by the growing leisure marine and recreational boating industry and advancing shipbuilding industry worldwide.

According to the United Nations Conference on Trade and Development, Japan, China, and South Korea accounted for a share of approximately 90.0% of the global marine vessel production with China leading the global shipbuilding industry. The country accounts for a share of approximately 40.0% of the total marine vessels produced worldwide, followed by Japan and South Korea.

Additionally, China accounts for a share of approximately 60.0% of the bulk carriers, approximately 49.0% of the container ships, approximately 47.0% of the general cargo ships, and approximately 45.0% of the offshore vessels manufactured worldwide. This advancing shipbuilding industry in Asia Pacific region is contributing to growth of the product market.

Moreover, according to the National Marine Manufacturers Association (NMMA) of the U.S., the sales of recreational boats in the country witnessed an increase of 12.0% in 2020 than their sales in 2019. Thus, the U.S. witnessed sales of more than 310,000 new boats in 2020 that were the highest in the recreational boating industry of the country since 2008.

Moreover, the sales of boats and marine products, as well as the costs of services, reached USD 47.0 billion in 2020 in the U.S. witnessing a growth of 9.0% in the same year as compared with that of 2019. Thus, the increasing demand for the recreational boating activities is expected to surge demand for the boats during the forecast period, thereby fueling demand for the marine adhesives used in them.

However, tankers that are used for transporting, loading, or unloading oil and chemicals at ports generate volatile organic compounds (VOCs), which are harmful to the environment. To control these emissions from the tankers, the adhesives market has always been under strict scrutiny from diverse regional- and country-level regulatory bodies, including the International Maritime Organization. Thus, high level of VOC emission is acting as a restraining factor for the growth of product market.

Substrate Insights

Metal in substrate segment dominated the market with a revenue share of 68.24% in 2022. This growth is attributed to the fact that metals are one of the most important elements used in shipbuilding. Metals are used to construct a large portion of a ship. Steel is the most commonly used metal in the shipbuilding industry due to its excellent mechanical properties, structural integrity, and low cost.

Composites are another segment witnessing fastest growth during the forecast period. This growth owed to their exceptional properties. Composites are made up of two or more different materials that combine to improve strength, durability, and load distribution. Ferro cement is a shipbuilding technique that uses composites to build shell roofs, hulls, and barges. Composite structures constructed using ferro cement have the advantages of being lightweight, long-lasting (due to metal reinforcements), and are inexpensive to maintain.

Application Insights

Deck systems in the application segment dominated the global market with a revenue share of 39.16% in 2022. A deck is a covering over the hull or the compartment of a ship. It is the uppermost horizontal structure over the hull and provides strength to it. Moreover, it serves as the primary working surface of the ship. The deck of a boat is constructed using various adhesives such as epoxy, polyurethane, or acrylic. The deck is not made from a single piece of substrate, but rather from several substrates that are joined together.

Panel bonding is another segment witnessing the fastest growth during the forecast period. Panel bonding includes the bonding of quarter panels, roof skins, box sides, van sides, utility vehicle sides, and door skins. They are used wherever a long-lasting bond between outer body panels is required.

End-use Insights

Cargo based in the end-use segment dominated the global market with a revenue share of 45.53% in 2022. Cargo ships are container or merchant ships that are used to transport goods and materials from one port to another. As per the International Chamber of Shipping, over 50,000 merchant ships are trading internationally every year, transporting all types of cargo. Thus, the increasing usage of these ships is propelling demand for the product during the forecast period.

Boats are another segment witnessing growth throughout the forecast period. In naval terms, a boat is a small vessel that is carried aboard by ship and it comes in a variety of sizes and shapes. It is smaller than a ship, and is distinguished by its shape, size, and cargo or passenger capacity. Small boats are commonly found in protected coastal areas or inland waterways such as lakes and rivers. Some boats, such as the whaleboat, are designed for use in an offshore environment.

Regional Insights

Asia Pacific emerged as the dominating region with a revenue share of 42.67% in 2022. This growth is attributed to the fact that strong economic development coupled with population expansion in countries such as China and India are expected to increase marine spending in Asia Pacific during the next ten years. Furthermore, according to Oxford Economics, the volume of marine output is predicted to grow by 85.0% and reach USD 17.5 trillion by 2030, with China and India being the major economies driving the marine industry in the region.

Europe is another region witnessing the growth during the forecasted period. This is attributed to the fact that around 40.03% of the world’s shipping fleet is controlled by European ship owners. Europe has an extensive network of inland waterways, especially in the Central European countries such as France, Germany, Russia, and Belgium. Further development of inland waterways and their growing importance for trade and passenger travel is expected to drive demand for the marine adhesives.

Marine Adhesive Market Segmentations:

By Resin Type

By Substrate

By Application

By End-use

By Regional

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others