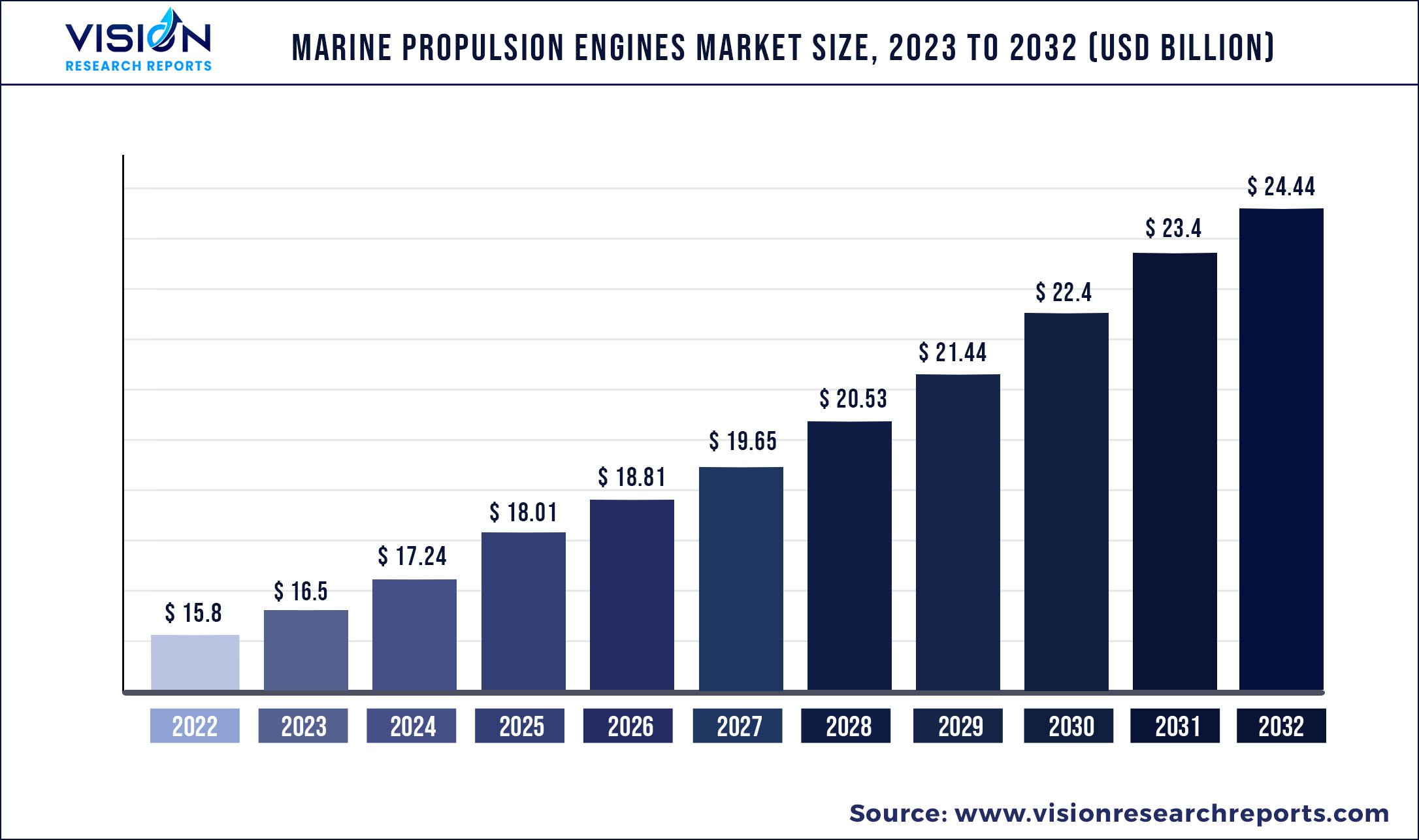

The global marine propulsion engines market was surpassed at USD 15.8 billion in 2022 and is expected to hit around USD 24.44 billion by 2032, growing at a CAGR of 4.46% from 2023 to 2032.

Key Pointers

| Report Coverage | Details |

| Market Size in 2022 | USD 15.8 billion |

| Revenue Forecast by 2032 | USD 24.44 billion |

| Growth rate from 2023 to 2032 | CAGR of 4.46% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Caterpillar; Hyundai Heavy Industries Co. Ltd.; Mitsubishi Heavy Industries Ltd.; Volvo Penta; Daihatsu Diesel MFG. Co. Ltd.; General Electric Company; Yanmar Holdings Co. Ltd.; IHI Power Systems Co. Ltd.; Wartsila; Rolls Royce Plc; Volkswagen Group (MAN Energy Solutions S.E.), Others |

The marine industry is increasing steadily due to dependency on the ships for transportation of goods required such as natural resources, and consumer supplies among other resources. The ships require high-performance engines for sailing the distance in lesser time and also powerful engines to bear the load of the ships. Such engines are usually powered by diesel engines, as they are reliable and require less maintenance as compared with other types of engines. The rising international trade on account of increasing globalization and industrialization is escalating the demand for container ship to transport various products such as oil, natural gas, and minerals.

The increasing focus on reducing fossil fuel consumption and improving efficiency is escalating the adoption of marine electric propulsion engines. The increase in the usage of LNG and nuclear propulsion, along with the rise in demand for the diesel-based marine propulsion engine market is driving the growth of the market. Moreover, as newer technologies engines that are installed in the ships are mostly based on nuclear power which works without refueling for more than 20 years, a small amount of nuclear fuel is also engaged in providing energy equivalent to a larger amount of coal and oil engines.

Dual-fuel diesel (DFD) marine propulsion engines have been installed as prime movers aboard LNG carriers to maximize natural gas use. LNG vessel propulsion systems are usually equipped with waste heat reduction systems (WHRs) as such systems help reduce emissions, enhanced fuel efficiency, and better engine performance. Switching to LNG-powered vessels is a complicated task for companies, however, they can combine modern WHRs with the engines to enhance their performance. Furthermore, the increased emphasis on decreasing fossil fuel use and improving energy efficiency encourages the global adoption of marine electric propulsion engines. Alternative fuels such as algal oils and bio-methane are also being utilized to power marine propulsion engines with minimal gas emissions as technology progresses and environmental awareness rises.

Regional Insights

Currently, Asia Pacific is witnessing strong maritime trade and shipping growth, resulting in an increase in demand for marine propulsion engines. The market is gaining momentum and is anticipated to reveal a CAGR of 4.06% during forecast period. China has become the world's largest exporter, necessitating a significant number of commercial ships, boosting the market expansion of the marine propulsion engines industry. Furthermore, Asian navies are expanding their maritime defense capabilities, likely raising market size.

North America is anticipated to have a significant impact on the marine propulsion engines market throughout the projected period. The area anticipates requiring marine engine producers to create motors that adhere to US EPA New Source Performance Standards (NSPS). Due to the expanding seaborne trade, the region's marine propulsion engine market is expected to develop faster than the world average.

Marine Propulsion Engines Market Segmentations:

By Fuel Type

By Application

By Power Range

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Marine Propulsion Engines Market

5.1. COVID-19 Landscape: Marine Propulsion Engines Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Marine Propulsion Engines Market, By Fuel Type

8.1. Marine Propulsion Engines Market, by Fuel Type, 2023-2032

8.1.1 Diesel

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Heavy Fuel Oil

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Natural Gas

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Other Fuels

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Marine Propulsion Engines Market, By Application

9.1. Marine Propulsion Engines Market, by Application, 2023-2032

9.1.1. Commercial

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Defense

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Passenger

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Marine Propulsion Engines Market, By Power Range

10.1. Marine Propulsion Engines Market, by Power Range, 2023-2032

10.1.1. 0-1,000 HP

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. 1,001-5,000 HP

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. 5,001-10,000 HP

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. 10,001-20,000 HP

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Above 20,000 HP

10.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Marine Propulsion Engines Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Fuel Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by Power Range (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Fuel Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Power Range (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Fuel Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Power Range (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Fuel Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.3. Market Revenue and Forecast, by Power Range (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Fuel Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Power Range (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Fuel Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Power Range (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Fuel Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Power Range (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Fuel Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Power Range (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Fuel Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.3. Market Revenue and Forecast, by Power Range (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Fuel Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Power Range (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Fuel Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Power Range (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Fuel Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Power Range (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Fuel Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Power Range (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Fuel Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.3. Market Revenue and Forecast, by Power Range (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Fuel Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Power Range (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Fuel Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Power Range (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Fuel Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Power Range (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Fuel Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Power Range (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Fuel Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.3. Market Revenue and Forecast, by Power Range (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Fuel Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Power Range (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Fuel Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Power Range (2020-2032)

Chapter 12. Company Profiles

12.1. Caterpillar

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Hyundai Heavy Industries Co. Ltd.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Mitsubishi Heavy Industries Ltd.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Volvo Penta

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Daihatsu Diesel MFG. Co. Ltd.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. General Electric Company

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Yanmar Holdings Co. Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. IHI Power Systems Co. Ltd.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Wartsila

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Rolls Royce Plc

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others