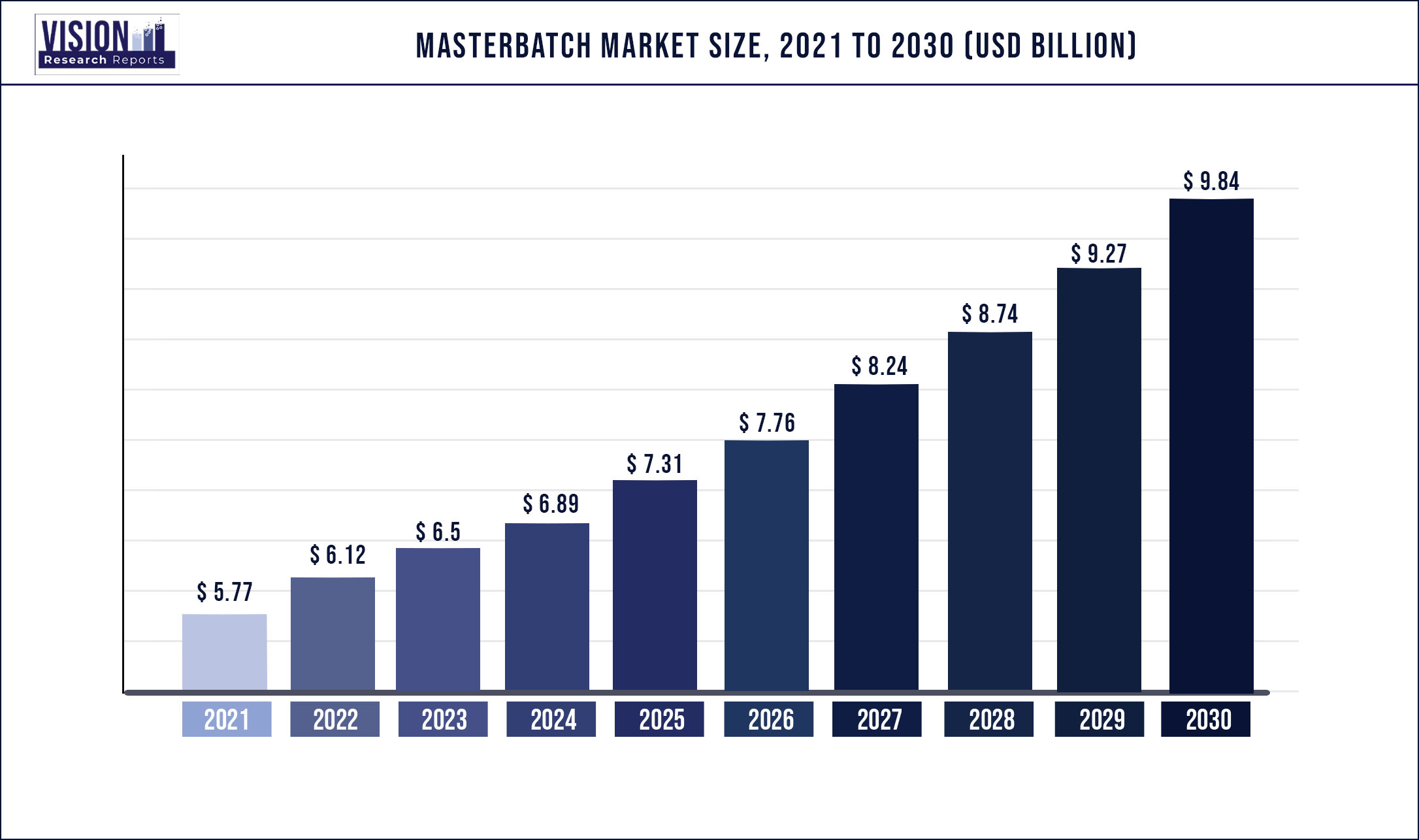

The global masterbatch market was surpassed at USD 5.77 billion in 2021 and is expected to hit around USD 9.84 billion by 2030, growing at a CAGR of 6.11% from 2022 to 2030.

Report Highlights

Increasing replacement of metal with plastic is projected to fuel the market growth. In addition, rising demand from the European region is expected to propel the demand over the forecast period.

In terms of revenue, black masterbatch was the largest type segment in 2021 and the trend is anticipated to continue over the forecast period. The increasing need for improving the surface appearance of plastic components in automotive and transportation, building and construction, and consumer goods is expected to contribute to the growth. Additive masterbatch is being widely used on account of various properties it imparts to plastics such as antistatic, antifoaming, antioxidant, antimicrobial, thermo-stabilizer, barrier properties, metal deactivators, anti-block, flame retardant, UV stabilizer, oxygen scavenger, and abrasion resistance. The growth of the packaging sector, especially plastic packaging, is anticipated to drive the masterbatch demand.

Masterbatch is used in various end-use industries, such as packaging, building and construction, consumer goods, automotive and transportation, and agriculture, as it imparts useful functional properties such as smooth surface finish and desired hardness. The increasing spending capability of customers toward purchasing attractively packaged consumer goods is expected to trigger the need for various plastic components, which use masterbatches to improve the appearance and other properties. These factors together are anticipated to boost the market demand over the forecast period.

In terms of revenue, polypropylene (PP) was the largest carrier polymer segment in 2021 and the trend is anticipated to continue over the forecast period. Polypropylene offers excellent electrical resistance and does not present stress-cracking problems at high temperatures and strong chemicals. As such, it is useful in both rigid and flexible packaging applications. The demand for polypropylene as a carrier polymer is projected to increase owing to its excellent mechanical strength and flexibility offered by it. Polypropylene also enhances the quality of surfaces. It is lightweight and therefore, is used to replace metal components in the automotive industry.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 5.77 billion |

| Revenue Forecast by 2030 | USD 9.84 billion |

| Growth rate from 2022 to 2030 | CAGR of 6.11% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Type, carrier polymer, end use, region |

| Companies Covered |

A. Schulman, Inc.; Ampacet Corporation; Cabot Corporation; Clariant AG; Hubron International Ltd.; Penn Color, Inc.; Plastiblends India Ltd.; Global Colors Group; PolyOne Corporation; Tosaf Group |

Type Insights

In terms of revenue, black masterbatch held the largest share of more than 25.03% in 2021. The growth in demand for black masterbatch is attributed to the high demand for tires, PVC containers, and other products for application in the automotive and transportation, building and construction, agriculture, and packaging industries. The growing need for various agricultural products such as drip irrigation tubing and tape, greenhouse films, shade cloth, and geomembranes is also projected to boost the market growth over the forecast period.

The color on products is used to differentiate the products in the market, which is an important factor driving the demand for color masterbatches over the forecast period. In addition to this, color masterbatches provide customization alternatives to manufacture products with attractive visual appearance.

End-use Insights

In terms of revenue, packaging masterbatch held the largest share of more than 25.31% in 2021. The packaging industry includes retail, industrial, and consumer packaging, which further includes flexible and rigid options. A rise in the number of city inhabitants who require packaged goods is resulting in the increased demand for packaging. Consumers need packaging that is convenient, sustainable, flexible, offers protection and is easily traceable. As plastic packing fulfills all these needs, its demand is expected to grow, which is, in turn, projected to result in the growing demand for the product. There is the immense growth potential for the packaging industry in emerging economies such as India and China.

The rise in infrastructural activities in these countries has resulted in the growing demand from the building and construction sector, which may boost the product demand. The development of various government schemes such as Make in India and Smart City plans is also projected to ascend the demand for the product over the forecast period.

Carrier Polymer Insights

In terms of revenue, polypropylene (PP) masterbatch held the largest share of more than 25.08% in 2021. The demand for polypropylene as a carrier polymer is projected to increase owing to its excellent mechanical strength and flexibility offered by it. Polypropylene also enhances the quality of surfaces. It is lightweight and therefore, is used to replace metal components in the automotive industry. All these factors are expected to fuel the growth of the polypropylene segment over the forecast period.

The polyethylene segment in the European market was valued at over USD 231 million in 2021. Germany as a major manufacturing hub is expanding its production facilities, which is expected to increase the demand for polyethylene. The presence of a large number of plastic component manufacturing companies within the European region, which implies the easy and cost-effective availability of plastics, is a key factor driving the market in the region.

Polypropylene is being extensively used in consumer goods, which has been a contributing factor to the growth of the product demand. It has antimicrobial and antibacterial properties, making it useful in manufacturing various products related to building and construction. The polypropylene manufacturers are shifting the focus from synthetic to biobased due to environmental concerns, which is projected to drive the market over the forecast period.

Regional Insights

In terms of revenue, Asia Pacific held the largest share of more than 30.07% in 2021. The increased demand can be attributed to the presence of a number of end-use industries including automotive and transportation, packaging, building and construction, and consumer goods. The growth of these industries is expected to fuel the demand for the product over the next eight years.

In terms of revenue, Europe was the second-largest regional market in 2021 and the trend is projected to continue over the forecast period. The rapid growth of the packaging, consumer goods, and automotive and transportation industries, coupled with the growing building and construction and agriculture sectors in Asia Pacific, which are among the major end-use sectors using the product, is projected to be a major market driver.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Masterbatch Market

5.1. COVID-19 Landscape: Masterbatch Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Masterbatch Market, By Type

8.1. Masterbatch Market, by Type, 2022-2030

8.1.1 White

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Black

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Color

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Additive

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Filler

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Masterbatch Market, By Carrier Polymer

9.1. Masterbatch Market, by Carrier Polymer, 2022-2030

9.1.1. Polypropylene (PP)

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Polyethylene (PE)

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Polyvinyl Chloride (PVC)

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Polyethylene Terephthalate (PET)

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Biodegradable Plastics

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Masterbatch Market, By End-use

10.1. Masterbatch Market, by End-use, 2022-2030

10.1.1. Packaging

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Building & Construction

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Consumer Goods

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Automotive & Transportation

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Agriculture

10.1.5.1. Market Revenue and Forecast (2017-2030)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Masterbatch Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.2. Market Revenue and Forecast, by Carrier Polymer (2017-2030)

11.1.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Carrier Polymer (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Carrier Polymer (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.2. Market Revenue and Forecast, by Carrier Polymer (2017-2030)

11.2.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Carrier Polymer (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Carrier Polymer (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Carrier Polymer (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Carrier Polymer (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.2. Market Revenue and Forecast, by Carrier Polymer (2017-2030)

11.3.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Carrier Polymer (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Carrier Polymer (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Carrier Polymer (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Carrier Polymer (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.2. Market Revenue and Forecast, by Carrier Polymer (2017-2030)

11.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Carrier Polymer (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Carrier Polymer (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Carrier Polymer (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Carrier Polymer (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.2. Market Revenue and Forecast, by Carrier Polymer (2017-2030)

11.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Carrier Polymer (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Carrier Polymer (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 12. Company Profiles

12.1. A. Schulman, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Ampacet Corporation

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Cabot Corporation

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Clariant AG

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Hubron International Ltd.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Penn Color, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Plastiblends India Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Global Colors Group

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. PolyOne Corporation

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Tosaf Group

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others