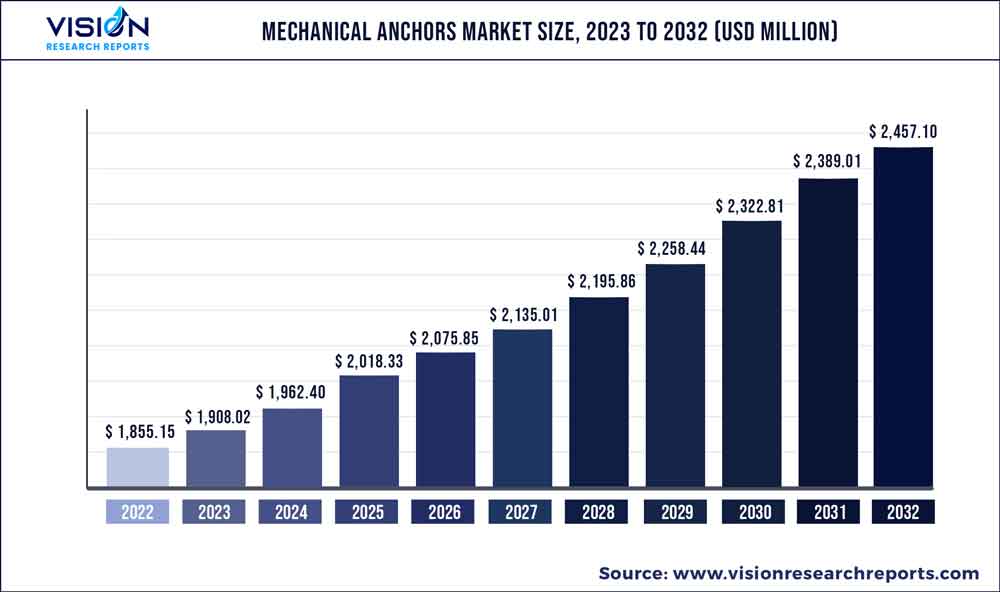

The global mechanical anchors market was surpassed at USD 1,855.15 million in 2022 and is expected to hit around USD 2,457.10 million by 2032, growing at a CAGR of 2.85% from 2023 to 2032. The mechanical anchors market in the United States was accounted for USD 376.3 million in 2022.

Key Pointers

Report Scope of the Mechanical Anchors Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 36.72% |

| CAGR of Middle East & Africa | 4.86% |

| Revenue Forecast by 2032 | USD 2,457.10 million |

| Growth rate from 2023 to 2032 | CAGR of 2.85% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Stanley Black & Decker, Inc.; Guangdong Kin Long Hardware Products Co., Ltd; Hilti Group; Simpson Strong-Tie Company, Inc.; Illinois Tool Works Inc.; Koelner Rawlplug IP; Mungo Befestigungstechnik AG; Prosoco, Inc.; MITEK IN; Mudge Fasteners, Inc.: MKT Fastening, LLC; Mechanical Plastic Corporation; UCAN FASTENING PRODUCTS; fisher Group of Companies; NINGBO LONDEX INDUSTRIALS CO., L.T.D.; Cobra Anchors |

The mechanical anchors have potential demand and installation across the building and construction sector including historic masonry materials. These anchors mechanically anchor themselves in the base material with the help of friction and some type of movement to achieve holding values.

The rapidly expanding construction industry is driving demand for the mechanical anchor industry growth. The increasing focus on advanced architectural design across the construction sector is expected to create potential demand over the forecast timeframe from 2023 to 2030. The economic development across rapidly developing countries including China and India is further estimated to accelerate growth during the forecast timeframe.

The continuous involvement of the government and international non-profit organizations for the development of respective areas and countries, in terms of advanced structural designs, that can meet the sustainable goals of the future is helping to generate market demand for mechanical anchors. Additionally, the rising focus to limit the emission of greenhouse gases (GHG) across the buildings and construction industry is another factor anticipated to create demand in the near future.

Mechanical anchors are primarily used in a solid concrete base, brick, & block, and stone. These mechanical anchors have to be strong and sturdy as they are subjected to transferring the load to the base material through, friction, bearing, or keying which requires high strength and hardness. As a result, majority of the mechanical anchors are made from carbon steel material as they exhibit outstanding workability, and strength to absorb stress in extreme load conditions.

The mechanical anchors industry is segmented into residential and commercial based on the applications. The residential application segment holds a comparatively small share when compared to commercial applications. The use of mechanical anchors in residential applications includes fixing wooden or plastic frames to the concrete or masonry units, railing and fences, and cable trenches.

The U.S. mechanical anchor industry is anticipated to witness moderate growth over the coming years owing to rising demand for machinery tools from the automotive, construction, and aerospace & defense industries. Despite the downturn in 2020 caused by the COVID-19 pandemic, rising emphasis on the production of building tools in the region, along with the continuation of construction operations, is anticipated to prove beneficial for the demand for the anchor.

The value chain of the mechanical anchors market comprises raw material suppliers, manufacturers, suppliers/distributors/exporters, and end-users. The raw materials include carbon steel and stainless steel. These raw materials are used in the manufacturing of anchors and are procured directly from the steel manufacturers or their distributors or suppliers and anchor manufacturers have signed agreements with the steel manufacturers for smooth supply.

Material Insights

Stainless steel was the largest and fastest growing market segment and accounted for 54.24% of the revenue share in 2022 as stainless steel hardly gets oxidized when compared to other materials including iron, and carbon steel. Additionally, aesthetic shining appearance, corrosion resistance, low maintenance, and strength make stainless steel a widely used material for manufacturing mechanical anchors.

Carbon steel accounted for USD 674.15 million for the year 2022 owing to its high strength. The presence of high carbon content makes them good at resisting abrasion and retaining shape under excess load in construction buildings. In addition, the material is primarily heat-treated by austenitizing, and quenching, followed by tempering to enhance its mechanical properties including yield and tensile strength.

In terms of the price standpoint, stainless steel is primarily more expensive than carbon steel. The high price of stainless steel is attributed to the wide array of other metals that are added to the stainless steel including chromium, manganese, and nickel. These additional elements increase the cost of stainless steel metal over carbon steel which is widely used in the building & construction industry.

Other materials used on a small scale to produce mechanical anchors include alloy steel which is expected to expand at a CAGR of 2.84%. These are primarily iron-based mixtures resulting in the formation of alloy steel having different element compositions including manganese, silicon, and copper. Other materials are also used in small quantities including nickel, chromium, and molybdenum in the alloy steel to achieve the required hardness, strength, and chemical resistance.

Application Insights

The mechanical anchors industry is segmented into residential and commercial based on the applications. The residential application segment holds a comparatively small share when compared to commercial applications which accounted for 74.37% of the market. In commercial sectors, mechanical anchor finds its wide application in various malls, hotels, sports complexes, and industries.

The building design of malls, hotels, and sports & recreational stadiums is becoming more complex and is fitted with a wide variety of pipes, tubes, and cables suspended from the ceiling. These are primarily held on metal trenches which are fitted with mechanical anchors to fasten them to the underside of the concrete deck for support and hold.

Residential applications accounted for a revenue share of over USD 476.05 million in 2022. The use of mechanical anchors in residential applications includes fixing wooden or plastic frames to the concrete or masonry units, railing and fences, and cable trenches. Metals such as aluminum and steel are widely used in the manufacturing of windows and doors in buildings owing to the lightweight and highly durable properties exhibited by the metals.

Furthermore, critical design and construction considerations for the adequate connection of the wooden frames and structural systems to concrete or stone base are the major key areas where mechanical fasteners are used in residential applications. In addition, increasing security concerns among the residential areas are amplifying the need for railing and fencing that uses mechanical anchors which get fixed to the railing bars with the boundary wall of the house. The above-mentioned factors are expected to boost the market demand during the forecast period.

Regional Insights

Asia Pacific accounted for the largest and fastest market with a 36.72% market share in 2022 owing to the increasing expansion of petrochemical plants along with the growing construction sector in the region. In addition, the growing demand for fuels and consumer goods is increasing the expansion of crude oil capacity coupled with rising investment for new infrastructural projects in the countries such as India, Australia, Hong Kong, Japan, Thailand, and Vietnam is propelling the market for mechanical anchors in these countries.

North America is one of the prominent regional markets for mechanical anchors owing to higher market penetration in the developed economies of the region such as the U.S. and Canada. Growing construction activities in developing economies such as Mexico is the key factor propelling the usage of the mechanical anchor. Rising investment toward the renovation of existing residential buildings and increasing disposable incomes are the major factors contributing to the growth of the market in the region.

In Europe, the European Organization for Technical Assessment (EOTA) is a non-profit organization offering the regulations for the European Technical Assessment (ETA) of construction products to ensure consistent product performance information. It has given regulations and guidelines to which the companies have to adhere by and take approval for every product launched. Any product with a label of ETA ensures safety application in order to prevent any failure and collapse of the structure installed.

The Middle East & Africa accounted for 4.86% of the market share in 2022 as it is the world leader in crude oil production. Many major countries in the region including Kuwait, Oman, Bahrain, Libya, Iraq, Iran, and Saudi Arabia are economically dependent on oil businesses. Mechanical tools are used in the assembly of rotary drilling equipment, and drilling rigs in setting up offshore drilling machinery.

Mechanical Anchors Market Segmentations:

By Material

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Mechanical Anchors Market

5.1. COVID-19 Landscape: Mechanical Anchors Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Mechanical Anchors Market, By Material

8.1. Mechanical Anchors Market, by Material, 2023-2032

8.1.1. Carbon Steel

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Stainless Steel

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Mechanical Anchors Market, By Application

9.1. Mechanical Anchors Market, by Application, 2023-2032

9.1.1. Residential

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Commercial

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Mechanical Anchors Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Material (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Material (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Material (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Material (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Material (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Material (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Material (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Material (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Material (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Material (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Material (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Material (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Material (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Material (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Material (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Material (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Material (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Material (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Material (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Material (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Material (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Stanley Black & Decker, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Guangdong Kin Long Hardware Products Co., Ltd

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Hilti Group

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Simpson Strong-Tie Company, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Illinois Tool Works Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Koelner Rawlplug IP

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Mungo Befestigungstechnik AG

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Prosoco, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. MITEK IN

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Mudge Fasteners, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others