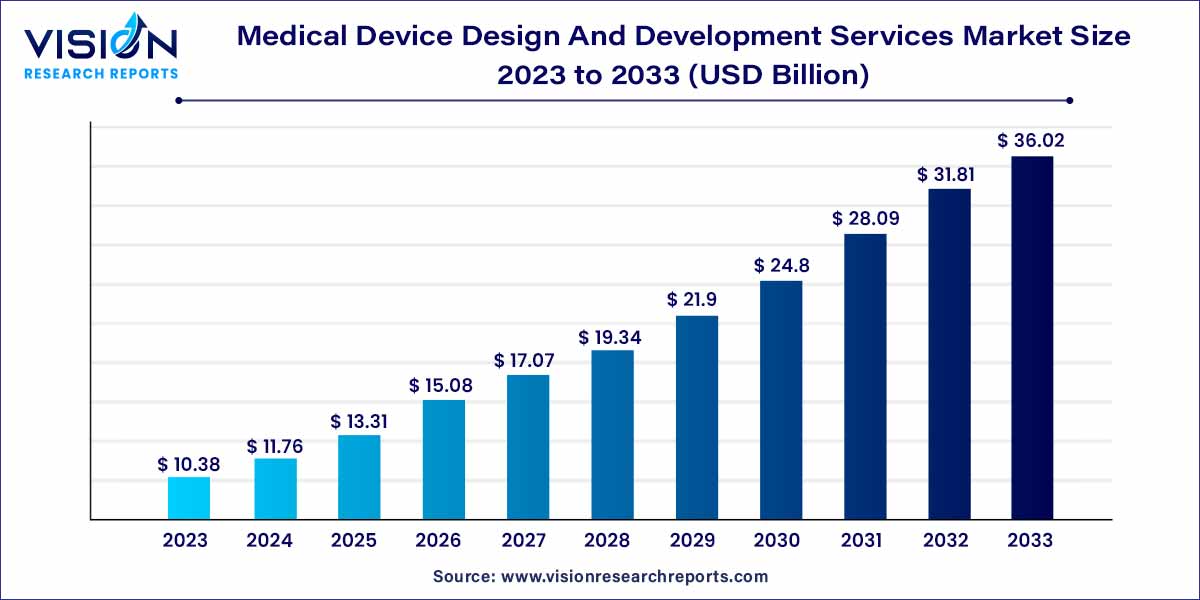

The global medical device design and development services market size was estimated at USD 10.38 billion in 2023 and it is expected to surpass around USD 36.02 billion by 2033, poised to grow at a CAGR of 13.25% from 2024 to 2033. The medical device design and development services market is witnessing significant growth driven by the increasing demand for innovative medical devices, advancements in technology, and the growing emphasis on patient-centric healthcare solutions.

The growth of the medical device design and development services market is propelled by several key factors. Firstly, the increasing demand for advanced and innovative medical devices to address complex healthcare challenges, such as an aging population and the prevalence of chronic diseases, drives the need for comprehensive design and development services. Secondly, technological advancements, including 3D printing, artificial intelligence, and advanced materials, enable the development of more personalized and efficient devices, thereby fueling market growth. Additionally, stringent regulatory requirements imposed by regulatory bodies necessitate expertise in navigating complex regulatory pathways, emphasizing the importance of specialized design and development services. Moreover, the trend towards patient-centric healthcare solutions and the focus on improving patient outcomes further contribute to the growth of this market. Overall, these factors combined create a conducive environment for the expansion of the medical device design and development services market.

Based on the array of services provided, the designing and engineering sector emerged as the dominant market segment, capturing the largest revenue share of 36% in 2023. The market is categorized into designing & engineering, machining, and molding packaging. Design and engineering firms have demonstrated their proficiency by meeting stringent regulatory standards, even amidst highly intricate, diverse, and demanding projects. Furthermore, the mounting pressure to curtail expenses, intensifying competition, burgeoning demand from emerging economies, and technological advancements are compelling device manufacturers to explore outsourcing options for design and engineering tasks. These factors are poised to propel growth within this segment.

The machining segment is projected to exhibit the most rapid Compound Annual Growth Rate (CAGR) of 12.73% over the forecast period. The segment's expansion is primarily driven by the escalating demand for miniaturized and intricate devices. The capability to machine complex materials in adherence to regulatory guidelines, coupled with technological innovations in medical machining such as laser micromachining, Computerized Numerical Control (CNC), and precision machining of micro-components, is anticipated to further stimulate growth in the machining market.

The drug delivery devices segment emerged as the leading revenue contributor in the medical devices market, capturing a substantial share of 17% in 2023. This market segment encompasses a diverse range of medical devices, including cardiovascular devices, point-of-care (POC) diagnostic equipment, orthopedic devices, dental devices, surgical devices, imaging devices, and more. Within the drug delivery devices segment, various subcategories such as auto-injectors, infusion pumps, prefilled syringes, inhalers, nebulizers, nasal sprays, intrauterine devices (IUDs), and transdermal patches are identified. Growth in the drug delivery devices sector is propelled by evolving trends in drug delivery methods, increasing demand for enhanced therapies, cost advantages for patients and healthcare systems, and rapid technological advancements.

The point-of-care (POC) diagnostic equipment segment is poised to exhibit the fastest Compound Annual Growth Rate (CAGR) of 15.72% over the forecast period. POC devices offer rapid and reliable test results at the point of need, presenting unique design challenges. Moreover, the design of POC diagnostic equipment ensures accurate results while maintaining the integrity of specimen samples, leading to increased adoption of rapid diagnostic tests. Additionally, stringent regulatory standards and ongoing technological advancements are expected to further bolster the growth of POC diagnostic equipment within the market

In terms of therapeutic areas, the "others" segment emerged as the dominant revenue contributor, holding a significant market share of 71% in 2023. This segment is categorized into cardiovascular, diagnostic, and other therapeutic areas. The "others" category encompasses a wide range of medical devices related to drug delivery, orthopedic conditions, dental care, surgical procedures, respiratory treatments, and various other medical applications. The growth of this segment is driven by several factors, including the potential for improved patient outcomes across diverse diseases and the ability to potentially reduce treatment costs.

The cardiovascular segment is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) of 15.15% over the forecast period. Cardiovascular devices play a pivotal role in advancing treatments for heart failure, heart disease, arrhythmias, and other cardiac conditions. This growth is attributed to the increasing number of products in development pipelines and continuous enhancements in cardiovascular device technologies. Furthermore, there's a growing emphasis on technology-driven solutions, competitive pricing strategies, and ensuring high quality standards for new device approvals, which are all accelerating the demand for robust cardiovascular devices.

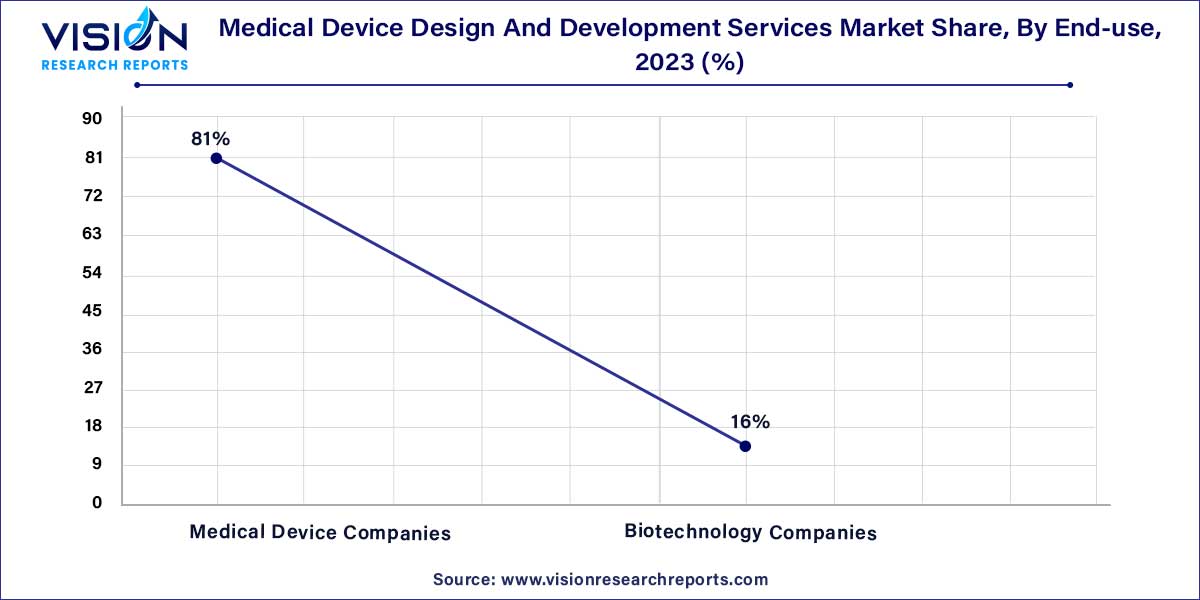

In terms of end-use, the medical device companies segment emerged as the market leader, commanding the largest revenue share of 81% in 2023. The market is categorized into two main segments: medical device companies and biotechnology companies. The substantial growth of the medical device companies segment can be attributed to the escalating global demand for high-quality medical device products. Additionally, factors such as the increasing aging population and the prevalence of diseases have spurred research and development activities in medical device design and development.

On the other hand, the biotechnology companies segment is expected to exhibit the fastest Compound Annual Growth Rate (CAGR) of 12.34% over the forecast period. Recent trends indicate a significant shift in medical devices, with notable advancements in diagnosis and treatment modalities. Moreover, the scope of medical devices within biotechnology companies extends to the development of healthcare products and procedures aimed at diagnosing, treating, or preventing diseases through the integration of pharmaceuticals or biologics.

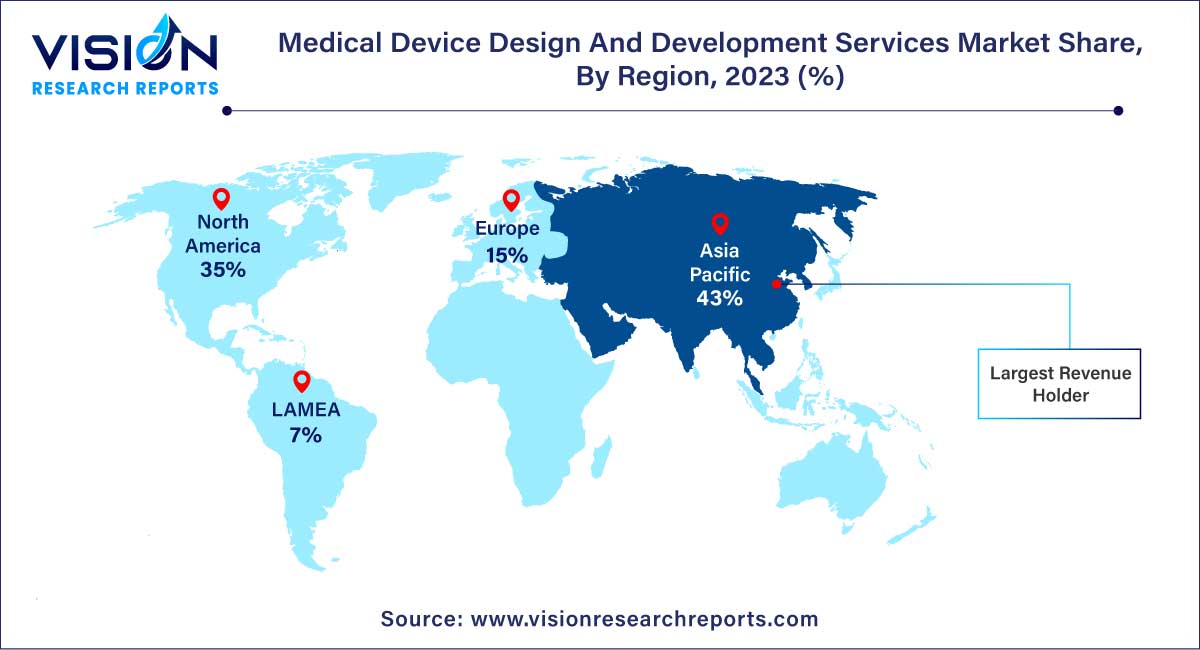

The Asia Pacific region emerged as the dominant force in the market, capturing the largest revenue share of 43% in 2023. This significant share can be attributed primarily to the evolving business landscape of medical device outsourcing and Research and Development (R&D) activities within the region. Countries like India and China offer strong cost-efficiency through their medical device design and development companies, further bolstering the region's prominence in this sector.

The North American market is anticipated to experience the fastest Compound Annual Growth Rate (CAGR) of 12.85% during the forecast period. This rapid growth can be attributed to the region's established manufacturing companies and a consistent focus on innovation to deliver high-quality products.

By Services

By Medical

By Therapeutic Area

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Medical Device Design and Development Services Market

5.1. COVID-19 Landscape: Medical Device Design and Development Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Medical Device Design and Development Services Market, By Services

8.1. Medical Device Design and Development Services Market, by Services, 2024-2033

8.1.1. Designing & Engineering

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Machining

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Molding

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Packaging

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Medical Device Design and Development Services Market, By Therapeutic Area

9.1. Medical Device Design and Development Services Market, by Therapeutic Area, 2024-2033

9.1.1. Cardiovascular

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Diagnostic

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Medical Device Design and Development Services Market, By End-use

10.1. Medical Device Design and Development Services Market, by End-use, 2024-2033

10.1.1. Medical Device Companies

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Biotechnology Companies

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Medical Device Design and Development Services Market, By Medical

11.1. Medical Device Design and Development Services Market, by Medical, 2024-2033

11.1.1. Cardiovascular Devices

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. POC Diagnostic Equipment

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Hb1Ac Testing

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Drug Delivery Devices

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Orthopedic Devices

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Dental Devices

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Surgical Devices

11.1.7.1. Market Revenue and Forecast (2021-2033)

11.1.8. Imagining Devices

11.1.8.1. Market Revenue and Forecast (2021-2033)

11.1.9. Sleep & Respiratory Devices

11.1.9.1. Market Revenue and Forecast (2021-2033)

11.1.10. Ophthalmology Devices

11.1.10.1. Market Revenue and Forecast (2021-2033)

11.1.11. Endoscopy

11.1.11.1. Market Revenue and Forecast (2021-2033)

11.1.12. Diabetes Care

11.1.12.1. Market Revenue and Forecast (2021-2033)

11.1.13. Cochlear Implants

11.1.13.1. Market Revenue and Forecast (2021-2033)

11.1.14. Neurostimulators

11.1.14.1. Market Revenue and Forecast (2021-2033)

11.1.15. Others

11.1.15.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Medical Device Design and Development Services Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Services (2021-2033)

12.1.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.1.3. Market Revenue and Forecast, by End-use (2021-2033)

12.1.4. Market Revenue and Forecast, by Medical (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Services (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Medical (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Services (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.1.6.3. Market Revenue and Forecast, by End-use (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Medical (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Services (2021-2033)

12.2.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.2.3. Market Revenue and Forecast, by End-use (2021-2033)

12.2.4. Market Revenue and Forecast, by Medical (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Services (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Medical (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Services (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Medical (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Services (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Medical (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Services (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.2.8.3. Market Revenue and Forecast, by End-use (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Medical (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Services (2021-2033)

12.3.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.3.3. Market Revenue and Forecast, by End-use (2021-2033)

12.3.4. Market Revenue and Forecast, by Medical (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Services (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Medical (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Services (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Medical (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Services (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Medical (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Services (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.3.8.3. Market Revenue and Forecast, by End-use (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Medical (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Services (2021-2033)

12.4.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.4.3. Market Revenue and Forecast, by End-use (2021-2033)

12.4.4. Market Revenue and Forecast, by Medical (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Services (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Medical (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Services (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Medical (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Services (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Medical (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Services (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.4.8.3. Market Revenue and Forecast, by End-use (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Medical (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Services (2021-2033)

12.5.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.5.3. Market Revenue and Forecast, by End-use (2021-2033)

12.5.4. Market Revenue and Forecast, by Medical (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Services (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Medical (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Services (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.5.6.3. Market Revenue and Forecast, by End-use (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Medical (2021-2033)

Chapter 13. Company Profiles

13.1. Ximedica

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. DeviceLAb

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Jabil, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Flex Ltd

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Plbexus Corp

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Nordson Medical

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Celestica, Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Starfish Medical

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Planet Innovation

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Donatelle

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others