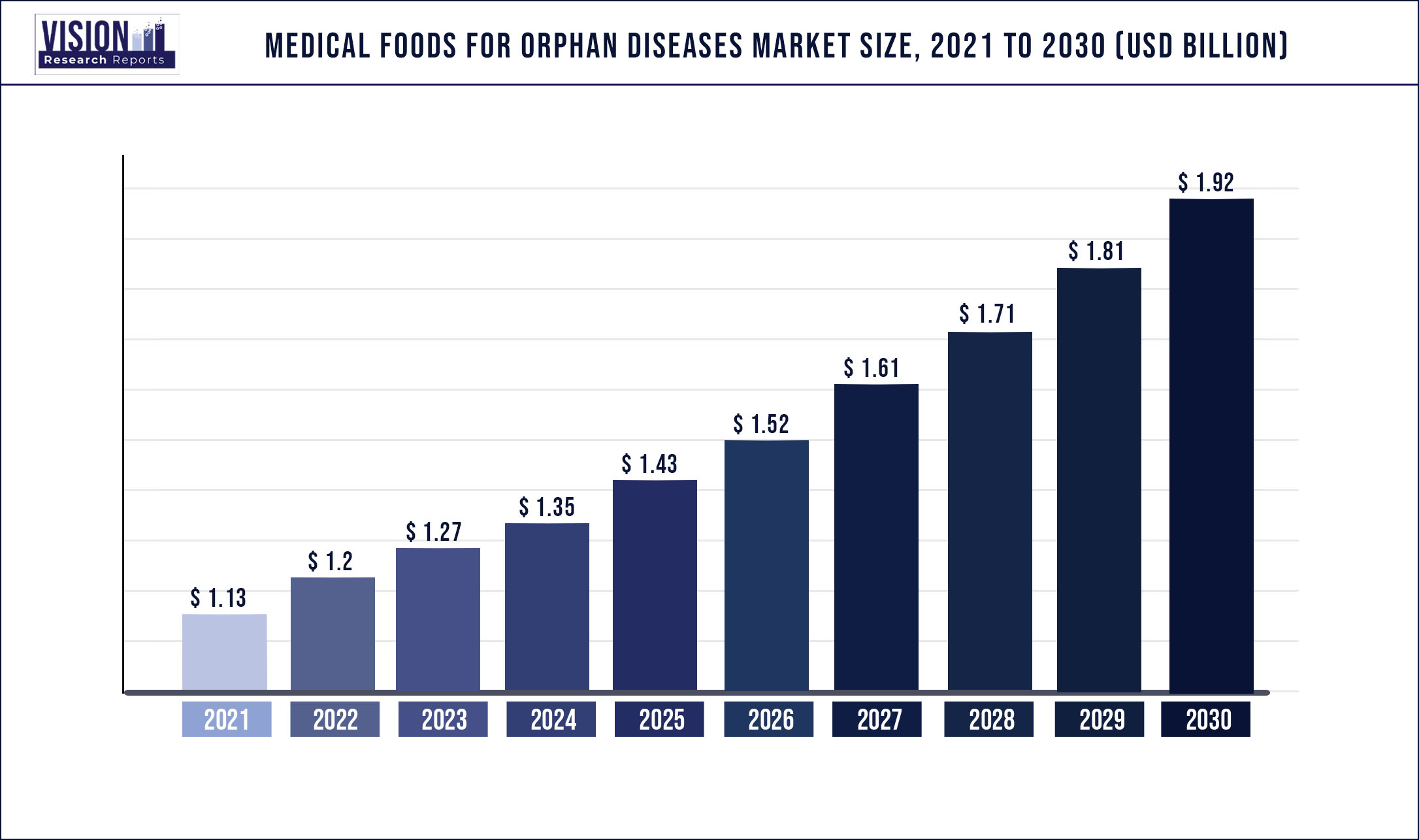

The global medical foods for orphan diseases market was estimated at USD 1.13 billion in 2021 and it is expected to surpass around USD 1.92 billion by 2030, poised to grow at a CAGR of 6.07% from 2022 to 2030.

Report Highlights

The major factors contributing to the industry’s growth are the growing prevalence of orphan diseases and increasing awareness about such rare conditions. Moreover, rising government initiatives for early screening and increasing initiatives by key players to develop products that cater to such niche segments also spell a promising horizon of growth.

Special medical nutritional requirements are needed for a variety of rare diseases in order to prevent major disabilities and allow normal growth in children and adults. Conditions like food protein-induced maple syrup urine disease, short bowel syndrome, and others, require special dietary requirements in order to maintain robust health. The growing awareness of such rare conditions and increased efficacy of diet plans also promise more avenues for growth.

Medical foods are expensive and may or may not be covered under health insurance. Since the FDA does not classify medicinal foods as drugs, many insurance plans do not cover them. This can impede market expansion over the forecast period.

Unlike other industries, COVID-19 had a positive impact on market growth. The increased awareness about immunity and healthy foods led to a significant rise in the adoption rate of clinical foods. In the year 2020, consumers opted for much healthier diets encompassing nutritional support and dietetic care as compared to the year 2019.

The oral segment dominated the market with a revenue share of over 69.46% in 2021. The oral route for medicinal foods remains the most convenient, and hassle-free. Hence, it remains the most preferred route for consumers globally and oral products are easily available. The expanding production of oral goods in the form of tablets, powder, and pre-thickened products also remains a prominent driver of growth.

The powder segment accounted for the largest revenue share of over 35.38% in 2021. Easy commercial availability of medicinal foods in powdered form is largely responsible for the segment's expansion. Additionally, powered forms of products are simple to use and hence widely preferred by pediatric and geriatric patients suffering from various rare diseases, which continues to drive the segment's expansion.

The institutional sales channel accounted for the largest revenue share of over 41.17% in 2021. The segment includes home care settings, hospitals, and disability facilities. The online sales segment is anticipated to expand at the fastest rate over the forecast period. Due to the convenience, these sales channel provides, more people choose to buy medicinal foods online.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 1.13 billion |

| Revenue Forecast by 2030 | USD 1.92 billion |

| Growth rate from 2022 to 2030 | CAGR of 6.07% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, route of administration, application, sales channel, region |

| Companies Covered |

Abbott; Nestle; Danone; Mead Johnson & Company, LLC; Relief Therapeutics; Solace Nutrition; Ajinomoto Cambrooke, Inc. |

Product Insights

The powder segment accounted for the largest revenue share of over 35.38% in 2021. The growth of the segment can be attributed to commercial availability of large variety of medical foods in the powdered form. This form remains easy to consume and thus, is highly preferred by the pediatric and geriatric patients suffering from different orphan diseases, thereby fueling the segment growth. Physicians regularly advise powdered formulations as it can be easily administered through enteral and oral routes by patients of all ages.

However, the liquid segment is expected to grow at the fastest CAGR over the forecast period of 2022-2030. The growth is attributed to the rising adoption rate of liquid formulations by pediatric and geriatric consumers, as the intake of solid formulations is often unfeasible. Furthermore, the easy commercial availability of liquid formulations and the growing preference of liquid medical foods promise robust growth during the forecast period. Doctors prescribe liquid-formulated medical food for patients who have gastrointestinal disorders. Moreover, the increasing advantages of taking liquid-formulated food for maintaining sufficient hydration and electrolyte balance promise a further boost to the segment’s growth.

Application Insights

The other segment accounted for the largest revenue share of over 36.44% in 2021. Conditions like maple syrup urine disease, and short bowel syndrome require special nutritional support. Hence, enabling patients to control such rare conditions remains a key driver of growth. The high commercial availability of medical foods remains an important factor as well.

Furthermore, the growing penetration rate of such rare diseases along with growing awareness about orphan diseases are 2 major key factors that fuel the market growth. Key players remain highly invested in the development of disease-specific medical foods, which is expected to drive growth during the forecast period.

FPIES condition is expected to showcase the fastest CAGR-driven growth over the forecast period of 2022-2030. This condition makes patient allergic to one or many kinds of food products. Such patients require a special diet in order to meet their nutrition needs. Increasing initiatives for early screening of this condition and rising knowledge about this condition fuel market growth. Rising launches of hypoallergenic products and easy commercial availability of such products in various formulation further boosts the segment’s growth.

Sales Channel Insights

The institutional sales channel accounted for the largest revenue share of 41.17% in 2021. It consists of home care settings, hospitals, and disability facilities. The rising percentage of patient visits to hospitals and other settings remains this segment's primary driver of growth. Furthermore, the diagnosis and treatment of new orphan disorders also propel the growth of the segment.

Medical foods are often prescribed by doctors for the management of particular diseases. In addition, a large percentage of consumers opt for a special consultation with doctors for managing orphan diseases which positively impacts the segment's growth. Rising healthcare expenditure, and expanding healthcare infrastructure the across the globe are likely to aid this growth further.

The online sales segment is anticipated to expand at the fastest CAGR over the forecast period. With the convenience of shopping via online channels, a growing number of consumers continue to flock to e-commerce. Medical foods are mostly taken under medical supervision, but they are also meant for long-term nutrition control, which also remains a major factor behind the upsurge in e-commerce sales. Thus, with the penetration of e-commerce, consumers are switching from traditional ways of purchasing to online purchases of medical foods. This is expected to create new avenues for growth.

Route Of Administration Insights

The oral segment dominated the market with a revenue share of over 69.46% in 2021. Commonly, medical foods for orphan diseases are administered through the oral route which is one of the key reasons propelling the growth. Furthermore, the growing manufacturing of oral products in the form of pre-thickened products, powder, and pills, is further anticipated to fuel the segment’s growth. For instance, Relief announced the U.S. launch of PKU Golike in October 2021. It is a medical food product for the dietary management of phenylketonuria (PKU).

However, the enteral route of the administration segment is expected to showcase the fastest growth over the forecast years. The manufacturers remain keen on the development of technologically advanced enteral feeding devices. This is expected to aid the segment’s growth during the forecast period. In addition, the development and launch of disease-specific nutritional products remain a core concern for key players. The rapid adoption of condition-specific and immune-modulating formulas for the management of a wide variety of rare diseases continues to fuel the segment’s growth.

Regional Insights

In 2021, North America held the largest revenue share of 30.55%. The presence of international companies such as Abbott Laboratories and Mead Johnson & Company and their high revenue generation remains the key driver of growth. Additionally, strategic developments by key players in the form of mergers, acquisitions, and product launches also remain prominent drivers of growth. Rising prevalence of chronic conditions, and increasing adoption of medical food products by healthcare professionals and patients also continue to boost the market growth.

Asia Pacific is anticipated to be the fastest-growing regional market over the forecast period owing to the increasing penetration rate of rare conditions, along with several government initiatives in the healthcare segment. Furthermore, the highly populated nature of the region, and growing awareness among patients about medical foods are anticipated to drive the growth. The growing presence of global players in several countries in the region and several key untapped opportunities promise major growth during the forecast period.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Medical Foods For Orphan Diseases Market

5.1. COVID-19 Landscape: Medical Foods For Orphan Diseases Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Medical Foods For Orphan Diseases Market, By Route of Administration

8.1. Medical Foods For Orphan Diseases Market, by Route of Administration , 2022-2030

8.1.1. Oral

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Enteral

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Medical Foods For Orphan Diseases Market, By Product

9.1. Medical Foods For Orphan Diseases Market, by Product, 2022-2030

9.1.1. Pills

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Powder

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Liquid

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Medical Foods For Orphan Diseases Market, By Application

10.1. Medical Foods For Orphan Diseases Market, by Application, 2022-2030

10.1.1. Phenylketonuria

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Tyrosinemia

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Eosinophilic esophagitis

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. FPIES

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. MSUD

10.1.5.1. Market Revenue and Forecast (2017-2030)

10.1.6. Homocystinuria

10.1.6.1. Market Revenue and Forecast (2017-2030)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Medical Foods For Orphan Diseases Market, By Sales Channel

11.1. Medical Foods For Orphan Diseases Market, by Sales Channel , 2022-2030

11.1.1. Online Sales

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Institutional Sales

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Retail Sales

11.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Medical Foods For Orphan Diseases Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.1.2. Market Revenue and Forecast, by Product (2017-2030)

12.1.3. Market Revenue and Forecast, by Application (2017-2030)

12.1.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Product (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.1.5.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Product (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.1.6.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.2.2. Market Revenue and Forecast, by Product (2017-2030)

12.2.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Product (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.5.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Product (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.6.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Product (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.7.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Product (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.8.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.3.2. Market Revenue and Forecast, by Product (2017-2030)

12.3.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Product (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.5.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Product (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.6.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Product (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.7.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Product (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.8.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.4.2. Market Revenue and Forecast, by Product (2017-2030)

12.4.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Product (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.5.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Product (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.6.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Product (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.7.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Product (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.8.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.5.2. Market Revenue and Forecast, by Product (2017-2030)

12.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.5.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Product (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.5.5.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Product (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.5.6.4. Market Revenue and Forecast, by Sales Channel (2017-2030)

Chapter 13. Company Profiles

13.1. Nestle

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Danone

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Abbott

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Mead Johnson & Company, LLC

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Relief Therapeutics

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Solace Nutrition

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Ajinomoto Cambrooke, Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others