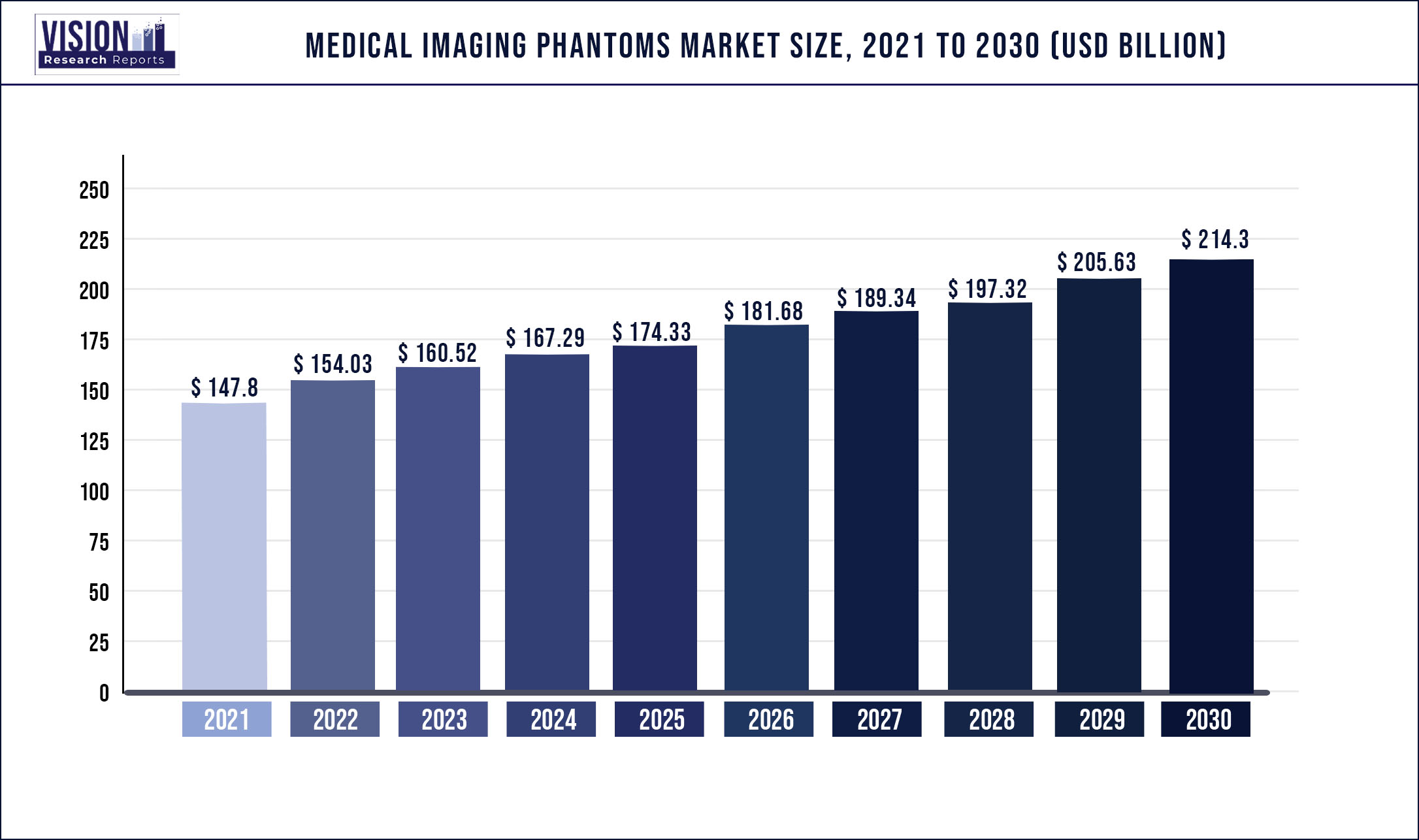

The global medical imaging phantoms market was surpassed at USD 147.8 million in 2021 and is expected to hit around USD 214.3 million by 2030, growing at a CAGR of 4.21% from 2022 to 2030.

Diagnostic radiology is widely adopted for precision diagnosis of brain injuries, cancer, and other diseases. In addition, computed tomography (CT) scan and magnetic resonance imaging (MRI) are widely used techniques. These phantoms help in enhancing the efficiency of these imaging devices by helping medical experts in detecting, interpreting, analyzing, and evaluating information required for treatments. Therefore, the increasing adoption of these devices for the diagnosis of severe diseases is expected to drive the market growth.

Effective reimbursement scenario of medical imaging and growing competition to provide advanced technologies are a few factors driving the adoption of the product. Moreover, the growing participation of key players in various radiology conferences is expected to drive the adoption of these devices and their respective phantoms. The increasing number of preclinical studies to understand the effectiveness of these phantoms for hybrid imaging devices is expected to expand the growth potential in the coming years.

The introduction of advanced materials and production techniques are some of the major factors expected to strengthen the applications of these phantoms for specific diseases. The introduction of advanced simulating phantoms is anticipated to provide deep insights on actual dynamics at a cellular level, thus enhancing the precision in diagnostics.

These devices have various associated advantages, which is a key factor driving the market growth. For instance, realistic medical imaging phantoms of organs and tissues are being developed using 3D technology to enhance the performance of medical imaging devices. This, in turn, is expected to drive the medical imaging phantom market growth over the forecast period.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 147.8 million |

| Revenue Forecast by 2030 | USD 214.3 billion |

| Growth rate from 2022 to 2030 | CAGR of 4.21% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Device type, end-use, material, region |

| Companies Covered | Biodex Medical Systems, Inc.; Gold Standard Phantoms; Pure Imaging Phantoms; Modus Medical Devices Inc.; True Phantom Solutions; Computerized Imaging Reference Systems, Inc.; Carville Limited; PTW Freiburg GmbH; Dielectric Corporation; Quart GmbH; Leeds Test Objects Ltd; Kyoto Kagaku Co. Ltd; PhantomX |

Device Type Insights

Based on device type, the medical imaging phantom market has been segmented into ultrasound, X-ray, CT, nuclear imaging, MRI, and others. Other devices include radionuclide, mammography, optical tomography, and specimen imaging. X-ray phantoms held the largest share in 2019 and the segment is expected to register a significant growth rate over the forecast period.

The increasing number of radiography tests is boosting the need for X-ray devices. For instance, according to the NHS, in January 2017, 1.9 million plain radiography tests were recorded in England. The rising adoption of X-ray devices is contributing to the growing demand for X-ray medical imaging phantoms. To meet the growing demand, several market players are increasingly focusing on the development of advanced and realistic phantoms.

The nuclear imaging phantoms segment is expected to grow at the fastest rate from 2020 to 2027 owing to the development of detailed anatomical phantoms for its effective use in biomedical and bioengineering research. Therefore, these realistic anatomical changes in phantoms will help develop an advanced computational model for nuclear imaging, which would in turn drive the segment growth over the forecast period.

Material Insights

Based on material, the market has been segmented into simulating devices and false organs. Simulating devices held the largest market share in 2019 and is also expected to grow at the fastest rate over the forecast period. The increasing adoption of simulating devices to measure the flow rate, temperature, and other parameters of imaging devices is expected to drive market growth over the forecast period. Moreover, these devices are connected to imaging devices wirelessly and provide effective control, monitoring, and recording for imaging purposes. In addition, simulating devices have a wide application in multi-nuclear imaging, spectroscopy, quantitative diffusion imaging, and MRI, among others. Therefore, effective use of simulating devices for enhancing the performance of medical imaging devices is expected to contribute to market growth.

The false organs segment is expected to witness a moderate growth rate over the forecast period. These organs are available in different anatomies to facilitate a realistic user experience. Moreover, false organs are widely used in ultrasound and radiology for the diagnosis of pediatric as well as adult patients. The increasing application of these organs is expected to drive the segment growth during the forecast period.

End-use Insights

Based on end-use, the medical imaging phantom market has been segmented into hospitals, diagnostic and reference laboratories, academic and research institutes, and medical device companies. Hospitals held the largest market share in 2019, and the segment is estimated to grow at a significant rate during the forecast period. The increasing number of medical imaging procedures in hospitals is leading to the installation of effective and accurate medical devices. This, in turn, is driving the need for medical imaging phantoms in hospitals.

Medical device companies are also expected to gain a significant share of the industry in the near future owing to increasing medical training and research activities. The high number of clinical and preclinical trials for various imaging modalities integrated with artificial intelligence are anticipated to play a pivotal role in market growth.

Large-sized hospitals are starting in-house imaging centers which help in saving a significant amount of time during diagnosis and treatment. This is expected to boost the demand for imaging systems as well as imaging phantoms in the coming years.

The academic and research institutes segment also held a significant share of the market in 2019 due to the growing demand for trained students in the field of medical imaging. Moreover, increasing research activities and technological innovation in the production and designing of phantoms is expected to play a pivotal role in boosting demand. Several bioengineering researchers are aiming to develop a realistic phantom head for magnetic resonance research, which is an emerging trend in the market.

Regional Insights

North America held the largest share in the global market in 2019 largely due to the increasing healthcare expenditure and installation of various medical imaging devices such as CT scanners and MRI devices in the region. In addition, growing awareness of medical imaging in countries such as the U.S. and Canada is expected to impact the adoption of medical imaging devices.

Asia Pacific is expected to witness the fastest growth rate during the forecast period. This is mainly due to the increasing prevalence of lifestyle-associated disorders such as cardiac failure. For instance, according to the American Heart Association (AHA), the prevalence of heart failure in the Asia Pacific region ranges from 1.3% to 6.7%. In addition, 4.2 million people in China alone suffer from heart failure. Therefore, the increasing prevalence of such diseases drives the demand for early diagnosis, which would subsequently drive the demand for medical imaging phantoms. Moreover, the growing number of skilled professionals, increasing demand for advanced diagnostic products, and rising medical tourism in developing economies of the region are boosting the market in the Asia Pacific region.

Key Players

·Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Medical Imaging Phantoms Market

5.1. COVID-19 Landscape: Medical Imaging Phantoms Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Medical Imaging Phantoms Market, By Device Type

8.1. Medical Imaging Phantoms Market, by Device Type, 2022-2030

8.1.1 X-ray

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Ultrasound

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. CT

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. MRI

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Nuclear imaging

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Medical Imaging Phantoms Market, By End-use

9.1. Medical Imaging Phantoms Market, by End-use, 2022-2030

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Academic and Research Institutes

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Diagnostic and Reference Laboratories

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Medical Device Companies

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Medical Imaging Phantoms Market, By Material

10.1. Medical Imaging Phantoms Market, by Material, 2022-2030

10.1.1. Simulating devices

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. False organs

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Medical Imaging Phantoms Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Device Type (2017-2030)

11.1.2. Market Revenue and Forecast, by End-use (2017-2030)

11.1.3. Market Revenue and Forecast, by Material (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Device Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by End-use (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Material (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Device Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by End-use (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Material (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Device Type (2017-2030)

11.2.2. Market Revenue and Forecast, by End-use (2017-2030)

11.2.3. Market Revenue and Forecast, by Material (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Device Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by End-use (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Material (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Device Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by End-use (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Material (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Device Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by End-use (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Material (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Device Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by End-use (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Material (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Device Type (2017-2030)

11.3.2. Market Revenue and Forecast, by End-use (2017-2030)

11.3.3. Market Revenue and Forecast, by Material (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Device Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by End-use (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Material (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Device Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by End-use (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Material (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Device Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by End-use (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Material (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Device Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by End-use (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Material (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Device Type (2017-2030)

11.4.2. Market Revenue and Forecast, by End-use (2017-2030)

11.4.3. Market Revenue and Forecast, by Material (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Device Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by End-use (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Material (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Device Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by End-use (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Material (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Device Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by End-use (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Material (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Device Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by End-use (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Material (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Device Type (2017-2030)

11.5.2. Market Revenue and Forecast, by End-use (2017-2030)

11.5.3. Market Revenue and Forecast, by Material (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Device Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by End-use (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Material (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Device Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by End-use (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Material (2017-2030)

Chapter 12. Company Profiles

12.1. Biodex Medical Systems, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Gold Standard Phantoms

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Pure Imaging Phantoms

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Modus Medical Devices Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. True Phantom Solutions

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Computerized Imaging Reference Systems, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Carville Limited; PTW Freiburg GmbH

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Dielectric Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Quart GmbH

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Leeds Test Objects Ltd

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others