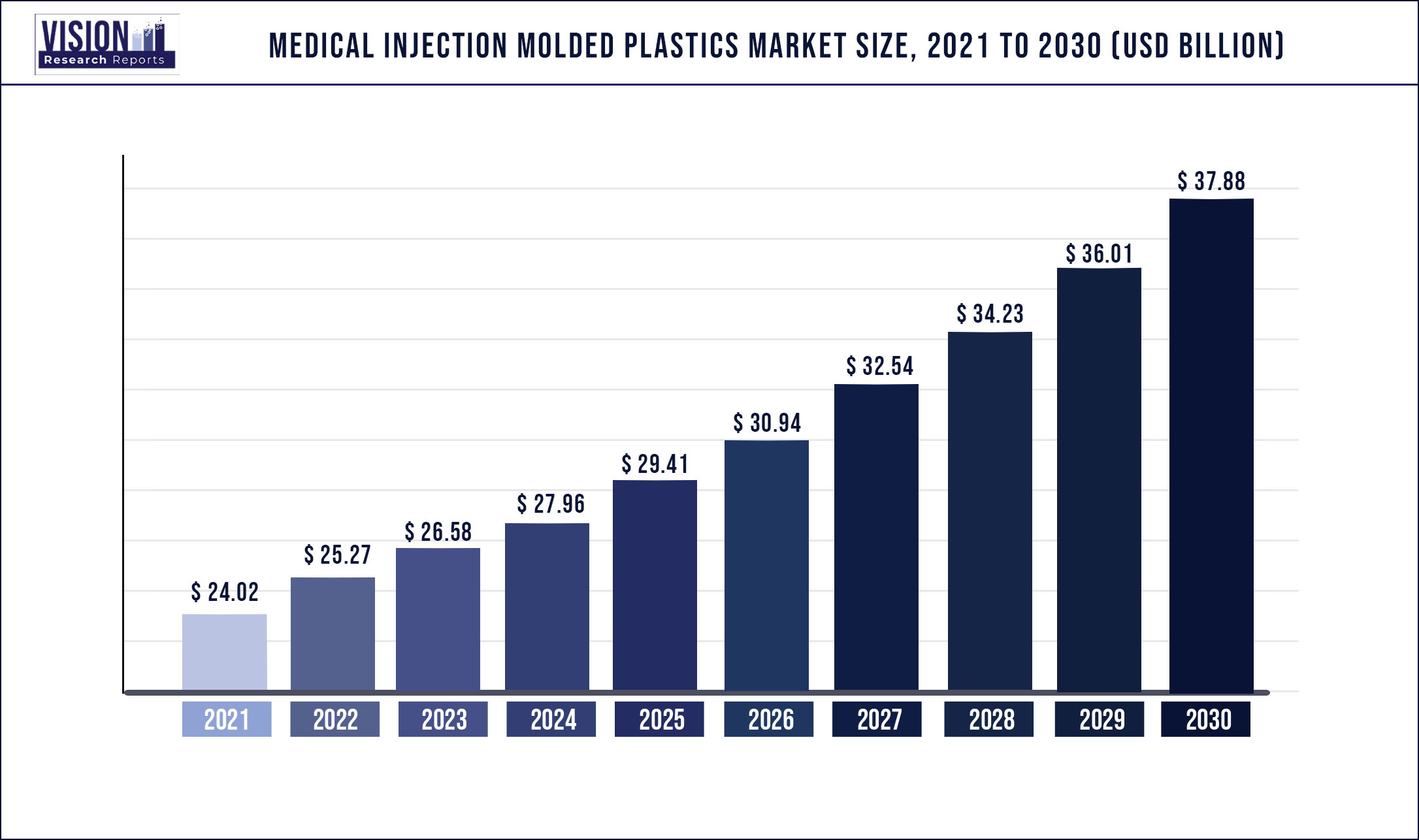

The global medical injection molded plastics market size was estimated at around USD 24.02 billion in 2021 and it is projected to hit around USD 37.88 billion by 2030, growing at a CAGR of 5.19% from 2022 to 2030.

Report Highlights

Medical injection molded plastics have played a significant role in revolutionizing the healthcare sector. With the improvements in the healthcare industry, medical injection molded plastic has shown to be one of the few adaptable materials that have been able to keep up with the industry's changing needs. Injection molded plastics have been employed in a variety of applications including disposable plastic syringes, blood bags, new heart valves, and other medical devices.

Moreover, medical injection molded plastics can be molded as per the requirement of a specific application. For instance, they are being used to develop new medical devices. Plastics are now being used in surgical devices and procedures along with products like modern pacemakers, stents, and joint replacement devices owing to their ability to adapt to the tiniest and most intricate molds. This is expected to drive the market over the forecast period.

The Asia Pacific region is anticipated to expand at a lucrative CAGR of 5.3% in terms of revenue over the forecast period. The medical components application segment in the region is expected to witness substantial growth on account of the increasing applications of medical injection molded plastics in diagnostic drug kits, surgical consumables, drug delivery products, and others. An increase in healthcare expenditure, primarily in the U.S., China, and Germany, is expected to drive the demand for medical components, implants, mobility aids, etc., developed from injection-molded plastics over the forecast period.

The global demand for injection molded polypropylene from medical component manufacturers is expected to remain the highest during the forecast period owing to its superior properties, including ease of sterilization and high impact resistance. The consumption of injection molded plastics for cleanroom supplies is expected to witness growth due to the growing concerns regarding infection prevention in hospitals. Thus, the cleanroom supplies application segment is expected to account for a large share over the forecast period on account of the demand for premium-grade plastics. Polyethylene (PE) is a cost-effective medical-grade material that does not retain bacteria and is resistant to cleaning chemicals, making it suitable for medical equipment, devices, and supplies. It offers excellent impact resistance, chemical resistance, stability, flexibility, environmental friendliness, and minimal moisture absorption, making it ideal for medical-grade devices and components.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 24.02 billion |

| Revenue Forecast by 2030 | USD 37.88 billion |

| Growth rate from 2022 to 2030 | CAGR of 5.19% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, application, region |

| Companies Covered |

Dow, Inc.; SABIC; Eastman Chemical Company; Celanese Corporation; Covestro AG; Rutland Plastic; Evonik Industries AG; Sumitomo Chemical Co., Ltd.; Arkema; INEOS Group |

Product Insights

The polypropylene segment led the market and accounted for more than 30.05% share of the global revenue in 2021. Owing to its exceptional toughness and durability, polypropylene (PP) is utilized for making protective packaging and medical equipment. It also has lightweight, bacterial and chemical resistance, and low-cost features, therefore, it is likely to witness significant expansion in medical component applications throughout the forecast period. Furthermore, it is readily molded in correct proportions as needed and hence has a great demand in the fabrication of syringes.

Acrylonitrile Butadiene Styrene (ABS) is anticipated to grow at the fastest rate during the forecast period. With its high-impact resistance and durability, Acrylonitrile Butadiene Styrene (ABS) is utilized in non-absorbable sutures, tendon prosthesis, drug-delivery systems, cleaning applications, and tracheal tubes.

Injection-molded ABS is being widely used in medical devices on account of its temperature resistance, good tensile strength, heat resistance, shock absorbance, dimensional stability, and corrosion resistance properties. This is expected to further complement the demand for ABS across the market over the forecast period.

Application Insights

The medical components segment led the market and accounted for more than 24.11% share of the global revenue in 2021. The COVID-19 pandemic had put the global healthcare supply chain in the spotlight as the demand for medical components such as protective and personal equipment (PPE), face masks, gloves and gowns, and magnetic resonance imaging (MRI) scanner machines increased drastically. While emerging countries manufactured PPE, face masks, and gloves, developed countries manufactured technology-intensive equipment such as MRI scanners and mechanical ventilators.

With the impulsive impact of COVID-19, the demand for the aforementioned equipment is on the rise. This is expected to drive the market over the forecast period. Furthermore, increasing healthcare expenditure and changing lifestyles across the world are creating a huge demand for medical plastics in medical component applications such as testing equipment, ventilators, syringes, and medical trays. This is expected to drive the market over the forecast period.

Regional Insights

North America dominated the market and accounted for more than 40.28% share of the global revenue in 2021. The region comprises mature markets and is characterized by a technologically advanced medical injection molded plastics industry, thereby contributing significantly to the global market growth. In the North American region, Canada is attracting significant investments in both public and private sectors owing to the increasing geriatric population and rising incidences of chronic diseases.

According to the Canadian Institute for Health Information (CIHI), government spending on the healthcare industry was about 12.7% of the country’s total GDP in 2021. The country is characterized by high health consciousness and high life expectancy, viz., 85 years for women and 79 years for men. This is anticipated to pose lucrative growth opportunities for medical plastic manufacturers in the country.

The rising number of chronic diseases and a burgeoning aging population are driving up the demand for medical devices in Canada's healthcare industry. The expansion of the healthcare industry is being fueled by the introduction of new and more expensive medical devices and increased per-patient use of medical supplies. This is expected to drive the product demand over the forecast period.

The massive growth in demand for medical components in Mexico is driven by the rising incidence of cardiovascular diseases, diabetes, malignant tumors, liver diseases, metabolic disorders, and respiratory diseases, which, in turn, is likely to augment the demand for medical plastics at a significant rate over the forecast period. The COVID-19-related treatments, the pharmaceutical industry, public healthcare, and safety are now the main priorities of the nation, which is expected to drive the market over the forecast period.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Medical Injection Molded Plastics Market

5.1. COVID-19 Landscape: Medical Injection Molded Plastics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Medical Injection Molded Plastics Market, By Product

8.1. Medical Injection Molded Plastics Market, by Product, 2022-2030

8.1.1. Polypropylene (PP)

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Acrylonitrile Butadiene Styrene (ABS)

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Polyethylene (PE)

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Polystyrene (PS)

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Polycarbonate (PC)

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Medical Injection Molded Plastics Market, By Application

9.1. Medical Injection Molded Plastics Market, by Application, 2022-2030

9.1.1. Medical Components

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Implants

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Cleanroom Supplies

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Mobility Aids

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Medical Injection Molded Plastics Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 11. Company Profiles

11.1. Dow, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. SABIC

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Eastman Chemical Company

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Celanese Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Covestro AG

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Rutland Plastic

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Evonik Industries AG

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Sumitomo Chemical Co., Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Arkema

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. INEOS Group

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others