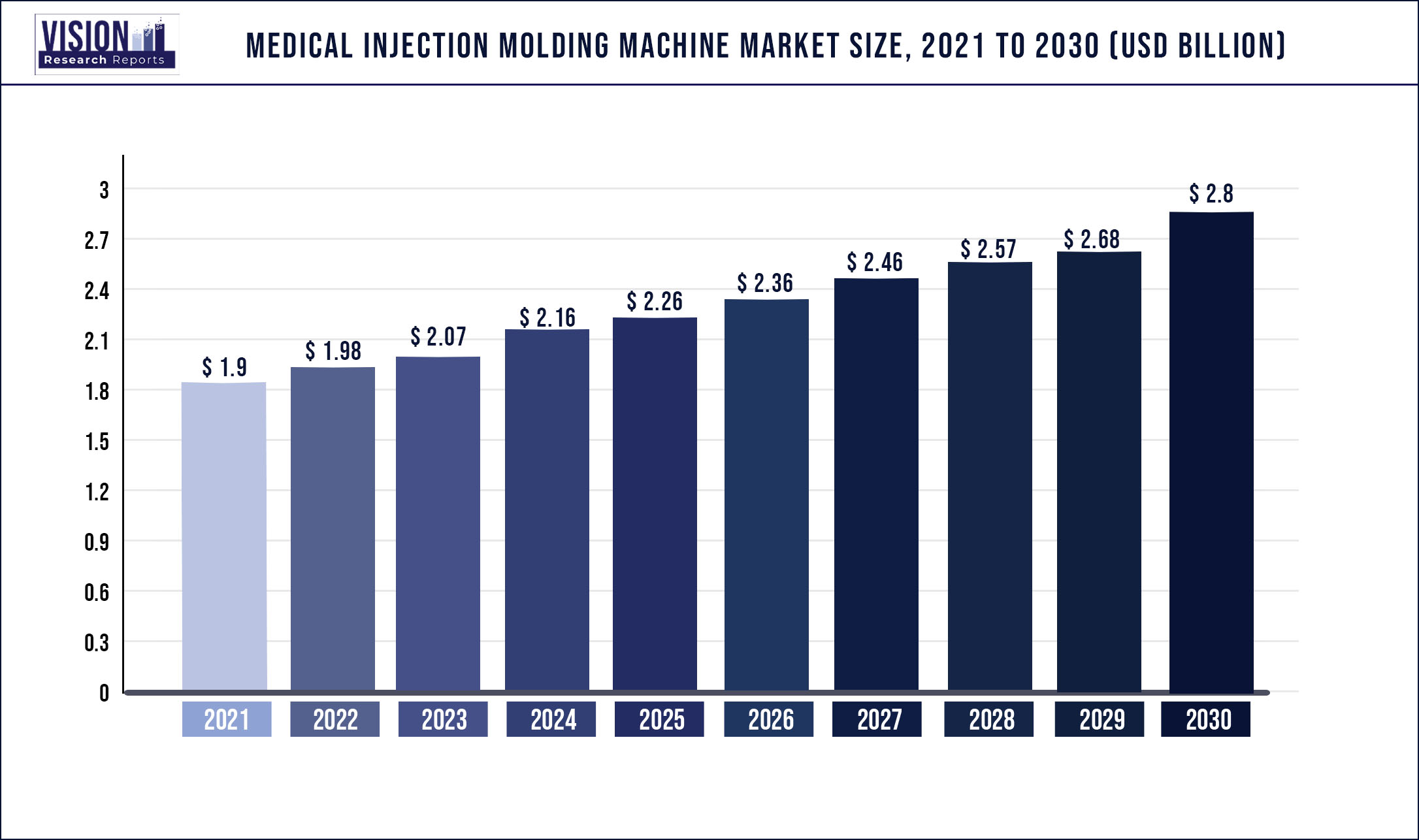

The global medical injection molding machine market was valued at USD 1.9 billion in 2021 and it is predicted to surpass around USD 2.8 billion by 2030 with a CAGR of 4.4% from 2022 to 2030.

The industry is primarily driven by the increased application of plastics in several healthcare products, and technological advancements in the medical industry.

The demand for testing kits witnessed exponential growth globally, as healthcare authorities attempted to track the spread of the COVID-19 pandemic. This resulted in various companies in the medical devices and pharmaceuticals sectors initiating the production of these kits and ramping up their production capacities to help alleviate testing shortages.

The adoption of different raw materials used in the injection molding process, as well as the rising energy efficiency of injection molding machines, have replaced traditional molding machines. This, in turn, has boosted the demand for automated and energy-efficient injection molding equipment used in the medical industry. The key factors influencing the demand for medical products include availability, awareness, affordability, and adaptability. Increasing demand for better healthcare facilities and the ongoing COVID-19 pandemic has boosted the growth of medical devices manufactured by using injection molding machines.

Manufacturers are focusing on producing injection molding machines that can bring down production costs, provide flexibility in production, reduce scrap, are low maintenance, shorten production cycle times, and are efficient in every manner. This is increasing the demand for electric and hybrid medical injection molding machines.

Key market players are undertaking collaborations and new product launches as sustainable strategies. In April 2021, Tederic Machinery Co. launched the NEO series of electric, hybrid injection molding machines that consists of a new generation of servo pumps. These machines can save up to 80% more energy as compared to hydraulic machines.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 1.9 billion |

| Revenue Forecast by 2030 | USD 2.8 billion |

| Growth rate from 2022 to 2030 | CAGR of 4.4% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, system, material, region |

| Companies Covered | Sumitomo (SHI) Demag Plastics Machinery GmbH; Husky Injection Molding Systems Ltd; Arburg GmbH + Co KG; Engel Austria GmbH; HARBEC; Uvex Group; Wittmann Battenfeld; The Japan Steel Works, Ltd.; Metro Mold and Design |

Product Insights

The electric product segment led the market and accounted for 46.6% of the global revenue share in 2021. Electric machines are digitally controlled, which enables them to operate at a very high speed and accuracy. Independent motors direct everything from injection to extruder to clamping and ejection on electric type, making them extremely efficient. Compared to hydraulic type, these machines require shorter start-up & runtime, while being cleaner, faster, tighter, & offering more repeatable process manufacturing equipment with little waste, resulting in an average energy reduction of roughly 75%.

Electric types are favored over hydraulic machines for producing products like heart pump parts, orthopedic devices, custom knee braces, catheters, and fetal heartbeat monitors, among others since they are cleaner in operation. The hybrid machinery segment is estimated to witness growth at a CAGR of 5.7% during the forecast period. The benefits of both electric and hydraulic types are combined in a hybrid type. The clamping force of a hydraulic type is combined with the reduced noise, precision, and efficiency of an electric molding machine, resulting in improved performance for both thick and thin-walled products.

The hydraulic type machines have been around for a long time and are still a very effective method of making medical devices that meet today's industry demands. However, manufacturers are under pressure to make medical devices at a faster rate and lesser cost, which has allowed hybrid injection molding machines to play an increasingly important role in medical device manufacturing.

System Insights

Hot runner systems led the segment and accounted for more than 56.6% of the global revenue share in 2021. Various advantages provided by these systems include faster cycle time and lower pressure required to drive the molten mixture into the mold cavity, elimination of waste due to the elimination of runners, the housing of larger parts with greater volume of production, and increased uniformity and quality of parts.

Hot sprinter molds are made up of two plates that are heated by a sophisticated structure. This structure keeps liquid thermoplastics at the same temperature as their warming chamber. There are two types of hot sprinters: inside warmed sprinters and distantly warmed sprinters. The hot sprinter framework keeps the material in a liquid state throughout the sprinter method, until it enters the form pit.

On the other hand, the cold runner system segment is likely to grow at a CAGR of 4.0% during the projection period. The use of a cold runner system is based on its benefits such as ease of maintenance and cost-effectiveness; it is suited for a wide range of polymers. This technology is a viable choice because it produces higher-quality parts. As a result of reduced initial investments compared to other systems, the use of cold runner systems is increasing at a rapid pace.

A cold runner system is a physical tube that is not heated and is used to inject plastic through a sprue. Its mold base is made up of two or three plates. The injection technique employs molten thermoplastic, which is injected into the molds through a nozzle via a sprue. Runners are kept at the same temperature as molds in this system.

Material Insights

The plastics material segment led the medical injection molding machine market and accounted for 85.2% of the global revenue share in 2021. Plastic injection molding is a viable approach for producing complex medical products. Medical-grade injection-molded goods are in high demand because they are long-lasting, inherently resistant to pollutants and chemicals, and provide economies of scale to major manufacturing companies.

Because of their high metal tolerance, tensile strength, and temperature endurance, engineering-grade plastic resins are useful in the manufacture of medical and pharmaceutical items. Furthermore, they cut waste, weight, and total production costs, consequently adding to the industry growth.

The demand for metals in the manufacturing process is likely to grow at a CAGR of 6.2% during the forecast period. Metal injection molding is an excellent method for producing delicate, tiny, and precise metal components for the medical industry. The metal injection molding process employs both thermoplastic and powder metallurgy injection molding.

Metal injection molding is a more cost-effective technology than other traditional manufacturing processes since it reduces raw material utilization, labor, and inventory costs. Products made with this method also have higher mechanical qualities when compared to other powder metal components and castings. These goods also have a high sintered density and fine particle size, which should help manufacturers who need components with superior mechanical qualities.

Regional Insights

The Asia Pacific led the market and accounted for 36.5% of the global revenue share in 2021. The healthcare industry in the region is expected to grow at a swift pace, owing to several factors, including aging population and urbanization, improving standards of living, and expanding healthcare infrastructure in countries such as China, India, and Japan.

In North America, rising healthcare costs and an aging population are expected to boost the medical sector. Government authorities are anticipated to invest considerably in healthcare facilities following the COVID-19 epidemic. The increasing use of injection molding to manufacture a variety of parts and components for medical devices is likely to boost industry growth in the coming years.

The European region is likely to grow at a CAGR of 4.3% during the forecast period. The regulatory framework for the medical device sector in Europe is being changed, with the goal of raising medical device safety and performance standards. As a result, during the projection years, demand for high-quality, biocompatible, recyclable, and innovative plastics in medical devices is expected to increase.

Germany is Europe's leading plastic industry. In the healthcare sector, plastic is used to manufacture molded products for the treatment and diagnosis of various diseases. There are several benefits of using plastic in the injection molding process, such as cost reduction and long product life cycle. This is expected to boost the demand for plastic in medical injection molding.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Medical injection molding machine Market

5.1. COVID-19 Landscape: Medical injection molding machine Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Medical injection molding machine Market, By Product

8.1. Medical injection molding machine Market, by Product, 2022-2030

8.1.1 Hydraulic

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Electric

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Hybrid

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Medical injection molding machine Market, By System

9.1. Medical injection molding machine Market, by System, 2022-2030

9.1.1. Hot Runner

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Cold Runner

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Medical injection molding machine Market, By Material

10.1. Medical injection molding machine Market, by Material, 2022-2030

10.1.1. Plastics

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Metals

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Medical injection molding machine Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.2. Market Revenue and Forecast, by System (2017-2030)

11.1.3. Market Revenue and Forecast, by Material (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.4.2. Market Revenue and Forecast, by System (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Material (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.5.2. Market Revenue and Forecast, by System (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Material (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.2. Market Revenue and Forecast, by System (2017-2030)

11.2.3. Market Revenue and Forecast, by Material (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.4.2. Market Revenue and Forecast, by System (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Material (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.5.2. Market Revenue and Forecast, by System (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Material (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.6.2. Market Revenue and Forecast, by System (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Material (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.7.2. Market Revenue and Forecast, by System (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Material (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.2. Market Revenue and Forecast, by System (2017-2030)

11.3.3. Market Revenue and Forecast, by Material (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.4.2. Market Revenue and Forecast, by System (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Material (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.5.2. Market Revenue and Forecast, by System (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Material (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.6.2. Market Revenue and Forecast, by System (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Material (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.7.2. Market Revenue and Forecast, by System (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Material (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.2. Market Revenue and Forecast, by System (2017-2030)

11.4.3. Market Revenue and Forecast, by Material (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.4.2. Market Revenue and Forecast, by System (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Material (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.5.2. Market Revenue and Forecast, by System (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Material (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.6.2. Market Revenue and Forecast, by System (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Material (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.7.2. Market Revenue and Forecast, by System (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Material (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.2. Market Revenue and Forecast, by System (2017-2030)

11.5.3. Market Revenue and Forecast, by Material (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.4.2. Market Revenue and Forecast, by System (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Material (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.5.2. Market Revenue and Forecast, by System (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Material (2017-2030)

Chapter 12. Company Profiles

12.1. Sumitomo (SHI) Demag Plastics Machinery GmbH

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. ENGEL MACHINERY INDIA PVT. LTD.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Husky Injection Molding Systems Ltd

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Arburg GmbH + Co KG

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Engel Austria GmbH

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Milacron MSA

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. HARBEC

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Metro Mold & Design

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Proto Labs, Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. AMS Micromedical, LLC

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others