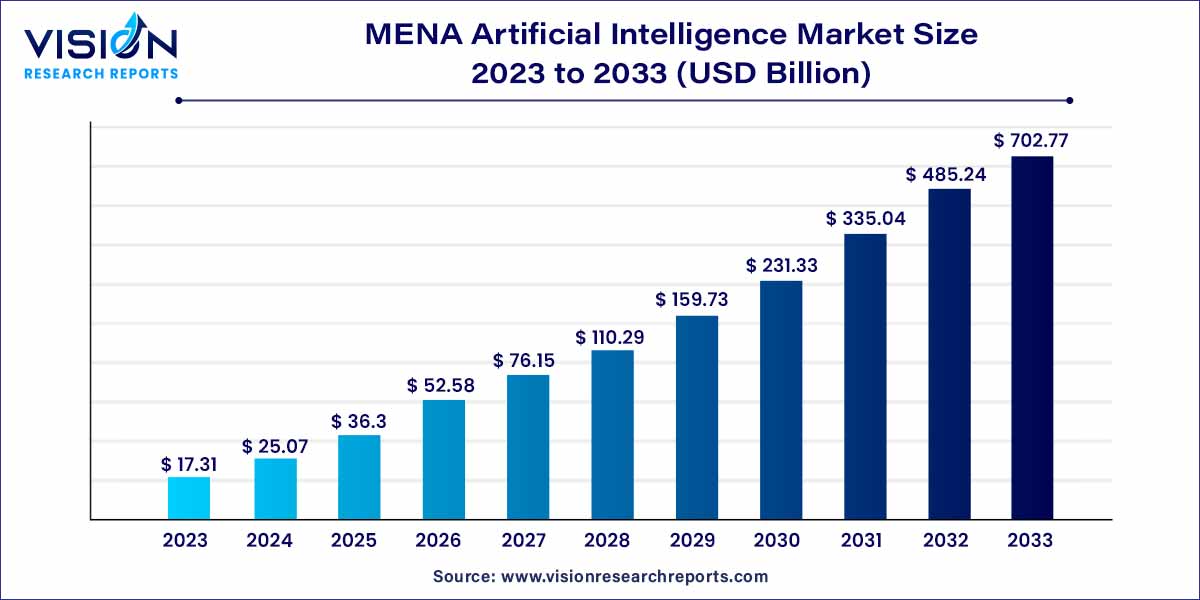

The MENA artificial intelligence market size was estimated at around USD 17.31 billion in 2023 and it is projected to hit around USD 702.77 billion by 2033, growing at a CAGR of 44.83% from 2024 to 2033.

The Middle East and North Africa (MENA) region has witnessed significant growth and adoption in the field of Artificial Intelligence (AI) in recent years. As technology continues to shape various industries, AI has emerged as a key driver of innovation and efficiency across the MENA region.

The MENA artificial intelligence (AI) market is experiencing robust growth, driven by several key factors. Foremost among these is the proactive support from regional governments, who are investing significantly in fostering AI development and adoption. This commitment is evident through strategic initiatives, incentives, and infrastructure development aimed at creating a conducive environment for AI innovation. Additionally, the ongoing digital transformation across diverse industries in the region plays a pivotal role. As businesses increasingly embrace technology to enhance efficiency and competitiveness, the demand for AI solutions has surged. The MENA region's wealth of data availability is another critical growth factor, providing a rich foundation for the development of sophisticated AI applications. This data-driven landscape empowers organizations to extract valuable insights, driving informed decision-making. Despite challenges, including the need for skilled professionals and ethical considerations, the MENA AI market's growth trajectory remains promising, with a clear emphasis on technological advancement, government support, and a rising awareness of AI's transformative potential.

| Report Coverage | Details |

| Growth rate from 2024 to 2033 | CAGR of 44.83% |

| Market Size in 2023 | USD 17.31 billion |

| Revenue Forecast by 2033 | USD 702.77 billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

In 2023, the deep learning technology segment secured the largest share of market revenue. This technology empowers machines to enhance their performance through learning from experience and data, proving particularly effective with unstructured data such as images, videos, and language. Its applications are vast, notably within autonomous vehicles, where deep neural networks play a crucial role in tasks like object detection, recognition, road mapping, and decision-making processes. The market has experienced significant growth due to the intricate capabilities of deep learning, especially in addressing challenges associated with complex data-driven applications like text, content, and speech recognition.

The machine vision is expected to witness a notable CAGR during forecast the period. Automation is a prevailing trend in machine learning, aiming to minimize manual labor in constructing and deploying models. The rise of automated machine learning (AutoML) platforms is democratizing machine learning capabilities, enabling non-experts to expedite model building.

Furthermore, embedded analytics featuring built-in machine learning models have become a mainstream capability in business intelligence platforms. Marketers are leveraging machine learning-driven behavioral analytics tools to enhance user retention strategies. These tools analyze user interactions with websites or applications, identifying signs of disengagement or potential customer churn. Armed with this data, marketers can proactively take measures to retain users and increase customer lifetime value. For example, if a user exhibits reduced activity on a platform, personalized offers or content can be delivered to reignite their interest.

In 2023, the Banking, Financial Services, and Insurance (BFSI) end-use segment dominated the market share. Artificial Intelligence (AI) is playing a pivotal role in streamlining credit scoring and underwriting processes within the sector. Machine learning models are utilized to analyze extensive datasets, enabling a more accurate assessment of borrowers' creditworthiness. This trend empowers financial institutions to make improved lending decisions, subsequently reducing the risk of default and enhancing the overall efficiency of the loan origination process. Furthermore, traditional banks are evolving into AI-driven entities to offer new value propositions and elevate customer experiences. AI systems swiftly analyze large volumes of transaction data to identify irregularities and potential fraud, thereby enhancing security measures.

The healthcare sector is poised for significant CAGR in the forecast period. AI is instrumental in analyzing vast datasets, including clinical trial data and health records, amassed by healthcare organizations, providing actionable insights for decision-making. Generative AI holds the potential to enhance operational efficiency, customize experiences, and improve data connectivity in the healthcare industry. Noteworthy collaborations between major players are contributing to industry expansion. For instance, in August 2022, Google announced a partnership with Cognizant. In this collaboration, Cognizant is entrusted with creating healthcare solutions utilizing Google's Language and Learning Models (LLMs). The primary aim of this venture is to leverage advanced AI capabilities to address diverse challenges in the healthcare sector, opening up new opportunities for growth within the LLM market.

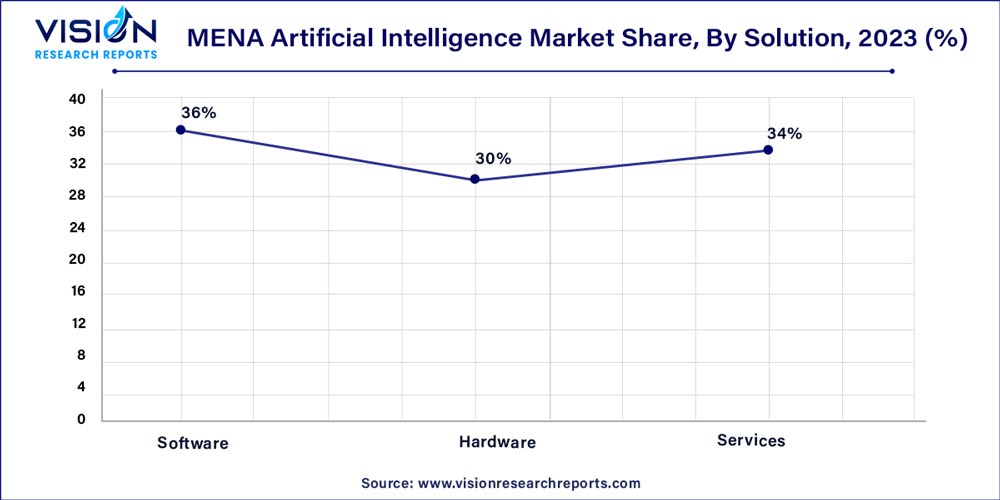

In 2023, the software segment held the largest revenue share of 36%. Notably, significant mergers and acquisitions (M&A) by major players have been instrumental in propelling market growth. An illustrative example is the acquisition announced in July 2022, where IBM Corporation acquired Databand.ai, Ltd., a provider of data observability software. This strategic move enhances IBM Corporation's research and development (R&D) efforts, strengthening its position in automation and artificial intelligence. By integrating Databand.ai Ltd. with IBM observability through IBM Watson Studio and Instana APM, IBM is well-equipped to address the complete spectrum of observability across IT operations. Additionally, prudent advancements in information storage capacity, high computing power, and parallel processing capabilities contribute to the growth of high-end AI software, catering to dynamic end-user verticals.

The service segment is poised to experience a significant CAGR throughout the forecast period. Enterprises are making substantial investments in AI services to unlock the potential of their businesses. These services encompass a broad spectrum of activities, including forecasting, planning, predictive maintenance, and the implementation of customer service chatbots. The scope of AI services also extends to integration, maintenance, and support tasks. Over the projection period, the service segment is expected to witness substantial growth. Key players' involvement in mergers and acquisitions continues to drive market expansion. An instance of this is the completion of Google LLC's acquisition of the cybersecurity company Mandiant in September 2022. This strategic move aims to provide clients with an end-to-end security operations suite, encompassing both on-premises and cloud contexts, along with additional capabilities.

By Technology

By Solution

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Technology Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on MENA Artificial Intelligence Market

5.1. COVID-19 Landscape: MENA Artificial Intelligence Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. MENA Artificial Intelligence Market, By Technology

8.1. MENA Artificial Intelligence Market, by Technology, 2024-2033

8.1.1 Deep Learning

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Machine Learning

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Natural Language Processing (NLP)

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Machine Vision

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. MENA Artificial Intelligence Market, By Solution

9.1. MENA Artificial Intelligence Market, by Solution, 2024-2033

9.1.1. Software

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Hardware

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Services

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. MENA Artificial Intelligence Market, By End-use

10.1. MENA Artificial Intelligence Market, by End-use, 2024-2033

10.1.1. Media & Entertainment

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. BFSI

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. IT & Telecommunication

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Healthcare

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Automotive & Transportation

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Oil & Gas

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 11. MENA Artificial Intelligence Market, Regional Estimates and Trend Forecast

11.1. MENA

11.1.1. Market Revenue and Forecast, by Technology (2021-2033)

11.1.2. Market Revenue and Forecast, by Solution (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Advanced Micro Devices.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. DevisionX.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Baidu, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Google LLC.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. IBM.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Intel Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Intelmatix.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Digital Energy

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Gleac.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others