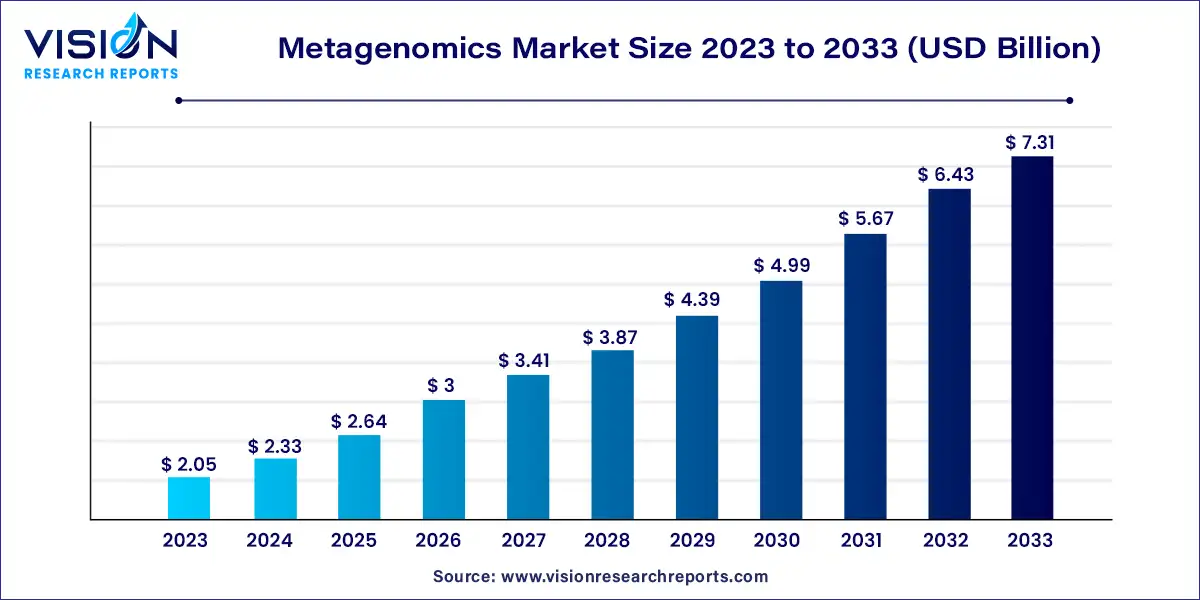

The global metagenomics market size was estimated at around USD 2.05 billion in 2023 and it is projected to hit around USD 7.31 billion by 2033, growing at a CAGR of 13.55% from 2024 to 2033.

Metagenomics, a cutting-edge field within genomics, has emerged as a pivotal tool in understanding the complex microbial communities inhabiting diverse ecosystems. This innovative approach transcends traditional sequencing methods by enabling the comprehensive study of microbial genetic material directly from environmental samples. The Metagenomics Market, characterized by rapid advancements and expanding applications, offers promising opportunities for research, diagnostics, and therapeutic development.

The growth of the Metagenomics Market is propelled by an increasing recognition of the pivotal role played by microbial communities in various ecosystems, including human health and disease, is driving demand for metagenomic research. Advancements in sequencing technologies have significantly lowered costs and improved efficiency, making metagenomic analysis more accessible to researchers and industry players alike. Additionally, the expanding scope of metagenomics beyond microbial ecology to areas such as personalized medicine, agriculture, and environmental monitoring is creating new avenues for market growth. These factors, combined with growing investments in research and development, are fueling the expansion of the Metagenomics Market and its potential to revolutionize diverse sectors.

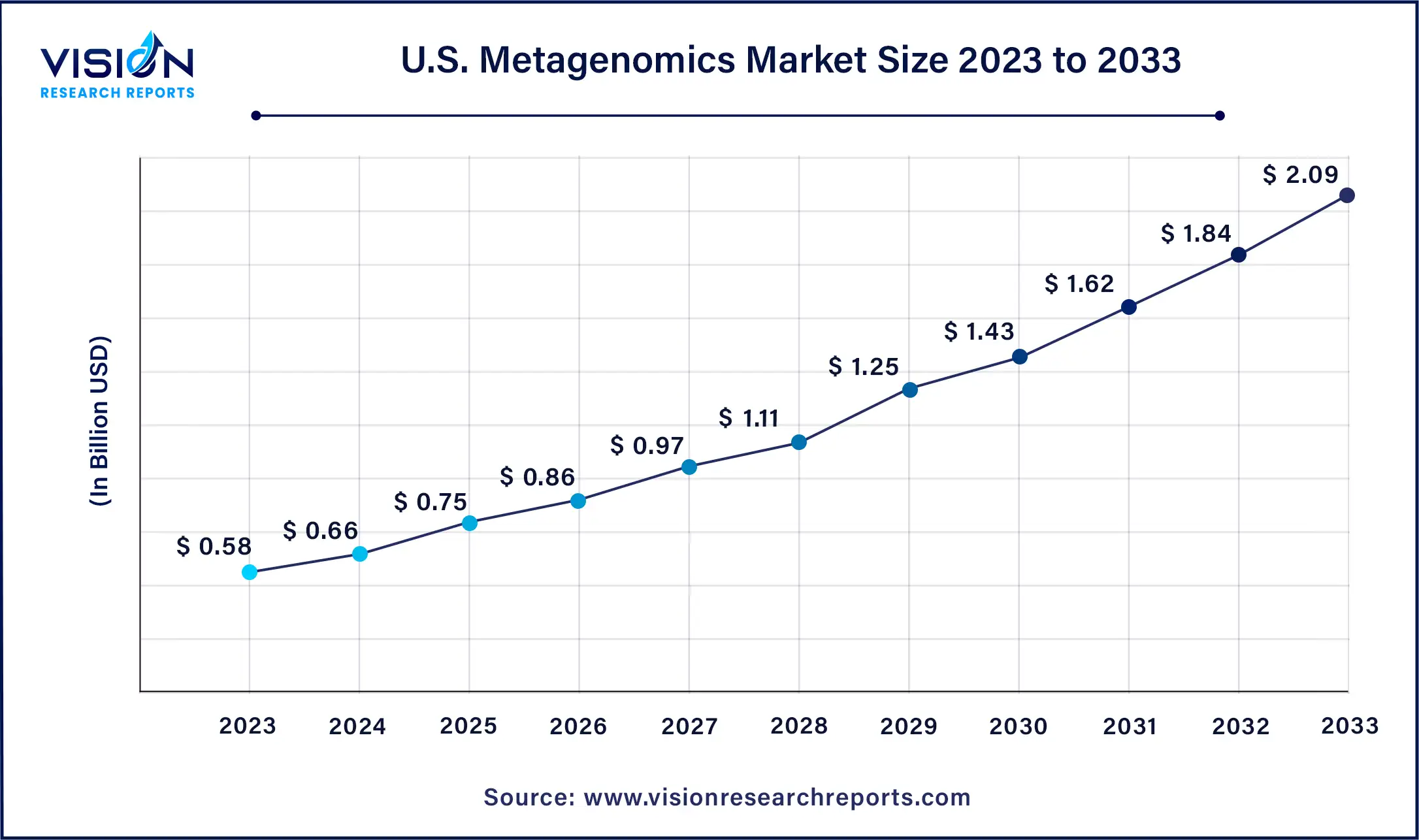

The U.S. metagenomics market size was valued at USD 0.58 billion in 2023 and is predicted to surpass around USD 2.09 billion by 2033 with a CAGR of 13.67% from 2024 to 2033.

This can be credited to extensive genomics, oncology, and whole-genome sequencing research in the country. Other contributing factors include sophisticated research and medical infrastructure, ample funding, a skilled workforce, and companies pushing for improved research methods to identify newer technologies for diagnosis and therapies.

North America emerged as the dominant player in the metagenomics market in 2023, capturing a revenue share of 41%. This dominance is attributed to several factors, including the presence of key companies, increased research and development funding, and advancements in sequencing technology. Collaborations between companies and academic institutions are a prominent strategy driving growth in the region. For instance, in September 2021, The Broad Institute collaborated with the CDC and Theiagen Genomics to enhance support for public health laboratories in the U.S., particularly focusing on nationwide pathogen genomics surveillance.

In contrast, Asia Pacific is expected to exhibit the fastest compound annual growth rate (CAGR) during the forecast period. This growth is propelled by substantial advancements in metagenomics adoption across diverse applications, particularly in India and China. The region's focus on genomics and proteomics research, coupled with proactive initiatives from academic institutions to advance sequencing technologies, presents lucrative growth opportunities throughout the forecast period.

The segment for kits and reagents dominated the revenue share, accounting for over 62% in 2023. These kits and reagents are tailored for specific purposes such as analyzing soil, water, and biological samples. They find extensive use in screening various microbial entities like bacteria, viruses, pathogens, fungi, and micro-eukaryotic species as per the study's requirements. Consequently, the introduction of innovative kits employing these techniques for tasks like library preparation, Polymerase Chain Reaction (PCR) assays, and other assays is expected to propel growth within this segment.

Furthermore, the sequencing and data analytics services segment is anticipated to exhibit significant growth during the forecast period. The increased adoption of sequencing technologies has led to a heightened demand for platforms facilitating data analysis. Simultaneously, companies are either providing services for interpreting metagenomics data or launching products to engage research entities in clinical applications.

The shotgun sequencing segment dominated with the largest revenue share, accounting for 35% in 2023. This technique involves sequencing entire genomes by randomly fragmenting DNA into small pieces and then sequencing each fragment. It finds extensive applications in genomics research, clinical diagnostics, and various industries including environmental monitoring and conservation, as well as agriculture and crop improvement. Moreover, in clinical settings, shotgun sequencing plays a vital role in identifying genetic mutations associated with diseases and facilitating personalized treatment plans.

The 16S sequencing segment is expected to experience significant growth during the forecast period. This technique, commonly used in microbial ecology studies, aids in understanding microbial diversity. The rising interest in exploring the human microbiome and microbial communities in diverse environments has fueled the demand for methods like 16S sequencing and metagenomics. Additionally, 16S sequencing contributes to the discovery of novel bioactive compounds from environmental samples, thereby bolstering drug discovery and biotechnological applications.

The sequencing segment emerged as the market leader, capturing a revenue share of 54% in 2023. This growth is primarily attributed to the cost-effectiveness and enhanced accuracy achieved through technological advancements in sequencing. Companies routinely integrate sequencing methods into genetic research, a pivotal aspect of genetic testing. For instance, in June 2023, Delve Bio introduced a novel metagenomic sequencing platform tailored for diagnosing infectious diseases.

Conversely, the data analysis segment is poised to exhibit a lucrative compound annual growth rate (CAGR) over the forecast period. This projection stems from the pivotal role of data analysis in deciphering complex biological information. Data analysis is instrumental in extracting meaningful patterns, identifying crucial microbial species, and unraveling functional insights from genomic data. The ability to unveil intricate details regarding microbial interactions, community dynamics, and functional potential significantly enhances the impact of metagenomic research. Consequently, the overall demand for data analysis is anticipated to surge during the forecast period.

In 2023, the environmental segment emerged as the market leader, commanding a revenue share of 26%. Metagenomics research is rapidly expanding its role in agriculture and environmental protection by employing sequencing analysis or gene screening to understand microorganisms within specific environments. This approach marks a novel way of comprehending microbial ecosystems. Additionally, environmental metagenomics analysis is employed in studying ecological remediation, agricultural microbiome analysis, oceanic oil spills, and other biological investigations. The integration of genome-centric metagenomics analysis with single-cell genomics provides access to unprecedented genomic information about microbes.

On the other hand, the clinical diagnostics segment is poised to exhibit a lucrative compound annual growth rate (CAGR) over the forecast period. In clinical diagnostics, metagenomics utilizes advanced genomic technologies to examine the genetic material of microbial communities present in clinical samples. This method revolutionizes pathogen detection by offering a holistic perspective on various pathogens, including bacteria, viruses, fungi, and parasites, thus overcoming the limitations of conventional diagnostic techniques.

By Product

By Technology

By Workflow

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Metagenomics Market

5.1. COVID-19 Landscape: Metagenomics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Metagenomics Market, By Product

8.1. Metagenomics Market, by Product, 2024-2033

8.1.1. Kits & Reagents

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Sequencing & Data Analytics Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Software

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Metagenomics Market, By Technology

9.1. Metagenomics Market, by Technology, 2024-2033

9.1.1. Shotgun Sequencing

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. 16S Sequencing

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Whole Genome Sequencing

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Metagenomics Market, By Workflow

10.1. Metagenomics Market, by Workflow, 2024-2033

10.1.1. Pre-sequencing

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Sequencing

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Data Analysis

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Metagenomics Market, By Application

11.1. Metagenomics Market, by Application, 2024-2033

11.1.1. Environmental

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Clinical Diagnostics

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Drug Discovery

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Biotechnology

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Food & nutrition

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Others

11.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Metagenomics Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.3. Market Revenue and Forecast, by Workflow (2021-2033)

12.1.4. Market Revenue and Forecast, by Application (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Workflow (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Workflow (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.3. Market Revenue and Forecast, by Workflow (2021-2033)

12.2.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Workflow (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Workflow (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Workflow (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Technology (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Workflow (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Application (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.3. Market Revenue and Forecast, by Workflow (2021-2033)

12.3.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Workflow (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Workflow (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Workflow (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Technology (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Workflow (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Application (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.3. Market Revenue and Forecast, by Workflow (2021-2033)

12.4.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Workflow (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Workflow (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Workflow (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Technology (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Workflow (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Application (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.5.3. Market Revenue and Forecast, by Workflow (2021-2033)

12.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Technology (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Workflow (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Technology (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Workflow (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Application (2021-2033)

Chapter 13. Company Profiles

13.1. Bio-Rad Laboratories, Inc

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Illumina, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. PerkinElmer, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Thermo Fisher Scientific, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Novogene Co., Ltd.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Promega Corporation

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. QIAGEN

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Takara Bio, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Oxford Nanopore Technologies

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. F. Hoffmann-La Roche Ltd.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others