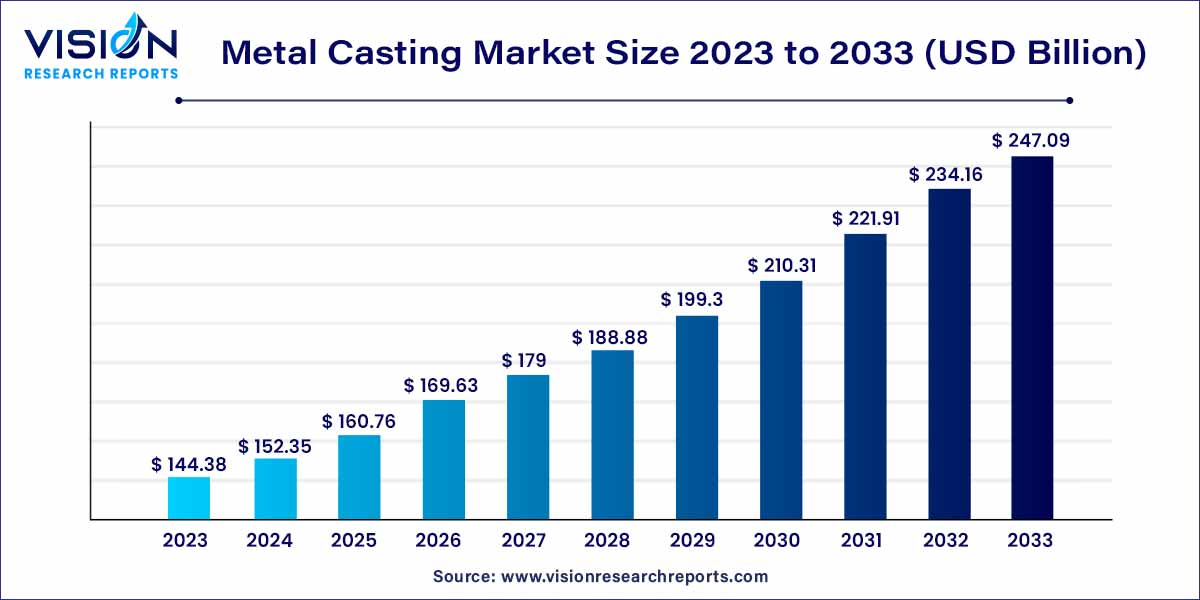

The global metal casting market size was estimated at around USD 144.38 billion in 2023 and it is projected to hit around USD 247.09 billion by 2033, growing at a CAGR of 5.52% from 2024 to 2033. The automotive sector's rising demand for casting is expected to fuel market growth in the forecast period. Metal casting, a widely used manufacturing process, entails pouring molten metal into a die or sand mold to achieve the desired shape.

The metal casting market stands as a critical component of the global manufacturing landscape, providing an indispensable process for shaping metal into a myriad of components essential to various industries. This overview delves into key aspects that define the current state and future prospects of the metal casting market.

The growth of the metal casting market is propelled by several key factors. Firstly, the increasing demand for precision-engineered components across diverse industries, such as automotive and aerospace, continues to drive the market's expansion. Technological advancements, including the adoption of computer-aided design (CAD) and simulation tools, contribute to enhanced efficiency and reduced defects in the casting process, further fueling growth. Additionally, the industry's adaptability to a wide range of materials, including ferrous and non-ferrous metals, allows for versatile applications, meeting the specific requirements of various end-user sectors. Moreover, the global emphasis on sustainability and environmentally friendly practices is influencing the adoption of eco-conscious initiatives within the metal casting process, aligning with broader industry trends. These factors collectively contribute to a positive growth trajectory for the Metal Casting market, fostering innovation and ensuring its continued significance in the manufacturing landscape.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 247.09 billion |

| Growth Rate from 2024 to 2033 | CAGR of 5.52% |

| Revenue Share of Asia Pacific in 2023 | 56% |

| CAGR of Europe from 2024 to 2033 | 4.86% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The aluminum segment accounted for the largest revenue share of 39% in 2023. The global Metal Casting market, with a focus on aluminum as a predominant material, is experiencing a noteworthy evolution driven by its unique properties and widespread applications. Aluminum, a lightweight and corrosion-resistant metal, has become a material of choice in the casting process for a variety of industries. Its versatility, combined with advantageous mechanical properties, positions aluminum as a key player in the manufacturing of diverse components.

The aluminum segment is projected to grow at a CAGR of 8.75% over the forecast period. The demand for lightweight metals including magnesium and aluminum is anticipated to create many opportunities for market vendors. Stricter emission regulations and increasing requirements for energy efficiency are projected to boost the production of lightweight materials in the market over the forecast period. These materials assist in reducing the consumption of fuel owing to the light weight of auto components.

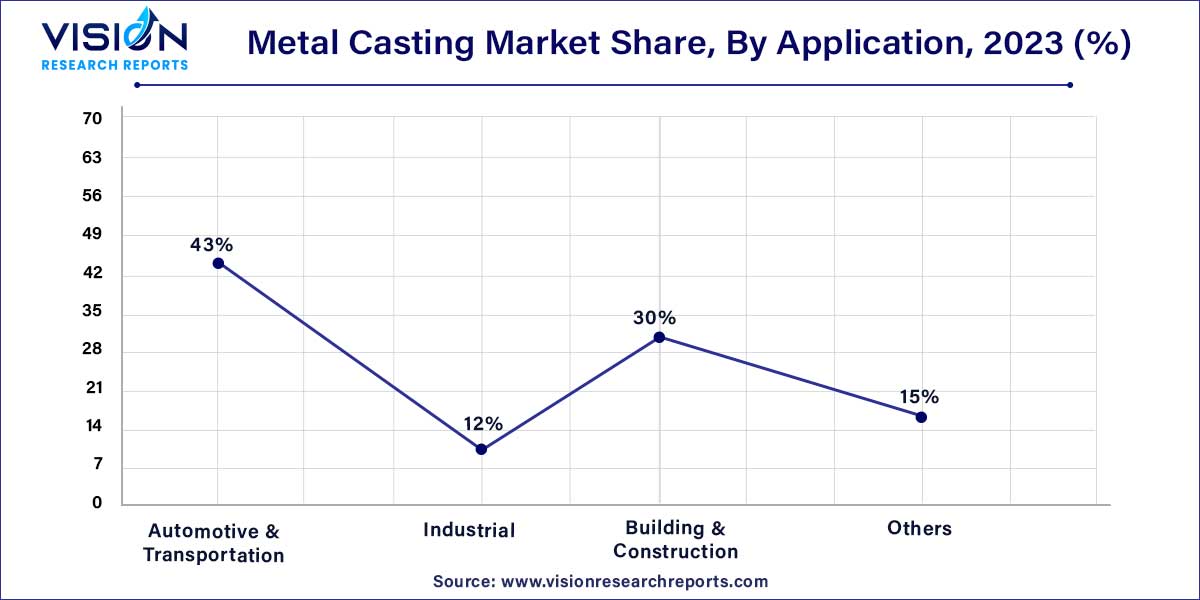

The automotive segment held the largest revenue share of 60% in 2023. In the automotive industry, metal casting is an indispensable process that contributes substantially to the production of critical components. From engine blocks and transmission components to suspension parts and brake system elements, metal casting, particularly with materials like aluminum and iron alloys, is pivotal in creating complex and durable components that meet the stringent performance and safety standards of the automotive sector.

The industrial segment is expected to grow at the fastest CAGR of 5.93% over the forecast period. In industrial settings, metal castings are utilized for the manufacturing of gears, valves, pumps, and other critical components that are integral to the functioning of diverse industrial machinery. The flexibility of metal casting processes allows for the customization of components to meet the specific requirements of various industrial applications. The industrial sector's reliance on metal casting extends to sectors such as construction, energy, and mining, where durable and precisely crafted components are essential for the reliability and longevity of equipment.

Asia Pacific dominated the market with largest revenue share of 56% in 2023. Asia-Pacific stands as a powerhouse in the global Metal Casting market, driven by the rapid industrialization and manufacturing growth in countries like China and India. The region's robust demand for automotive components, infrastructure development, and consumer goods fuels the expansion of the metal casting industry. With a vast manufacturing base and a strategic focus on cost-effective production, Asia-Pacific emerges as a key contributor to the global market's overall dynamics.

Europe metal casting market is anticipated to grow at the fastest CAGR of 4.86% from 2024 to 2033. In Europe, the Metal Casting market is deeply entrenched in the continent's rich industrial heritage. European countries have a long history of metalworking, and this expertise is reflected in the sophisticated metal casting techniques employed. The automotive industry, in particular, benefits from Europe's commitment to sustainability and stringent environmental regulations. The region's focus on green practices and energy-efficient manufacturing processes positions it at the forefront of shaping the future of metal casting.

Endurance Technologies Limited successfully acquired the Italian car parts company Grimeca Srl in June 2020. Endurance declared in a filing with the stock exchange that it has acquired a 100% ownership position in Grimeca for 2.25 million Euros, or roughly $2.45 million USD.

POSCO declared in November 2022 that two of its steel mills, in Gwangyang and Pohang, had been certified for their outstanding efforts to support the steel industry's sustainable future. This outstanding achievement highlights the plants' unwavering dedication and skillful management in advancing corporate governance (CSG) and environmental, social, and ethical goals.

By Material

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others