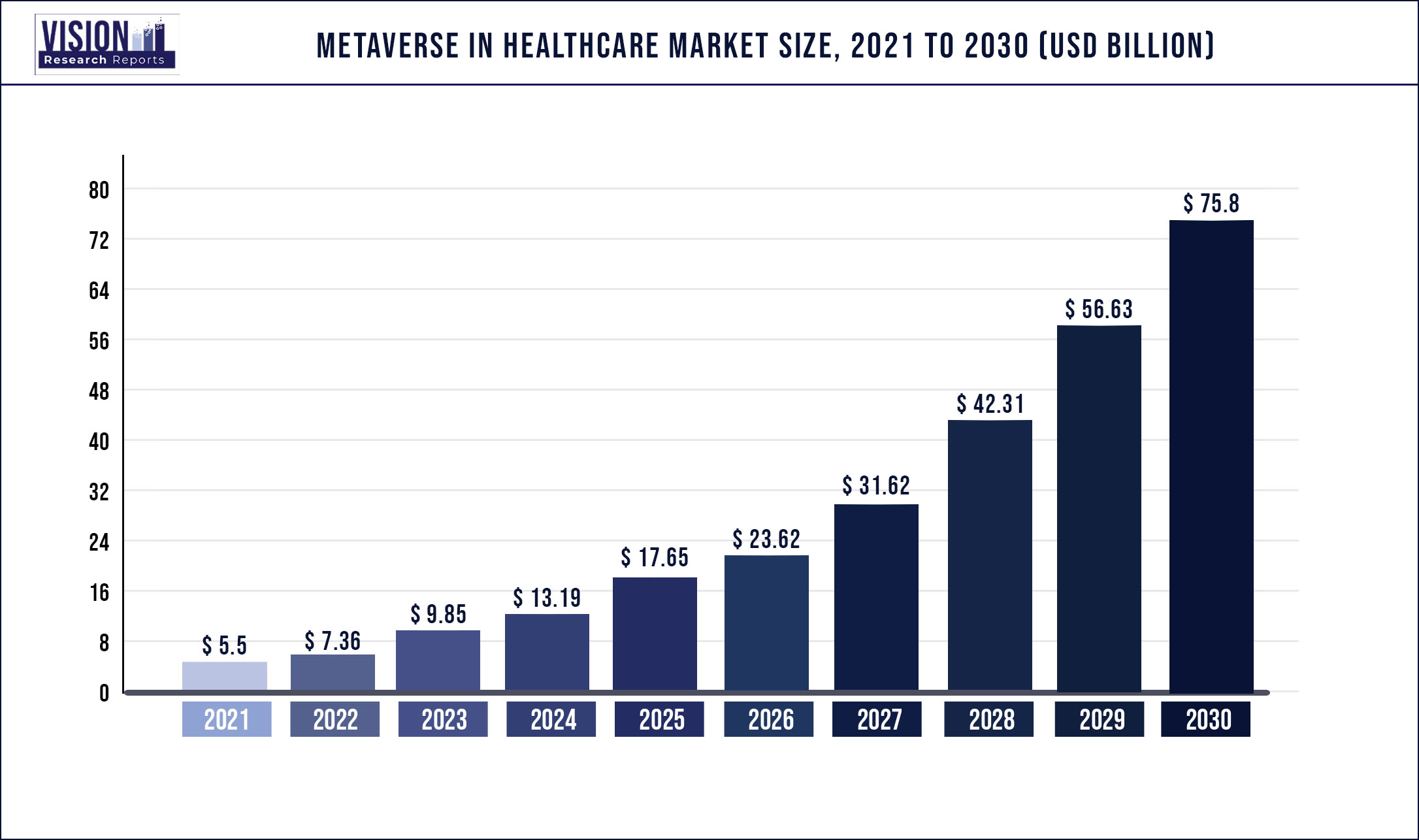

The global metaverse in healthcare market size was valued at USD 5.5 billion in 2021 and is expected to worth around USD 75.8 billion by 2030 with a CAGR of 36% from 2022 to 2030.

The Metaverse is an emerging concept that will add many new dimensions as significant social players combine various aspects of virtual reality and immersive experiences. It will be a great tool in healthcare to learn, empower, and provide blissful experiences to patients and providers. The Metaverse's role in transforming healthcare cannot be overstated because it combines AI, Virtual Reality, Augmented Reality, the Internet of Medical Devices, Web 3.0, intelligent cloud, edge and quantum computing, and robotics. With its goofy-looking headgear and sci-fi detours, the world of augmented reality is ready to transform patient medical experiences. As surgical procedures have already used robotics, complex surgeries are now set to use augmented realities. Doctors and experts use virtual reality to train other doctors and medical personnel.

Increasing the use of AR platforms to perform complex surgical procedures with greater precision and flexibility will help the Metaverse grow in the healthcare market. Other critical factors expected to contribute to market revenue in the coming years include increased collaborations among major companies to develop AR and VR solutions to improve the overall surgical environment and rising investment to create metaverse platforms to transform the healthcare sector. Increasing number of companies are making investments heavily in digital healthcare platforms to improve telemedicine experiences, accelerate the transition to virtual reality, and enhance other medical services through augmented reality.

The privacy of patient data, the high cost of high-tech devices and hardware, and the rising costs of more advanced digital healthcare infrastructure are challenges for the Metaverse in the healthcare market.

North America is expected to lead the forecast period. It is owing to the region's strong presence of metaverse-focused companies, rapid advancements in healthcare infrastructure, integration of AR and VR devices and platforms in the healthcare sector, increased investment in AR products and applications, and upgrades in software and hardware.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 5.5 billion |

| Revenue Forecast by 2030 | USD 75.8 billion |

| Growth rate from 2022 to 2030 | CAGR of 36% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Component, Technology, Device, End-user, region |

| Companies Covered | Surgical Inc., CableLabs, Microsoft, Google LLC, Meta Platforms, Inc., 8chilli, Inc., Global Healthcare Academy, 3D Systems Corp., AccuVein Inc., BioflightVR, CAE Inc., Devden Creative Solutions Pvt. Ltd., Dhi Tattva Solutions Pvt. Ltd., Eon Reality Inc., ImmersiveTouch Inc., Intuitive Surgical Inc., Koninklijke Philips NV, Medical Realities Ltd., MindMaze SA, Oodles Technologies, Siemens AG, Sky gate, UnitedHealth Group Inc., Wipro Ltd., WorldViz Inc. |

Component Insights

Hardware segment is expected to register significantly rapid revenue growth rate over the forecast period

On the basis of component, the global metaverse in healthcare market has been segmented into hardware and software. Hardware segment is expected to register a significantly rapid revenue growth rate over the forecast period, attributable to advancements in hardware technology, rapid adoption of AR devices and VR headsets for more immersive experiences, and technological upgrades in sensing displays, and optics technologies. In addition, development and advancements in haptic devices to ensure more enhanced metaverse-focused sensory experiences are delivered and increasing investment and efforts by companies to develop advanced haptic devices are some other key factors expected to contribute to revenue growth of the segment going ahead.

Technology Insights

AR segment expected to register robust revenue CAGR over the forecast period

On the basis of technology, the global metaverse in healthcare market has been segmented into Augmented Reality (AR), Virtual Reality (VR), Artificial Intelligence (AI), and Mixed Reality (MR). Augmented reality segment is expected to register robust revenue CAGR over the forecast period, attributable to increasing use of AR platforms in the healthcare sector for surgical training and education, use of AR devices to monitor patients’ vital signs during surgical procedures, and increasing use of VR and AR-based apps for self-guided treatments. Augmented reality is being widely used in the healthcare sector across the globe for applications such as vein visualization, surgical visualization, and educational training. In addition, recent technological advancements in hardware and software have further reduced the expenses associated with augmented reality and significantly improved patient and healthcare personnel experience. Augmented reality can also enhance visualization of Computerized Tomography (CT) or Magnetic Resonance Imaging (MRI) data by superimposition of images during surgeries that require precise navigation to vital organs and this is further boosting adoption of AR devices in healthcare.

Device Insights

AR devices segment to account for largest revenue share over the forecast period

On the basis of device, the global metaverse in healthcare market has been segmented into VR headsets, AR devices, and mixed reality platforms. AR devices segment is expected to account for largest revenue share over the forecast period, attributable to increasing use of AR devices such as AR-enabled head mounted devices by medical professionals to enhance surgical precision and monitor patient vitals. AR devices assist in creating immersive and interactive experiences that can demonstrate the way devices or drugs react with the body. In addition, technological advancements and versatility of AR has made it more accessible and affordable for applications in medical imaging, medical education, training nurses, and dentistry and this is another factor expected to contribute to revenue growth of the segment over the forecast period.

End Use Insights

Medical training & education modules segment is expected to dominate other end use segments over the forecast period

On the basis of end use, the global metaverse in healthcare market has been segmented into medical training & education modules, diagnosis, treatment, designing ORs, surgical training, remote monitoring, and others. Medical training & education modules segment is expected to dominate other end use segments in terms of revenue share over the forecast period. Revenue growth of this segment is driven by increasing use of AR, VR, and MR to explain surgical procedures, increasing use of AR devices and applications to improve patient education/awareness and outcomes, and improve surgical accuracy. Augmented reality applications have also enabled healthcare professionals help patients better understand surgical procedures and the mode of action of medicines and medical devices.

Regional Insights

North America is expected to account for largest revenue share over the forecast period

Based on regional analysis, North America is expected to account for largest revenue share over the forecast period, attributable to robust presence of metaverse-focused companies in the region, rapid advancements in healthcare infrastructure, integration of AR and VR devices and platforms in healthcare sector, increasing investment to develop new and more innovative AR products and applications, and advancements in software and hardware.

Asia Pacific is expected to register robust revenue CAGR over the forecast period, attributable to increasing adoption of immersive technology across the healthcare sector in countries in the region, rising spending on augmented and virtual reality research and development, emerging opportunities for metaverse in healthcare, increasing number of collaborations between metaverse technology companies to expand metaverse in Asia Pacific, and presence of key technology companies such as Samsung investing significantly in AR and VR technologies.

Prominent market players are Intuitive Surgical Inc., CableLabs, Microsoft, Google LLC, Meta Platforms, Inc., 8chilli, Inc., Global Healthcare Academy, 3D Systems Corp., AccuVein Inc., BioflightVR, CAE Inc., Devden Creative Solutions Pvt. Ltd., Dhi Tattva Solutions Pvt. Ltd., Eon Reality Inc., ImmersiveTouch Inc., Intuitive Surgical Inc., Koninklijke Philips NV, Medical Realities Ltd., MindMaze SA, Oodles Technologies, Siemens AG, Sky gate, UnitedHealth Group Inc., Wipro Ltd., WorldViz Inc.

Key Developments in the market

Market Segmentation

By Component

By Technology

By Device

By End-User

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Metaverse in Healthcare Market

5.1. COVID-19 Landscape: Metaverse in Healthcare Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Metaverse in Healthcare Market, By Component

8.1. Metaverse in Healthcare Market, by Component, 2022-2030

8.1.1. Software

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Hardware

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Metaverse in Healthcare Market, By Technology

9.1. Metaverse in Healthcare Market, by Technology e, 2022-2030

9.1.1. AR

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. VR

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. AI

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. MR

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Metaverse in Healthcare Market, By Device

10.1. Metaverse in Healthcare Market, by Device, 2022-2030

10.1.1. VR Headsets

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. AR Devices

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Mixed Reality Platforms

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Metaverse in Healthcare Market, By End-User

11.1. Metaverse in Healthcare Market, by End-User, 2022-2030

11.1.1. Medical Training & Education Modules

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Diagnosis

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Treatment

11.1.3.1. Market Revenue and Forecast (2017-2030)

11.1.4. Designing ORs

11.1.4.1. Market Revenue and Forecast (2017-2030)

11.1.5. Surgical Training

11.1.5.1. Market Revenue and Forecast (2017-2030)

11.1.6. Remote Monitoring

11.1.6.1. Market Revenue and Forecast (2017-2030)

11.1.7. Others

11.1.7.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Metaverse in Healthcare Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Component (2017-2030)

12.1.2. Market Revenue and Forecast, by Technology (2017-2030)

12.1.3. Market Revenue and Forecast, by Device (2017-2030)

12.1.4. Market Revenue and Forecast, by End-User (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Device (2017-2030)

12.1.5.4. Market Revenue and Forecast, by End-User (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Component (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Technology (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Device (2017-2030)

12.1.6.4. Market Revenue and Forecast, by End-User (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Component (2017-2030)

12.2.2. Market Revenue and Forecast, by Technology (2017-2030)

12.2.3. Market Revenue and Forecast, by Device (2017-2030)

12.2.4. Market Revenue and Forecast, by End-User (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Device (2017-2030)

12.2.5.4. Market Revenue and Forecast, by End-User (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Component (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Technology (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Device (2017-2030)

12.2.6.4. Market Revenue and Forecast, by End-User (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Component (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Technology (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Device (2017-2030)

12.2.7.4. Market Revenue and Forecast, by End-User (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Component (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Technology (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Device (2017-2030)

12.2.8.4. Market Revenue and Forecast, by End-User (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Component (2017-2030)

12.3.2. Market Revenue and Forecast, by Technology (2017-2030)

12.3.3. Market Revenue and Forecast, by Device (2017-2030)

12.3.4. Market Revenue and Forecast, by End-User (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Device (2017-2030)

12.3.5.4. Market Revenue and Forecast, by End-User (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Component (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Technology (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Device (2017-2030)

12.3.6.4. Market Revenue and Forecast, by End-User (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Component (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Technology (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Device (2017-2030)

12.3.7.4. Market Revenue and Forecast, by End-User (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Component (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Technology (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Device (2017-2030)

12.3.8.4. Market Revenue and Forecast, by End-User (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Component (2017-2030)

12.4.2. Market Revenue and Forecast, by Technology (2017-2030)

12.4.3. Market Revenue and Forecast, by Device (2017-2030)

12.4.4. Market Revenue and Forecast, by End-User (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Device (2017-2030)

12.4.5.4. Market Revenue and Forecast, by End-User (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Component (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Technology (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Device (2017-2030)

12.4.6.4. Market Revenue and Forecast, by End-User (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Component (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Technology (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Device (2017-2030)

12.4.7.4. Market Revenue and Forecast, by End-User (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Component (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Technology (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Device (2017-2030)

12.4.8.4. Market Revenue and Forecast, by End-User (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.5.3. Market Revenue and Forecast, by Device (2017-2030)

12.5.4. Market Revenue and Forecast, by End-User (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Device (2017-2030)

12.5.5.4. Market Revenue and Forecast, by End-User (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Component (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Technology (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Device (2017-2030)

12.5.6.4. Market Revenue and Forecast, by End-User (2017-2030)

Chapter 13. Company Profiles

13.1. Surgical Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. CableLabs, Microsoft

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Google LLC

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Meta Platforms, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. 8chilli, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Global Healthcare Academy

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. 3D Systems Corp.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. AccuVein Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. BioflightVR, CAE Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Devden Creative Solutions Pvt. Ltd.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others