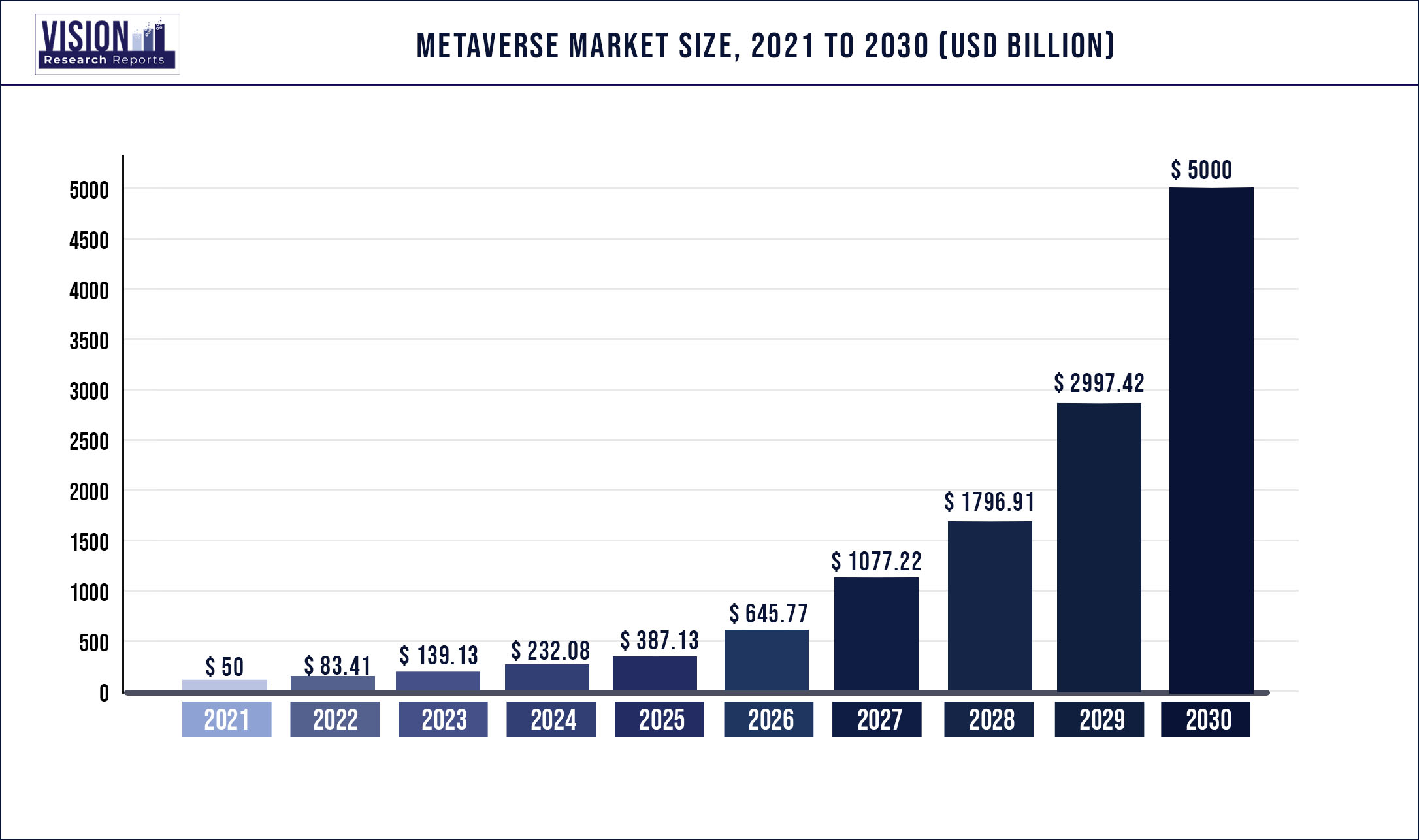

The global metaverse market was valued at USD 50 billion in 2021 and it is projected to attain valuation USD 5 trillion by 2030, expanding growth at a CAGR of 66.87% from 2022 to 2030.

Growth Factors

Market Growth is driven by increasing demand from end-use industries, which prominently include media and entertainment, education, and aerospace and defense is anticipated to propel the industry growth over the forecast period. The metaverse market is also growing due to the steady adoption of XR technologies to enhance user experience on various platforms. The growing demand for metaverse to purchase digital assets using cryptocurrencies is expected to drive the market significantly. The development and distribution of Augmented reality (AR), Virtual Reality (VR), and Mixed Reality (MR) devices are anticipated to spur market growth in years to come.

The prefix "meta" is commonly used in Greek to denote "after" or "beyond." The metaverse is a three-dimensional interactive and immersive environment where several people can interact through avatars. The usage of the metaverse to purchase digital assets using bitcoin is becoming more popular around the world. Gaming websites, messaging applications, and social media platforms such as Facebook are being used to communicate with one another online. The metaverse is the advent of new online environments in which people's interactions are more multidimensional and they can engage more deeply with digital content rather than merely reading it.

The metaverse is widely used as a real-time virtual world to build and leverage vast opportunities for brand connection. It would also set the stage for the next phase of post-COVID-19 digital activity, namely the emergence of digital social experiences. On Metaverse platforms that allow blockchain technology to be utilized, users can create, own, and trade autonomous digital assets and virtual regions using cryptocurrencies like Bitcoin and Ethereum, as well as nonfungible tokens (NFTs). During the forecast period, rising demand for blockchain-based metaverse networks and platforms for trading digital assets is expected to drive considerable market revenue growth. One of the major factors driving the future expansion of the metaverse business is the rise of the gaming industry.

Total Addressable Market Insights

Metaverse is one of the trending technology platforms attracting various social networks and technology leaders, and online game makers to enter and establish its presence within the market. The metaverse is a fast-growing trend with a considerate penetration rate of users for various applications such as gaming, content creation, social interaction, learning and training, and online virtual shopping.

According to industry experts, the metaverse is expected to infiltrate a multitude of industries in numerous ways in the coming years, with the potential market opportunity or the total addressable market estimated at more than USD 1 trillion in yearly revenues.

In addition, according to the United Nations, the global digital economy represented 15.5% of total GDP in 2018, which led to a forecast of 15% to 16.8% by 2021. According to C-level executives of the leading metaverse solution providers, depending on the percentage share of the digital economy shifting to the metaverse and the percentage of total addressable market expansion, the potential market opportunity for the metaverse is estimated to be between USD 3.75 trillion and USD 12.46 trillion. As a result, various end-user players such as Walmart; Nike, Inc; Gap Inc; Verizon, Hulu, LLC; Adidas; and Atari, Inc., are entering the metaverse in different ways to witness the immersive experience of the digital world.

The concept or idea of metaverse gained momentum after Facebook, Inc. announced that the firm would be renamed Meta Platforms Inc., or 'Meta' for short, effective immediately. The company would be dedicated to the creation of the metaverse, an immersive digital environment. The metaverse is being used extensively as a real-time virtual world to develop and leverage huge possibilities for brand interaction.

Report Scope of the Metaverse Market

| Report Coverage | Details |

| Market Size by 2030 | USD 5 Trillion |

| Growth Rate from 2022 to 2030 |

CAGR of 66.87% |

| North America Market Share in 2021 | 46% |

| Gaming Segment Market Share in 2021 | 28% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Product, Platform, Application, End User, Offering, Technology, Geography |

| Companies Mentioned | Meta Platforms, Inc.; Epic Games, Inc.; Nvidia Corporation; Tencent Holdings Ltd; ByteDance Ltd.; Lilith Games; Unity Technologies, Inc.; Roblox Corporations; NetEase, Inc.; Nextech AR Solutions Corp. |

Metaverse Market Dynamics:

Drivers & Opportunity:

Growing demand for metaverse to purchase digital assets using cryptocurrencies

The metaverse’s currency is a cryptocurrency and every metaverse has its collection of coins. They’re used to paying for everything from NFTs to virtual real estate to avatar shoes. Cryptocurrencies are used to connect the physical and virtual worlds. They allow us to calculate the worth of digital assets in the government-issued currency as well as the returns on those assets over time. The use of the metaverse to buy digital assets using cryptocurrency is gaining traction around the world.

Individuals now communicate with one another digitally via websites, messaging apps, and social media platforms such as Facebook. The metaverse is the emergence of fresh online settings in which people’s interactions are highly multidimensional, and they can participate more meaningfully with digital content rather than simply reading information. Because of the accessibility of crypto on exchanges all around the world, investors can make money by selling metaverse coins and NFTs directly to purchasers.

Expanded opportunities for Business-to-Consumer (B2C) and Business-to-Business (B2B) enterprises

One of the metaverse’s promising prospects is that it is vastly increasing access to the marketplace for consumers in emerging and frontier economies. The Internet has already opened up access to previously unavailable goods and services. Workers from low-income countries, for example, may now be able to find work in western corporations without emigrating. Virtual reality environments will help enhance educational options, as they are a low-cost and effective way to learn.

There will need to be clear governance as a result of these developments. Business-to-business (B2B) marketing includes trade exhibitions, product demos, client meetings, customer service, and commercials. The metaverse now has the power to drastically modify each of these things. Because many B2B products are commodities, excellent customer service can make all the difference. The Metaverse has an interesting side effect of blurring the distinctions between B2B and B2C. Companies can use this to grow their traditional consumer bases while avoiding corporate traditions.

Challenge:

The threat of cyber-based attacks targeting the metaverse is a primary concern

Even if the final implementation of the metaverse differs from today’s vision, technologies such as Virtual Reality (VR), Augmented Reality (AR), the Internet of Things (IoT), and cryptocurrencies will certainly be used. These technologies have the potential to merge and synchronize the physical and digital worlds. They will, however, provide new opportunities for cybercriminals to attack businesses and individuals. Concerns about data security and privacy in metaverse environments, issues about user identity, and challenges of persuading users to use payment services in these settings are some key factors that are expected to stifle global metaverse market revenue growth to some extent during the forecast period.

COVID-19 Impact On Metaverse Market

The COVID-19 pandemic played a significant role in stimulating interest in the metaverse concept. People started working from home and students began taking classes online, creating a need for practical techniques or channels to make online contact more realistic. The pandemic heightened its importance among consumers and businesses alike. In the year 2020, tech corporations began developing this technology and announced their investments. Because of the billion dollars spent by Metaverse, the year 2021 was a good one for Metaverse technology investments (Facebook).

According to industry experts, the COVID-19 pandemic catalyzed metaverse technology, and the post-pandemic environment is predicted to pique customer interest. The pandemic has accelerated the creation of virtual online communities as key lifestyle areas for users who were confined due to the lock-downs and closures, including interactive game landscapes and the expanding use of mixed reality. The COVID-19 pandemic has positively impacted the metaverse market, which has potentially improved many industries. The rise of digital assets, blockchain, and Nonfungible Tokens (NFTs) is adding to the metaverse’s popularity.

The automotive and manufacturing industries will be firmly embedded in the metaverse owing to a shared online area that crosses dimensions and is powered by a mixture of VR, AR, and MR. While campus digital twins have substantially improved the remote education experience, it is projected that the metaverse will organically promote spatial patterns throughout the education business in the years to come. Pursuing knowledge will be redesigned to include an interactive experience complemented by digital records in the metaverse, rather than just words, images, and lectures available on demand.

It would also provide the framework for the next chapter of post-COVID digital activity, the emergence of digital social experiences. Certain users only see the metaverse as a virtual world where they can create and operate an avatar that can travel about and interact with other players. Users can build, own, and exchange independent digital assets and virtual territories using cryptocurrencies such as Bitcoin Ethereum, among others as well as NFTs on metaverse platforms supported by blockchain end-use. Increasing demand for the deployment of blockchain-based metaverse platforms for digital trading assets is expected to drive significant market revenue growth in the coming years.

End-use Insights

Due to the rising gaming industry globally, the media and entertainment category is predicted to account for the largest revenue share of 31% over the forecast period. Businesses are increasingly focusing on organizing virtual music concerts, and the adoption of this concept by a growing number of businesses is likely to boost this segment's revenue growth. For instance, Meta Platform, Inc Meta Platform, Inc unveiled a lineup of major virtual reality concerts that took place completely on its Horizon Venues metaverse. The celebrity singers and performers included Young Thug, DJ David Guetta, and The Chainsmokers at the New Year's Eve event. Warner Music Group has announced the launch of the virtual music theme park through The Sandbox platform.

Musical experiences and concerts from the music company's star-studded roster of musicians, including Bruno Mars, Ed Sheeran, Dua Lipa, and Cardi B, will be featured in the virtual theme park. Metaverse offers musicians enhanced flexibility to experiment and engage with audiences electronically. Other musicians and media content firms collaborating with musicians are more likely to experiment with virtual reality and broadcast content online instead of attending live concerts because of the endless possibilities. For instance, games such as Fortnite hosted a metaverse event where musicians and music bands performed live in April 2020. It was the platform's largest in-game concert. Based on end-use, the global market for metaverse is divided into Banking, Financial Services, and Insurance (BFSI), retail, media and entertainment, education, aerospace and defense, automotive, and others.

Product Insights

The hardware segment accounted for USD 16.50 billion in 2021 and is expected to expand at a CAGR of over 39%. Due to a growing focus among firms on producing products that provide a better user experience and enable more extended user immersion, the hardware segment is expected to account for the largest revenue share during the projected period. To improve the realism of virtual worlds, companies are also working to develop more advanced hardware, such as VR/AR headsets, haptic devices, and sensors. Designing interfaces that allow people to access 3D content on a variety of devices, such as next-generation TVs, smartphones, and mixed reality smart glasses called HoloLens, is also predicted to drive revenue growth in this segment.

For instance, Facebook Reality Labs is estimated to spend at least USD 10 billion on the development of Augmented Reality (AR) and Virtual Reality (VR) hardware. The global metaverse market is divided into hardware, software, and services segments based on product. The hardware segment is sub-segmented into displays, eXtended Reality (XR) components, and AR/VR headsets. Extended Reality (XR) components sub-segment is further divided into haptic sensors & devices, smart glasses, and omni treadmills. The software segment is sub-segmented as asset creation tools and programming engines.

Platform Insights

Between 2022 and 2030, the desktop segment accounted for the largest revenue share, followed by the headset. The segment was estimated at USD 16.30 billion in 2021. Computers used to be the primary portal into the metaverse, but with the introduction of smartphones and wireless networks, that has changed. Virtual desktop is a program that allows users to utilize the computer in virtual reality using the HTC Vive, Oculus Rift / Rift S, WMR headsets, and Valve Index. On a massive virtual screen, users may surf the web, view movies on Netflix, and even play games.

Virtual desktops are gaining traction for the use of VR devices. Smartphones and mobile networks have made access to the metaverse unrivaled and near-constant. Downloading, uploading, and sharing large amounts of data in networked cyberspace is becoming increasingly common. Users of mobile phones can publish photographs and movies to the metaverse and communicate with others using video conferencing and messaging apps. While playing online multiplayer games, users can also converse with one another. Smartphone popularity is increasing, and it is rapidly becoming the most prominent way to connect to the metaverse.

Offering Insights

The asset marketplace segment is expected to grow at the highest CAGR of 41% during the forecast period, owing to the increased investments made in bitcoins, NFTs, Ethereum, and other cryptocurrencies. Because of the expansions in virtual metaverse platforms, the virtual platforms segment is expected to account for a significant revenue share during the forecast period. The design and management of integrated virtual and typically three-dimensional simulations, settings, and surroundings in which people and businesses can discover, create, socialize, and engage in a wide variety of activities while also running a business are referred to as virtual platforms.

Virtual platforms such as Minecraft, Roblox, the Sandbox, HyperVerse, and Fortnite Creative Mode are currently popular. Furthermore, rising smartphone penetration and growth in the rate of app developers are likely to boost revenue growth in this segment in the future. Based on offering, the global market is segmented into asset marketplaces, virtual platforms, avatars, and financial services.

Technology Insights

The augmented reality (AR) and virtual reality (VR) technology contributed to the largest revenue share of over 36% in 2021. Due to the increased use of MR to engage more proficiently in the metaverse, the Mixed Reality (MR) segment is predicted to contribute the highest CAGR of 40.4% in the technology segment in the global market during the forecast period. The global market is divided into three categories based on technology: blockchain, virtual reality (VR) and augmented reality (AR), mixed reality (MR), and others. The other segment includes artificial intelligence (AI), IoT, 3D reconstruction, brain-computer interface, machine learning, 5G, etc.

Mixed reality is when people can interact directly with metaverse surroundings in a physical area. Users do not require a virtual reality headset to interact with the metaverse. Regardless of their level of immersion, users could simply interact with the metaverse using a keyboard. AR and VR technology is being utilized in the gaming industry to make the game more realistic and to provide a better gaming experience. However, the demand for VR and AR devices is expected to exhibit substantial growth in the coming years. Thus, the segment is predicted to contribute significantly to the overall Metaverse industry. The demand for VR and AR devices is expected to rise owing to the rising gaming industry.

Application Insights

The gaming segment held the leading revenue share of 28% in 2021, due to significant ongoing innovations and developments by developers, as well as a growing focus on boosting immersion and making games more realistic. Furthermore, organizations' increasing emphasis on utilizing games to promote their corporate image is likely to boost revenue growth. Based on application, the market is divided into gaming, online shopping, content creation & social media, events & conferences, content creation, digital marketing (advertising), testing and inspection, and others.

The content creation & social media segment is also expected to grow significantly during the forecast period. During the COVID-19 pandemic, the internet and social media became more important than ever before in daily life. With no signs of slowing down to the pandemic, businesses had no choice but to adapt, basing their entire company on these platforms. As a result of this occurrence, a new type of entrepreneur emerged: the content creator. To obtain a competitive advantage, many organizations are now employing content creation to market their brand and product portfolio.

Virtual reality training can help airlines and ground handlers learn and improve their aircraft inspection skills in a safe setting. Virtual Reality (VR) for Aircraft Inspection allows for training in various situations of aircraft inspection on all types of aircraft to minimize any potential failures during operation. The cabin crew can learn how to handle severe real-life circumstances like medical problems, an impending disaster, or a hijacking by substituting virtual reality training for classroom training. Aircraft mechanics and MRO technicians can learn to inspect different elements of the aircraft using virtual reality and augmented reality without ever leaving their desks.

Regional Insights

North America is likely to account for the largest revenue share of over 46% in 2021 owing to the customers and users in the region that are adopting the new and more complex technology. Furthermore, the growing number of start-ups focusing on the establishment of metaverse platforms for commercialization is another factor projected to support the revenue growth of the regional market. Furthermore, the strong presence of gaming and metaverse businesses such as The Sandbox, Nvidia Corporation, and Epic Games, Inc. in the region, which is concentrating on incorporating metaverse into games, is creating market growth potential. For Instance, Nvidia Corporation announced partnerships with Blender and Adobe that will enable NVIDIA Omniverse, the world's first collaboration, and simulation platform, to reach millions more users.

The Asia Pacific region is expected to register a very strong CAGR over the forecast period. A growing number of start-ups and organizations such as The Sandbox (Hong Kong), Bolly Heroes (India), Axie Infinity (Singapore), NextMeet (India), GuildFi (Thailand) as well as Shenzhen Zhongqingbaowang Interaction Network Co., Ltd. (ZQGame Global), and miHoYo Co., Ltd. in China, are projected to drive market expansion in the Asia Pacific region. These virtual metaverse marketplaces and gaming platforms offer an immersive experience where users can participate in live and concurrent activities powered by their chosen third-party apps.

Some of the prominent players operating in the global metaverse market are:

Market Segmentation

By Product

By Platform

By Technology

By Offering

By Application

By End User

By Geography

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. End User Procurement Analysis

4.3.2. Sales and Distribution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Metaverse Market

5.1. COVID-19 Landscape: Metaverse Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Metaverse Market, By Components

8.1. Metaverse Market, by Components, 2022-2030

8.1.1. Software

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Hardware

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Metaverse Market, By Platform

9.1. Metaverse Market, by Platform, 2022-2030

9.1.1. Mobile

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Desktop

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Metaverse Market, By Offering’s

10.1. Metaverse Market, by Offering’s, 2022-2030

10.1.1. Avatars

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Virtual platforms

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Asset marketplace

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Financial services

10.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Metaverse Market, By Technology

11.1. Metaverse Market, by Technology, 2022-2030

11.1.1. Virtual reality and augmented reality

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Blockchain

11.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Metaverse Market, By Application

12.1. Metaverse Market, by Application, 2022-2030

12.1.1. Aircraft maintenance

12.1.1.1. Market Revenue and Forecast (2017-2030)

12.1.2. Gaming

12.1.2.1. Market Revenue and Forecast (2017-2030)

12.1.3. Online shopping

12.1.3.1. Market Revenue and Forecast (2017-2030)

12.1.4. Social media

12.1.4.1. Market Revenue and Forecast (2017-2030)

12.1.5. Virtual runway shows

12.1.5.1. Market Revenue and Forecast (2017-2030)

12.1.6. Content creation

12.1.6.1. Market Revenue and Forecast (2017-2030)

12.1.7. Others

12.1.7.1. Market Revenue and Forecast (2017-2030)

Chapter 13. Global Metaverse Market, By End User

13.1. Metaverse Market, by End User, 2022-2030

13.1.1. Media and Entertainment

13.1.1.1. Market Revenue and Forecast (2017-2030)

13.1.2. BFSI

13.1.2.1. Market Revenue and Forecast (2017-2030)

13.1.3.Retail

13.1.3.1. Market Revenue and Forecast (2017-2030)

13.1.4. Aerospace and defense

13.1.4.1. Market Revenue and Forecast (2017-2030)

13.1.5. Education

13.1.5.1. Market Revenue and Forecast (2017-2030)

13.1.6. Automotive

13.1.6.1. Market Revenue and Forecast (2017-2030)

13.1.7. Others

13.1.7.1. Market Revenue and Forecast (2017-2030)

Chapter 14. Global Metaverse Market, Regional Estimates and Trend Forecast

14.1. North America

14.1.1. Market Revenue and Forecast, by Components (2017-2030)

14.1.2. Market Revenue and Forecast, by Platform (2017-2030)

14.1.3. Market Revenue and Forecast, by Offering’s (2017-2030)

14.1.4. Market Revenue and Forecast, by Technology (2017-2030)

14.1.5. Market Revenue and Forecast, by Application (2017-2030)

14.1.6. Market Revenue and Forecast, by End User (2017-2030)

14.1.7. U.S.

14.1.7.1. Market Revenue and Forecast, by Components (2017-2030)

14.1.7.2. Market Revenue and Forecast, by Platform (2017-2030)

14.1.7.3. Market Revenue and Forecast, by Offering’s (2017-2030)

14.1.7.4. Market Revenue and Forecast, by Technology (2017-2030)

14.1.8. Market Revenue and Forecast, by Application (2017-2030)

14.1.8.1. Market Revenue and Forecast, by End User (2017-2030)

14.1.9. Rest of North America

14.1.9.1. Market Revenue and Forecast, by Components (2017-2030)

14.1.9.2. Market Revenue and Forecast, by Platform (2017-2030)

14.1.9.3. Market Revenue and Forecast, by Offering’s (2017-2030)

14.1.9.4. Market Revenue and Forecast, by Technology (2017-2030)

14.1.10. Market Revenue and Forecast, by Application (2017-2030)

14.1.11. Market Revenue and Forecast, by End User (2017-2030)

14.1.11.1.

14.2. Europe

14.2.1. Market Revenue and Forecast, by Components (2017-2030)

14.2.2. Market Revenue and Forecast, by Platform (2017-2030)

14.2.3. Market Revenue and Forecast, by Offering’s (2017-2030)

14.2.4. Market Revenue and Forecast, by Technology (2017-2030)

14.2.5. Market Revenue and Forecast, by Application (2017-2030)

14.2.6. Market Revenue and Forecast, by End User (2017-2030)

14.2.7.

14.2.8. UK

14.2.8.1. Market Revenue and Forecast, by Components (2017-2030)

14.2.8.2. Market Revenue and Forecast, by Platform (2017-2030)

14.2.8.3. Market Revenue and Forecast, by Offering’s (2017-2030)

14.2.9. Market Revenue and Forecast, by Technology (2017-2030)

14.2.10. Market Revenue and Forecast, by Application (2017-2030)

14.2.10.1. Market Revenue and Forecast, by End User (2017-2030)

14.2.11. Germany

14.2.11.1. Market Revenue and Forecast, by Components (2017-2030)

14.2.11.2. Market Revenue and Forecast, by Platform (2017-2030)

14.2.11.3. Market Revenue and Forecast, by Offering’s (2017-2030)

14.2.12. Market Revenue and Forecast, by Technology (2017-2030)

14.2.13. Market Revenue and Forecast, by Application (2017-2030)

14.2.14. Market Revenue and Forecast, by End User (2017-2030)

14.2.14.1.

14.2.15. France

14.2.15.1. Market Revenue and Forecast, by Components (2017-2030)

14.2.15.2. Market Revenue and Forecast, by Platform (2017-2030)

14.2.15.3. Market Revenue and Forecast, by Offering’s (2017-2030)

14.2.15.4. Market Revenue and Forecast, by Technology (2017-2030)

14.2.16. Market Revenue and Forecast, by Application (2017-2030)

14.2.16.1. Market Revenue and Forecast, by End User (2017-2030)

14.2.17. Rest of Europe

14.2.17.1. Market Revenue and Forecast, by Components (2017-2030)

14.2.17.2. Market Revenue and Forecast, by Platform (2017-2030)

14.2.17.3. Market Revenue and Forecast, by Offering’s (2017-2030)

14.2.17.4. Market Revenue and Forecast, by Technology (2017-2030)

14.2.18. Market Revenue and Forecast, by Application (2017-2030)

14.2.18.1. Market Revenue and Forecast, by End User (2017-2030)

14.3. APAC

14.3.1. Market Revenue and Forecast, by Components (2017-2030)

14.3.2. Market Revenue and Forecast, by Platform (2017-2030)

14.3.3. Market Revenue and Forecast, by Offering’s (2017-2030)

14.3.4. Market Revenue and Forecast, by Technology (2017-2030)

14.3.5. Market Revenue and Forecast, by Application (2017-2030)

14.3.6. Market Revenue and Forecast, by End User (2017-2030)

14.3.7. India

14.3.7.1. Market Revenue and Forecast, by Components (2017-2030)

14.3.7.2. Market Revenue and Forecast, by Platform (2017-2030)

14.3.7.3. Market Revenue and Forecast, by Offering’s (2017-2030)

14.3.7.4. Market Revenue and Forecast, by Technology (2017-2030)

14.3.8. Market Revenue and Forecast, by Application (2017-2030)

14.3.9. Market Revenue and Forecast, by End User (2017-2030)

14.3.10. China

14.3.10.1. Market Revenue and Forecast, by Components (2017-2030)

14.3.10.2. Market Revenue and Forecast, by Platform (2017-2030)

14.3.10.3. Market Revenue and Forecast, by Offering’s (2017-2030)

14.3.10.4. Market Revenue and Forecast, by Technology (2017-2030)

14.3.11. Market Revenue and Forecast, by Application (2017-2030)

14.3.11.1. Market Revenue and Forecast, by End User (2017-2030)

14.3.12. Japan

14.3.12.1. Market Revenue and Forecast, by Components (2017-2030)

14.3.12.2. Market Revenue and Forecast, by Platform (2017-2030)

14.3.12.3. Market Revenue and Forecast, by Offering’s (2017-2030)

14.3.12.4. Market Revenue and Forecast, by Technology (2017-2030)

14.3.12.5. Market Revenue and Forecast, by Application (2017-2030)

14.3.12.6. Market Revenue and Forecast, by End User (2017-2030)

14.3.13. Rest of APAC

14.3.13.1. Market Revenue and Forecast, by Components (2017-2030)

14.3.13.2. Market Revenue and Forecast, by Platform (2017-2030)

14.3.13.3. Market Revenue and Forecast, by Offering’s (2017-2030)

14.3.13.4. Market Revenue and Forecast, by Technology (2017-2030)

14.3.13.5. Market Revenue and Forecast, by Application (2017-2030)

14.3.13.6. Market Revenue and Forecast, by End User (2017-2030)

14.4. MEA

14.4.1. Market Revenue and Forecast, by Components (2017-2030)

14.4.2. Market Revenue and Forecast, by Platform (2017-2030)

14.4.3. Market Revenue and Forecast, by Offering’s (2017-2030)

14.4.4. Market Revenue and Forecast, by Technology (2017-2030)

14.4.5. Market Revenue and Forecast, by Application (2017-2030)

14.4.6. Market Revenue and Forecast, by End User (2017-2030)

14.4.7. GCC

14.4.7.1. Market Revenue and Forecast, by Components (2017-2030)

14.4.7.2. Market Revenue and Forecast, by Platform (2017-2030)

14.4.7.3. Market Revenue and Forecast, by Offering’s (2017-2030)

14.4.7.4. Market Revenue and Forecast, by Technology (2017-2030)

14.4.8. Market Revenue and Forecast, by Application (2017-2030)

14.4.9. Market Revenue and Forecast, by End User (2017-2030)

14.4.10. North Africa

14.4.10.1. Market Revenue and Forecast, by Components (2017-2030)

14.4.10.2. Market Revenue and Forecast, by Platform (2017-2030)

14.4.10.3. Market Revenue and Forecast, by Offering’s (2017-2030)

14.4.10.4. Market Revenue and Forecast, by Technology (2017-2030)

14.4.11. Market Revenue and Forecast, by Application (2017-2030)

14.4.12. Market Revenue and Forecast, by End User (2017-2030)

14.4.13. South Africa

14.4.13.1. Market Revenue and Forecast, by Components (2017-2030)

14.4.13.2. Market Revenue and Forecast, by Platform (2017-2030)

14.4.13.3. Market Revenue and Forecast, by Offering’s (2017-2030)

14.4.13.4. Market Revenue and Forecast, by Technology (2017-2030)

14.4.13.5. Market Revenue and Forecast, by Application (2017-2030)

14.4.13.6. Market Revenue and Forecast, by End User (2017-2030)

14.4.14. Rest of MEA

14.4.14.1. Market Revenue and Forecast, by Components (2017-2030)

14.4.14.2. Market Revenue and Forecast, by Platform (2017-2030)

14.4.14.3. Market Revenue and Forecast, by Offering’s (2017-2030)

14.4.14.4. Market Revenue and Forecast, by Technology (2017-2030)

14.4.14.5. Market Revenue and Forecast, by Application (2017-2030)

14.4.14.6. Market Revenue and Forecast, by End User (2017-2030)

14.5. Latin America

14.5.1. Market Revenue and Forecast, by Components (2017-2030)

14.5.2. Market Revenue and Forecast, by Platform (2017-2030)

14.5.3. Market Revenue and Forecast, by Offering’s (2017-2030)

14.5.4. Market Revenue and Forecast, by Technology (2017-2030)

14.5.5. Market Revenue and Forecast, by Application (2017-2030)

14.5.6. Market Revenue and Forecast, by End User (2017-2030)

14.5.7. Brazil

14.5.7.1. Market Revenue and Forecast, by Components (2017-2030)

14.5.7.2. Market Revenue and Forecast, by Platform (2017-2030)

14.5.7.3. Market Revenue and Forecast, by Offering’s (2017-2030)

14.5.7.4. Market Revenue and Forecast, by Technology (2017-2030)

14.5.8. Market Revenue and Forecast, by Application (2017-2030)

14.5.8.1. Market Revenue and Forecast, by End User (2017-2030)

14.5.9. Rest of LATAM

14.5.9.1. Market Revenue and Forecast, by Components (2017-2030)

14.5.9.2. Market Revenue and Forecast, by Platform (2017-2030)

14.5.9.3. Market Revenue and Forecast, by Offering’s (2017-2030)

14.5.9.4. Market Revenue and Forecast, by Technology (2017-2030)

14.5.9.5. Market Revenue and Forecast, by Application (2017-2030)

14.5.9.6. Market Revenue and Forecast, by End User (2017-2030)

Chapter 15. Company Profiles

15.1. Meta (Facebook,Inc.)

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. Tencent holdings Ltd

15.2.1. Company Overview

15.2.2. ProductOfferings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. Roblox corporation

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. Nvidia corporation

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. NetEase, Inc.

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others