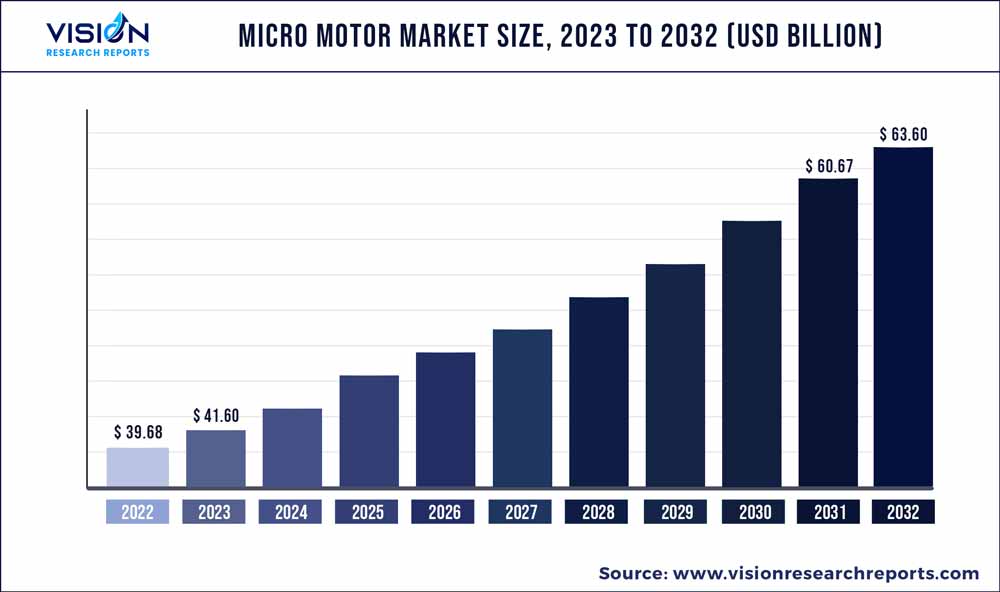

The global micro motor market was surpassed at USD 39.68 billion in 2022 and is expected to hit around USD 63.6 billion by 2032, growing at a CAGR of 4.83% from 2023 to 2032. The micro motor market in the United States was accounted for USD 6.1 billion in 2022.

Key Pointers

Report Scope of the Micro Motor Market

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2022 | 31% |

| CAGR of North America from 2023 to 2032 | 5.05% |

| Revenue Forecast by 2032 | USD 63.6 billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.83% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Mitsuba Corporation; Nidec Corporation; Johnson Electric Holdings Limited; Mabuchi Motor Company Ltd; ABB Ltd.; Constar Micromotor Co Ltd; Buhler Motor GmbH; Robert Bosch GmbH; Denso Corporation; Maxon Motor AG; Arc Systems Inc.; Siemens AG |

The rising advancements in the medical equipment sector significantly contribute to the demand for micromotors. They have several healthcare applications, including medical implants, dental implants, diagnostic tools, and drug delivery equipment. The trend of miniaturization in medical equipment significantly contributes to the growth of the target market. The increasing demand for automation in different processes of industries presents a significant opportunity for the growth of the target market. Additionally, the growth of the automotive industry is a major driver for the target market. Micromotors are extensively used across different components of an automobile, such as fans, water pumps, wipers, anti-slip brakes, ABS pumps, roofs, clutch actuators, alternators, condensers, and steering wheels, among others. Agriculture equipment, 3D printers, and electronic appliances are some other important applications of micromotors.

The target market faces several challenges, including the high cost of technologies involved in manufacturing micro motors. The cost of developing a niche application micro motor is even higher as it requires significant customization. Additionally, the availability of cheaper local variants of micro motors is impacting the industry players. To overcome the competition from an unorganized market, the organized players are engaging in partnerships with end-use companies such as automotive companies, medical equipment manufacturers, and home appliances manufacturers.

Type Insights

Based on type, the market is segmented into AC motors and DC motors. The DC motor segment held the largest revenue share of about 62% in 2022 and is expected to grow at a CAGR of 4.63% through the forecast period. DC motors are of two types: brushless and brushed. DC motors have high power density and are used in power tools and personal use appliances such as hair dryers, electric toothbrushes, and electric razors, among others. DC motors are more robust as they have high starting torque, starting and reversing speeds, and are cheaper than AC motors.

The AC motor segment is anticipated to grow at the fastest CAGR of 5.12% over the forecast period. AC motors have better energy efficiency and performance than DC motors. AC motors are suitable for industrial and commercial applications such as compressors, HVAC systems, and pumps. These motors are also in high demand for sophisticated automation and control systems in several industries. AC motors are more dependable owing to the fewer moving parts and simpler designs possible with AC motors.

Technology Insights

Based on technology, the market is segmented into brushless and brushed. The brushed segment dominated with the largest revenue share of about 55% in 2022. It is anticipated to grow at a CAGR of 4.45% during the forecast period. Brushed are easy to install and are priced at a lower value as compared to brushless motors. These motors operate at a speed of about 1,000 to 10,000 rpm. Several automotive systems, such as windshield wipers, power windows, cooling fans, and so on, use a brushed DC motor.

The brushless segment is expected to grow at the fastest CAGR of 4.85% throughout the forecast period. Brushless are more susceptible to damage and have comparatively higher longevity. Brushless motors have a life expectancy of more than 10,000 hours of operation. Brushless motors even require less maintenance and provide higher output per frame size. Although brushless are complex in nature and have high initial costs, their adoption is, however, increasing owing to their longer lifespan as compared to brushed motors.

Power Consumption Insights

Based on power consumption, the market is segmented into below 11 V, 12-24 V, 25-48 V, and above 48 V. Among these, the below 11 V segment dominated the market in 2022, with a revenue share of about 32%. It is anticipated to grow at a CAGR of 4.2% through the forecast period. The low cost and efficiency of these micromotors have led to the increased adoption of several products which can function on low voltage. Low-voltage motors are finding applications in several products, including coffee machines, vacuum cleaners, air purifiers, mixers, food processors, and dryers.

The above 48 V segment is expected to grow at a considerable CAGR of 5.75% throughout the forecast period. Higher power output, energy efficiency, and higher durability of above 48 V micro motors lead to increased demand. These motors can be employed on heavy-duty machinery, unmanned aerial vehicles, autonomous guided vehicles, and aircraft actuation systems. The high torque of these micromotors enables their applications in the high-end transportation and aerospace sector.

Application Insights

Based on application, the market is segmented into automotive, industrial automation, electronic appliances, healthcare, aerospace, and others. The automotive application segment dominated the market in 2022, with a market of about 23%. Micromotors are used in several components of automobiles, such as powered window lifters, power seats, parking brakes, door lock actuators, door mirrors, and several other autonomous systems. Safety mechanisms such as anti-lock braking systems also use micromotors.

The healthcare application segment is anticipated to register the fastest CAGR of 5.72% during the forecast period. Micromotors are used in portable medical devices, automated insulin pumps, blood pressure monitors, glucose monitoring systems, pocket ECGs, and portable ultrasounds. Micromotors are also used in several medical equipment related to surgery, diagnostics, and drug delivery. The healthcare sector is one of the major application sectors for micromotors as they enable the miniaturization of equipment.

Regional Insights

North America is expected to grow at a significant CAGR of 5.05% during the forecast period. The high growth can be attributed to the presence of several key players and the strong presence of automotive, aerospace, healthcare, and electronic appliances markets in North America. The high demand for personal care equipment and electronic appliances in the region leads to the growing demand for micromotors. Europe is also among the key regional markets owing to the large presence of the automotive industry in the region.

The Asia Pacific region dominated the market in 2022 with a revenue of about 31%. China, Japan, and India are the leading markets in the Asia Pacific region. The increasing adoption of automation across industries and the strong presence of the manufacturing sector in the countries contribute to its leading position. Moreover, Asia Pacific has emerged to be the leading automotive manufacturer in the world, which is significantly contributing to the demand for micromotors for several automotive components such as door locks, mirrors, and windows.

Micro Motor Market Segmentations:

By Type

By Technology

By Power Consumption

By Application

By Regional

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others