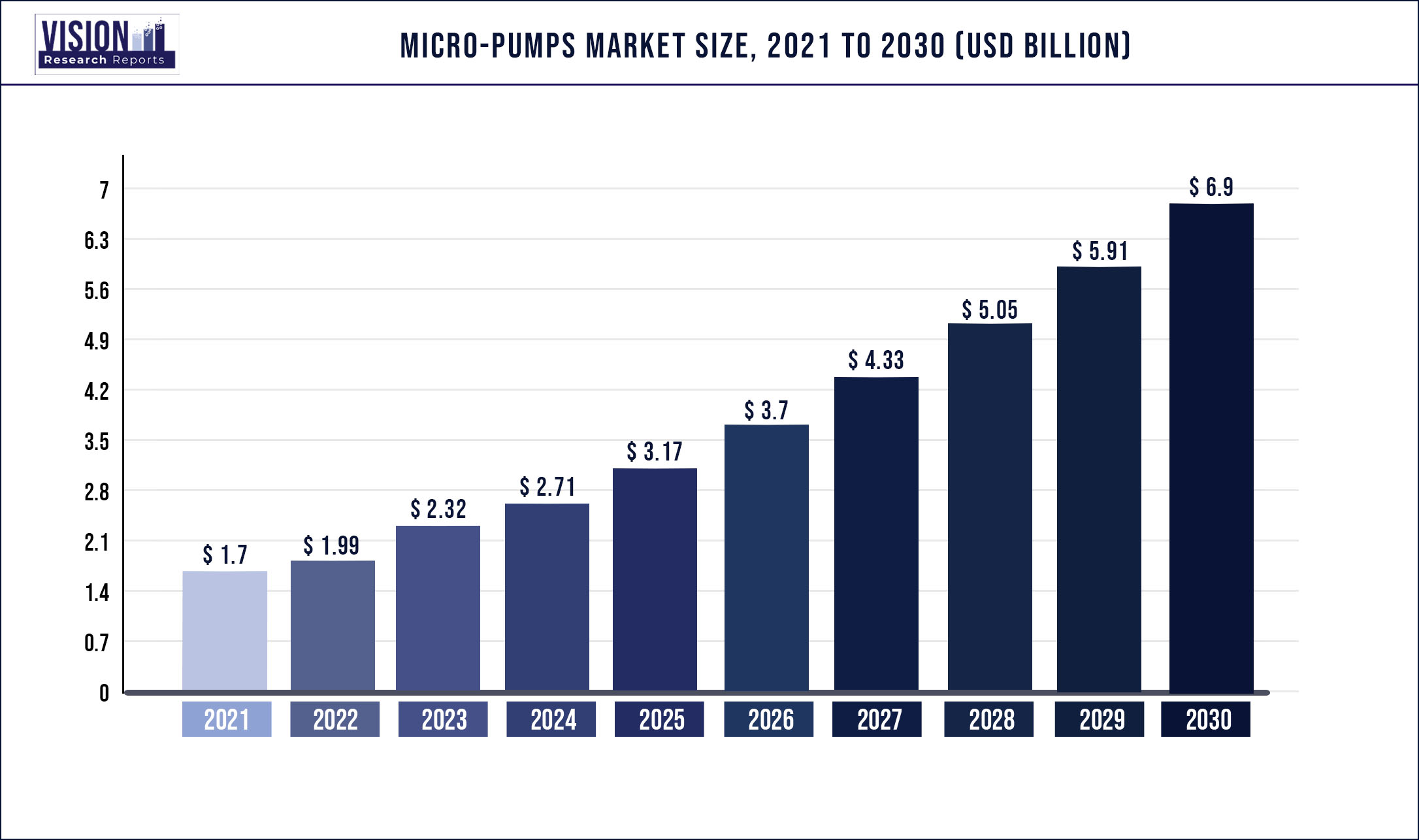

The global micro-pumps market was surpassed at USD 1.7 billion in 2021 and is expected to hit around USD 6.9 billion by 2030, growing at a CAGR of 16.84% from 2022 to 2030.

Increasing demand for Point-Of-Care-Testing (POCT) kits, rising awareness of controlled drug delivery systems, increasing miniaturization of medical devices, and increase in the research and development of pharmaceutical companies, is expected to drive the market.

In the product segment, the mechanical micro-pumps segment dominated the market in 2021 is expected to serve as a key revenue-generating product owing to their extensive use in microfabrication technology and the rise in microfluidics research. Drug Delivery held a lucrative share in the application segment and is expected to grow substantially. The rising adoption of implanted drug delivery systems and medical devices, as well as the increasing research in the field of drug delivery, supported the growth of this segment. For instance, Sensile AG (A Subsidiary of Gerresheimer) Medical announced it had developed a wearable micro-pump for a European pharmaceutical company that is designed to treat Parkinson’s disease.

The onset of the pandemic positively affected the medical devices market by the end of 2020. The use of Micro-pumps in biomedical and pharmaceutical research for Covid-19 treatments increased. Individuals with chronic diseases required frequent monitoring of vital signs from time to time which led to the adoption of Point-Of-Care-Testing (POCT) kits. Even after the pandemic, there is a rise in adoption of POCT kits at hospital, clinics, homes and hence, they are expected to support the growth of the market.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 1.7 billion |

| Revenue Forecast by 2030 | USD 6.9 billion |

| Growth rate from 2022 to 2030 | CAGR of 16.84% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Products, applications, end use |

| Companies Covered | Bartels Mikrotechnik GmbH; Bürkert Fluid Control Systems; TOPS INDUSTRY & TECHNOLOGY CO., LTD.; The Lee Company; Xiamen AJK Technology Co.,Ltd.; Xavitech; ALLDOO Micropump; Servoflo Corporation; Dolomite Microfluidics(Backtrace Holdings Ltd.); TTp ventus; Arcmed Group (Halma) |

Product Insights

The mechanical micro-pumps segment led the market and accounted for revenue share of around 56.0% in 2021. The market is anticipated to witness growth over the forecast period. This can be attributed to the use of mechanical micro-pumps in the Micro-Electro-Mechanical Systems (MEMS). The MEMS is used in drug delivery system vehicles, these systems are very cheap, easy to be operated, capable of monitoring diseases, and providing rapid detection and delivering medicines.

Mechanical micro-Pumps consist of moving parts like micro-valve membranes or flaps and actuation. Non-mechanical micro-Pumps do not need physical actuation, like capillary micro-Pumps. Non-mechanical micro-Pumps have certain limitations such as the actuation mechanisms interfering with the pumping liquids and the use of only low conductivity fluids. The increasing biomedical application of mechanical micro Pumps such as ‘Lab On Chip’ (LOC), micro-total analysis systems, and POCT are expected to drive the growth of the market. Advanced biological sample processing, manipulation, and analysis are possible in miniature fluidic devices by using to lab-on-chip (LoC) technology.

Application Insights

Drug Delivery is identified as the largest segment in 2021, accounting for around 32.5% of the market share. This can be attributed to the increasing use of micro-pumps in implanted drug delivery systems. The in-vitro diagnostic segment is expected to increase rapidly as micro-Pumps are used for early disease detection, easier monitoring, and increased personalization in the case of in-vitro diagnostics. There are also various developments in wearable medical devices that use micro-Pumps for transporting micro-fluids. For instance, in March 2022, Medtronic launched its MiniMed 780 G systems in India. The system is a part of new Medtronic portfolio of insulin pumps with smartphone technology via Bluetooth connectivity.

Such researches on new techniques of drug delivery seeks to develop micro devices capable of delivering exact quantities of close to the treatment site as possible and at right time. These devices are incorporated with micro-pumps, silicon micro-machined needles or controlled-release propellants for drug delivery, storage, and dispensing. The rising awareness of controlled drug delivery system devices and increasing production of drug delivery devices is expected to demand more number of micro-pumps and thereby drive the market growth.

End-use Insights

The biotechnological and pharmaceutical companies segment held the largest revenue share of 39.3% in 2021. These companies require micro-Pumps for infusion therapies, biomedical research, and research therapies including vaccines. According to the April 2021 report of the Congressional Budget Office, in 2019, the pharmaceutical industry spent USD 83 billion dollars on R & D. Also, the number of new drugs approval increased by 60% compared between the years 2010 to 2019. Hence, an increase in research and development has led to increased demand for micro-Pumps and thereby contributed to the market share of biotechnological and pharmaceutical companies. Hospitals and diagnostic centers are expected to surge the market growth over the forecast period as there is an increase in the use of micro-Pumps in point-of-care diagnosis and in devices used for blood transport and glucose monitoring devices used in diabetes patients.

An increase in Point-of-Care-Testing (POCT) has risen since the COVID-19 pandemic. An increase in funding and strategic initiatives by multiple sources, including the U.S. Department of Defense (DOD), the NIH, and NBIB has been taken. For instance, in October 2020, the National Institute of Biomedical Imaging and Bioengineering created the Point-of-Care-Technologies Research Network to drive the development of point-of-care diagnostic technologies. POCT has the potential for early disease diagnosis, treatment of noncommunicable diseases, easier monitoring, and increased personalization. Rapid, reliable, and low-cost diagnostic tools at point-of-care (PoC) are therefore in high demand.

Regional Insights

North America domianted the micro-pumps market and held the largest revenue sahre of 49.4% in 2021. High purchasing power, strong government support for quality healthcare, the presence of high-quality infrastructure for clinical and laboratory research, and high adoption of technologically advanced products are a few of the reasons driving regional market progress. Furthermore, the rise of the regional market has been aided by increased government support for medical devices and their approvals in this region. Likewise, advantageous government initiatives to assist research and development in the relevant industry are increasing the usage of devices made with micro-pumps, enhancing the market's growth.

Asia Pacific is projected to be the fastest-growing market over the forecast period owing to its increasing quality healthcare infrastructure, competent workforce, increasing awareness of healthcare products, rise in point-of-care diagnostic centers, and rigourous research and development initiative. In 2017-18, India spent 0.7 percent of its GDP on research and development, compared to 2.1 percent in China, 0.8 percent in South Africa, 1.3 percent in Brazil, and 1.1 percent in Russia.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Micro-pumps Market

5.1. COVID-19 Landscape: Micro-pumps Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Micro-pumps Market, By Product

8.1. Micro-pumps Market, by Product, 2022-2030

8.1.1 Mechanical

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Non-mechanical

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Micro-pumps Market, By Application

9.1. Micro-pumps Market, by Application, 2022-2030

9.1.1. Drug Delivery

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. In-vitro Diagnostics

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Medical Devices

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Micro-pumps Market, By End-use

10.1. Micro-pumps Market, by End-use, 2022-2030

10.1.1. Biotechnological & Pharmaceutical Companies

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Hospitals & Diagnostic Centers

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Academic & Research Institutes

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Micro-pumps Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 12. Company Profiles

12.1. Bartels Mikrotechnik GmbH

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Bürkert Fluid Control Systems

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. TOPS INDUSTRY & TECHNOLOGY CO., LTD.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. The Lee Company

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Xiamen AJK Technology Co., Ltd.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Xavitech

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. ALLDOO Micropump

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Servoflo Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Dolomite Microfluidics (Backtrace Holdings Ltd.)

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. TTp ventus

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others