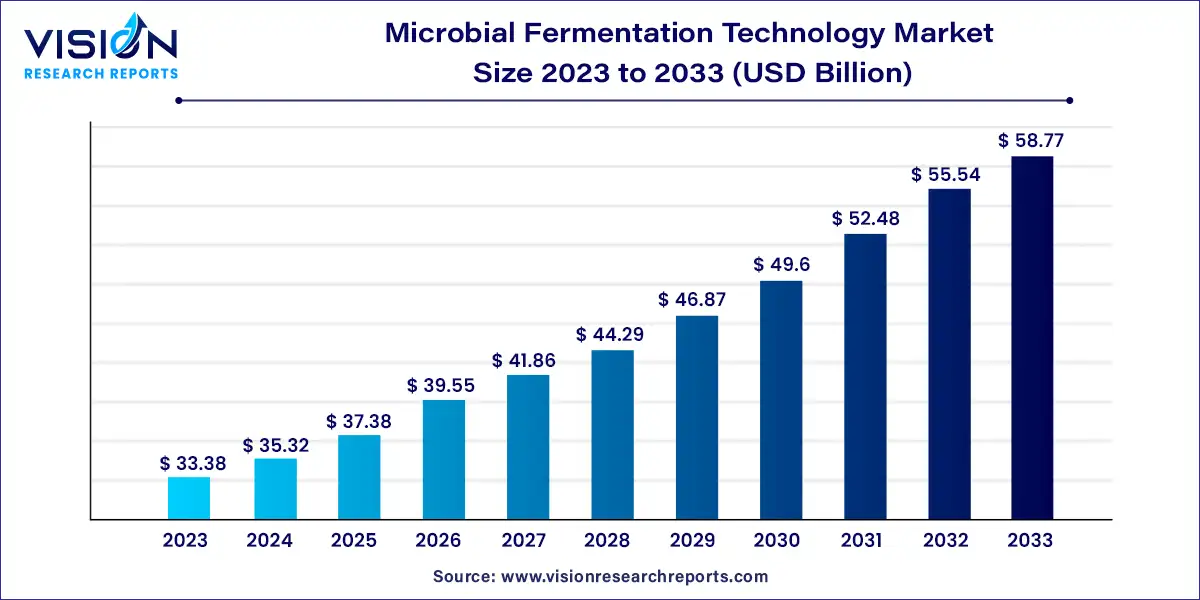

The global microbial fermentation technology market size was estimated at USD 33.38 billion in 2023 and it is expected to surpass around USD 58.77 billion by 2033, poised to grow at a CAGR of 5.82% from 2024 to 2033.

Microbial fermentation technology has emerged as a pivotal force driving innovation across various industries, from pharmaceuticals to food and beverages. This dynamic process harnesses the metabolic activities of microorganisms to produce a diverse array of valuable products.

The growth of the microbial fermentation technology market is propelled by an increasing demand for sustainable production methods has led industries to embrace microbial fermentation due to its eco-friendly nature and minimal waste generation. Secondly, the expanding biopharmaceutical sector relies heavily on microbial fermentation for the production of therapeutic proteins and vaccines, driving significant market growth. Additionally, advancements in genetic engineering have revolutionized microbial fermentation processes, enhancing productivity and enabling the production of high-value compounds. Moreover, the rising adoption of precision fermentation, facilitated by synthetic biology and data-driven approaches, is contributing to market expansion by allowing precise control over microbial metabolism.

| Report Coverage | Details |

| Market Size in 2023 | USD 33.38 billion |

| Revenue Forecast by 2033 | USD 58.77 billion |

| Growth rate from 2024 to 2033 | CAGR of 5.82% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

The antibiotics segment captured the largest market share of 33% in 2023 and is expected to witness the fastest growth throughout the forecast period. The dominance of the segment can be attributed to the high demand for antibiotics across the globe, the increasing focus on microbial metabolite research, and the introduction of new antibiotics in the market. Microbial fermentation plays a crucial role in the development of antibiotics. For instance, several studies have stated that out of all discovered antibiotics 70-80% are produced from a single genus of bacteria.

At the same time, owing to the COVID-19 pandemic, the urgent need for the development of a vaccine against the SARS-CoV-2 virus resulted in the high usage of fermentation technology in research and development. For instance, in a study published in March 2021, a team of researchers used bacterial fermentation technology for the large-scale and inexpensive production of the COVID-19 vaccine. Such advancements are anticipated to increase the use of microbial fermentation in the coming years.

The CMOs and CDMOs segment dominated the market and accounted for the highest share of 43% in 2023. CMOs and CDMOs are rapidly becoming the favorable option for biotherapeutics manufacturers because most of the innovation in the bioprocess space is achieved by smaller firms that have a capacity constraint, lack of trained professionals, and resources for the commercialization of these products. Also, the constantly growing clinical pipeline of biologics is another contributing factor expected to increase this segment’s growth.

Outsourcing to contract manufacturing/research service providers can provide a faster market product penetration due to the competitive expertise and experience. Thermo Fisher Scientific and Lonza are a few of the many companies that provide contract services due to their commercial-scale production capabilities and wide geographical presence. According to an article published in March 2020, approximately 35% of the process is outsourced with traditional biologics and more than 65% of the manufacturing process for advanced therapies is outsourced.

Asia Pacific dominated the market and accounted for the highest revenue share of 46% in 2023. This is due to the recognition of Asian countries as a hub for biopharmaceutical outsourcing. Asian companies, including domestic players and international giants, are estimated to build about 50% of the new bioprocessing facilities across the globe. For instance, several bioprocessing facilities are expected to be constructed in China to meet domestic demand. The confluence of the above-mentioned factors would increase the demand for microbial fermentation technology in the region.

On the other hand, North America is expected to witness significant growth in the coming years. This can be attributed to the growing engagement of companies in research and product development in biologics coupled with the presence of a substantial number of contract development organizations in the region. The strong regulatory framework is another key factor in shaping the North America market. The U.S. FDA continues to make attempts to improve guidelines regarding the promotion, development, approval, and legal practice surrounding biopharmaceutical products.

The U.S. is the key revenue contributor in the North America region. The evolving landscape of the manufacturing of biologics is a major driving factor for the U.S. market. In addition, increasing funding for biopharmaceutical research and development as well as the adoption of highly innovative manufacturing technologies for GMP manufacturing have contributed to market growth.

By Application

By End-user

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Microbial Fermentation Technology Market

5.1. COVID-19 Landscape: Microbial Fermentation Technology Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Microbial Fermentation Technology Market, By Application

8.1. Microbial Fermentation Technology Market, by Application, 2024-2033

8.1.1. Antibiotics

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Probiotics Supplements

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Monoclonal Antibodies

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Recombinant Proteins

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Biosimilars

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Vaccines

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Enzymes

8.1.7.1. Market Revenue and Forecast (2021-2033)

8.1.8. Small Molecules

8.1.8.1. Market Revenue and Forecast (2021-2033)

8.1.9. Others

8.1.9.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Microbial Fermentation Technology Market, By End-user

9.1. Microbial Fermentation Technology Market, by End-user, 2024-2033

9.1.1. Bio-Pharmaceutical Companies

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Contract Research Organizations (CROs)

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. CMOs & CDMOs

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Academic & Research Institutes

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Microbial Fermentation Technology Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Application (2021-2033)

10.1.2. Market Revenue and Forecast, by End-user (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.1.3.2. Market Revenue and Forecast, by End-user (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.1.4.2. Market Revenue and Forecast, by End-user (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.2. Market Revenue and Forecast, by End-user (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.3.2. Market Revenue and Forecast, by End-user (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.4.2. Market Revenue and Forecast, by End-user (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.5.2. Market Revenue and Forecast, by End-user (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.6.2. Market Revenue and Forecast, by End-user (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.2. Market Revenue and Forecast, by End-user (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.3.2. Market Revenue and Forecast, by End-user (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.4.2. Market Revenue and Forecast, by End-user (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.5.2. Market Revenue and Forecast, by End-user (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.6.2. Market Revenue and Forecast, by End-user (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.2. Market Revenue and Forecast, by End-user (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.3.2. Market Revenue and Forecast, by End-user (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.4.2. Market Revenue and Forecast, by End-user (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.5.2. Market Revenue and Forecast, by End-user (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.6.2. Market Revenue and Forecast, by End-user (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Application (2021-2033)

10.5.2. Market Revenue and Forecast, by End-user (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.5.3.2. Market Revenue and Forecast, by End-user (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.5.4.2. Market Revenue and Forecast, by End-user (2021-2033)

Chapter 11. Company Profiles

11.1. Biocon Ltd.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. BioVectra Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Danone UK

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. F. Hoffmann-La Roche Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Koninklijke DSM NV

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Lonza

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Novozymes A/S

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. TerraVia Holdings, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. BIOZEEN

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others