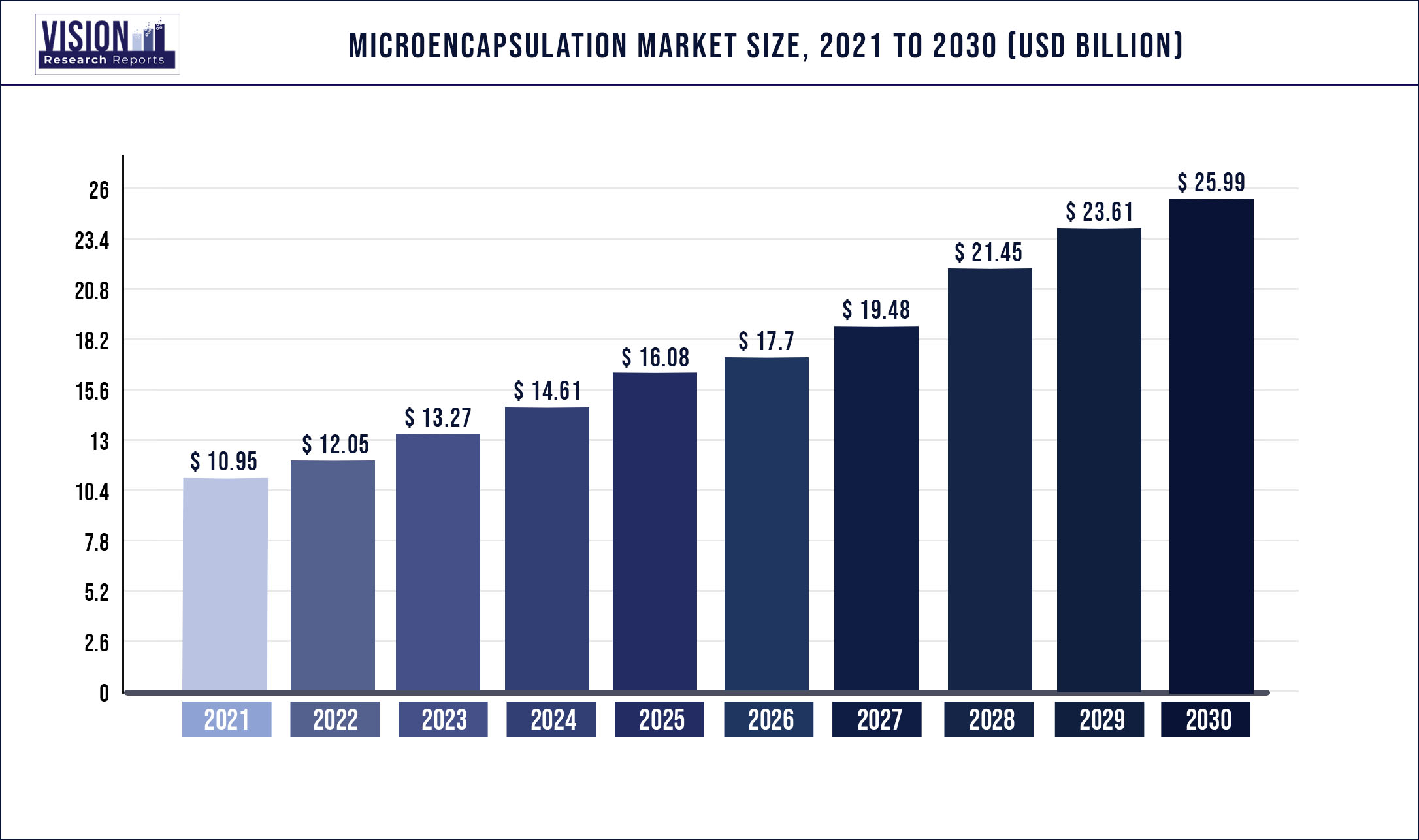

The global microencapsulation market size was estimated at around USD 10.95 billion in 2021 and it is projected to hit around USD 25.99 billion by 2030, growing at a CAGR of 10.08% from 2022 to 2030.

Rising demand for microencapsulated fragrances, bleach activators, and anti-bacterial compounds in the home and personal care industry is expected to propel market growth. Increasing penetration of the technology in the pharmaceutical application for the controlled and sustained release of drugs is likely to be a key factor for the industry expansion.

In addition, the use of the technology in masking odor, taste, and activities of encapsulated drug ingredients is expected to benefit the microencapsulation industry during the projected period. High initial investments for the technology development, coupled with the dominance of the existing market players, are expected to act as a threat to the new entrants. However, the scope for innovations in upcoming fields such as phase change materials (PCM) to incorporate them in sports equipment, building materials, and textiles is expected to drive the product demand.

The microencapsulation technique offers viable texture blending, appealing aroma release, and taste to flavors and fragrances used in food and beverage products. Microencapsulation of flavors protects them from evaporation, oxidation, and thermal degradation, and extends the shelf-life by retaining the food flavors, which is projected to drive their demand in this application.

Numerous industries were negatively impacted due to the COVID-19 outbreak. However, the microencapsulation industry registered good growth owing to its application across different industries. Microcapsules are currently used in baked goods, beverages, meat, poultry, dairy products, and others. Furthermore, in the pharmaceutical industry, microencapsulation has been utilized to strengthen stability, conceal bitter taste, improve drug release qualities, and enable customized drug delivery.

Microencapsulation is a useful technique in the cosmetics industry, as it allows for the protection and controlled release of a variety of active ingredients such as essential and natural oils, perfumes, vitamins, antioxidants, and so on. The do-it-yourself and online sales trends helped the cosmetic and the microencapsulation industry to sail through during the pandemic.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 10.95 billion |

| Revenue Forecast by 2030 | USD 25.99 billion |

| Growth rate from 2022 to 2030 | CAGR of 10.08% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Coating material, technology, application, region |

| Companies Covered | Capsulae; LycoRed Group; BASF SE; Balchem; Encapsys LLC (Milliken); AVEKA Group; Reed Pacific Pty Ltd.; Microtek Laboratories, Inc.; TasteTech Ltd.; GAT Microencapsulation GmbH; Ronald T. Dodge Co.; Evonik Industries AG; Inno Bio Limited; Bayer AG; Dow Corning Corporation; The 3M Company |

Coating Material Insights

The carbohydrates segment, which includes chitosan, starch, maltodextrin, cyclodextrin, and corn syrup as the key coating materials, accounted for a 19.9% share of the overall revenue in 2021. The superior solubility offered by these products, coupled with their ability to sustain in a volatile environment, is expected to have a positive impact on segment growth.

A polymer as a coating material is expected to register a CAGR of 10.8% during the projected period on account of its premium qualities. Polylactic acid (PLA) and polylactic-co-glycolic acid (PLGA) have been the most preferred polymers owing to their extensive use in products, such as surgical sutures and depot formulations, approved by the U.S. Food and Drug Administration (FDA).

Gum acacia is majorly used in the encapsulation of fragrances and flavors and is mainly consumed in the food and beverage industry. Gum acacia produces and stabilizes emulsions and is proven to be excellent for encapsulation of flavors, as it emulsifies, has a bland flavor, and has a low viscosity. Furthermore, it can prevent oxidation, thereby driving the demand in the flavors and fragrances industry.

Lipids as a coating material are expected to exhibit a CAGR of 9.8% during the forecast period. Fatty acids, alcohols, waxes, paraffin, beeswax, diacylglycerols, oils, fats, phospholipids, stearic acids, and glycerides are the key lipids that are used for the microencapsulation coating of minerals, vitamins, food colorants, flavors, fragrances.

Technology Insights

Spray technology is the most widely used technique and accounted for a 33.5% revenue share of the microencapsulation market in 2021. High penetration of this technique in the encapsulation of food ingredients, flavors, and fragrances has resulted in a higher market share. The technique offers continuous and rapid processing at low cost, high encapsulation efficiency, along with good stability of finished products.

Microencapsulation technology encapsulates active ingredients with a coating material and is categorized into coating, emulsion, spray, and dripping techniques. The shape and size of the active ingredients, chemical properties, permeability, degradability, and biocompatibility of the coating materials are the key factors considered while selecting appropriate microencapsulation techniques.

Coating technologies including pan coating, fluidized bed coating, and air suspension coating are expected to register a CAGR of 9.7% from 2022 to 2030. The pan coating process can encapsulate relatively large particles, which is expected to propel their demand in pharmaceutical applications during the assessment period.

Dripping technologies of microencapsulation primarily include spinning-disk, co-extrusion, and simple extrusion techniques. The microcapsules obtained from the dripping technique are biocompatible and have a low particle size distribution, which is expected to drive their demand in pharmaceuticals, cosmetics, and food and beverage applications.

Application Insights

The pharmaceutical and healthcare products application segment accounted for the highest market share of around 66% in 2021. The technology is used to mask the bitter taste of drugs and reduce gastric and other G.I. tract irritations caused by drugs. It is also used to reduce the hygroscopic properties, odor, and volatility of core materials.

The home and personal care industry utilize the technology to encapsulate colors, fragrances, and essential oils (EOs) in cosmetic products. Increasing demand for essential oils in the fragrance industry is expected to drive technology demand during the projected period.

The construction industry is expected to register a CAGR of 9.7% during the forecast period on account of the rising demand in the manufacturing of building materials. Microencapsulated active agents such as fire retardants, mineral oils, surfactants, heat retarding agents, polyurethane, antimicrobial agents, and thermochromic materials are found to be the most widely used microencapsulated products for the construction industry.

The food and beverage application segment accounted for an 8.0% share of the overall revenue in 2021. Growing consumer inclination towards healthy living to prevent illnesses caused by diet is a key trend in the market. Manufacturers in the food and beverage industry are improving the nutritional value of the food products, which has a major impact on driving the demand for microencapsulation.

Regional Insights

North America accounted for a 37.1% share of the overall revenue in 2021 on account of high product demand for pharmaceutical and food and beverage applications. Innovations in the textile industry to incorporate the technology for improvement in product quality and strength are expected to complement the growth during the projected period.

The U.S. dominated the market in North America with a share of over 82% in 2021 owing to the high penetration of the technique in the pharmaceuticals and healthcare industries. The presence of major pharmaceutical companies including Merck & Co, Johnson & Johnson, Pfizer, Bristol-Myers Squibb Company, and Eli Lilly and Company in the country is expected to propel growth.

U.K., Germany, Italy, and France together accounted for over 70% share of the overall revenue in Europe owing to the early adoption of the technology in end-use applications. The presence of major pharmaceutical manufacturers in the region including Roche, Novartis, GlaxoSmithKline, Sanofi, Novo Nordisk, and Bayer has led to a focus on the development of novel drug delivery systems, which is having a major impact on the market demand.

The Asia Pacific market is expected to expand at a CAGR of 11.6% during the assessment period, on account of the rapid expansion of the pharmaceutical and food processing industries across the region. Favorable government policies to promote FDI in the pharmaceutical industry in China and India have played a crucial role in promoting the healthcare industry in the Asia Pacific.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Microencapsulation Market

5.1. COVID-19 Landscape: Microencapsulation Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Microencapsulation Market, By Coating Material

8.1. Microencapsulation Market, by Coating Material, 2022-2030

8.1.1 Carbohydrates

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Gums & Resins

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Lipids

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Polymers

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Proteins

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Microencapsulation Market, By Technology

9.1. Microencapsulation Market, by Technology, 2022-2030

9.1.1. Coating

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Emulsion

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Spray Technologies

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Dripping

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Microencapsulation Market, By Application

10.1. Microencapsulation Market, by Application, 2022-2030

10.1.1. Pharmaceutical & Healthcare Products

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Home & Personal Care

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Food & Beverages

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Agrochemicals

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Construction

10.1.5.1. Market Revenue and Forecast (2017-2030)

10.1.6. Textile

10.1.6.1. Market Revenue and Forecast (2017-2030)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Microencapsulation Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Coating Material (2017-2030)

11.1.2. Market Revenue and Forecast, by Technology (2017-2030)

11.1.3. Market Revenue and Forecast, by Application (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Coating Material (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Coating Material (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Coating Material (2017-2030)

11.2.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Coating Material (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Coating Material (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Coating Material (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Coating Material (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Application (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Coating Material (2017-2030)

11.3.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Coating Material (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Coating Material (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Coating Material (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Coating Material (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Application (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Coating Material (2017-2030)

11.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Coating Material (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Coating Material (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Coating Material (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Coating Material (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Application (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Coating Material (2017-2030)

11.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Coating Material (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Coating Material (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Application (2017-2030)

Chapter 12. Company Profiles

12.1. Capsulae

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. LycoRed Group

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. BASF SE

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Balchem

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Encapsys LLC (Milliken)

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. AVEKA Group

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Reed Pacific Pty Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Microtek Laboratories, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. TasteTech Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. GAT Microencapsulation GmbH

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others