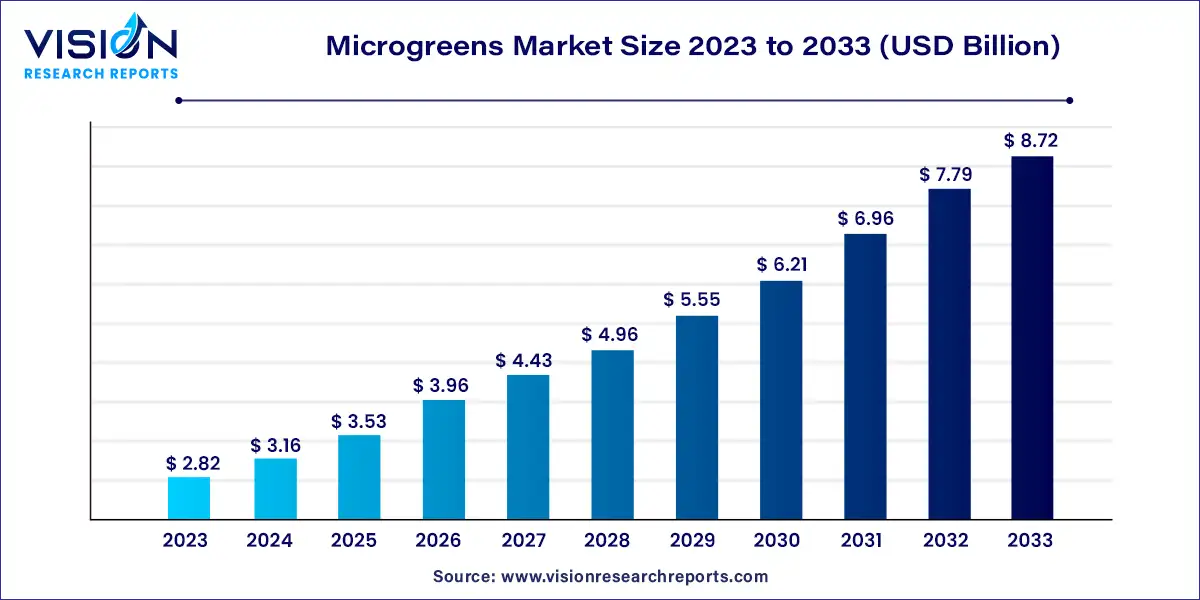

The global microgreens market size was surpassed at USD 2.82 billion in 2023 and is expected to hit around USD 8.72 billion by 2033, growing at a CAGR of 11.95% from 2024 to 2033.

The microgreens market has witnessed substantial growth driven by increasing consumer awareness regarding the health benefits and culinary versatility of these nutrient-packed greens. Microgreens, tiny edible greens harvested at an early growth stage, have gained popularity among health-conscious individuals, chefs, and food enthusiasts alike.

The growth of the microgreens market is propelled by an increasing consumer awareness and demand for nutrient-dense foods drive the popularity of microgreens, which are packed with vitamins, minerals, and antioxidants. Secondly, the expansion of urban agriculture, including initiatives such as urban farming and home gardening, contributes to the availability of fresh microgreens year-round. Additionally, the culinary versatility of microgreens, appreciated by chefs and home cooks alike, fuels demand in the foodservice industry. These factors collectively contribute to the robust growth of the microgreens market, positioning it as a promising segment within the broader food and agriculture landscape.

| Report Coverage | Details |

| Revenue Share of Europe in 2023 | 38% |

| CAGR of Asia Pacific from 2024 to 2033 | 12.48% |

| Revenue Forecast by 2033 | USD 8.72billion |

| Growth Rate from 2024 to 2033 | CAGR of 11.95% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The market is categorized into indoor vertical farms, commercial greenhouses, and others. The commercial greenhouse segment dominated the industry with a revenue share of 46% in 2023 and is expected to maintain its dominance. Commercial greenhouses are favored for growing microgreens due to their precise environmental control, providing optimal conditions for these delicate greens. They offer stability and protection from external factors, ensuring uninterrupted year-round production. This allows for a constant supply of fresh microgreens, meeting steady demand from restaurants, grocery stores, and consumers. Greenhouse cultivation also grants growers greater flexibility in selecting diverse microgreens varieties, enhancing their market competitiveness.

The indoor vertical farms segment is anticipated to grow at a significant CAGR of 12.55% over the forecast period. It is credited to indoor farming's space-efficient nature, which makes it an ideal solution for cultivation due to its small footprints, enabling growers to use limited space effectively and scale operations vertically for enhanced productivity and resource optimization. Moreover, this method reduces reliance on conventional agricultural practices, such as vast arable land and extensive water consumption. Utilizing hydroponic or aeroponic systems common in indoor microgreens farming substantially reduces water usage, promoting sustainable and eco-friendly practices.

In terms of distribution channels, the market is classified into retail stores, online, farmers' markets, and others. The retail stores segment dominated the market and accounted for a revenue share of 42% in 2023. Retail stores are the preferred destination for purchasing microgreens due to their convenience, accessibility, and diverse selection. With the perishable nature of microgreens and their short shelf life, retail outlets offer quick access to fresh produce without the need for pre-ordering or waiting for deliveries. Customers can find a wide range of microgreens varieties in retail stores, catering to different culinary preferences and nutritional needs, enhancing the overall shopping experience. Reputable retailers prioritize food safety and quality control measures, ensuring that the microgreens on their shelves meet the highest standards, and providing reassurance to health-conscious consumers.

In addition, retail environments empower consumers with essential product information through packaging and labeling, facilitating informed purchasing decisions. Moreover, retailers' economies of scale and efficient distribution networks result in competitive pricing, making it more affordable and accessible to a broader customer base. In conclusion, retail stores serve as a convenient and reliable source for microgreens, offering convenience, variety, quality assurance, transparency, and cost-effectiveness to meet the increasing demand for these nutritious greens. The online segment is expected to grow at the fastest CAGR of 12.34% during the forecast period. The online mode of shopping is witnessing a significant increase due to several compelling factors. First and foremost, the user-friendly nature and widespread availability of online platforms make it considerably more convenient for consumers to purchase microgreens from the comfort of their homes.

With just a few clicks, customers can easily explore a diverse selection of product varieties, catering to various culinary preferences and health needs. Online stores provide in-depth product information, empowering shoppers to make well-informed decisions about their purchases. In addition, the direct sourcing of microgreens from growers or specialized suppliers ensures optimal freshness and quality, appealing to health-conscious consumers in search of nutrient-rich produce. Competitive pricing, exclusive deals, and doorstep delivery options further enhance the appeal of online microgreen shopping, contributing to the growing trend of choosing the virtual marketplace for procuring these nutritious greens.

In terms of produce, the market is classified into broccoli, cabbage, radish, arugula, basil, amaranth, celery, beets, and others. The radish segment held the maximum market share of 28% in 2023. The rising demand for radish microgreens can be attributed to several key factors. Firstly, their unique peppery flavor and vibrant appearance make them a preferred choice among chefs and culinary enthusiasts, elevating the taste and visual appeal of various dishes. This culinary versatility has increased adoption in the food service industry and at-home cooking. In addition, radish greens garner attention for their exceptional nutritional profile, which is rich in essential vitamins, minerals, and antioxidants.

These include vitamins A, B, C, E, and K and vital minerals like calcium, iron, magnesium, phosphorus, potassium, and zinc. Moreover, they contain amino acids, carotene, chlorophyll, and protein, making them a powerhouse of health benefits in a compact and flavorful form. The growing emphasis on health and wellness has driven consumers to seek nutrient-dense food options, and radishes fit the bill perfectly. Furthermore, the rising popularity of plant-based diets and the ongoing trend of sustainable, locally sourced produce have fueled the demand for radish microgreens, as they offer a fresh and eco-friendly option for health-conscious consumers. The broccoli segment is anticipated to grow at a CAGR of 13.56% over the forecast period.

Broccoli offers a concentrated source of essential nutrients, including vitamins, minerals, and antioxidants, appealing to health-conscious consumers seeking nutrient-dense food options. Broccoli is gaining popularity among chefs and home cooks alike for its versatility in adding a mild, nutty flavor and a delicate crunch to a wide range of dishes, from salads and wraps to smoothies and sandwiches. Moreover, the growing interest in plant-based diets and the desire for sustainable, locally sourced produce have further boosted the appeal of broccoli microgreens. With their quick growth cycle and ease of cultivation, suppliers and growers are experiencing a surge in demand for broccoli microgreens. This makes them a sought-after and profitable choice in the flourishing market.

Europe dominated the overall market in 2023 with a share of 38%. Europe has established itself as a prominent leader in the market driven by a combination of factors that have shaped its dominant position in the industry. One key driver is the region's unwavering emphasis on health and wellness. European consumers are aware of the importance of nutrition in maintaining overall well-being, leading to rising demand for nutrient-dense foods like microgreens. The region's robust and thriving food service industry has also played a significant role in propelling the product's popularity.

Renowned for their diverse culinary offerings and innovations, European restaurants and chefs have embraced microgreens as a way to elevate the visual and gustatory appeal of their dishes. For instance, Nok’s Kitchen, one of the most famous restaurants in the UK uses microgreens in their various recipes as food dressing. As consumers increasingly prioritize high protein intake and seek low-carb food options, there is a growing demand for such products. In response, vegetable growers are focusing on cultivating microgreens alongside traditional vegetables and expanding their area under protected cultivation. Asia Pacific is expected to register the fastest CAGR of 12.47% during the forecast period.

This growth can be attributed to various factors, such as a health-conscious consumer base and urbanization trends. In addition, the integration of microgreens into traditional cuisine is boosting their popularity. Furthermore, there is a growing interest in sustainability and agricultural advancements, contributing to the market's expansion. Notably, China plays a crucial role in this growth as the largest product exporter. The country's competitive pricing strategies, ability to meet diverse customer demands, highly efficient & technologically advanced agricultural sector enabling large-scale production & streamlined export processes all contribute to its dominant position in the global market.

By Farming Type

By Distribution Channel

By Produce

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Farming Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Microgreens Market

5.1. COVID-19 Landscape: Microgreens Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Microgreens Market, By Farming Type

8.1. Microgreens Market, by Farming Type, 2024-2033

8.1.1 Indoor Vertical Farming

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Commercial Greenhouse

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Commercial Greenhouse

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Microgreens Market, By Distribution Channel

9.1. Microgreens Market, by Distribution Channel, 2024-2033

9.1.1. Retail Stores

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Online

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Farmers Market

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Microgreens Market, By Produce

10.1. Microgreens Market, by Produce, 2024-2033

10.1.1. Broccoli

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Cabbage

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Radish

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Arugula

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Basil

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Amaranth

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Celery

10.1.7.1. Market Revenue and Forecast (2021-2033)

10.1.8. Beets

10.1.8.1. Market Revenue and Forecast (2021-2033)

10.1.9. Ohers

10.1.9.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Microgreens Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Farming Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.1.3. Market Revenue and Forecast, by Produce (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Farming Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Produce (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Farming Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Produce (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Farming Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.3. Market Revenue and Forecast, by Produce (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Farming Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Produce (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Farming Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Produce (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Farming Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Produce (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Farming Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Produce (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Farming Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.3. Market Revenue and Forecast, by Produce (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Farming Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Produce (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Farming Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Produce (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Farming Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Produce (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Farming Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Produce (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Farming Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.3. Market Revenue and Forecast, by Produce (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Farming Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Produce (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Farming Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Produce (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Farming Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Produce (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Farming Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Produce (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Farming Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.5.3. Market Revenue and Forecast, by Produce (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Farming Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Produce (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Farming Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Produce (2021-2033)

Chapter 12. Company Profiles

12.1. AeroFarms.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Fresh Origins.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Gotham Greens.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Good Leaf Farms.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Living Earth Farms.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Farmbox Greens

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Chef’s Garden.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Bowery Farming

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Teshuva Agricultural Projects Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Madar Farms

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others