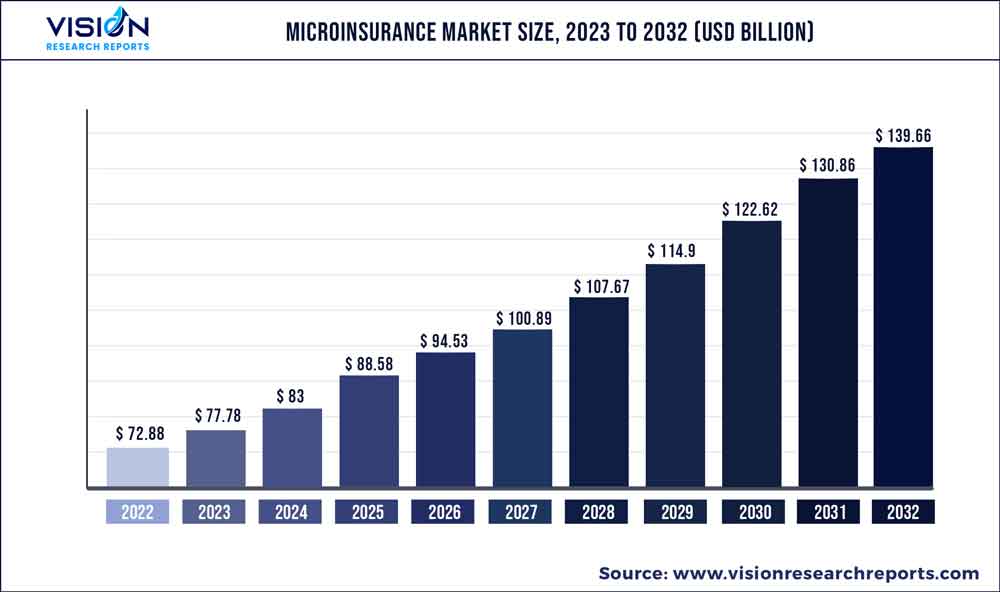

The global microinsurance market was surpassed at USD 72.88 billion in 2022 and is expected to hit around USD 139.66 billion by 2032, growing at a CAGR of 6.72% from 2023 to 2032. The microinsurance market in the United States was accounted for USD 8.3 billion in 2022.

Key Pointers

Report Scope of the Microinsurance Market

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2022 | 31.05% |

| Revenue Forecast by 2032 | USD 139.66 billion |

| Growth rate from 2023 to 2032 | CAGR of 6.72% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | The Hollard Insurance Company; afpgen.com.ph; American International Group, Inc.; Bharti AXA Life Insurance Company Ltd.; SBI Life Insurance Company Ltd.; ICICI Prudential Life Insurance Co. Ltd.; Banco do Nordeste Brasil S.A.; Climbs; Allianz SE; Bajaj Allianz Life Insurance Co. Ltd. |

The industry growth can be attributed to various factors, such as increasing disposable income, technological advancements in insurance and mobile technology, and the expansion of high-speed mobile networks worldwide. Companies, such as Bima and MicroEnsure, utilize mobile technology and collaborate with top telecommunication firms to provide microinsurance to low-income people. For instance, in October 2021, MicroEnsure partnered with Jazz Business, a leading B2B solutions provider, to offer tailored insurance products to its corporate customers at preferential rates.

Blockchain technology is being utilized to reduce high insurance premiums, simplify the claims process, facilitate the development of specialized coverage, and support people residing in low-income and disaster-prone areas. Various microinsurance providers worldwide offer microinsurance products and services based on blockchain technology. For instance, Blocksure Ltd., a software company based in London, UK, provides Blocksure OS, a blockchain-based insurance platform for low-income customers in developing countries. Microinsurance providers are exploring new business models like peer-to-peer insurance and on-demand coverage. These models leverage technology to provide customers with more personalized and flexible insurance options while reducing costs and increasing efficiency.

Microinsurance providers are embracing technology, sustainability, and innovation to serve their customers better and positively impact society. The COVID-19 pandemic highlighted the importance of digital transformation. The pandemic has accelerated the shift toward digital distribution channels in this market. Digital channels offer customers the convenience of buying insurance products from the comfort of their own homes without the need for face-to-face interactions. In addition, digital channels can be customized to meet the specific needs of different customer segments, offering a more personalized experience. The microinsurance (commercially viable) segment dominated the market in 2022. The commercially viable microinsurance market has been expanding rapidly in recent years, with several developments helping drive growth & improve product accessibility.

The microinsurance (commercially viable) segment is also more likely to have access to formal financial services, which makes it easier for insurance companies to distribute their products and collect premiums. This allows insurance companies to reduce administrative costs and increase efficiency. The Asia Pacific region dominated the industry in 2022. The region has seen significant economic growth in recent years due to increasing disposable income among low-income households. This has resulted in a growing demand for insurance products catering to the low-income population segment. In addition, the region has a high mobile phone penetration rate, facilitating the growth of mobile-based microinsurance products.

Provider Insights

The microinsurance (commercially viable) segment dominated the market in 2022 and accounted for a revenue share of more than 67.04%. Microinsurance (commercially viable) products are designed to meet the needs of impoverished people, who typically face more significant risks and vulnerabilities than those in higher income brackets. Microinsurance (commercially viable) providers are focusing on developing new products tailored to the specific needs of low-income individuals and communities. These products include weather index-based insurance, which provides coverage for crop losses due to adverse weather conditions, and health insurance, which covers specific illnesses.

The microinsurance through aid/government support segment is anticipated to grow significantly over the forecast period. Aid and government support help microinsurance providers overcome financial and regulatory barriers that make it challenging to provide affordable and accessible insurance products to populations with low income. Through aid/government support, several microinsurance providers are integrating their products with digital platforms, such as mobile banking and digital wallets. For instance, in February 2022, the Kenyan government launched, a digital microinsurance platform allowing customers to purchase and manage their insurance policies using mobile phones.

Model Type Insights

The partner agent model segment dominated the market in 2022 and accounted for a revenue share of more than 42.07%. Microinsurance providers can benefit from working closely with partner agents who deeply understand their clients' needs and preferences. Through such collaboration, insurance providers can customize their products and services to meet the specific demands of the local market, making their offerings more attractive to potential customers. Moreover, the partner agent model is highly scalable and can be easily expanded by adding more agents in new areas.

The full-service model segment is anticipated to grow significantly over the forecast period due to several factors, including the increasing demand for high-quality services, the rising disposable income of consumers, and the growing popularity of full-service models in various industries. The full-service model in microinsurance is gaining popularity as it addresses the unique needs and challenges low-income individuals and families face. For example, many low-income households do not have access to traditional banking services, making it difficult to save money or access credit. Full-service microinsurance providers can help address such issues by offering financial education and products.

Product Type Insights

The life insurance segment dominated the market in 2022 and accounted for a revenue share of 48.04%. The dominance of life insurance in the global market can be attributed to the combination of lower risk, greater demand, simplified underwriting, and lower premiums. Life insurance is often considered necessary in many cultures, particularly in developing countries. Low-income households may prioritize life insurance over other types of insurance because they want to ensure that their families are financially protected after their death.

The health insurance segment is anticipated to grow significantly over the forecast period. The segment’s growth can be attributed to the rising healthcare costs globally. Healthcare costs are rising globally, and low-income individuals and families are particularly vulnerable to financial hardship caused by unexpected medical expenses. Health insurance help mitigate this risk and provides affordable access to healthcare services.

Distribution Channel Insights

The financial institutions segment dominated the market in 2022 and accounted for a revenue share of 31.07%. Microinsurance is predominantly distributed through financial institutions, with a significant share of the market being served by banks that specialize in micro-enterprise offerings. Many Microfinance Institutions (MFIs), credit unions, and commercial and cooperative banks provide financial services to low-income customers. Financial institutions, such as banks and Microfinance Institutions (MFIs), have established infrastructure and distribution networks that they can leverage to offer microinsurance products.

This allows them to reach many low-income individuals and families who may not have access to traditional insurance products. The digital channel segment is anticipated to grow significantly over the forecast period. The microinsurance industry is experiencing growth in adopting digital marketing channels to distribute its products. Digital marketing involves promoting services or products through digital platforms, such as social media, websites, emails, search engines, and mobile applications. This shift towards digital marketing has become vital for microinsurance companies due to the increasing popularity of digital channels in developing markets.

End-use Insights

The business segment dominated the market in 2022 and accounted for a global revenue share of over 56.02%. Small business owners adopt microinsurance to manage financial risks associated with operating a business. It protects against potential losses due to business interruption, damage to equipment or property, or liability claims from employees or customers. Microinsurance companies are focusing on providing insurance to these underserved sectors. For instance, in February 2022, CARD Pioneer Microinsurance Inc. (CMPI) collaborated with the Philippine Crop. Insurance Corp. (PCIC), a government-owned entity, to improve access to insurance products and services, particularly for small farmers in the Philippines.

The personal segment is anticipated to register significant growth over the forecast period. The increasing adoption of microinsurance products by low-income individuals owing to their vast benefits propels segment growth. A rise in the middle-class population in many developing countries has led to an increase in disposable income and a greater willingness to invest in insurance products. In addition, microinsurance providers increasingly offer affordable and accessible personal insurance products, such as health and life insurance, to meet the needs of low-income individuals and families.

Regional Insights

Asia Pacific dominated the market in 2022 and accounted for a more than 31.05% revenue share due to the presence of a large pool of underserved populations, low insurance penetration, a supportive regulatory environment, and technological innovation. Many governments in the Asia Pacific region support microinsurance initiatives and have implemented policies to promote their development. For example, some countries, such as the Philippines and Indonesia, have exempted microinsurance providers from specific regulatory requirements, such as capitalization and solvency rules. For instance, in the Philippines, the Microinsurance Act of 2013 establishes a simplified regulatory framework for microinsurance.

The North America regional market is expected to grow significantly over the forecast period. The growth of digital platforms and mobile technology has made it easier and more cost-effective to offer microinsurance products to consumers. This has led to the emergence of new players in the market, including insurtech startups, which are leveraging technology to reach underserved populations. North America also has a well-established regulatory framework for insurance products, creating a stable environment for microinsurance providers.

Microinsurance Market Segmentations:

By Provider

By Model Type

By Product Type

By Distribution Channel

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Microinsurance Market

5.1. COVID-19 Landscape: Microinsurance Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Microinsurance Market, By Provider

8.1. Microinsurance Market, by Provider, 2023-2032

8.1.1. Microinsurance (Commercially Viable)

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Microinsurance Through Aid/Government Support

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Microinsurance Market, By Model Type

9.1. Microinsurance Market, by Model Type, 2023-2032

9.1.1. Partner Agent Model

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Full-Service Model

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Provider Driven Model

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Microinsurance Market, By Product Type

10.1. Microinsurance Market, by Product Type, 2023-2032

10.1.1. Life Insurance

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Health Insurance

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Property Insurance

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Microinsurance Market, By Distribution Channel

11.1. Microinsurance Market, by Distribution Channel, 2023-2032

11.1.1. Direct Sales

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Financial Institutions

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Digital Channels

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Microinsurance Market, By End Use

12.1. Microinsurance Market, by End Use, 2023-2032

12.1.1. Business

12.1.1.1. Market Revenue and Forecast (2020-2032)

12.1.2. Personal

12.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 13. Global Microinsurance Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Provider (2020-2032)

13.1.2. Market Revenue and Forecast, by Model Type (2020-2032)

13.1.3. Market Revenue and Forecast, by Product Type (2020-2032)

13.1.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.1.5. Market Revenue and Forecast, by End Use (2020-2032)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Provider (2020-2032)

13.1.6.2. Market Revenue and Forecast, by Model Type (2020-2032)

13.1.6.3. Market Revenue and Forecast, by Product Type (2020-2032)

13.1.6.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.1.7. Market Revenue and Forecast, by End Use (2020-2032)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Provider (2020-2032)

13.1.8.2. Market Revenue and Forecast, by Model Type (2020-2032)

13.1.8.3. Market Revenue and Forecast, by Product Type (2020-2032)

13.1.8.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.1.8.5. Market Revenue and Forecast, by End Use (2020-2032)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Provider (2020-2032)

13.2.2. Market Revenue and Forecast, by Model Type (2020-2032)

13.2.3. Market Revenue and Forecast, by Product Type (2020-2032)

13.2.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.2.5. Market Revenue and Forecast, by End Use (2020-2032)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Provider (2020-2032)

13.2.6.2. Market Revenue and Forecast, by Model Type (2020-2032)

13.2.6.3. Market Revenue and Forecast, by Product Type (2020-2032)

13.2.7. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.2.8. Market Revenue and Forecast, by End Use (2020-2032)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Provider (2020-2032)

13.2.9.2. Market Revenue and Forecast, by Model Type (2020-2032)

13.2.9.3. Market Revenue and Forecast, by Product Type (2020-2032)

13.2.10. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.2.11. Market Revenue and Forecast, by End Use (2020-2032)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Provider (2020-2032)

13.2.12.2. Market Revenue and Forecast, by Model Type (2020-2032)

13.2.12.3. Market Revenue and Forecast, by Product Type (2020-2032)

13.2.12.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.2.13. Market Revenue and Forecast, by End Use (2020-2032)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Provider (2020-2032)

13.2.14.2. Market Revenue and Forecast, by Model Type (2020-2032)

13.2.14.3. Market Revenue and Forecast, by Product Type (2020-2032)

13.2.14.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.2.15. Market Revenue and Forecast, by End Use (2020-2032)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Provider (2020-2032)

13.3.2. Market Revenue and Forecast, by Model Type (2020-2032)

13.3.3. Market Revenue and Forecast, by Product Type (2020-2032)

13.3.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.3.5. Market Revenue and Forecast, by End Use (2020-2032)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Provider (2020-2032)

13.3.6.2. Market Revenue and Forecast, by Model Type (2020-2032)

13.3.6.3. Market Revenue and Forecast, by Product Type (2020-2032)

13.3.6.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.3.7. Market Revenue and Forecast, by End Use (2020-2032)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Provider (2020-2032)

13.3.8.2. Market Revenue and Forecast, by Model Type (2020-2032)

13.3.8.3. Market Revenue and Forecast, by Product Type (2020-2032)

13.3.8.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.3.9. Market Revenue and Forecast, by End Use (2020-2032)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Provider (2020-2032)

13.3.10.2. Market Revenue and Forecast, by Model Type (2020-2032)

13.3.10.3. Market Revenue and Forecast, by Product Type (2020-2032)

13.3.10.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.3.10.5. Market Revenue and Forecast, by End Use (2020-2032)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Provider (2020-2032)

13.3.11.2. Market Revenue and Forecast, by Model Type (2020-2032)

13.3.11.3. Market Revenue and Forecast, by Product Type (2020-2032)

13.3.11.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.3.11.5. Market Revenue and Forecast, by End Use (2020-2032)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Provider (2020-2032)

13.4.2. Market Revenue and Forecast, by Model Type (2020-2032)

13.4.3. Market Revenue and Forecast, by Product Type (2020-2032)

13.4.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.4.5. Market Revenue and Forecast, by End Use (2020-2032)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Provider (2020-2032)

13.4.6.2. Market Revenue and Forecast, by Model Type (2020-2032)

13.4.6.3. Market Revenue and Forecast, by Product Type (2020-2032)

13.4.6.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.4.7. Market Revenue and Forecast, by End Use (2020-2032)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Provider (2020-2032)

13.4.8.2. Market Revenue and Forecast, by Model Type (2020-2032)

13.4.8.3. Market Revenue and Forecast, by Product Type (2020-2032)

13.4.8.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.4.9. Market Revenue and Forecast, by End Use (2020-2032)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Provider (2020-2032)

13.4.10.2. Market Revenue and Forecast, by Model Type (2020-2032)

13.4.10.3. Market Revenue and Forecast, by Product Type (2020-2032)

13.4.10.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.4.10.5. Market Revenue and Forecast, by End Use (2020-2032)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Provider (2020-2032)

13.4.11.2. Market Revenue and Forecast, by Model Type (2020-2032)

13.4.11.3. Market Revenue and Forecast, by Product Type (2020-2032)

13.4.11.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.4.11.5. Market Revenue and Forecast, by End Use (2020-2032)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Provider (2020-2032)

13.5.2. Market Revenue and Forecast, by Model Type (2020-2032)

13.5.3. Market Revenue and Forecast, by Product Type (2020-2032)

13.5.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.5.5. Market Revenue and Forecast, by End Use (2020-2032)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Provider (2020-2032)

13.5.6.2. Market Revenue and Forecast, by Model Type (2020-2032)

13.5.6.3. Market Revenue and Forecast, by Product Type (2020-2032)

13.5.6.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.5.7. Market Revenue and Forecast, by End Use (2020-2032)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Provider (2020-2032)

13.5.8.2. Market Revenue and Forecast, by Model Type (2020-2032)

13.5.8.3. Market Revenue and Forecast, by Product Type (2020-2032)

13.5.8.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.5.8.5. Market Revenue and Forecast, by End Use (2020-2032)

Chapter 14. Company Profiles

14.1. The Hollard Insurance Company

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. afpgen.com.ph

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. American International Group, Inc.

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Bharti AXA Life Insurance Company Ltd.

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. SBI Life Insurance Company Ltd.

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. ICICI Prudential Life Insurance Co. Ltd.

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Banco do Nordeste Brasil S.A.

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Climbs

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Allianz SE

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Bajaj Allianz Life Insurance Co. Ltd.

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others