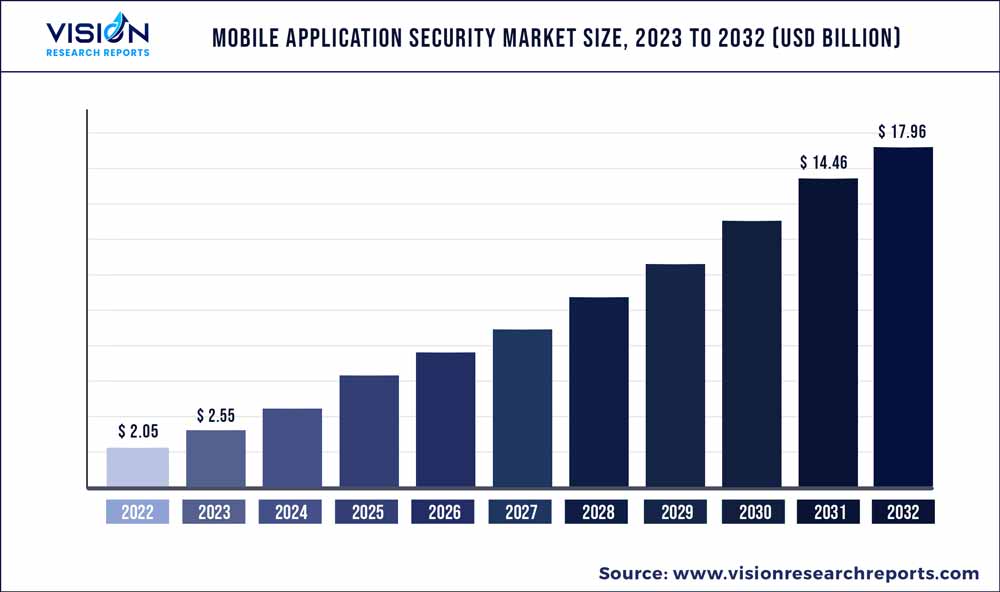

The global mobile application security market was estimated at USD 2.05 billion in 2022 and it is expected to surpass around USD 17.96 billion by 2032, poised to grow at a CAGR of 24.24% from 2023 to 2032. The mobile application security market in the United States was accounted for USD 119.2 million in 2022.

Key Pointers

Report Scope of the Mobile Application Security Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 38% |

| CAGR of Asia Pacific from 2023 to 2032 | 27.04% |

| Revenue Forecast by 2032 | USD 17.96 billion |

| Growth Rate from 2023 to 2032 | CAGR of 24.24% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Google; NowSecure; VMware; Ivanti; Sophos; Cisco Systems; Broadcom, Inc.; Micro Focus; Indusface; Data Theorem; Onapsis; Aeries Technology; F5, Inc.; Veracode; Acunetix |

Mobile applications are becoming an integral part of the day-to-day activities of businesses and companies. With the occurrence of the COVID-19 pandemic, employees are actively using mobile devices to share information and data over various applications developed to enable smooth remote working among them.

However, switching to mobile devices and remote work applications has brought new challenges for businesses, as cybercriminals are actively targeting these applications to compromise critical organizational information. Thus, the demand for robust mobile security applications is growing significantly in the market for mobile application security.

There has been a surge in mobile application users for e-commerce, banking, gaming, and other purposes. Furthermore, as the average spending time of customers is growing significantly for mobile applications, the need to ensure their safety and security is becoming an essential factor for key global app developers and service providers. For instance, in December 2022, Google announced the expansion of its earlier launched App Defense Alliance in 2019.

The development is intended to safeguard Android users from bad applications, along with coordinating with other key application providers to detect potential threats. In the recent addition, the company expanded its collaboration with key leaders in the industry, including mobile application security assessment, malware mitigation, and cloud application security assessment, to protect application users by eliminating threats and enhancing the quality of applications across the ecosystem.

Mobile app security deals with securing Android and iOS applications from threats and cyber criminals, and it helps detect vulnerabilities within the applications. Comprehensive mobile application security combines various tools and features to enhance the safety and security of such applications. With mobile application security, customers can get quick, easy resolutions against potential cyber threats such as malware, bugs, and ransomware. These applications are developed by following strict regulatory compliances. Such factors are poised to drive the market for mobile application security.

The rising internet penetration and significant government initiatives towards digitization are making mobile devices a center of everyone’s day-to-day working life. For instance, in March 2022, the Government of India announced a three-month-long Digital Payment Utsav to boost the adoption of digital transactions in the country. Major stakeholders, including payment service providers, banking institutes, and local and state governments, participated in the event.

Such strategic initiatives are expected to encourage the flow of digital payments, and their applications, in e-commerce and other related industries. Thus, ensuring the safety of these applications is becoming a critical factor; therefore, the demand for security applications for mobile devices is expected to open several growth opportunities in the market for mobile application security.

With the growing demand for online availability of healthcare, retail, consumer goods, and other product and service offerings, key companies developing technological solutions are partnering with leading application security providers. For instance, in February 2023, Indusface, a notable application security as a service provider, partnered with Redington Limited, which deals in providing technological solutions.

The aim of the partnership is to offer comprehensive application security solutions, including website application scanning, cloud-enabled web application firewall, bot and distributed denial-of-service mitigation, threat intelligence engine, etc. Allowed customers can get access to advanced security features designed to safeguard applications. Such developments are expected to support the mobile application security market growth.

Solution Insights

The software segment accounted for the largest market share of 64% in 2022. Mobile application software is expected to gain significant momentum as key operators are involved in taking strategic decisions to enhance their security offerings in this segment. For instance, in September 2022, Nokia announced the strengthening of its software portfolio across the security and automation areas. Furthermore, the company has introduced the IGNITE Digital Ecosystem to bring application partners and customers together to accelerate the innovation of security, monetization, and automation solutions.

The services segment is anticipated to expand at a CAGR of 25.12% during the forecast period. Mobile application security, as a service, is gaining popularity among organizations, depending upon third-party application security as a service. For instance, in November 2022, Data Theorem, Inc., an application security provider, announced a strategic partnership with AppOmni, a SaaS security company.

Thus, organizations developing their own applications while depending on third-party and first-party SaaS and APIs can get access to unified application security posture management offerings. It is designed to provide centralized visibility, data access management, and advanced security controls that can be seamlessly integrated across the

SaaS environment.

Services Insights

The professional services segment accounted for a market share of 57% in 2022. Mobile applications are gaining traction in this segment, as application developers and service providers, in order to ensure customer safety and counter protentional threats, approach key mobile application security providers.

For instance, Wipro, a technology & consulting company, announced a collaboration with Onapsis, a provider of business application cybersecurity and compliance, in January 2023, with the aim to eliminate the risk of cyber threats, ensuring business growth, along with maintaining a smooth digital transformation journey for organizations.

The managed services segment is expected to advance at a substantial growth rate of 24.55% during the forecast period. Ensuring the safety and security of applications, during and after their launch, is becoming a critical factor. Furthermore, the growing initiatives being witnessed in this segment are expected to drive the market demand.

For instance, in April 2023, Aeries Technology, a professional services and consulting partner for organizations, announced the launch of its cyber security managed services offering, which provides organizations with access to industry-leading cyber security services, including application security services. Such initiatives are expected to drive the segment demand for the mobile application security market over the forecast period.

Professional Services Insights

The consulting segment accounted for a market share of 38% in 2022. The constant rise in the usage of mobile applications amid the higher adoption of smartphones and tablets is creating a unique set of challenges for organizations, which needs to be addressed in a defined way by identifying security, privacy, and compliance risks, from the application development to the deployment stages. Mobile application security offers consulting support by utilizing extensive knowledge, skill, and experience to understand the issues and offer customized solutions for ensuring security.

The support and maintenance services segment is anticipated to expand at a CAGR of 27.22% during the forecast period. Mobile application support and maintenance offers help to ensure the functionality and capabilities of these applications to ensure that the security features are upgraded as per the latest cybersecurity trends, compliances, and regulations followed by the industry. Thus, the demand for mobile application security support and maintenance services is expected to experience a healthy growth in the market.

Deployment Insights

The cloud-based segment accounted for a market share of 56% in 2022. Cloud-based mobile application security is gaining momentum, as it allows app developers to leverage these security applications based on their requirements and time. For instance, in March 2022, Promon partnered with F5, inc. Both these companies are involved in providing application security solutions and services.

The companies undertook this partnership to offer a fast and easy implementation of the latter’s Distributed Cloud Bot Defense, developed for mobile applications, which can be accessed through Promon’s hassle-free, no-code, software development kit integration platform. It allows application developers to secure their Android and iOS apps without touching the existing code. Once the app is secured, it can be distributed across public app stores.

The on-premise segment is anticipated to witness a growth rate of 22.35% during the forecast period. On-premise mobile application security offers complete control to the organization for ensuring the security of applications from malware and cyber threats. Along with this, it offers both specific and custom solutions to developers and application users to create a healthy ecosystem for app users.

The rising demand for remote work practices and the expanding acceptance of hybrid work culture has led to the sharing of data in a large volume across a series of unsecured applications. Thus, the on-premise mobile application security ensures the safety and security of applications used by the organization and its employees.

Enterprise Size Insights

The large enterprise segment accounted for the higher market share of 53% in 2022. The incidences of cyber threats, ransomware attacks, and hacking are becoming an increasingly common phenomenon in large organizations. They are constantly involved in countering these growing cyber threats across applications, which can otherwise lead to loss of customers, data, and revenue. Thus, to cater to the growing cases of cyberattacks on applications, the demand for mobile application security in large enterprises is expected to increase substantially.

The SMEs segment is expected to expand at the highest CAGR of 24.94% during the forecast period. The growing cyber-attacks on applications, limited availability of skilled employees in small organizations, and the heavy IT expenditure required to tackle the growing mobile application security breaches are factors expected to drive the demand for mobile application security software and services.

Mobile application security serves as a flexible alternative for small organizations having limited resources and budgets for handling these cyber security challenges. Thus, the above-mentioned factors are expected to drive the market demand in the small- and medium-sized enterprises segment during the forecast period.

Vertical Insights

The IT and telecom segment accounted for the largest market share of 21% in 2022. IT and telecom are among the key sectors gaining momentum and thus are constantly driving the demand for mobile application security. The sector is among the key industries that are constantly engaged in developing and accessing mobile applications for everyday tasks and client handling.

Thus, they are one of the high-target verticals facing cyberattacks. The demand for robust application security is constantly rising in this industry, owing to the rapidly increasing user base of smartphones, rising internet penetration, and the ever-expanding e-commerce footprint. Therefore, the demand for high-end mobile application security is expected to drive market growth in this segment.

The retail segment is anticipated to expand at the highest CAGR of 28.13% during the forecast period. The constantly evolving consumer base in the retail industry, along with the constant launch of mobile applications to supplement the growing trend of online buying, is leading to the rising usage of mobile applications in this segment.

Furthermore, retail businesses constantly experience higher footfall as compared to other industries, as they hold a large customer base; therefore, ensuring the safety of this application becomes a critical factor for organizations to offer a better customer experience. Thus, the demand for mobile application security solutions in retail is expected to witness lucrative growth in the coming years.

Regional Insights

North America held the major revenue share of 38% of the target market in 2022. In North America, the market for mobile application security is expected to witness positive traction owing to the surging demand for smartphones, higher internet penetration, the constantly evolving e-commerce space, and hybrid work policies.

Furthermore, the region is defined by the presence of key industry players, including IBM Corporation, Microsoft Corporation, Google, and VMware Inc. These companies have a range of mobile application security offerings such as threat intelligence, routine application update, monitoring, application management, and security assessment, which is expected to open several growth opportunities in the North American market.

Asia Pacific is anticipated to emerge as the fastest-developing regional market at a CAGR of 27.04% during the forecast period. This is on account of the rapid adoption of mobile phones, growing government initiatives, the rapid rollout of 5G technology, and the large customer base of e-commerce, gaming, and social media in the region. These applications are constantly exposed to cyber threats as they share high traffic, customer data, and critical user information.

To safeguard the users from these growing threats, application developers and service providers are constantly making strategic decisions by investing and partnering with leading mobile application security providers in the region. Thus, the aforementioned factors are expected to drive the market demand for mobile application security in the Asia Pacific region.

Mobile Application Security Market Segmentations:

By Solution

By Services

By Professional Services

By Deployment

By Enterprise Size

By Vertical

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Vertical Procurement Analysis

4.3.2. Sales and Distribution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Mobile Application Security Market

5.1. COVID-19 Landscape: Mobile Application Security Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Mobile Application Security Market, By Solution

8.1. Mobile Application Security Market, by Solution, 2023-2032

8.1.1. Software

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Mobile Application Security Market, By Services

9.1. Mobile Application Security Market, by Services, 2023-2032

9.1.1. Managed Services

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Professional Services

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Mobile Application Security Market, By Professional Services

10.1. Mobile Application Security Market, by Professional Services, 2023-2032

10.1.1. Consulting

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Integration

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Support and Maintenance

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Mobile Application Security Market, By Deployment

11.1. Mobile Application Security Market, by Deployment, 2023-2032

11.1.1. Cloud

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. On-premise

11.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Mobile Application Security Market, By Enterprise Size

12.1. Mobile Application Security Market, by Enterprise Size, 2023-2032

12.1.1. Small and medium-sized enterprises

12.1.1.1. Market Revenue and Forecast (2020-2032)

12.1.2. Large enterprises

12.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 13. Global Mobile Application Security Market, By Vertical

13.1. Mobile Application Security Market, by Vertical, 2023-2032

13.1.1. BFSI

13.1.1.1. Market Revenue and Forecast (2020-2032)

13.1.2. Telecom and IT

13.1.2.1. Market Revenue and Forecast (2020-2032)

13.1.3. Retail

13.1.3.1. Market Revenue and Forecast (2020-2032)

13.1.4. Healthcare

13.1.4.1. Market Revenue and Forecast (2020-2032)

13.1.5. Education

13.1.5.1. Market Revenue and Forecast (2020-2032)

13.1.6. Transportation and Logistics

13.1.6.1. Market Revenue and Forecast (2020-2032)

13.1.7. Manufacturing

13.1.7.1. Market Revenue and Forecast (2020-2032)

13.1.8. Government

13.1.8.1. Market Revenue and Forecast (2020-2032)

13.1.9. Others

13.1.9.1. Market Revenue and Forecast (2020-2032)

Chapter 14. Global Mobile Application Security Market, Regional Estimates and Trend Forecast

14.1. North America

14.1.1. Market Revenue and Forecast, by Solution (2020-2032)

14.1.2. Market Revenue and Forecast, by Services (2020-2032)

14.1.3. Market Revenue and Forecast, by Professional Services (2020-2032)

14.1.4. Market Revenue and Forecast, by Deployment (2020-2032)

14.1.5. Market Revenue and Forecast, by Enterprise Size (2020-2032)

14.1.6. Market Revenue and Forecast, by Vertical (2020-2032)

14.1.7. U.S.

14.1.7.1. Market Revenue and Forecast, by Solution (2020-2032)

14.1.7.2. Market Revenue and Forecast, by Services (2020-2032)

14.1.7.3. Market Revenue and Forecast, by Professional Services (2020-2032)

14.1.7.4. Market Revenue and Forecast, by Deployment (2020-2032)

14.1.8. Market Revenue and Forecast, by Enterprise Size (2020-2032)

14.1.8.1. Market Revenue and Forecast, by Vertical (2020-2032)

14.1.9. Rest of North America

14.1.9.1. Market Revenue and Forecast, by Solution (2020-2032)

14.1.9.2. Market Revenue and Forecast, by Services (2020-2032)

14.1.9.3. Market Revenue and Forecast, by Professional Services (2020-2032)

14.1.9.4. Market Revenue and Forecast, by Deployment (2020-2032)

14.1.10. Market Revenue and Forecast, by Enterprise Size (2020-2032)

14.1.11. Market Revenue and Forecast, by Vertical (2020-2032)

14.1.11.1.

14.2. Europe

14.2.1. Market Revenue and Forecast, by Solution (2020-2032)

14.2.2. Market Revenue and Forecast, by Services (2020-2032)

14.2.3. Market Revenue and Forecast, by Professional Services (2020-2032)

14.2.4. Market Revenue and Forecast, by Deployment (2020-2032)

14.2.5. Market Revenue and Forecast, by Enterprise Size (2020-2032)

14.2.6. Market Revenue and Forecast, by Vertical (2020-2032)

14.2.7.

14.2.8. UK

14.2.8.1. Market Revenue and Forecast, by Solution (2020-2032)

14.2.8.2. Market Revenue and Forecast, by Services (2020-2032)

14.2.8.3. Market Revenue and Forecast, by Professional Services (2020-2032)

14.2.9. Market Revenue and Forecast, by Deployment (2020-2032)

14.2.10. Market Revenue and Forecast, by Enterprise Size (2020-2032)

14.2.10.1. Market Revenue and Forecast, by Vertical (2020-2032)

14.2.11. Germany

14.2.11.1. Market Revenue and Forecast, by Solution (2020-2032)

14.2.11.2. Market Revenue and Forecast, by Services (2020-2032)

14.2.11.3. Market Revenue and Forecast, by Professional Services (2020-2032)

14.2.12. Market Revenue and Forecast, by Deployment (2020-2032)

14.2.13. Market Revenue and Forecast, by Enterprise Size (2020-2032)

14.2.14. Market Revenue and Forecast, by Vertical (2020-2032)

14.2.14.1.

14.2.15. France

14.2.15.1. Market Revenue and Forecast, by Solution (2020-2032)

14.2.15.2. Market Revenue and Forecast, by Services (2020-2032)

14.2.15.3. Market Revenue and Forecast, by Professional Services (2020-2032)

14.2.15.4. Market Revenue and Forecast, by Deployment (2020-2032)

14.2.16. Market Revenue and Forecast, by Enterprise Size (2020-2032)

14.2.16.1. Market Revenue and Forecast, by Vertical (2020-2032)

14.2.17. Rest of Europe

14.2.17.1. Market Revenue and Forecast, by Solution (2020-2032)

14.2.17.2. Market Revenue and Forecast, by Services (2020-2032)

14.2.17.3. Market Revenue and Forecast, by Professional Services (2020-2032)

14.2.17.4. Market Revenue and Forecast, by Deployment (2020-2032)

14.2.18. Market Revenue and Forecast, by Enterprise Size (2020-2032)

14.2.18.1. Market Revenue and Forecast, by Vertical (2020-2032)

14.3. APAC

14.3.1. Market Revenue and Forecast, by Solution (2020-2032)

14.3.2. Market Revenue and Forecast, by Services (2020-2032)

14.3.3. Market Revenue and Forecast, by Professional Services (2020-2032)

14.3.4. Market Revenue and Forecast, by Deployment (2020-2032)

14.3.5. Market Revenue and Forecast, by Enterprise Size (2020-2032)

14.3.6. Market Revenue and Forecast, by Vertical (2020-2032)

14.3.7. India

14.3.7.1. Market Revenue and Forecast, by Solution (2020-2032)

14.3.7.2. Market Revenue and Forecast, by Services (2020-2032)

14.3.7.3. Market Revenue and Forecast, by Professional Services (2020-2032)

14.3.7.4. Market Revenue and Forecast, by Deployment (2020-2032)

14.3.8. Market Revenue and Forecast, by Enterprise Size (2020-2032)

14.3.9. Market Revenue and Forecast, by Vertical (2020-2032)

14.3.10. China

14.3.10.1. Market Revenue and Forecast, by Solution (2020-2032)

14.3.10.2. Market Revenue and Forecast, by Services (2020-2032)

14.3.10.3. Market Revenue and Forecast, by Professional Services (2020-2032)

14.3.10.4. Market Revenue and Forecast, by Deployment (2020-2032)

14.3.11. Market Revenue and Forecast, by Enterprise Size (2020-2032)

14.3.11.1. Market Revenue and Forecast, by Vertical (2020-2032)

14.3.12. Japan

14.3.12.1. Market Revenue and Forecast, by Solution (2020-2032)

14.3.12.2. Market Revenue and Forecast, by Services (2020-2032)

14.3.12.3. Market Revenue and Forecast, by Professional Services (2020-2032)

14.3.12.4. Market Revenue and Forecast, by Deployment (2020-2032)

14.3.12.5. Market Revenue and Forecast, by Enterprise Size (2020-2032)

14.3.12.6. Market Revenue and Forecast, by Vertical (2020-2032)

14.3.13. Rest of APAC

14.3.13.1. Market Revenue and Forecast, by Solution (2020-2032)

14.3.13.2. Market Revenue and Forecast, by Services (2020-2032)

14.3.13.3. Market Revenue and Forecast, by Professional Services (2020-2032)

14.3.13.4. Market Revenue and Forecast, by Deployment (2020-2032)

14.3.13.5. Market Revenue and Forecast, by Enterprise Size (2020-2032)

14.3.13.6. Market Revenue and Forecast, by Vertical (2020-2032)

14.4. MEA

14.4.1. Market Revenue and Forecast, by Solution (2020-2032)

14.4.2. Market Revenue and Forecast, by Services (2020-2032)

14.4.3. Market Revenue and Forecast, by Professional Services (2020-2032)

14.4.4. Market Revenue and Forecast, by Deployment (2020-2032)

14.4.5. Market Revenue and Forecast, by Enterprise Size (2020-2032)

14.4.6. Market Revenue and Forecast, by Vertical (2020-2032)

14.4.7. GCC

14.4.7.1. Market Revenue and Forecast, by Solution (2020-2032)

14.4.7.2. Market Revenue and Forecast, by Services (2020-2032)

14.4.7.3. Market Revenue and Forecast, by Professional Services (2020-2032)

14.4.7.4. Market Revenue and Forecast, by Deployment (2020-2032)

14.4.8. Market Revenue and Forecast, by Enterprise Size (2020-2032)

14.4.9. Market Revenue and Forecast, by Vertical (2020-2032)

14.4.10. North Africa

14.4.10.1. Market Revenue and Forecast, by Solution (2020-2032)

14.4.10.2. Market Revenue and Forecast, by Services (2020-2032)

14.4.10.3. Market Revenue and Forecast, by Professional Services (2020-2032)

14.4.10.4. Market Revenue and Forecast, by Deployment (2020-2032)

14.4.11. Market Revenue and Forecast, by Enterprise Size (2020-2032)

14.4.12. Market Revenue and Forecast, by Vertical (2020-2032)

14.4.13. South Africa

14.4.13.1. Market Revenue and Forecast, by Solution (2020-2032)

14.4.13.2. Market Revenue and Forecast, by Services (2020-2032)

14.4.13.3. Market Revenue and Forecast, by Professional Services (2020-2032)

14.4.13.4. Market Revenue and Forecast, by Deployment (2020-2032)

14.4.13.5. Market Revenue and Forecast, by Enterprise Size (2020-2032)

14.4.13.6. Market Revenue and Forecast, by Vertical (2020-2032)

14.4.14. Rest of MEA

14.4.14.1. Market Revenue and Forecast, by Solution (2020-2032)

14.4.14.2. Market Revenue and Forecast, by Services (2020-2032)

14.4.14.3. Market Revenue and Forecast, by Professional Services (2020-2032)

14.4.14.4. Market Revenue and Forecast, by Deployment (2020-2032)

14.4.14.5. Market Revenue and Forecast, by Enterprise Size (2020-2032)

14.4.14.6. Market Revenue and Forecast, by Vertical (2020-2032)

14.5. Latin America

14.5.1. Market Revenue and Forecast, by Solution (2020-2032)

14.5.2. Market Revenue and Forecast, by Services (2020-2032)

14.5.3. Market Revenue and Forecast, by Professional Services (2020-2032)

14.5.4. Market Revenue and Forecast, by Deployment (2020-2032)

14.5.5. Market Revenue and Forecast, by Enterprise Size (2020-2032)

14.5.6. Market Revenue and Forecast, by Vertical (2020-2032)

14.5.7. Brazil

14.5.7.1. Market Revenue and Forecast, by Solution (2020-2032)

14.5.7.2. Market Revenue and Forecast, by Services (2020-2032)

14.5.7.3. Market Revenue and Forecast, by Professional Services (2020-2032)

14.5.7.4. Market Revenue and Forecast, by Deployment (2020-2032)

14.5.8. Market Revenue and Forecast, by Enterprise Size (2020-2032)

14.5.8.1. Market Revenue and Forecast, by Vertical (2020-2032)

14.5.9. Rest of LATAM

14.5.9.1. Market Revenue and Forecast, by Solution (2020-2032)

14.5.9.2. Market Revenue and Forecast, by Services (2020-2032)

14.5.9.3. Market Revenue and Forecast, by Professional Services (2020-2032)

14.5.9.4. Market Revenue and Forecast, by Deployment (2020-2032)

14.5.9.5. Market Revenue and Forecast, by Enterprise Size (2020-2032)

14.5.9.6. Market Revenue and Forecast, by Vertical (2020-2032)

Chapter 15. Company Profiles

15.1. Google

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. NowSecure

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. VMware

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. Ivanti

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. Sophos

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. Abbott

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. Broadcom, Inc.

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. Micro Focus

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. Indusface

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. Data Theorem

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others