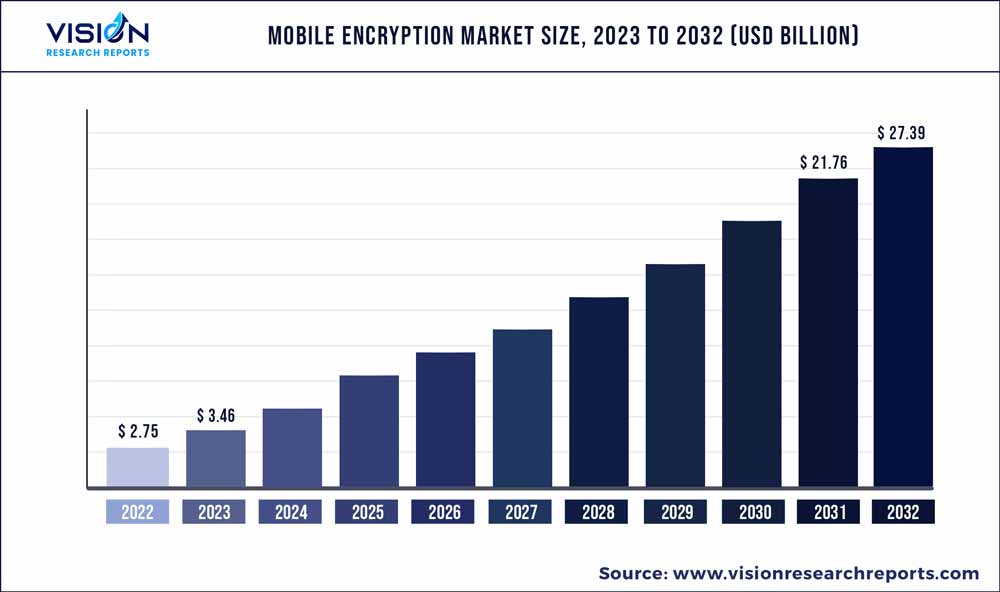

The global mobile encryption market was surpassed at USD 2.75 billion in 2022 and is expected to hit around USD 27.39 billion by 2032, growing at a CAGR of 25.84% from 2023 to 2032. The mobile encryption market in the United States was accounted for USD 786.8 million in 2022.

Key Pointers

Report Scope of the Mobile Encryption Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 37% |

| CAGR of Asia Pacific from 2023 to 2032 | 28.13% |

| Revenue Forecast by 2032 | USD 27.39 billion |

| Growth Rate from 2023 to 2032 | CAGR of 25.84% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | BlackBerry; Symantec; McAfee; IBM; Thales Group; Cisco Systems; Microsoft; Silent Circle; Lookout; Cellebrite; Kaspersky Lab; Sophos; MobileIron; Zimperium; Wickr |

Mobile encryption involves the use of encryption technologies to protect data on mobile devices, such as smartphones and tablets. Mobile encryption is essential for safeguarding sensitive information, such as financial data, personal information, and confidential business data, from unauthorized access and cyber threats. The market is driven by several factors, including the increasing use of mobile devices for personal and business purposes, the rising incidence of cyber threats and data breaches, and the growing adoption of mobile encryption solutions by government organizations and businesses.

Growing concern for data security is one of the key drivers of the market. The increasing number of high-profile data breaches and cyber-attacks in recent years has led to a growing awareness of the importance of data security, especially on mobile devices that are increasingly used for personal and business purposes. Mobile devices, such as smartphones and tablets, often contain sensitive information, such as personal and financial data, that can be compromised if the device falls into the wrong hands. In addition to concerns about personal data security, many industries, such as healthcare and finance, are subject to strict data protection laws and regulations. Mobile encryption is often mandated to ensure compliance with these regulations.

Additionally, with the increasing popularity of mobile payment services such as Apple Pay, Google Pay, and Samsung Pay, consumers are using their mobile devices to conduct financial transactions more frequently. These transactions often involve the transmission of sensitive financial data, such as credit card numbers and other personal information. Mobile encryption is essential to protect this sensitive financial information during these transactions. Encryption ensures that the data is secure and unreadable if it falls into the wrong hands. This is important for both consumers and merchants who need to protect their financial information from unauthorized access and potential fraud. Moreover, many countries have regulations and standards that mandate the use of encryption for mobile payments. For instance, the Payment Card Industry Data Security Standard (PCI DSS) requires that payment transactions be encrypted to protect sensitive data.

Moreover, increased adoption of encryption technologies is one of the growing trends in the mobile encryption industry. Encryption is a critical tool for protecting sensitive data on mobile devices, and as the number of cyber threats continues to rise, more individuals and organizations are recognizing the need to implement encryption solutions to secure their data. The adoption of encryption technologies is expected to continue to grow as more people become aware of the importance of data privacy and security, and as new regulations are implemented to mandate the use of encryption for sensitive data.

However, one of the major restraints of the mobile encryption market is the potential for compatibility issues with other software or systems. Mobile encryption solutions need to be compatible with the various devices, platforms, and software that people use, which can be a challenge. Additionally, some users may find encryption solutions too complex or time-consuming to use, which could limit adoption rates. Also, the cost of implementing encryption solutions can be a significant barrier to adoption for some individuals and organizations. Encryption solutions can be expensive to develop and implement, which could limit the availability of these solutions to smaller businesses or individuals who may not have the financial resources to invest in them.

Solution Insights

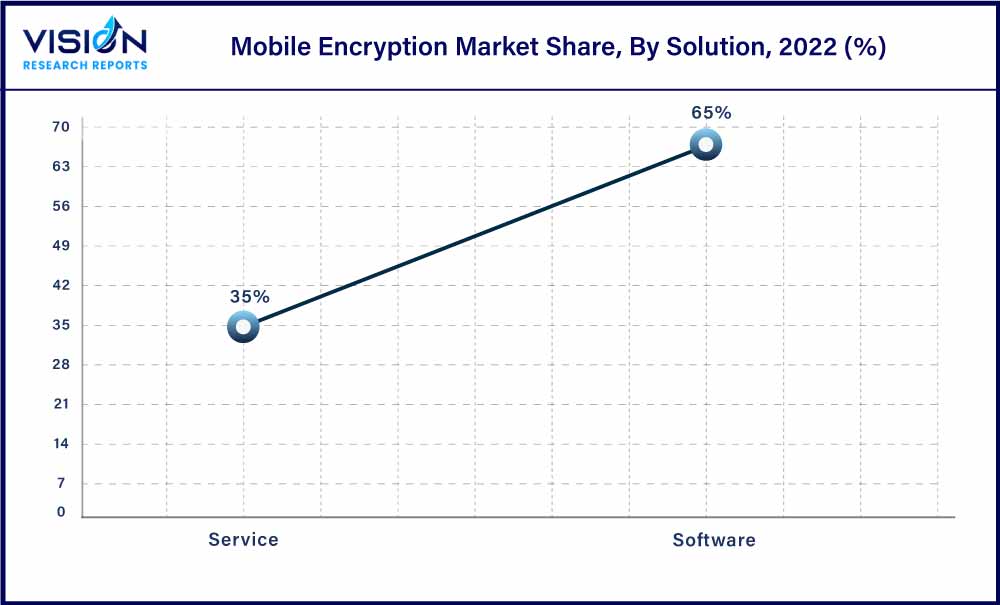

The software segment accounted for the largest market share of 65% in 2022. Mobile encryption software provides a range of security features, such as data encryption, remote wipe, secure storage, password protection, anti-phishing protection, and two-factor authentication, to protect sensitive data stored on mobile devices. With the increasing use of mobile devices for personal and business purposes, it is important to ensure that confidential information such as financial data, medical records, and Personal Identification Numbers (PINs) are kept secure. The benefits of mobile encryption software include safeguarding against data breaches and cyberattacks, protecting user privacy, meeting regulatory compliance requirements, and reducing the risk of identity theft. Additionally, encryption software can help ensure that sensitive information is only accessed by authorized individuals.

The service segment is anticipated to expand at a CAGR of 26.73% during the forecast period. Mobile encryption services offer a comprehensive solution for managing and securing mobile devices used for work-related activities. These services are designed to enable organizations to increase productivity, enhance security, and ensure compliance while providing employees with the flexibility and convenience of using their mobile devices for work.

Deployment Insights

The cloud-based segment accounted for a market share of 56% in 2022. One of the key benefits of cloud-based mobile encryption software solutions is that they provide a high level of security for data stored on mobile devices. This is particularly important for businesses and organizations that handle sensitive information such as financial data, customer information, and intellectual property. By encrypting this data, cloud-based mobile encryption software solutions can help prevent unauthorized access and theft. Additionally, cloud-based solutions are often easy to use and can be quickly deployed. Many of these solutions are designed to integrate seamlessly with existing IT infrastructure, making it easy to implement and manage encryption policies across multiple devices and platforms. Moreover, these solutions can also help businesses and organizations comply with data protection regulations such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA). By encrypting sensitive data stored on mobile devices and in the cloud, organizations can reduce the risk of data breaches and ensure compliance with these regulations.

On-premise segment is anticipated to expand at a CAGR of 21.62% during the forecast period. On-premise mobile encryption solutions are a type of software that is installed on local servers or devices rather than being hosted on a cloud-based platform. These solutions are designed to provide similar levels of security as cloud-based solutions, but with the added benefit of having complete control over the encryption process. They can also provide organizations with more flexibility and scalability compared to cloud-based solutions. Because these solutions are installed locally, they can be customized to meet specific security requirements and can be easily scaled to accommodate growth or changes in security needs.

Application Insights

Disk encryption segment accounted for a market share of 31% in 2022. Disk encryption is being increasingly used owing to its offered benefits. One of the key benefits of disk encryption solutions is that they provide a high level of security for sensitive data stored on mobile devices. This is particularly important for businesses and organizations that handle confidential information such as financial data, customer information, and intellectual property. By encrypting this data, disk mobile encryption solutions can help prevent unauthorized access and theft. Also, these solutions can be easily deployed and are designed to work seamlessly with existing operating systems and applications, making it easy to implement and manage encryption policies across multiple devices and platforms. Thus, the increasing use of disk encryption solutions is positively impacting the market growth.

File/Folder encryption segment is anticipated to expand at a CAGR of 26.85% during the forecast period. The increasing adoption of file/folder mobile encryption solutions has been driven by several factors, including the rise of remote work, the growing number of mobile devices used for work purposes, and the increasing number of high-profile data breaches. As a result, it is likely that the use of file/folder mobile encryption solutions will continue to grow in the coming years as businesses and individuals seek to protect their sensitive data from unauthorized access and theft.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share of 54% in 2022. Many large enterprises are using mobile encryption solutions to protect sensitive data stored on their employees' mobile devices. These solutions are particularly important for organizations that handle large amounts of confidential information, such as financial institutions, healthcare providers, and government agencies. A few of the large enterprises using mobile encryption solutions include Bank of America, Pfizer, NASA, Coca-Cola, and the U.S. Department of Defense among others. As the use of mobile devices continues to grow in the workplace, it is likely that more and more organizations will adopt mobile encryption solutions to ensure the security of their confidential information. Thus, this will further boost the market growth in the coming years.

SMEs segment is expected to expand at the highest CAGR of 26.53% during the forecast period. SMEs are increasingly using mobile encryption solutions to protect their sensitive data on employees' mobile devices. SMEs often have limited resources and may not have the same level of cybersecurity expertise as larger enterprises, making them more vulnerable to cyber-attacks. Mobile encryption solutions can provide an additional layer of security and help SMEs protect their data against unauthorized access. A few of the SMEs using mobile encryption solutions include small law firms, medical practices, and financial services firms, among others. Moreover, mobile encryption solutions can provide an affordable and easy-to-use solution for SMEs that may not have the same level of resources or expertise as larger enterprises.

Vertical Insights

IT and telecom segment accounted for the largest market share of 21% in 2022. The IT and telecom industry is one of the largest contributors to the mobile encryption market. The IT and Telecom industry uses mobile encryption solutions to protect their customers' data, such as personal information, credit card details, and transaction information. These solutions also help protect intellectual property, trade secrets, and other sensitive business information. In addition, mobile encryption solutions provide a secure communication channel for employees, which is essential for remote workers and teams working across different locations. As the use of mobile devices for business purposes continues to grow, the demand for mobile encryption solutions is expected to increase, and the IT and Telecom industry will continue to be a significant user of these solutions.

Retail segment is anticipated to expand at a CAGR of 30.13% during the forecast period. The retail industry is a significant user of mobile encryption solutions. As the retail industry continues to adopt mobile payment systems and e-commerce platforms, the demand for mobile encryption solutions has increased. Mobile encryption solutions provide end-to-end encryption of data on mobile devices, making it difficult for unauthorized users to access sensitive information. In the retail industry, this includes credit card information and customer data. By using mobile encryption solutions, retailers can protect their customers' data and ensure their confidentiality and integrity. Thus, the demand for these solutions is expected to continue to grow in the future as the industry continues to adopt new technologies and payment systems.

Regional Insights

North America held the major share of 37% of the target market in 2022. The increasing use of mobile devices for business purposes and the growing concerns over data privacy and security have driven the demand for mobile encryption solutions in North America. The region is the home to several industries that handle sensitive data, such as financial services, healthcare, and government, which have been early adopters of mobile encryption solutions. Also, North America is home to several prominent players in the mobile encryption market, such as IBM Corporation, Symantec Corporation, and BlackBerry Limited.

Asia Pacific is anticipated to grow as the fastest-developing regional market at a CAGR of 28.13% The Asia Pacific mobile encryption market is one of the fastest-growing markets for mobile encryption solutions. The region is home to several emerging economies, such as China, India, and Southeast Asian countries, which are rapidly adopting mobile technologies for business purposes. In addition, the Asia Pacific region has witnessed an increasing number of cyber-attacks in recent years, which has further fueled the demand for mobile encryption solutions. Moreover, the region is witnessing a significant shift towards digital payments, which has further increased the demand for mobile encryption solutions. Mobile encryption solutions help secure digital payments and prevent fraud, which is crucial for the growth of the digital payments industry in the region.

Mobile Encryption Market Segmentations:

By Solution

By Deployment

By Application

By Enterprise Size

By Vertical

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Mobile Encryption Market

5.1. COVID-19 Landscape: Mobile Encryption Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Mobile Encryption Market, By Solution

8.1. Mobile Encryption Market, by Solution, 2023-2032

8.1.1. Software

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Service

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Mobile Encryption Market, By Deployment

9.1. Mobile Encryption Market, by Deployment, 2023-2032

9.1.1. Cloud

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. On-premise

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Mobile Encryption Market, By Application

10.1. Mobile Encryption Market, by Application, 2023-2032

10.1.1. Disk Encryption

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. File/Folder Encryption

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Communication Encryption

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Cloud Encryption

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Mobile Encryption Market, By Enterprise Size

11.1. Mobile Encryption Market, by Enterprise Size, 2023-2032

11.1.1. Small and medium-sized enterprises

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Large enterprises

11.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Mobile Encryption Market, By Vertical

12.1. Mobile Encryption Market, by Vertical, 2023-2032

12.1.1. BFSI

12.1.1.1. Market Revenue and Forecast (2020-2032)

12.1.2. IT and Telecom

12.1.2.1. Market Revenue and Forecast (2020-2032)

12.1.3. Retail

12.1.3.1. Market Revenue and Forecast (2020-2032)

12.1.4. Healthcare

12.1.4.1. Market Revenue and Forecast (2020-2032)

12.1.5. Education

12.1.5.1. Market Revenue and Forecast (2020-2032)

12.1.6. Transportation and Logistics

12.1.6.1. Market Revenue and Forecast (2020-2032)

12.1.7. Manufacturing

12.1.7.1. Market Revenue and Forecast (2020-2032)

12.1.8. Government

12.1.8.1. Market Revenue and Forecast (2020-2032)

12.1.9. Others

12.1.9.1. Market Revenue and Forecast (2020-2032)

Chapter 13. Global Mobile Encryption Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Solution (2020-2032)

13.1.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.1.3. Market Revenue and Forecast, by Application (2020-2032)

13.1.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.1.5. Market Revenue and Forecast, by Vertical (2020-2032)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Solution (2020-2032)

13.1.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.1.6.3. Market Revenue and Forecast, by Application (2020-2032)

13.1.6.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.1.7. Market Revenue and Forecast, by Vertical (2020-2032)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Solution (2020-2032)

13.1.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.1.8.3. Market Revenue and Forecast, by Application (2020-2032)

13.1.8.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.1.8.5. Market Revenue and Forecast, by Vertical (2020-2032)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Solution (2020-2032)

13.2.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.3. Market Revenue and Forecast, by Application (2020-2032)

13.2.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.2.5. Market Revenue and Forecast, by Vertical (2020-2032)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Solution (2020-2032)

13.2.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.6.3. Market Revenue and Forecast, by Application (2020-2032)

13.2.7. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.2.8. Market Revenue and Forecast, by Vertical (2020-2032)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Solution (2020-2032)

13.2.9.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.9.3. Market Revenue and Forecast, by Application (2020-2032)

13.2.10. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.2.11. Market Revenue and Forecast, by Vertical (2020-2032)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Solution (2020-2032)

13.2.12.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.12.3. Market Revenue and Forecast, by Application (2020-2032)

13.2.12.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.2.13. Market Revenue and Forecast, by Vertical (2020-2032)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Solution (2020-2032)

13.2.14.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.14.3. Market Revenue and Forecast, by Application (2020-2032)

13.2.14.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.2.15. Market Revenue and Forecast, by Vertical (2020-2032)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Solution (2020-2032)

13.3.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.3. Market Revenue and Forecast, by Application (2020-2032)

13.3.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.3.5. Market Revenue and Forecast, by Vertical (2020-2032)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Solution (2020-2032)

13.3.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.6.3. Market Revenue and Forecast, by Application (2020-2032)

13.3.6.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.3.7. Market Revenue and Forecast, by Vertical (2020-2032)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Solution (2020-2032)

13.3.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.8.3. Market Revenue and Forecast, by Application (2020-2032)

13.3.8.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.3.9. Market Revenue and Forecast, by Vertical (2020-2032)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Solution (2020-2032)

13.3.10.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.10.3. Market Revenue and Forecast, by Application (2020-2032)

13.3.10.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.3.10.5. Market Revenue and Forecast, by Vertical (2020-2032)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Solution (2020-2032)

13.3.11.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.11.3. Market Revenue and Forecast, by Application (2020-2032)

13.3.11.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.3.11.5. Market Revenue and Forecast, by Vertical (2020-2032)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Solution (2020-2032)

13.4.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.3. Market Revenue and Forecast, by Application (2020-2032)

13.4.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.4.5. Market Revenue and Forecast, by Vertical (2020-2032)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Solution (2020-2032)

13.4.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.6.3. Market Revenue and Forecast, by Application (2020-2032)

13.4.6.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.4.7. Market Revenue and Forecast, by Vertical (2020-2032)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Solution (2020-2032)

13.4.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.8.3. Market Revenue and Forecast, by Application (2020-2032)

13.4.8.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.4.9. Market Revenue and Forecast, by Vertical (2020-2032)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Solution (2020-2032)

13.4.10.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.10.3. Market Revenue and Forecast, by Application (2020-2032)

13.4.10.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.4.10.5. Market Revenue and Forecast, by Vertical (2020-2032)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Solution (2020-2032)

13.4.11.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.11.3. Market Revenue and Forecast, by Application (2020-2032)

13.4.11.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.4.11.5. Market Revenue and Forecast, by Vertical (2020-2032)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Solution (2020-2032)

13.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.5.3. Market Revenue and Forecast, by Application (2020-2032)

13.5.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.5.5. Market Revenue and Forecast, by Vertical (2020-2032)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Solution (2020-2032)

13.5.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.5.6.3. Market Revenue and Forecast, by Application (2020-2032)

13.5.6.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.5.7. Market Revenue and Forecast, by Vertical (2020-2032)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Solution (2020-2032)

13.5.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.5.8.3. Market Revenue and Forecast, by Application (2020-2032)

13.5.8.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.5.8.5. Market Revenue and Forecast, by Vertical (2020-2032)

Chapter 14. Company Profiles

14.1. BlackBerry

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Symantec

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. McAfee

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. IBM

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Thales Group

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Cisco Systems

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Microsoft

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. ilent Circle

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Lookout

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Cellebrite

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others