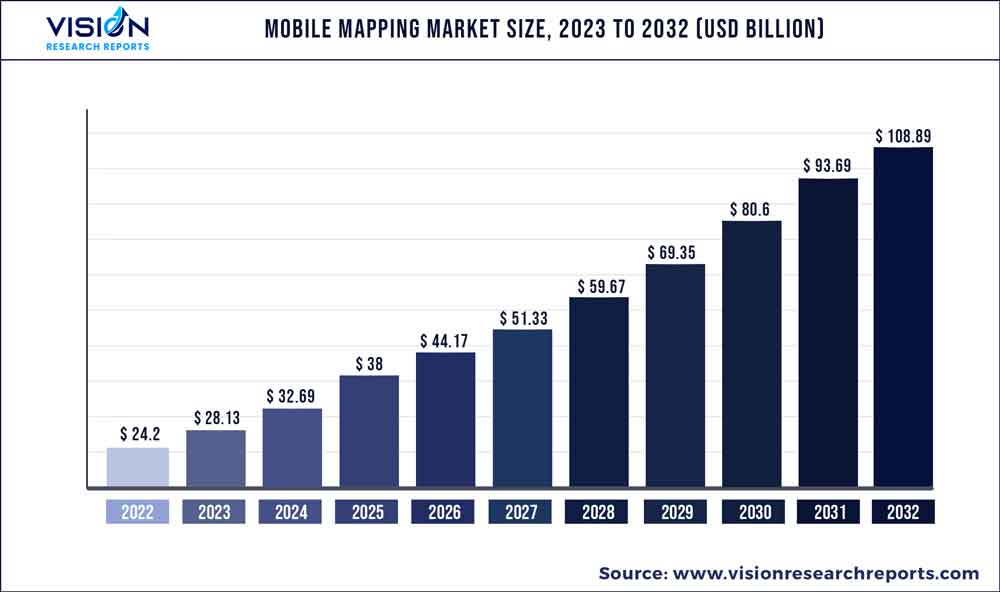

The global mobile mapping market surpassed USD 24.2 billion in 2022 and is expected to reach around USD 108.89 billion by 2032, growing at a CAGR of 16.23% from 2023 to 2032. The mobile mapping market in the United States was accounted for USD 4.7 billion in 2022.

Key Pointers

Report Scope of the Mobile Mapping Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 28.13% |

| CAGR of Asia Pacific | 18.75% |

| Revenue Forecast by 2032 | USD 108.89 billion |

| Growth Rate from 2023 to 2032 | CAGR of 16.23% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Trimble Inc.; Google (Alphabet Inc.); Leica Geosystems AG (Hexagon Geosystems); Topcon; Teledyne Technologies Incorporated; imajing SAS; RIEGL Laser Measurement Systems GmbH; Hi-Target; GreenValley International; and Klau Geomatics Pty Ltd. |

The mobile mapping industry is experiencing growth due to the widespread acceptance of satellite mapping technology, which is now seamlessly integrated into smartphones and other IoT-connected devices. This has created an increased demand for mobile mapping services, as the use of Global Navigation Satellite Systems (GNSS) for tasks such as 3D mapping, environmental monitoring, machinery control, accident investigation, and disaster response continues to rise.

The mobile mapping market is also driving the development of new, automated, and high-speed data collection techniques, enabled by the latest 5G internet technology. Decision-makers in transportation, construction, and urban planning benefit from the valuable insights provided by mobile mapping systems, which inform planning, design, and resource allocation.

A mobile mapping system is a technology that employs various sensors, including GPS, LiDAR, cameras, and Inertial Measurement Units (IMUs), installed on a vehicle or mobile platform, to acquire precise and current geographic data. The gathered data is usually processed and integrated into a digital map or 3D model, providing a comprehensive representation of the mapped area. Compared to traditional surveying methods, mobile mapping systems are often more economical, requiring fewer resources and covering more extensive areas in less time. They offer real-time data, allowing for efficient navigation and location-based services.

To provide even more comprehensive mapping data, mobile mapping systems can be combined with other technologies, such as drones and IoT sensors. They are valuable tools in a variety of industries, and their continued development promises more potential for innovation and progress. Additionally, mobile mapping systems are commonly utilized in agriculture and environmental management to map land use, track crop growth, and monitor environmental changes. This enhances crop yields, reduces waste, and promotes sustainable environmental practices.

Mobile mapping systems offer precise and current geographic data, enabling more effective navigation, location-based services, and infrastructure planning and management. Moreover, they can monitor environmental shifts, such as deforestation or water pollution, and promote sustainable environmental practices. However, anticipated hindrances to the market's growth include concerns regarding privacy and data security, as well as the high cost of implementing mobile mapping solutions. Nevertheless, the integration of mobile mapping with wearable smart devices and the growth of mapping analytics are predicted to present profitable opportunities for the mobile mapping market in the projected period.

The mobile mapping market has been positively impacted by the COVID-19 pandemic, as mobile mapping technology has become increasingly popular for tracking the travel history and locations of infected individuals. Governments have also employed mobile mapping tools to collect demographic data and analyze the virus's spread across different regions. However, the pandemic has caused disruptions in the supply chain and imposed government restrictions that have affected hardware manufacturers. Mobile mapping systems have played a crucial role in enhancing our understanding of the virus's global distribution. Geographic Information Systems (GIS) and geospatial analysis have been vital tools in modeling the virus's spread and subsequent activities like contact tracing, testing, and vaccine distribution. These tools have been able to consider the unique territorial characteristics of various regions.

The market is competitive and is anticipated to witness increased competition due to several players' presence. Major players are spending heavily on research and development activities to integrate advanced technologies in mobile mapping used by several industries, such as manufacturing and mining, telecommunication, energy and utilities, BFSI, retail, and government has intensified the competition among these players. This has intensified the competition among these players. Some of the prominent players in the market include Trimble Inc.; Google (Alphabet Inc.); Leica Geosystems AG (Hexagon Geosystems); and Topcon.

Technology Type Insights

The GNSS technology type segment of this market dominated in 2022, gaining a market share of 48.71%. Global Navigation Satellite System (GNSS) plays a significant role in mobile mapping systems by providing precise location information. In terms of technology type, the market is classified into GNSS, RADAR, and LiDAR. These systems utilize GNSS to determine the position and orientation of the platform, which is typically a vehicle or a handheld device. GNSS technology allows these systems to determine the position of the platform with high accuracy, which is critical for mapping applications. With GNSS, these systems can precisely capture the geographic location of features and assets. This information can then be used to create accurate maps, perform spatial analysis, and support various other applications.

The LiDAR technology type segment is expected to witness the highest growth rate of 17.23% during the forecast period. LiDAR (Light Detection and Ranging) utilizes lasers to measure distances and create precise 3D models of objects and environments. LiDAR has become an important technology in mobile mapping systems because it allows for highly accurate and detailed mapping of the surrounding environment. LiDAR can be used in various mobile mapping applications, including airborne, ground-based, and handheld systems. This allows for flexibility in mapping different types of environments and infrastructure. Moreover, LiDAR is capable of capturing millions of data points per second with sub-centimeter accuracy and precision. This level of accuracy and precision enables these systems to create highly accurate and detailed 3D models of the surrounding environment, including buildings, infrastructure, and natural features.

Mounting Type Insights

The drone-mounted segment dominated the market and accounted for the highest market share of 33.44%. In terms of mounting type, the market is classified into vehicle-mounted, railway-mounted, drone-mounted, and others (handheld, backpacks, and boat-mounted). Drone-mounted cameras and sensors have become an important technology in mobile mapping systems, providing significant advantages over traditional techniques. Drone-mounted cameras are capable of capturing high-resolution imagery, allowing for highly detailed mapping of the environment. This level of detail is not achievable with traditional mapping techniques, such as satellite imagery or ground-based surveys. Drone-mounted mapping systems can be used in various environments, including urban, rural, and remote areas. They can also be deployed quickly and easily, making them a valuable tool for emergency response and disaster management.

The vehicle mounted segment is anticipated to expand at a significant CAGR of 17.12% over the forecast period. A vehicle-mounted mobile mapping system is a sophisticated technology used to collect detailed geospatial data while traveling. It is mounted on a vehicle, such as a car or a truck. It enables data to be captured at high speeds, making it an efficient and cost-effective solution for collecting large amounts of data over long distances. The mounting type primarily includes high-resolution cameras, lidar sensors, and GPS receivers, which work together to capture 3D data of the surrounding environment. This data is further utilized for a variety of applications, including road maintenance and construction, urban planning, and asset management.

Application Insights

The asset management application segment dominated the mobile mapping market and accounted for a market share of 29.14%. In terms of application, the market is classified into asset management, topographic mapping, road surveys, and others (imaging services, satellite, and emergency response planning, and 3d modeling). These systems have significant importance in asset management, which involves managing and maintaining physical assets such as infrastructure, buildings, and equipment. Moreover, these systems can create highly accurate and detailed inventories of physical assets, which is a critical first step in asset management. Accurate asset inventories allow organizations to better understand the condition and location of their assets, enabling more effective maintenance, repair, and replacement planning. These systems can be used to identify potential risks to physical assets, such as geological hazards or environmental threats. This information can be used to develop risk management strategies and prioritize asset protection efforts.

The topographic mapping segment is expected to witness the highest growth rate of 17.57% during the forecast period. These systems have significant importance in topographic mapping, which involves creating detailed maps of the natural and man-made features of the Earth's surface. These systems can capture highly accurate data on the terrain, features, and structures of the landscape. This data can be used to create detailed topographic maps, which are essential for a range of applications, including urban planning, infrastructure design, and natural resource management. Moreover, mobile mapping systems can create highly accurate 3D models of the environment, which can be used for a wide range of applications, including terrain analysis, slope stability, and hydrological modeling.

End-user Insights

The agriculture segment dominated the market and accounted for a market share of 47.41%. The segment is expected to expand at a CAGR of 15.66% throughout the forecast period. In terms of end-user, the market is classified into agriculture, oil and gas, government and public sector, and others (manufacturing and mining, telecommunication, energy and utilities, BFSI, and retail). Mobile mapping systems have significant importance in agriculture, where they are used to map and analyze crops, soil conditions, and other factors that impact crop yields. These systems can create highly detailed maps of soil conditions, moisture levels, and other factors that impact crop growth, providing farmers with a detailed understanding of crop conditions. This data can be used to identify areas of stress or disease, enabling farmers to take corrective action before crop yields are impacted. These systems can provide real-time data on crop yields and identify potential risks to crops, such as weather events or pest outbreaks.

The government and public sector end-user segment is expected to witness the highest growth rate of 19.44% during the forecast period. Mobile mapping systems have significant importance in the government & public sector, where they are used to map and analyze a wide range of infrastructure and public services. These systems can be deployed quickly in emergency situations to provide real-time data on infrastructure damage, hazardous conditions, and other factors that impact response efforts. Additionally, these systems can be used to map and analyze public health and safety data, such as disease outbreaks, crime patterns, and traffic accidents.

Component Insights

The hardware segment dominated the market, gaining a revenue share of 53.81% in 2022 and witnessing a CAGR of 15.46% during the forecast period. By component segment, the mobile mapping market is bifurcated into hardware, software, and services. The hardware segment is further categorized into cameras, sensors, Inertial Measurement Units (IMU), and others (GPS, scanner, mobile phones). These systems are becoming increasingly popular due to their ability to quickly and efficiently collect and analyze accurate and comprehensive mapping data quickly and efficiently. However, the performance and accuracy of these systems depend on the quality of their hardware components. Integrating mobile mapping hardware with other technologies, such as artificial intelligence, the Internet of Things (IoT), and big data analytics, is driving the demand for mobile mapping hardware. This integration enables more advanced data analysis, real-time monitoring, and decision-making, making this hardware more valuable to businesses and organizations.

The software segment is anticipated to witness the fastest CAGR of 17.52% throughout the forecast period. Mobile mapping software offers a range of benefits to businesses and organizations. For instance, increasing adoption of mobile mapping, integration with other technologies, cost-effectiveness, and technological advancements are likely to fuel the growth of the mobile mapping software market in the coming years. For instance, the growing adoption of mobile devices such as tablets & smartphones is driving the demand for software. Mobile mapping software can be easily installed and used on mobile devices, enabling real-time data collection and analysis in the field.

Regional Insights

North America led the overall market in 2022, with a market share of 28.13%. The North America region is equipped with well-developed infrastructure and spends large amounts on extensive research and development base, which makes the region to be the top revenue contributor in this market during the projected period. Moreover, the presence of small and medium players in North America, which offer components and services to the giants such as Trimble Inc., Topcon, and Teledyne Technologies Incorporated have also propelled the market growth. The U.S. is expected to retain its dominance over the forecast period owing to large scale adoption of mobile mapping as they are highly scalable, convenient, cost-effective, and efficient. As the demand for geospatial tools continues to grow, the demand of this market in U.S. is expected to increase in the forecasted period.

Asia Pacific is expected to develop considerably by the projection period and expand at a CAGR of 18.75%. Asia Pacific is poised for the fastest growth as several end-use industries in the region are adopting advanced technologies to rake in a variety of benefits, such as improved scanning efficiency and accurately gather and analyze geospatial data in real-time offered by these systems, thereby driving the adoption of these mapping systems across the Asia Pacific. Market players are acting in response to the present situation by instituting groundbreaking solutions in line with the changing demands of the end-use industries. The growing demand for real-time data analysis and enhanced visualization for various mapping and surveying needs in countries such as China and India is expected to fuel the demand for the market over the forecast period.

Mobile Mapping Market Segmentations:

By Component

By Technology Type

By Mounting Type

By Application

By End-user

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Mobile Mapping Market

5.1. COVID-19 Landscape: Mobile Mapping Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Mobile Mapping Market, By Component

8.1. Mobile Mapping Market, by Component, 2023-2032

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Mobile Mapping Market, By Technology Type

9.1. Mobile Mapping Market, by Technology Type, 2023-2032

9.1.1. GNSS

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. RADAR

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. LiDAR

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Mobile Mapping Market, By Mounting Type

10.1. Mobile Mapping Market, by Mounting Type, 2023-2032

10.1.1. Vehicle-mounted

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Railway-mounted

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Drone-mounted

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Others (handheld, backpacks, and boat-mounted)

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Mobile Mapping Market, By Application

11.1. Mobile Mapping Market, by Application, 2023-2032

11.1.1. Asset Management

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Topographic Mapping

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Road Surveys

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Others (Imaging Services, Satellite, and Emergency Response Planning, and 3D Modeling)

11.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Mobile Mapping Market, By End-user

12.1. Mobile Mapping Market, by End-user, 2023-2032

12.1.1. Agriculture

12.1.1.1. Market Revenue and Forecast (2020-2032)

12.1.2. Oil & Gas

12.1.2.1. Market Revenue and Forecast (2020-2032)

12.1.3. Government & Public Sector

12.1.3.1. Market Revenue and Forecast (2020-2032)

12.1.4. Others (Manufacturing & Mining, Telecommunication, Energy & Utilities, BFSI, and Retail)

12.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 13. Global Mobile Mapping Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Component (2020-2032)

13.1.2. Market Revenue and Forecast, by Technology Type (2020-2032)

13.1.3. Market Revenue and Forecast, by Mounting Type (2020-2032)

13.1.4. Market Revenue and Forecast, by Application (2020-2032)

13.1.5. Market Revenue and Forecast, by End-user (2020-2032)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.1.6.2. Market Revenue and Forecast, by Technology Type (2020-2032)

13.1.6.3. Market Revenue and Forecast, by Mounting Type (2020-2032)

13.1.6.4. Market Revenue and Forecast, by Application (2020-2032)

13.1.7. Market Revenue and Forecast, by End-user (2020-2032)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Component (2020-2032)

13.1.8.2. Market Revenue and Forecast, by Technology Type (2020-2032)

13.1.8.3. Market Revenue and Forecast, by Mounting Type (2020-2032)

13.1.8.4. Market Revenue and Forecast, by Application (2020-2032)

13.1.8.5. Market Revenue and Forecast, by End-user (2020-2032)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.2. Market Revenue and Forecast, by Technology Type (2020-2032)

13.2.3. Market Revenue and Forecast, by Mounting Type (2020-2032)

13.2.4. Market Revenue and Forecast, by Application (2020-2032)

13.2.5. Market Revenue and Forecast, by End-user (2020-2032)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.6.2. Market Revenue and Forecast, by Technology Type (2020-2032)

13.2.6.3. Market Revenue and Forecast, by Mounting Type (2020-2032)

13.2.7. Market Revenue and Forecast, by Application (2020-2032)

13.2.8. Market Revenue and Forecast, by End-user (2020-2032)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.9.2. Market Revenue and Forecast, by Technology Type (2020-2032)

13.2.9.3. Market Revenue and Forecast, by Mounting Type (2020-2032)

13.2.10. Market Revenue and Forecast, by Application (2020-2032)

13.2.11. Market Revenue and Forecast, by End-user (2020-2032)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.12.2. Market Revenue and Forecast, by Technology Type (2020-2032)

13.2.12.3. Market Revenue and Forecast, by Mounting Type (2020-2032)

13.2.12.4. Market Revenue and Forecast, by Application (2020-2032)

13.2.13. Market Revenue and Forecast, by End-user (2020-2032)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.14.2. Market Revenue and Forecast, by Technology Type (2020-2032)

13.2.14.3. Market Revenue and Forecast, by Mounting Type (2020-2032)

13.2.14.4. Market Revenue and Forecast, by Application (2020-2032)

13.2.15. Market Revenue and Forecast, by End-user (2020-2032)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.2. Market Revenue and Forecast, by Technology Type (2020-2032)

13.3.3. Market Revenue and Forecast, by Mounting Type (2020-2032)

13.3.4. Market Revenue and Forecast, by Application (2020-2032)

13.3.5. Market Revenue and Forecast, by End-user (2020-2032)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.6.2. Market Revenue and Forecast, by Technology Type (2020-2032)

13.3.6.3. Market Revenue and Forecast, by Mounting Type (2020-2032)

13.3.6.4. Market Revenue and Forecast, by Application (2020-2032)

13.3.7. Market Revenue and Forecast, by End-user (2020-2032)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.8.2. Market Revenue and Forecast, by Technology Type (2020-2032)

13.3.8.3. Market Revenue and Forecast, by Mounting Type (2020-2032)

13.3.8.4. Market Revenue and Forecast, by Application (2020-2032)

13.3.9. Market Revenue and Forecast, by End-user (2020-2032)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.10.2. Market Revenue and Forecast, by Technology Type (2020-2032)

13.3.10.3. Market Revenue and Forecast, by Mounting Type (2020-2032)

13.3.10.4. Market Revenue and Forecast, by Application (2020-2032)

13.3.10.5. Market Revenue and Forecast, by End-user (2020-2032)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.11.2. Market Revenue and Forecast, by Technology Type (2020-2032)

13.3.11.3. Market Revenue and Forecast, by Mounting Type (2020-2032)

13.3.11.4. Market Revenue and Forecast, by Application (2020-2032)

13.3.11.5. Market Revenue and Forecast, by End-user (2020-2032)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.2. Market Revenue and Forecast, by Technology Type (2020-2032)

13.4.3. Market Revenue and Forecast, by Mounting Type (2020-2032)

13.4.4. Market Revenue and Forecast, by Application (2020-2032)

13.4.5. Market Revenue and Forecast, by End-user (2020-2032)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.6.2. Market Revenue and Forecast, by Technology Type (2020-2032)

13.4.6.3. Market Revenue and Forecast, by Mounting Type (2020-2032)

13.4.6.4. Market Revenue and Forecast, by Application (2020-2032)

13.4.7. Market Revenue and Forecast, by End-user (2020-2032)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.8.2. Market Revenue and Forecast, by Technology Type (2020-2032)

13.4.8.3. Market Revenue and Forecast, by Mounting Type (2020-2032)

13.4.8.4. Market Revenue and Forecast, by Application (2020-2032)

13.4.9. Market Revenue and Forecast, by End-user (2020-2032)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.10.2. Market Revenue and Forecast, by Technology Type (2020-2032)

13.4.10.3. Market Revenue and Forecast, by Mounting Type (2020-2032)

13.4.10.4. Market Revenue and Forecast, by Application (2020-2032)

13.4.10.5. Market Revenue and Forecast, by End-user (2020-2032)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.11.2. Market Revenue and Forecast, by Technology Type (2020-2032)

13.4.11.3. Market Revenue and Forecast, by Mounting Type (2020-2032)

13.4.11.4. Market Revenue and Forecast, by Application (2020-2032)

13.4.11.5. Market Revenue and Forecast, by End-user (2020-2032)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Component (2020-2032)

13.5.2. Market Revenue and Forecast, by Technology Type (2020-2032)

13.5.3. Market Revenue and Forecast, by Mounting Type (2020-2032)

13.5.4. Market Revenue and Forecast, by Application (2020-2032)

13.5.5. Market Revenue and Forecast, by End-user (2020-2032)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.5.6.2. Market Revenue and Forecast, by Technology Type (2020-2032)

13.5.6.3. Market Revenue and Forecast, by Mounting Type (2020-2032)

13.5.6.4. Market Revenue and Forecast, by Application (2020-2032)

13.5.7. Market Revenue and Forecast, by End-user (2020-2032)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Component (2020-2032)

13.5.8.2. Market Revenue and Forecast, by Technology Type (2020-2032)

13.5.8.3. Market Revenue and Forecast, by Mounting Type (2020-2032)

13.5.8.4. Market Revenue and Forecast, by Application (2020-2032)

13.5.8.5. Market Revenue and Forecast, by End-user (2020-2032)

Chapter 14. Company Profiles

14.1. Trimble Inc.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Google (Alphabet Inc.)

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Leica Geosystems AG (Hexagon Geosystems)

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Topcon

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Teledyne Technologies Incorporated

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. imajing SAS

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. RIEGL Laser Measurement Systems GmbH

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Hi-Target

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. GreenValley International

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Klau Geomatics Pty. Ltd.

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others