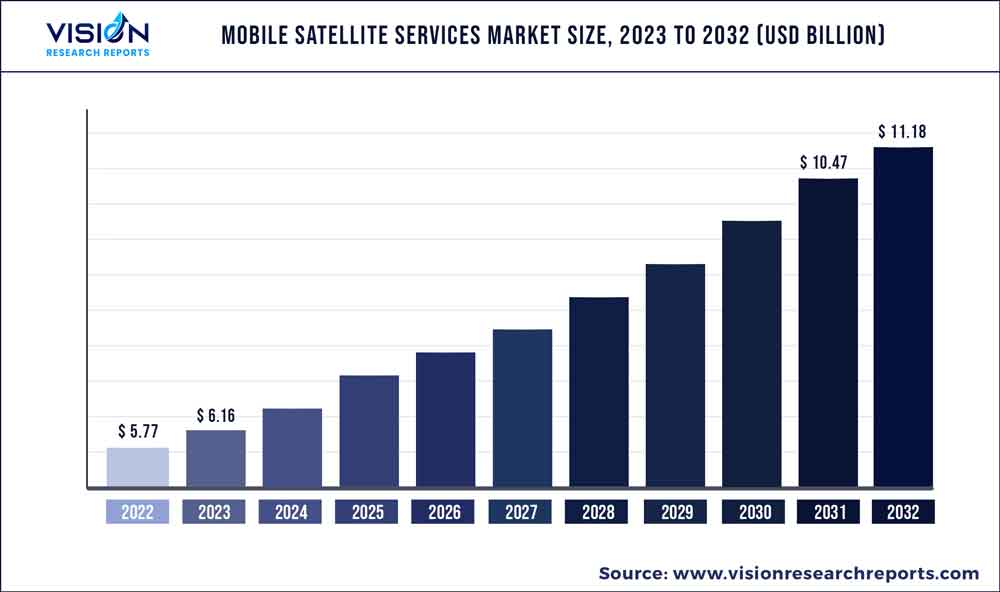

The global mobile satellite services market was surpassed at USD 5.77 billion in 2022 and is expected to hit around USD 11.18 billion by 2032, growing at a CAGR of 6.84% from 2023 to 2032. The mobile satellite services market in the United States was accounted for USD 1.5 billion in 2022.

Key Pointers

Report Scope of the Mobile Satellite Services Market

| Report Coverage | Details |

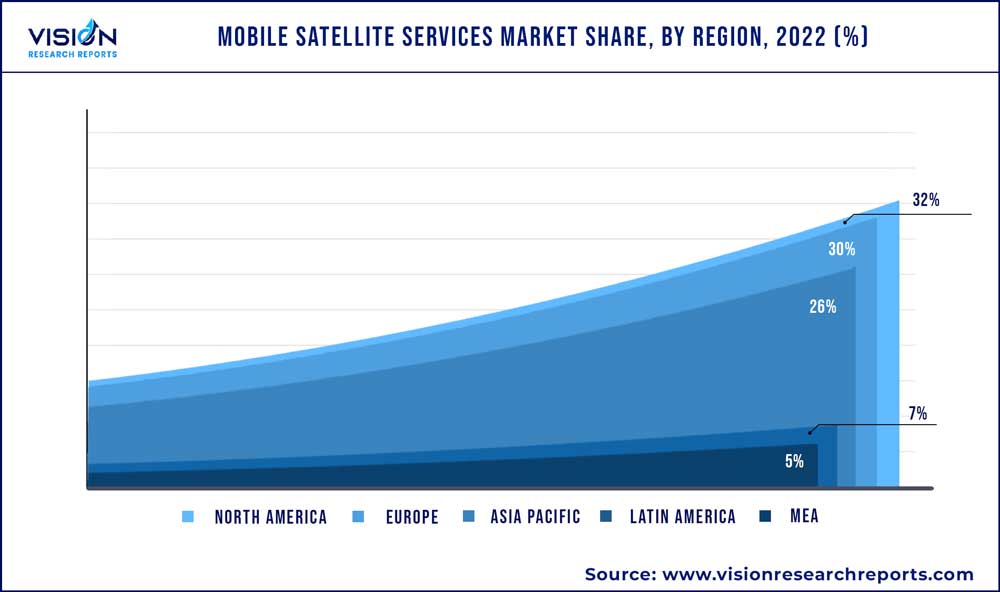

| Revenue Share of North America in 2022 | 32% |

| Revenue Forecast by 2032 | USD 11.18 billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.84% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Viasat, Inc.; SES S.A.; Intelsat S.A.; Telesat Corporation; EchoStar Corporation; Thuraya Telecommunications Company; Iridium Communications Inc.; SKY Perfect JSAT Holdings Inc.; Vizocom; Speedcast |

Mobile satellite services (MSS) utilize satellite technology to offer voice and data communication services to mobile users across the globe, regardless of their location on land, sea, or air. Mobile satellite services are witnessing significant growth owing to the increasing need for global connectivity, particularly in remote and rural areas where terrestrial infrastructure is insufficient. The market is expected to continue its growth trajectory in the coming years, primarily driven by the surging usage of mobile data and the growing adoption of satellite-based Internet of Things (IoT) applications.

Mobile satellite services are a means of providing communication services to mobile devices using satellite technology. Mobile satellite services are witnessing significant growth due to the increasing demand for connectivity solutions in remote, underserved, and rural areas where traditional terrestrial networks are either not functional or unavailable. One of the trends in this market is the usage of mobile satellite services during emergencies and natural disasters.

According to the Emergency Events Database EM-DAT, 2022 witnessed more than 387 natural disasters and hazards worldwide, resulting in the loss of 30,704 lives and affecting 185 million individuals. Moreover, the economic losses caused by these natural disasters reached around USD 223.8 billion. The considerable damages resulting from natural disasters have created a pressing need for solutions that can alert and connect people stuck in such hazardous situations. In this context, mobile satellite services prove to be highly beneficial as they are resilient to disaster damage.

Telecom operators and mobile satellite service providers are joining forces to tackle the issue of inadequate network coverage in remote areas. The main objective of these partnerships is to offer network connectivity in regions where the existing terrestrial network falls short. These efforts are anticipated to close the network gap and propel the expansion of the mobile satellite services industry in the foreseeable future. In addition to personal or consumer-level network connectivity, business operations in remote locations, such as the marine, mining, oil and gas, and defense sectors, face multiple challenges due to minimal access to terrestrial networks. As a result, these industries are increasingly turning to satellite-based connectivity, which is fueling the growth of mobile satellite services.

The adoption of mobile satellite services is significantly threatened by unique cybersecurity challenges. The mobile satellite services rely on a combination of ground-based technologies and satellite operations, which provide cybercriminals with ample opportunities for hacking through ground contact points. A key vulnerability that all satellite systems face is the need for uplinks and downlinks to go through the security protocols of telecom networks, which can be easily accessed by cybercriminals. This poses a major obstacle to the growth of mobile satellite services. However, satellite operators are implementing technological advancements and robust security measures to provide cutting-edge security to the mobile satellite services industry. This is expected to address cybersecurity concerns and mitigate its impact on market growth.

Service Insights

The data segment dominated the market in 2022 and accounted for a revenue share of more than 75%. The segment is anticipated to grow at the fastest growth rate during the forecast period. One of the primary factors driving the growth of the segment is the increasing demand from industries like aviation, marine, emergency response, and oil and gas, for high-capacity and high-speed data services in challenging and remote locations. These sectors require reliable and secure communication of data for various applications such as asset tracking, video surveillance, and remote monitoring. Furthermore, the need for a consistent and dependable connection is driving growth in this market segment, especially in urban and suburban areas where terrestrial infrastructure is available.

The services segment is anticipated to register substantial growth over the forecast period. The growth in this market segment can be attributed to the rising demand for dependable and secure communication services in remote areas and regions affected by disasters, where terrestrial infrastructure may not be available or damaged. This demand is driven by various industries, including maritime, oil and gas, emergency response, and aviation, where reliable voice communication is essential for operational safety and efficiency. Additionally, the adoption of 5G technology and High-Throughput Satellite (HTS) systems is fueling the growth of voice services in the mobile satellite services industry. 5G technology provides higher bandwidth and faster data rates, while HTS systems offer increased capacity and more efficient utilization of satellite resources, allowing mobile satellite service providers to offer advanced voice services, such as high-definition voice and video calls. Furthermore, the use of Software Defined Radios (SDRs) is enabling MSS providers to offer more scalable and flexible voice services, as SDRs can adapt to different network configurations and frequency bands.

Application Insights

The land mobile segment dominated the market in 2022 and accounted for a revenue share of over 35%. The segment is estimated to grow at the highest CAGR during the forecast period. The growth of the segment is attributed to its extensive usage of mobile satellite services in land mobile applications that require reliable and secure connectivity in remote locations where terrestrial infrastructure is not feasible. For instance, in mining operations, MSS can be utilized for remote monitoring purposes like equipment monitoring, asset tracking, and safety monitoring, enhancing productivity and safety while reducing costs.

In emergency response scenarios, such as natural disasters or accidents, where terrestrial communication infrastructure may be damaged or disrupted, MSS can serve as a dependable means of communication and data connectivity for first responders and emergency management organizations. By utilizing mobile satellite services, organizations can effectively coordinate their efforts and communicate with each other, which increases the adoption of MSS for land mobile applications.

The M2M segment is anticipated to witness significant growth through the forecast period. The ability of MSS to offer secure connectivity for M2M services operating in inaccessible areas, where terrestrial networks may not be available or reliable, is a major factor contributing to the segment growth. M2M services involve the exchange of data between two or more devices without human intervention, and MSS capabilities are increasingly being integrated into these devices. This allows companies to track and monitor the movement, location, and condition of assets such as containers, vehicles, and other equipment. MSS is also being used for remote monitoring and control of equipment and systems in various industries, including utilities, agriculture, and environmental monitoring. Such factors bode well for the growth of the segment over the forecast period.

End-user Insights

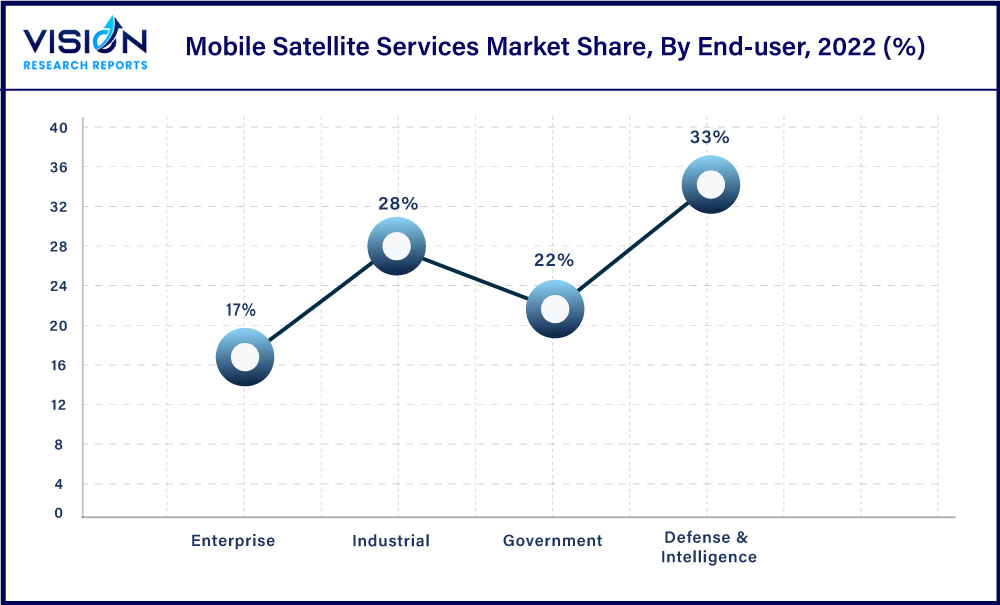

The defense & intelligence segment dominated the market in 2022 and accounted for a revenue share of more than 33%. The defense and intelligence sector has witnessed an increase in the adoption of mobile satellite services due to the growing demand for reliable and secure communication in remote and challenging environments. These services are employed in unmanned aerial vehicles to offer real-time Intelligence, Surveillance, and Reconnaissance (ISR) capabilities. Furthermore, the growing utilization of these services for secure data and voice communication in tactical environments enables troops to communicate effectively in areas where terrestrial networks are not feasible or dependable, which is driving the growth of this segment.

The industrial segment is expected to witness the highest growth rate during the forecast period. The increased use of machine learning and IoT technologies in industrial settings is driving the adoption of MSS for remote monitoring and data transfer of devices and sensors. This enables businesses to make data-driven decisions and improve their operational efficiency.

Applications of mobile satellite services include remote asset management in the mining and oil & gas industries, where they enable companies to monitor and control equipment and facilities from afar. These services also provide reliable communication capabilities for workers in remote locations. Furthermore, the growing need for sustainable energy is boosting the use of MSS in the renewable energy sector, particularly for the remote monitoring and control of solar and wind farms.

Regional Insights

North America dominated the mobile satellite services market in 2022 and accounted for a revenue share of over 32%. The increasing adoption of mobile satellite services in North America is driven by the necessity for dependable and accessible connectivity in remote regions. Several regions in North America, particularly rural and isolated areas, lack access to conventional telecommunications infrastructure. Mobile satellite services serve as a viable substitute for traditional networks, allowing individuals in these areas to remain connected.

The Asia Pacific region is experiencing the highest growth in the mobile satellite services market, driven by several factors, including the growing proliferation of smartphones, the development of digital infrastructure, and efforts taken by regional governments to implement 5G networks. Advancements in digital infrastructure, such as high-speed internet networks, fiber-optic connectivity, and satellite communication systems, are rapidly taking place in the region. These developments are generating opportunities for mobile satellite service providers to offer dependable and high-quality communication services to underserved and remote regions, where traditional networks may be limited. The enhanced digital infrastructure is facilitating better connectivity, and mobile satellite services are being utilized to fill the gaps in coverage and provide connectivity in remote areas.

Mobile Satellite Services Market Segmentations:

By Service

By Application

By End-user

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Service Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Mobile Satellite Services Market

5.1. COVID-19 Landscape: Mobile Satellite Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Mobile Satellite Services Market, By Service

8.1. Mobile Satellite Services Market, by Service, 2023-2032

8.1.1 Voice

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Data

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Mobile Satellite Services Market, By Application

9.1. Mobile Satellite Services Market, by Application, 2023-2032

9.1.1. Land Mobile

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Aviation & Aeronautics

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Maritime

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. M2M

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Mobile Satellite Services Market, By End-user

10.1. Mobile Satellite Services Market, by End-user, 2023-2032

10.1.1. Defense & Intelligence

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Government

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Industrial

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Enterprise

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Mobile Satellite Services Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Service (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by End-user (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Service (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-user (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Service (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End-user (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Service (2020-2032)

11.2.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.3. Market Revenue and Forecast, by End-user (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Service (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End-user (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Service (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End-user (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Service (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End-user (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Service (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End-user (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Service (2020-2032)

11.3.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.3. Market Revenue and Forecast, by End-user (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Service (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End-user (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Service (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End-user (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Service (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End-user (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Service (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End-user (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Service (2020-2032)

11.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.3. Market Revenue and Forecast, by End-user (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Service (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End-user (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Service (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End-user (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Service (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End-user (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Service (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End-user (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Service (2020-2032)

11.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.3. Market Revenue and Forecast, by End-user (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Service (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End-user (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Service (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End-user (2020-2032)

Chapter 12. Company Profiles

12.1. Viasat, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. SES S.A.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Intelsat S.A.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Telesat Corporation

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. EchoStar Corporation

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Thuraya Telecommunications Company

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Iridium Communications Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. SKY Perfect JSAT Holdings Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Vizocom

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Speedcast

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others