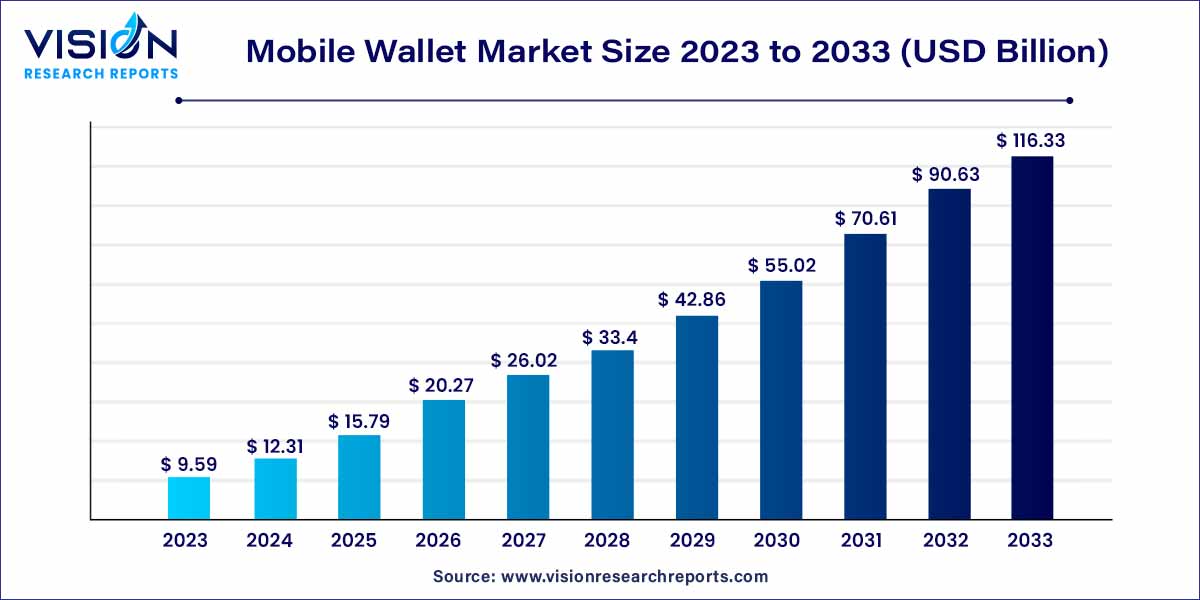

The global mobile wallet market was estimated at USD 9.59 billion in 2023 and it is expected to surpass around USD 116.33 billion by 2033, poised to grow at a CAGR of 28.35% from 2024 to 2033. The mobile wallet market in the United States was accounted for USD 971.9 million in 2023.

The mobile wallet market has witnessed unprecedented growth and evolution, driven by the increasing integration of digital technologies into everyday life. Mobile wallets, also referred to as digital wallets, have become instrumental in reshaping the way individuals manage their financial transactions. This overview aims to provide a comprehensive understanding of the mobile wallet market, outlining its key features, functionalities, and the driving forces behind its widespread adoption.

The robust expansion of the mobile wallet market can be attributed to several key growth factors. Primarily, the increasing ubiquity of smartphones and the growing preference for digital transactions have created a fertile ground for the widespread adoption of mobile wallets. The convenience offered by these digital payment solutions, allowing users to securely store and manage their financial information on-the-go, has significantly propelled their popularity. Moreover, the global shift towards a cashless economy, driven by the need for enhanced security and efficiency in financial transactions, further amplifies the market's growth trajectory. The collaborative efforts between financial institutions, technology companies, and startups have spurred innovation, resulting in diverse offerings and increased consumer confidence. Additionally, the integration of mobile wallets with various services, such as loyalty programs and discounts, enhances their value proposition. As the mobile wallet ecosystem continues to evolve, fueled by technological advancements and changing consumer behaviors, the market is poised for sustained growth in the foreseeable future.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 28.35% |

| Market Revenue by 2033 | USD 116.33 billion |

| Revenue Share of Asia Pacific in 2023 | 33% |

| CAGR of Latin America from 2023 to 2032 | 28.62% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The technology market has been categorized into two segments: remote and proximity. The proximity segment held the largest revenue share of 63% in 2023. This dominance is attributed to the utilization of proximity technology, allowing users to make payments for goods and services using their mobile phones or other smart devices at physical point-of-sale (POS) terminals.

Conversely, the remote technology segment is poised to exhibit the highest CAGR of 28.62% during the forecast period. This surge is anticipated due to the increasing prevalence of cashless payments facilitated by communication networks. With mobile wallets based on remote technology, users have the flexibility to purchase goods through a mobile website or SMS text message using their mobile devices.

The retail and e-commerce sector contributed the largest market share of 33% in 2023, a position it is anticipated to maintain throughout the forecast period. The advantages of embracing mobile wallet payments have become increasingly evident to retailers and online businesses. Retailers, by integrating cashless or contactless payment technologies with digital marketing strategies, aim to leverage consumer data and foster loyalty. Additionally, the adoption of NFC technology is expected to enhance operational efficiency, reducing processing costs and expediting the checkout process. This technology empowers e-commerce entities and retailers to offer compelling promotions and efficiently track loyalty rewards, thereby fortifying their relationships with mobile consumers.

Concurrently, the banking segment is expected to expand at the highest CAGR of 29.62% over the forecast period. The adoption of mobile payment solutions by vending businesses is also on the rise, facilitating convenient and rapid transactions at vending machines. These businesses are enabling customers to make mobile payments using QR code systems, wallet apps, or vouchers.

In 2023, the Asia Pacific region dominated the global market with the largest market share of 33%. Projections indicate that it will continue to lead with the fastest CAGR of 28.93% throughout the forecast period. Key drivers contributing to this dominance include the burgeoning population, widespread adoption of smartphones, an increasing number of internet subscribers, and the rapid expansion of the retail and e-commerce sector in countries like India and China. Government initiatives such as Digital India and Make in India are further expected to bolster smartphone penetration and smart device usage, consequently driving the escalating demand for mobile wallets.

In Latin America region expected to grow at the notable CAGR of 28.62% over the forecast period. This growth is attributed to the rising prevalence of smartphones, the surge in e-commerce activities, and the growing preference for convenience. Support from governments and financial institutions in Latin America, offering regulatory frameworks and infrastructure, is fostering the expansion of mobile wallets. For instance, in November 2020, the Brazilian government introduced a national mobile wallet platform, Pix, with the aim of encouraging the adoption of mobile wallets among its citizens.

By Technology

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Mobile Wallet Market

5.1. COVID-19 Landscape: Mobile Wallet Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Mobile Wallet Market, By Technology

8.1. Mobile Wallet Market, by Technology, 2024-2033

8.1.1. Remote

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Proximity

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Mobile Wallet Market, By Application

9.1. Mobile Wallet Market, by Application, 2024-2033

9.1.1. Retail & E-commerce

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Hospitality & Transportation

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Banking

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Vending Machine

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Mobile Wallet Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Technology (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Technology (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Amazon Web Services, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Visa Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. American Express

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. PayPal Holdings Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Apple Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Google Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Airtel

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Mastercard

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Alipay

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Samsung

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others