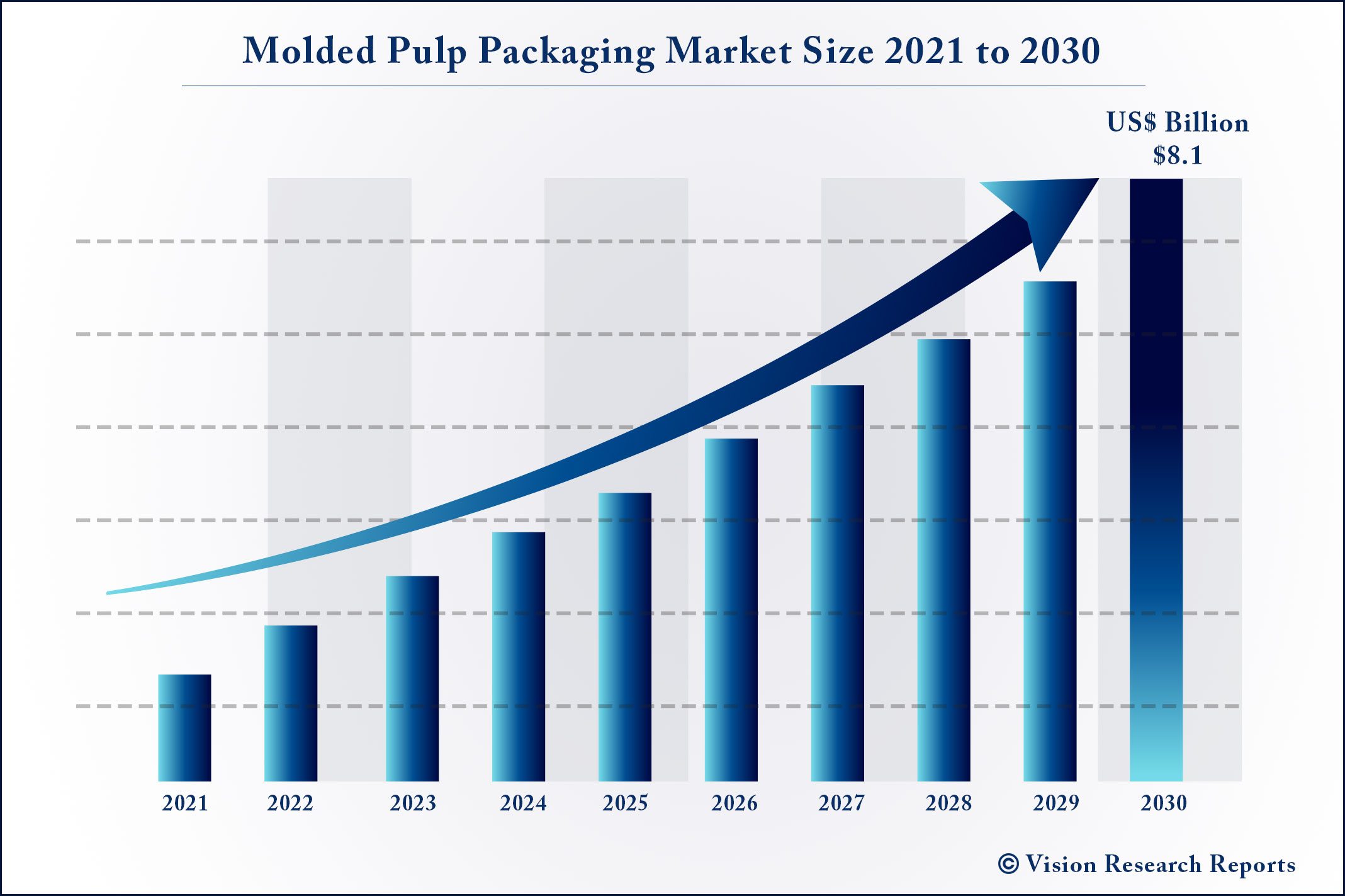

The global molded pulp packaging market size is expected to be worth around US$ 8.1 billion by 2030, according to a new report by Vision Research Reports.

The global molded pulp packaging market size was valued at US$ 3,815.2 million in 2020 and is anticipated to grow at a CAGR of 8.1% during forecast period 2021 to 2030.

Report Coverage

| Report Scope | Details |

| Market Size | USD 8.1 billion by 2030 |

| Growth Rate | CAGR of 8.1% From 2021 to 2030 |

| Base Year | 2021 |

| Historic Data | 2017 to 2020 |

| Forecast Period | 2021 to 2030 |

| Segments Covered | Source, Molded type, Product, Application |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Mentioned | Brodrene Hartmann A/S; Huhtamako Oyj; UFP Technologies, Inc; Thermoform Engineered Quality LLC; Genpak, LLC; Eco-Products, Inc; Fabri-Kal; Sabert Corp. |

Growth Factors

Growing demand for eco-friendly sustainable packaging from the end-user segments owing to growing awareness regarding the adverse effects of plastic pollution is expected to be the key driver for the market.

The Covid-19 pandemic has benefitted the molded pulp packaging owing to increased demand for eggs from the retail segment. In addition, increasing demand for home deliveries of fresh food, vegetables, and other grocery items owing to restrictions on the movement of the public also supported the market growth. However, shortages of raw material owing to supply chain disruption have increased the prices of the packaging products. Growing demand for sustainable packaging solutions from environment-conscious consumers and stringent regulations related to plastic usage is expected to drive the market over the forecast period.

Report Highlights

The wood pulp segment hold for the greatest revenue share of over 88% in the year 2020 owing to the easy availability and low cost of these sources. The declining pulp prices in most of the regions have also been boosting the segment growth over the past few years.

the non-wood source segment is projected to witness the fastest CAGR from 2021 to 2030. Non-wood pulp, which is manufactured with the help of non-woody cellulosic plant materials, such as grasses, cereal straw, sugar cane bagasse and, reeds, has also been gaining popularity. Cereal straw was the most used raw material in the production of non-wood pulp.

higher paper recycling rates in the developed economies of North America and Europe have been favoring the segment with raw material availability. The paper recyclability rate in the U.S has increased from 64% in 2009 to more than 70% in 2020.

The trays segment hold for the largest revenue share of over 42% in 2020. Trays are mainly used in the food and foodservice industries due to the high convenience, shock absorption, and stability offered by these products. In the food industry, molded pulp trays are largely used for primary egg packaging in retail distribution channels.

Molded pulp trays are anitcipated to have high demand due to several shortcomings of plastic trays. Foam and plastic trays are not ideal in foodservice packaging as these tend to distort hot food and beverages and also pose an additional possibility of contamination of the products at elevated temperatures.

End caps are a key product in the protective packaging market as they are cost-effective and biodegradable. Although several substitutes, such as foam end caps, are available in the market, raising concerns regarding the non-degradable properties of foam materials is boosting the demand for end caps.

Food packaging emerged as a dominating application segment in 2020 accounting for a revenue share of more than 45%. Molded pulp products used for the packaging of fruits and vegetables help regulate fruit respiration and maintain ethylene density. Ethylene is the hormone responsible for the ripening of the fruit.

The electronics application segment is expected to witness the greatest CAGR of over 9% from 2021 to 2030 owing to high product demand for the packaging of electronic devices, such as computers, modems, printers, hard drives, cellphones, and others.

In terms of revenue, the transfer molded type segment hold for the largest revenue share of over 59% in 2020. Transfer molded pulp packaging is witnessing high demand in food packaging applications as a result of its advantages, such as hygroscopic properties, and air permeability, which help extend the shelf life of food and beverage products.

The thick wall segment is projected to register a significant CAGR of more than 7% over the forecast period. This packaging holds a smooth surface on one side and an unfinished surface on the other side and is commonly used as end caps or trays for packaging industrial products.

The thermoformed or thin-wall molded type segment is estimated to record the fastest CAGR from 2021 to 2030. The manufacturing process of these products involves heated molds that press the pulp for a smoother finish and better dimensions.

The thermoformed or thin-wall molded type segment is projected to record the fastest CAGR from 2021 to 2030. The manufacturing process of these products involves heated molds that press the pulp for a smoother finish and better dimensions.

North America was the second-largest regional market in 2020 as it is home to several food service companies including restaurants, fast-food outlets, and catering services.

Europe had close to one million restaurants and mobile food service providers in 2020, and the number is expected to increase during the forecast period. With an increasing number of restaurants and other food outlets, the demand for sustainable packaging solutions is also expected to grow.

Key Players

Brodrene Hartmann A/S

Huhtamako Oyj

UFP Technologies, Inc.

Thermoform Engineered Quality LLC

Genpak, LLC

Eco-Products, Inc.

Fabri-Kal

Sabert Corp.

Market Segmentation

Source

Wood Pulp

Non-wood Pulp

Molded Type

Thick Wall

Transfer

Thermoformed

Processed

Product

Trays

End Caps

Bowls & Cups

Clamshells

Plates

Others

Application

Food Packaging

Food Service

Electronics

Healthcare

Industrial

Others

Regional

North America

U.S.

Canada

Mexico

Europe

Germany

France

U.K.

Italy

Asia Pacific

China

India

Japan

Central & South America

Brazil

Middle East & Africa

Saudi Arabia

The Molded Pulp Packaging market research report covers definition, classification, product classification, product application, development trend, product technology, competitive landscape, industrial chain structure, industry overview, national policy and planning analysis of the industry, the latest dynamic analysis, etc., and also includes major. The study includes drivers and restraints of the global market. It covers the impact of these drivers and restraints on the demand during the forecast period. The report also highlights opportunities in the market at the global level.

The report provides size (in terms of volume and value) of Molded Pulp Packaging market for the base year 2020 and the forecast between 2021 and 2030. Market numbers have been estimated based on form and application. Market size and forecast for each application segment have been provided for the global and regional market.

This report focuses on the global Molded Pulp Packaging market status, future forecast, growth opportunity, key market and key players. The study objectives are to present the Molded Pulp Packaging market development in United States, Europe and China.

It is pertinent to consider that in a volatile global economy, we haven’t just conducted Molded Pulp Packaging market forecasts in terms of CAGR, but also studied the market based on key parameters, including Year-on-Year (Y-o-Y) growth, to comprehend the certainty of the market and to find and present the lucrative opportunities in market.

In terms of production side, this report researches the Molded Pulp Packaging capacity, production, value, ex-factory price, growth rate, market share for major manufacturers, regions (or countries) and type.

In terms of consumption side, this report focuses on the consumption of Molded Pulp Packaging by regions (countries) and application.

Buyers of the report will have access to verified market figures, including global market size in terms of revenue and volume. As part of production analysis, the authors of the report have provided reliable estimations and calculations for global revenue and volume by Type segment of the global Molded Pulp Packaging market. These figures have been provided in terms of both revenue and volume for the period 2017 to 2030. Additionally, the report provides accurate figures for production by region in terms of revenue as well as volume for the same period. The report also includes production capacity statistics for the same period.

With regard to production bases and technologies, the research in this report covers the production time, base distribution, technical parameters, research and development trends, technology sources, and sources of raw materials of major Molded Pulp Packaging market companies.

Regarding the analysis of the industry chain, the research of this report covers the raw materials and equipment of Molded Pulp Packaging market upstream, downstream customers, marketing channels, industry development trends and investment strategy recommendations. The more specific analysis also includes the main application areas of market and consumption, major regions and Consumption, major Chinese producers, distributors, raw material suppliers, equipment providers and their contact information, industry chain relationship analysis.

The research in this report also includes product parameters, production process, cost structure, and data information classified by region, technology and application. Finally, the paper model new project SWOT analysis and investment feasibility study of the case model.

Overall, this is an in-depth research report specifically for the Molded Pulp Packaging industry. The research center uses an objective and fair way to conduct an in-depth analysis of the development trend of the industry, providing support and evidence for customer competition analysis, development planning, and investment decision-making. In the course of operation, the project has received support and assistance from technicians and marketing personnel in various links of the industry chain.

Molded Pulp Packaging market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to Molded Pulp Packaging market.

Prominent players in the market are predicted to face tough competition from the new entrants. However, some of the key players are targeting to acquire the startup companies in order to maintain their dominance in the global market. For a detailed analysis of key companies, their strengths, weaknesses, threats, and opportunities are measured in the report by using industry-standard tools such as the SWOT analysis. Regional coverage of key companies is covered in the report to measure their dominance. Key manufacturers of Molded Pulp Packaging market are focusing on introducing new products to meet the needs of the patrons. The feasibility of new products is also measured by using industry-standard tools.

Key companies are increasing their investments in research and development activities for the discovery of new products. There has also been a rise in the government funding for the introduction of new Molded Pulp Packaging market. These factors have benefited the growth of the global market for Molded Pulp Packaging. Going forward, key companies are predicted to benefit from the new product launches and the adoption of technological advancements. Technical advancements have benefited many industries and the global industry is not an exception.

New product launches and the expansion of already existing business are predicted to benefit the key players in maintaining their dominance in the global market for Molded Pulp Packaging. The global market is segmented on the basis of region, application, en-users and product type. Based on region, the market is divided into North America, Europe, Asia-Pacific, Latin America and Middle East and Africa (MEA).

In this study, the years considered to estimate the market size of Molded Pulp Packaging are as follows:

Reasons to Purchase this Report:

- Market segmentation analysis including qualitative and quantitative research incorporating the impact of economic and policy aspects

- Regional and country level analysis integrating the demand and supply forces that are influencing the growth of the market.

- Market value USD Million and volume Units Million data for each segment and sub-segment

- Competitive landscape involving the market share of major players, along with the new projects and strategies adopted by players in the past five years

- Comprehensive company profiles covering the product offerings, key financial information, recent developments, SWOT analysis, and strategies employed by the major market players

Research Methodology:

In-depth interviews and discussions were conducted with several key market participants and opinion leaders to compile the research report.

This research study involved the extensive usage of both primary and secondary data sources. The research process involved the study of various factors affecting the industry, including the government policy, market environment, competitive landscape, historical data, present trends in the market, technological innovation, upcoming technologies and the technical progress in related industry, and market risks, opportunities, market barriers and challenges. The following illustrative figure shows the market research methodology applied in this report.

Market Size Estimation

Top-down and bottom-up approaches are used to estimate and validate the global market size for company, regional division, product type and application (end users).

The market estimations in this report are based on the selling price (excluding any discounts provided by the manufacturer, distributor, wholesaler or traders). Market share analysis, assigned to each of the segments and regions are achieved through product utilization rate and average selling price.

Major manufacturers & their revenues, percentage splits, market shares, growth rates and breakdowns of the product markets are determined through secondary sources and verified through the primary sources.

All possible factors that influence the markets included in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The market size for top-level markets and sub-segments is normalized, and the effect of inflation, economic downturns, and regulatory & policy changes or others factors are accounted for in the market forecast. This data is combined and added with detailed inputs and analysis from Vision Research Reports and presented in this report.

Market Breakdown and Data Triangulation

After complete market engineering with calculations for market statistics; market size estimations; market forecasting; market breakdown; and data triangulation. Extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. In the complete market engineering process, both top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform market estimation and market forecasting for the overall market segments and sub-segments listed in this report.

Secondary Sources

Secondary Sources occupies approximately 25% of data sources, such as press releases, annual reports, Non-Profit organizations, industry associations, governmental agencies and customs data, and so on. This research study includes secondary sources; directories; databases such as Bloomberg Business, Wind Info, Hoovers, Factiva (Dow Jones & Company), TRADING ECONOMICS, and avention; Investing News Network; statista; Federal Reserve Economic Data; annual reports; investor presentations; and SEC filings of companies.

Primary Sources

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include product manufacturers (and their competitors), opinion leaders, industry experts, research institutions, distributors, dealer and traders, as well as the raw materials suppliers and producers, etc.

The primary sources from the demand side include industry experts such as business leaders, marketing and sales directors, technology and innovation directors, supply chain executive, end users (product buyers), and related key executives from various key companies and organizations operating in the global market.

The study objectives of this report are:

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Molded Pulp Packaging Market, By Source

7.1. Molded Pulp Packaging Market, by Source, 2020-2030

7.1.1. Wood Pulp

7.1.1.1. Market Revenue and Forecast (2017-2030)

7.1.2. Non-wood Pulp

7.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 8. Global Molded Pulp Packaging Market, By Molded Type

8.1. Molded Pulp Packaging Market, by Molded Type, 2020-2030

8.1.1. Thick Wall

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Transfer

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Thermoformed

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Processed

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Molded Pulp Packaging Market, By Product

9.1. Molded Pulp Packaging Market, by Product, 2020-2030

9.1.1. Trays

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. End Caps

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Bowls & Cups

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Clamshells

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Plates

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Molded Pulp Packaging Market, By Application

10.1. Molded Pulp Packaging Market, by Application, 2020-2030

10.1.1. Food Packaging

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Food Service

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Electronics

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Healthcare

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Industrial

10.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Molded Pulp Packaging Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Source (2017-2030)

11.1.2. Market Revenue and Forecast, by Molded Type (2017-2030)

11.1.3. Market Revenue and Forecast, by Product (2017-2030)

11.1.4. Market Revenue and Forecast, by Application (2017-2030)

11.1.5. U.S.

11.1.5.1. Market Revenue and Forecast, by Source (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Molded Type (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Product (2017-2030)

11.1.5.4. Market Revenue and Forecast, by Application (2017-2030)

11.1.6. Rest of North America

11.1.6.1. Market Revenue and Forecast, by Source (2017-2030)

11.1.6.2. Market Revenue and Forecast, by Molded Type (2017-2030)

11.1.6.3. Market Revenue and Forecast, by Product (2017-2030)

11.1.6.4. Market Revenue and Forecast, by Application (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Source (2017-2030)

11.2.2. Market Revenue and Forecast, by Molded Type (2017-2030)

11.2.3. Market Revenue and Forecast, by Product (2017-2030)

11.2.4. Market Revenue and Forecast, by Application (2017-2030)

11.2.5. UK

11.2.5.1. Market Revenue and Forecast, by Source (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Molded Type (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Product (2017-2030)

11.2.5.4. Market Revenue and Forecast, by Application (2017-2030)

11.2.6. Germany

11.2.6.1. Market Revenue and Forecast, by Source (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Molded Type (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Product (2017-2030)

11.2.6.4. Market Revenue and Forecast, by Application (2017-2030)

11.2.7. France

11.2.7.1. Market Revenue and Forecast, by Source (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Molded Type (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Product (2017-2030)

11.2.7.4. Market Revenue and Forecast, by Application (2017-2030)

11.2.8. Rest of Europe

11.2.8.1. Market Revenue and Forecast, by Source (2017-2030)

11.2.8.2. Market Revenue and Forecast, by Molded Type (2017-2030)

11.2.8.3. Market Revenue and Forecast, by Product (2017-2030)

11.2.8.4. Market Revenue and Forecast, by Application (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Source (2017-2030)

11.3.2. Market Revenue and Forecast, by Molded Type (2017-2030)

11.3.3. Market Revenue and Forecast, by Product (2017-2030)

11.3.4. Market Revenue and Forecast, by Application (2017-2030)

11.3.5. India

11.3.5.1. Market Revenue and Forecast, by Source (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Molded Type (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Product (2017-2030)

11.3.5.4. Market Revenue and Forecast, by Application (2017-2030)

11.3.6. China

11.3.6.1. Market Revenue and Forecast, by Source (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Molded Type (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Product (2017-2030)

11.3.6.4. Market Revenue and Forecast, by Application (2017-2030)

11.3.7. Japan

11.3.7.1. Market Revenue and Forecast, by Source (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Molded Type (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Product (2017-2030)

11.3.7.4. Market Revenue and Forecast, by Application (2017-2030)

11.3.8. Rest of APAC

11.3.8.1. Market Revenue and Forecast, by Source (2017-2030)

11.3.8.2. Market Revenue and Forecast, by Molded Type (2017-2030)

11.3.8.3. Market Revenue and Forecast, by Product (2017-2030)

11.3.8.4. Market Revenue and Forecast, by Application (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Source (2017-2030)

11.4.2. Market Revenue and Forecast, by Molded Type (2017-2030)

11.4.3. Market Revenue and Forecast, by Product (2017-2030)

11.4.4. Market Revenue and Forecast, by Application (2017-2030)

11.4.5. GCC

11.4.5.1. Market Revenue and Forecast, by Source (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Molded Type (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Product (2017-2030)

11.4.5.4. Market Revenue and Forecast, by Application (2017-2030)

11.4.6. North Africa

11.4.6.1. Market Revenue and Forecast, by Source (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Molded Type (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Product (2017-2030)

11.4.6.4. Market Revenue and Forecast, by Application (2017-2030)

11.4.7. South Africa

11.4.7.1. Market Revenue and Forecast, by Source (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Molded Type (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Product (2017-2030)

11.4.7.4. Market Revenue and Forecast, by Application (2017-2030)

11.4.8. Rest of MEA

11.4.8.1. Market Revenue and Forecast, by Source (2017-2030)

11.4.8.2. Market Revenue and Forecast, by Molded Type (2017-2030)

11.4.8.3. Market Revenue and Forecast, by Product (2017-2030)

11.4.8.4. Market Revenue and Forecast, by Application (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Source (2017-2030)

11.5.2. Market Revenue and Forecast, by Molded Type (2017-2030)

11.5.3. Market Revenue and Forecast, by Product (2017-2030)

11.5.4. Market Revenue and Forecast, by Application (2017-2030)

11.5.5. Brazil

11.5.5.1. Market Revenue and Forecast, by Source (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Molded Type (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Product (2017-2030)

11.5.5.4. Market Revenue and Forecast, by Application (2017-2030)

11.5.6. Rest of LATAM

11.5.6.1. Market Revenue and Forecast, by Source (2017-2030)

11.5.6.2. Market Revenue and Forecast, by Molded Type (2017-2030)

11.5.6.3. Market Revenue and Forecast, by Product (2017-2030)

11.5.6.4. Market Revenue and Forecast, by Application (2017-2030)

Chapter 12. Company Profiles

12.1. Brodrene Hartmann A/S

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Huhtamako Oyj

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. UFP Technologies, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Thermoform Engineered Quality LLC

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Genpak, LLC

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Eco-Products, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Fabri-Kal

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Sabert Corp.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others