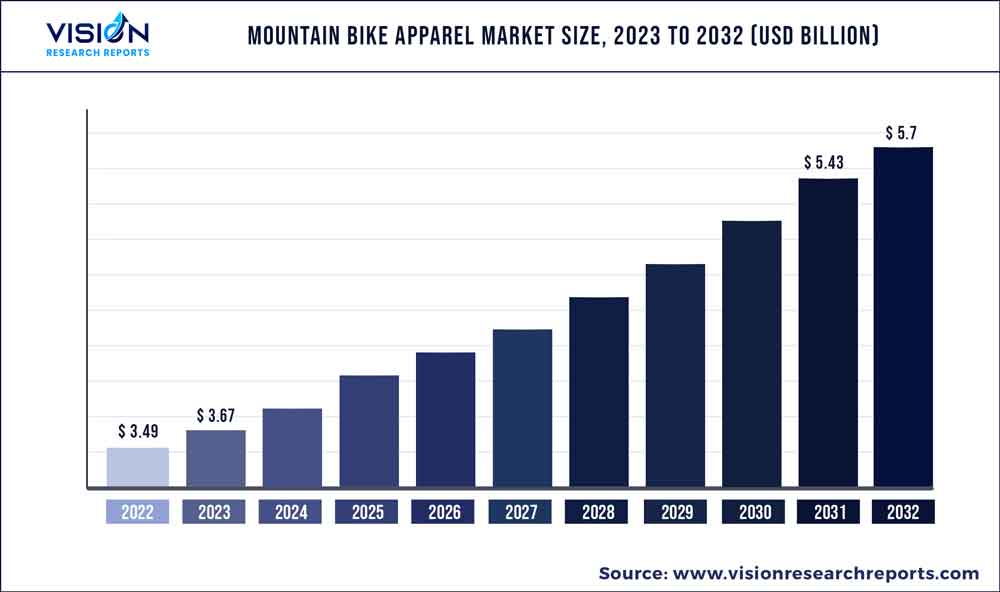

The global mountain bike apparel market was estimated at USD 3.49 billion in 2022 and it is expected to surpass around USD 5.7 billion by 2032, poised to grow at a CAGR of 5.03% from 2023 to 2032. The mountain bike apparel market in the United States was accounted for USD 435.5 million in 2022.

Key Pointers

Report Scope of the Mountain Bike Apparel Market

| Report Coverage | Details |

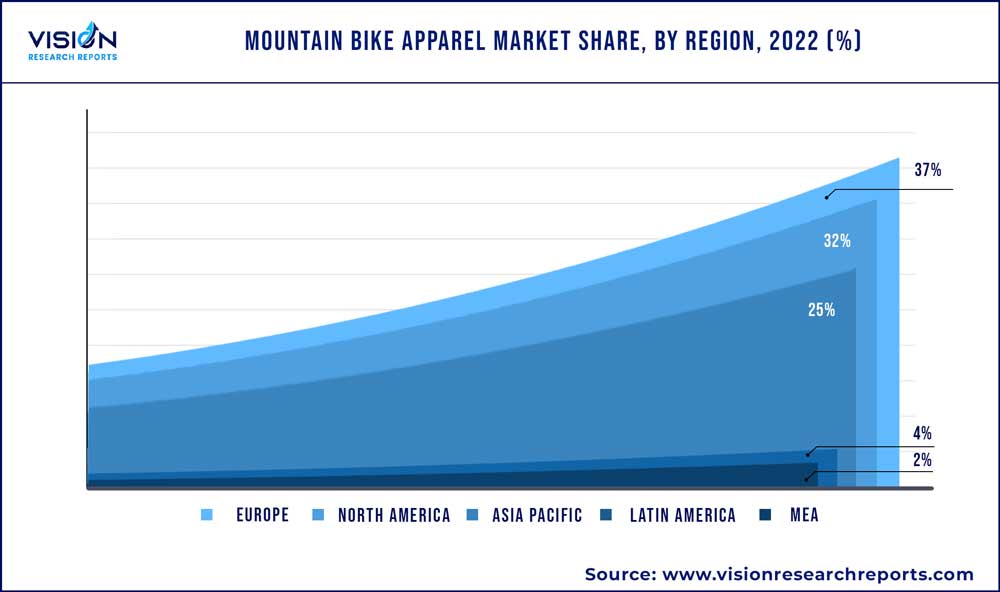

| Revenue Share of Europe in 2022 | 37% |

| CAGR of Asia Pacific from 2023 to 2032 | 5.83% |

| Revenue Forecast by 2032 | USD 5.7 billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.03% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Patagonia, Inc.; Alpinestars; LeMans Corporation; PEARL iZUMi; Endura Inc.; Dainese S.p.A; Giro Sport Design, LLC.; Louis Garneau Sports; Scott Sports SA; Race Face ; 7mesh Industries Inc; Rapha Racing Limited; FOX ; Troy Lee Designs; Dakine |

Mountain biking is a high-intensity sport that requires specific clothing and accessories to ensure safety, comfort, and performance. Mountain bike apparel protects from falls, collisions, and exposure to harsh weather conditions, while also offering comfort and flexibility for the rider. Increasing participation in mountain biking has been a significant growth driver for the global market. For instance, according to a report published by AusCycling in March 2021, Mountain Bike Australia saw a 60% increase in membership over the last five years, reaching 17,625 members countrywide.

As more people take up mountain biking as a recreational activity or a competitive sport, there is a higher demand for specialized gear and apparel designed to withstand the rigors of off-road cycling. The rising popularity of mountain biking has made the market more diverse, with a wider range of products and styles available. This has led to an increase in competition among brands, resulting in new product innovations and a focus on quality and design. As a result, mountain bike apparel has become more appealing and accessible to a broader audience, contributing to the growth of the market. A growing focus on mountain biking and cycling tourism has also boosted the demand for appropriate apparel.

For instance, according to a report by the charitable organization Cycling UK in June 2020, tourism spending from cyclists and mountain bikers in the UKwas approximately USD 574.8 million (£520 million). Technological advancements have had a significant impact on the global market. New materials like moisture-wicking fabrics have made clothing more comfortable and functional. Breathable fabrics have also become popular as they allow air to circulate, keeping riders cool and dry. The use of technical fabrics has increased as they are designed to withstand the harsh conditions of mountain biking, such as rough terrain and extreme weather conditions. The development of specialized materials and fabrics has made it possible to design this kind of apparel that is lightweight, comfortable, and durable.

Customization is another popular trend in the market. Riders want clothing and accessories that reflect their personality and style and enable them to stand out on the trail. Customization allows riders to create unique apparel that suits their preferences, whether it is color, design, or features. Moreover, sustainability has also strongly influenced the market. Consumers are increasingly concerned about the environmental impact of the products they use. This has led to the development of eco-friendly and sustainable apparel. Companies are using recycled materials, reducing waste, and promoting ethical and sustainable manufacturing practices. Consumers, too, are willing to pay more for products that align with their values.

The cost of superior-quality products can be significantly higher than regular outdoor clothing because of the use of specialized materials, such as breathable fabrics, moisture-wicking technology, and abrasion-resistant materials. However, the high cost of such products is likely to restrain the market growth. In addition, the limited accessibility of such products hindersgrowth. These specialized clothing items are available only in specific regions where mountain biking is common and popular. This leaves out regions where the popularity of the sport is low, as well as an entire section of the population that is not engaged in the activity. Furthermore, the development of new and innovative fabric technologies presents a significant market opportunity for mountain bike apparel manufacturers.

Lightweight, breathable, and moisture-wicking fabrics can improve the comfort and performance of mountain bike apparel. Players that invest in the development of innovative fabric technologies that are durable and comfortable while also being affordable are expected to gain a significant competitive advantage in the market. Moreover, the growth of e-commerce presents a significant growth opportunity for companies. An increasing number of consumers are turning to online shopping for their apparel needs. Players can reach a broader audience and increase their market share by creating a strong online presence with easy-to-use websites and robust online marketing strategies.

Product Insights

The top wear segment accounted for a share of 47% in 2022. The top wear segment is further segmented into t-shirts & jerseys, jackets, and others. The t-shirts and jackets sub-segment accounted for more than 80% of the overall revenue. Mountain biking top wear encompasses a variety of garments designed to meet the needs of riders while cycling on weathered grounds. These garments are typically made with breathable and moisture-wicking materials that help keep the rider cool and dry, while also protecting from any external elements. In addition, there is a growing demand for mountain biking garments made with technologically advanced fabric that offer moisture-wicking, temperature regulation, and abrasion resistance. Developing and marketing high-quality materials can be lucrative in the market.

Mountain biking top wear that can also be used for other outdoor activities, such as hiking or running, can appeal to consumers looking for versatile and multifunctional clothing options. This can be an opportunity to expand product offerings and reach a wider audience. Accessories are anticipated to grow at a CAGR of 6.2% over the forecast period from 2023 to 2032. Mountain biking accessories consist of gloves, socks, and hats, among others. Mountain bikers wear gloves that are distinct from the gloves worn by road cyclists due to two main features: padding and finger coverage. While road bike grips lack padding, the padded feature is optional for mountain bike grips. Padded gloves can provide additional comfort if the riders go a long way. However, gloves without padding are lighter, cooler, and offer a better bar feel, particularly useful when navigating steep, fast, or technical descents.

Product Price Range Insights

The top wear segment is further segmented into the price range, such as up to USD 50, USD 51 to 100, USD 101 to 150, and Above USD 150. Mountain bike top wear ranging from USD 51 to 100 accounted for a share of 43% in 2022. The brand plays a critical role in determining its price, with established and well-known brands commanding higher prices due to their reputation for quality and performance. On the other hand, lesser-known or new brands offer similar products at a lower price point to attract customers. The type and quality of materials used in the construction of the top wear apparel are also important determinants of price.

Technical fabrics that provide moisture-wicking, breathability, and UV protection may be more expensive than basic cotton blends. Yeti Cycles, 7mesh, and POC Sports are some brands that offer mountain bike top wear apparel in the price range of USD 51 to USD 100. These companies use dynamic pricing to attract customers. Some start-up brands that use penetration pricing to attract customers also fall under this category. Accessories priced in the range of USD 101 to USD 150 are anticipated to grow at a CAGR of 7.42% over the forecast period. Gloves, socks, and hats are important mountain bike accessories that can improve a rider's comfort, grip, and protection while riding.

Gloves provide a better grip on the handlebars and often come with padded palms to protect them in case of a fall. They are generally made with breathable materials. Socks are made of moisture-wicking and cushioning materials to keep feet dry, reduce fatigue, and prevent blisters. Hats provide protection from the sun, wind, and rain, are often made with lightweight and breathable materials, and have adjustable straps and built-in visors or brims. These accessories are essential for improving a mountain biker's overall riding experience, performance, and safety.

Distribution Channel Insights

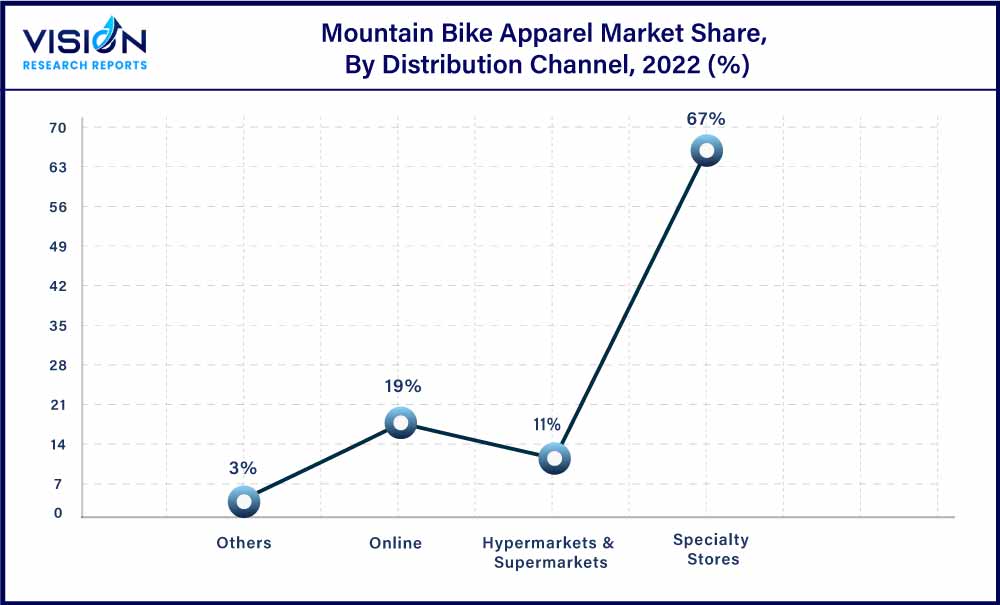

The specialty stores segment accounted for a share of 67% of the global revenue in 2022. Specialty stores are a widespread distribution channel for these products. These stores cater specifically to the needs of outdoor enthusiasts and carry a wide range of products, including mountain biking apparel, accessories, and equipment. Mountain biking apparel brands can benefit from partnering with specialty stores to reach their target audience. However, competition for shelf space can be intense in specialty stores, and brands must be able to differentiate themselves from their competitors and offer high-quality products that meet the needs of outdoor enthusiasts.

In addition, brands may need to work with distributors or have a robust online presence to supplement their in-store sales. The online channel segment is projected to register a CAGR of 6.54% over the forecast period. With the rise of e-commerce, more and more consumers are choosing to shop online, including mountain biking apparel. In addition, brands may need to invest in marketing and advertising to increase their visibility online and drive sales. Online distribution channels offer a variety of benefits for mountain biking apparel brands. These channels allow brands to reach a wider audience and increase sales through the convenience and ease of online shopping.

Regional Insights

Europe held a share of over 37% of the global market in 2022. Cycling tourism is on the rise in Europe as more individuals become health-conscious and seek active vacation options. Mountain bike tourism has gained wide popularity among cycling enthusiasts and adventure seekers in Europe as mountain biking involves varying levels of difficulty and expertise—from beautiful routes to extreme mountain riding activities. The growing participation in mountain biking activities has increased the need for mountain biking apparel, such as jerseys and jackets, waterproof trousers, gloves, and cycling socks in Europe, encouraging specialized merchants and brands to produce apparel and equipment for meeting the needs of mountain bike riders.

Several companies provide a variety of high-quality items specifically developed to offer durability, breathability, and moisture-wicking capabilities. The market in Asia Pacific is anticipated to grow at a CAGR of 5.83% over the forecast period. The Asia Pacific market covers clothing and accessories designed to cater to mountain bikers in the region. This includes cycling shorts, gloves, helmets, shoes, protective gear, and jerseys. Factors, such as location, terrain, weather conditions, energy exertion, and heat generation, are carefully considered by designers to ensure safety and comfort.

One crucial element of the design is the implementation of a layered clothing system that enables the efficient transfer of liquid sweat and water vapor from the body to the surrounding environment. This system comprises base-, mid-, and outer-shell layers, each with unique characteristics that enhance performance, durability, and comfort. Sustainable materials, construction, and garment design principles are also important considerations for apparel manufacturers. Innovation in the Asia Pacific regional market can drive advancements in the industry by incorporating new technologies, fabrics, and materials to enhance performance and sustainability while ensuring apparel’s functionality and comfort.

Mountain Bike Apparel Market Segmentations:

By Product

By Product Price Range

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Mountain Bike Apparel Market

5.1. COVID-19 Landscape: Mountain Bike Apparel Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Mountain Bike Apparel Market, By Product

8.1. Mountain Bike Apparel Market, by Product, 2023-2032

8.1.1 Top Wear

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Bottom Wear

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Accessories

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Mountain Bike Apparel Market, By Product Price Range

9.1. Mountain Bike Apparel Market, by Product Price Range, 2023-2032

9.1.1. Top Wear

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Bottom Wear

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Accessories

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Mountain Bike Apparel Market, By Distribution Channel

10.1. Mountain Bike Apparel Market, by Distribution Channel, 2023-2032

10.1.1. Hypermarkets & Supermarkets

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Specialty Stores

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Online

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Mountain Bike Apparel Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.2. Market Revenue and Forecast, by Product Price Range (2020-2032)

11.1.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Product Price Range (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Product Price Range (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.2. Market Revenue and Forecast, by Product Price Range (2020-2032)

11.2.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Product Price Range (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Product Price Range (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Product Price Range (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Product Price Range (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.2. Market Revenue and Forecast, by Product Price Range (2020-2032)

11.3.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Product Price Range (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Product Price Range (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Product Price Range (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Product Price Range (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.2. Market Revenue and Forecast, by Product Price Range (2020-2032)

11.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Product Price Range (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Product Price Range (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Product Price Range (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Product Price Range (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.2. Market Revenue and Forecast, by Product Price Range (2020-2032)

11.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Product Price Range (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Product Price Range (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 12. Company Profiles

12.1. Patagonia, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Alpinestars

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. LeMans Corporation.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. PEARL iZUMi

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Endura Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Dainese S.p.A

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Giro Sport Design, LLC..

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Louis Garneau Sports

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Scott Sports SA

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Race Face

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others