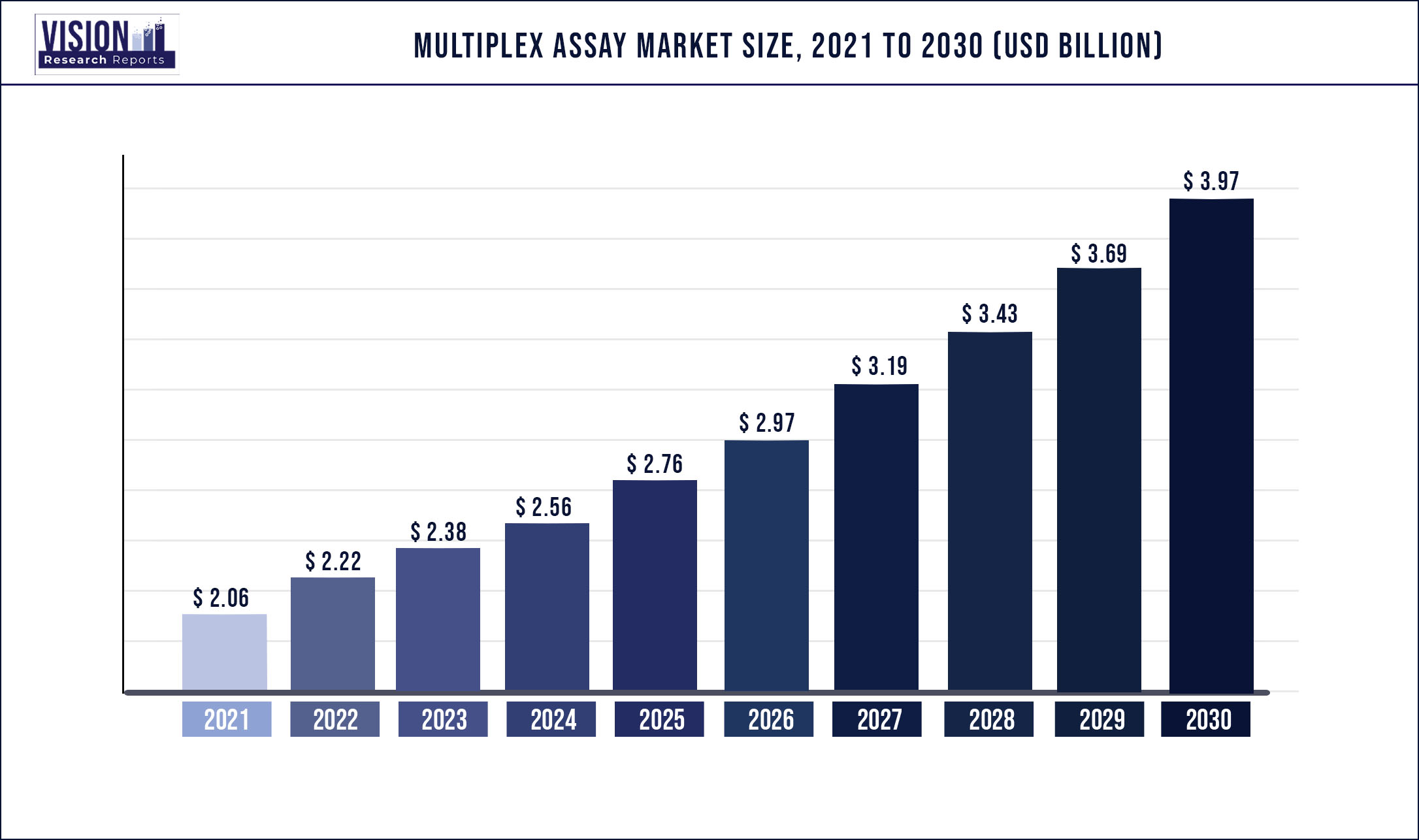

The global multiplex assay market was surpassed at USD 2.06 billion in 2021 and is expected to hit around USD 3.97 billion by 2030, growing at a CAGR of 7.56% from 2022 to 2030.

Report Highlights

The growing prevalence of infectious diseases isboosting the usage of multiplex assays in clinical trials. For instance, according to the American Cancer Society in 2021, 1.9 million cancer cases were reported along with 6,08,570 deaths in the United States. Multiplex assay aids in the diagnosis of cancer and reduces unnecessary invasive producers. Thus, growing chronic diseases can boost the necessity of these assays and is anticipated to fuel market growth. The increasing adoption of personalized medicine in recent years is another key factor driving the growth.

Personalized medicine is a precise medicine for an individual patient to attain improved treatment options based on the body type and disease risk. These assays ensure to be highly beneficial for the comprehensive diagnosis of personalized medicines. For instance, according to an article published in the MDPI journal in 2020, multiplex immunoassay provides a complete picture of the disease and pathways involved in Rheumatoid Arthritis (RA) and simultaneously analyzes multiple proteins that can yield biomarker signatures of RA subtypes to enable patients to benefit from personalized medicine. During the COVID-19 pandemic, multiplex testing continued to be an essential tool for healthcare professionals in effectively managing the spread of COVID-19. In addition, recently, several private companies have also developed novel versions of multiplex assays.

For instance, in Sept 2020, LabCorp launched an at-home collection version for diagnosis of influenza A/B, COVID-19, and respiratory syncytial virus single-panel tests. Furthermore, the advantages of multiplex assay over singleplex and traditional assay can boost the industry growth in coming years. Several benefits offered by these automated tests include microsampling capability, numerous arrays measured in a single trial, quicker results, high operational efficiency, easy operations, and reduced labor expenses. Thus, the industry has witnessed incremental growth in 2021 and is anticipated to have a similar trend during the forecast period. Moreover, increasing validation of the biomarkers in molecular & protein diagnostics and the rising need for high-throughput and automated systems are expected to create lucrative opportunities during the forecast period.

Multiple biomarker analysis has a wide range of applications in the area of infectious diseases, neurodegenerative diseases, autoimmune diseases, and cancer. Numerous biomarkers are being discovered, and there is a high possibility of the development of novel diagnostics. For instance, Cipla launched RT Direct multiplex PCR kit that delivers quicker results for COVID-19. Such developments can increase the market penetration of multiplex assay during the forecast period. The technological advancements and automation in the multiplex assay, improve the efficiency and speed of delivering accurate results. For instance, in July 2020, Luminex provided xMAP INTELLIFLEX system to discover novel applications, including the exclusive ability to detect multiple antibodies in a single serology test.

In May 2022, Vela Diagnostics launched a highly automated multiplex PCR-based test for detecting antimicrobial resistance genes and UTI pathogens. Hence novel technological developments can fuel the industry growth in the near future. However, the high cost of equipment can restrict the usage of multiplex assays by researchers and manufacturers in mid- and low-income countries. Also, the quality control standards and regulations are more stringent for multiplex assay compared to singlex assay, which can impede the industry growth during the forecast period.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 2.06 billion |

| Revenue Forecast by 2030 | USD 3.97 billion |

| Growth rate from 2022 to 2030 | CAGR of 7.56% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, type, technology, application, end-user, region |

| Companies Covered |

Bio-Rad Laboratories, Inc.; Abcam plc.; R&D Systems, Inc.; Merck KGaA; Assay Genie; Promega Connections; QIAGEN N.V.; Thermo Fisher Scientific; Luminex Corp.; Perkin Elmer Inc.; Advanced Cell Diagnostics, Inc.; Seegene Inc. |

Product Insights

On the basis of products, the global industry has been further categorized into consumables, instruments, and software. The consumables product segment dominated the global industry in 2021 and accounted for the largest share of more than 74.5% of the overall revenue. The segment is estimated to expand further at the fastest CAGR retaining its dominant market position throughout the forecast period. The high share and rapid growth of this segment can be attributed to the recurring purchases of consumables along with a rise in the number of diagnostic tests.

In addition, several key players are offering a wide range of consumables with several advantages, such as cost-effectiveness, customization of analytes, and faster delivery time with robust and reliable data. For instance, Bio-Techne Corp., a life science regent manufacturer, offers the most customizable Luminex analyte menu to choose from over 450 analytes along with flexible formats. Such advantages are expected to increase the specificity, precision, and stability to ensure consistent and accurate results, and are expected to broaden the applications of consumables in the market.

Type Insights

The protein multiplex assay segment dominated the global industry in 2021 and accounted for the highest share of more than 52.03% of the overall revenue. This is owing to the increasing focus on proteomics studies for biomarker research and clinical diagnostics. The quest for suitable biomarkers has significantly increased in clinical practice and quantitative measurement of protein is a crucial step in biomarker discovery. Analyzing a huge number of potential protein biomarkers in a statistical number of samples and controls constitutes a major technical obstacle.

Protein multiplex assays offer several advantages regarding the amount of data that can be generated, sample requirement, reagent cost, time, and the amount of data that can be generated. For instance, according to an article published in eCinical Medicine in July 2022, a multiplex protein panel assay was utilized for determining disease severity and prognosis in COVID-19 patients. Thus, increasing applications of protein multiplex assay in proteomics study is anticipated to boost segment growth. The nucleic acid assay is projected to be the fastest-growing segment over the forecast years.

Nucleic acid assay aids in the molecular tests to diagnose human diseases, such as human genetic marker indicative of disease (autoimmune disease and cancer), genetic markers for predisposition to disease, and tests to identify disease-causing pathogens. For instance, according to an article published by the American Chemical Society in September 2021, a nucleic acid assay based on lanthanide nanoparticles was used in the diagnosis of SARS-CoV-2to achieve fast screening with high accuracy. Hence, the increasing prevalence of chronic and infectious diseases is expected to widen the nucleic acid multiplex assay application in disease diagnosis and drive segment growth during the forecast period.

Technology Insights

The flow cytometry technology segment dominated the global industry in 2021 and accounted for the maximum share of more than 34.81% of the overall revenue. Flow cytometry has become an indispensable tool for basic research and clinical diagnostics. It provides information-rich multiparametric analysis for thousands of single cells per second. In addition, technological advancements and the launch of novel flow cytometers by various companies are contributing to the industry's growth. For instance, in June 2021, Thermo Fisher Scientific Inc. launched an innovative flow cytometer with imaging ability that enables users to collect data and better understand the quality and morphology of the cells in these assays.

The multiplex real-time PCR segment is expected to witness the fastest growth rate during the forecast years. Multiplex real-time PCR is a modified version of conventional PCR, it amplifies several target sequences using various sets of primers in a single PCR mixture. It controls internal amplification to enhance the accuracy of the negative PCR results. In addition, this technology enables the detection of various pathogens in a single reaction, even if they are from taxonomically different groups. These advantages are anticipated to increase its application in clinical diagnostics and can boost industry growth during the forecast period.

End-user Insights

The pharmaceutical and biotechnology companies segment dominated the global industry in 2021 and accounted for the highest share of more than 40.71% of the overall revenue. This is due to the rising pharma & biotech partnerships and collaborations to increase multiplexing capabilities. For instance, in August 2022, Becton, Dickinson and Company, and Labcorp collaborated to develop flow cytometry-based companion diagnostics for providing patients with efficient treatment options.Flow cytometry technology can help in multiplexing and offers high-sensitivity capabilities in the CDx landscape. Thus, partnerships are enhancing the growth prospects of multiplex assays and can boost industry growth.

The hospitals and diagnostic laboratories segment is likely to register the fastest CAGR during the forecast period owing tothe growing demand for rapid and accurate diagnosis for numerous chronic diseases.Multiplex assay offers quick results for multiple biomolecule targets in a single run and makes it a superior choice for disease identification in patients.For instance, according to the CDC, 9.3 to 45 million are infected by influenza annually, with 140,000 – 810,000 hospitalizations, and 12,000 – 61,000 deaths. For patients with multiple symptoms associated with respiratory viral infections, multiplex assay not only detects the influenza virus but also identifies other pathogens at once to provide a more comprehensive clinical diagnosis.

Application Insights

The research and development application segment dominated the global industry in 2021 and accounted for the maximum share of more than 52.66% of the overall revenue. The demand for multiplex assay is steadily increasing in drug discovery. These assays are used in clinical and preclinical stages to evaluate toxicity, immunotherapy success, and drug response biomarkers. In addition, biomarker discovery and validation are important in the current era for healthcare professionals to improve disease diagnosis, and cancer detection at initial stages, and monitor therapeutic responses. The validation of the marker candidate is required in each stage of the biomarker pipeline to reach its clinical utility.

Such applications of multiplex assay in R&D are expected to fuel segment growth. The clinical diagnostics segment is estimated to witness the fastest growth rate from 2022 to 2030 owing to the increasing prevalence of chronic diseases, such as infectious diseases, cancer, autoimmune diseases, and Cardiovascular Diseases (CVDs) For instance, according to the CDC, 3.4 million patients require a diagnosis for infectious and parasitic diseases in the emergency department. According to a 2022 report bythe CDC, in the U.S., one person dies every 34 seconds due to CVD. Multiplex assay helps in the identification of various biomarkers for CVD in a single sample and provides accurate, reproducible, simultaneous measurement of 39 CVD biomarkers in tissue culture samples plasma and serum.

Regional Insights

North America dominated the global industry in 2021 and accounted for the highest share of more than 37.11% of the overall revenue due to the growing R&D activities for the development of novel drugs and diagnosis & treatment options. The increasing incidence of chronic conditions, such as stroke & cancer, and the rising government funding for the detection of new biomarkers are anticipated to drive the region’s growth. In addition, the presence of key players in the region is likely to fuel the growth. Asia Pacific, on the other hand, is anticipated to register the fastest growth rate during the forecast years.

This is due to the rising number of hospitals in emerging countries, the developing R&D sector, the high demand for healthcare infrastructure, and investments by emerging players in the region. For instance, in November 2021, QuantuMDx received an investment of USD 10.9 million from Vita Spring and entered into a corporation agreement with Sansure Biotech to develop multiplexing capabilities in China. The rising prevalence of cancer is due to tobacco consumption.For instance, currently, half the world’s tobacco grown is consumed by people in the Asia Pacific region. As a result, there is a gradual rise in the number of people undergoing screenings in the region, which is anticipated to boost themarket growth in the near future.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Multiplex Assay Market

5.1. COVID-19 Landscape: Multiplex Assay Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Multiplex Assay Market, By Product

8.1. Multiplex Assay Market, by Product, 2022-2030

8.1.1. Consumables

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Instruments

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Software

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Multiplex Assay Market, By Type

9.1. Multiplex Assay Market, by Type, 2022-2030

9.1.1. Protein Multiplex Assays

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Nucleic Acid Multiplex Assays

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Cell-based Multiplex Assays

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Multiplex Assay Market, By Technology

10.1. Multiplex Assay Market, by Technology, 2022-2030

10.1.1. Flow Cytometry

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Fluorescence Detection

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Luminescence

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Multiplex Real-time PCR

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Other Technologies

10.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Multiplex Assay Market, By Application

11.1. Multiplex Assay Market, by Application, 2022-2030

11.1.1. Research & Development

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Clinical Diagnostics

11.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Multiplex Assay Market, By End-user

12.1. Multiplex Assay Market, by End-user, 2022-2030

12.1.1. Pharmaceutical & Biotechnology Companies

12.1.1.1. Market Revenue and Forecast (2017-2030)

12.1.2. Hospitals & Diagnostic laboratories

12.1.2.1. Market Revenue and Forecast (2017-2030)

12.1.3. Research & Academic Institutes

12.1.3.1. Market Revenue and Forecast (2017-2030)

12.1.4. Other End-users

12.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 13. Global Multiplex Assay Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Product (2017-2030)

13.1.2. Market Revenue and Forecast, by Type (2017-2030)

13.1.3. Market Revenue and Forecast, by Technology (2017-2030)

13.1.4. Market Revenue and Forecast, by Application (2017-2030)

13.1.5. Market Revenue and Forecast, by End-user (2017-2030)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Product (2017-2030)

13.1.6.2. Market Revenue and Forecast, by Type (2017-2030)

13.1.6.3. Market Revenue and Forecast, by Technology (2017-2030)

13.1.6.4. Market Revenue and Forecast, by Application (2017-2030)

13.1.7. Market Revenue and Forecast, by End-user (2017-2030)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Product (2017-2030)

13.1.8.2. Market Revenue and Forecast, by Type (2017-2030)

13.1.8.3. Market Revenue and Forecast, by Technology (2017-2030)

13.1.8.4. Market Revenue and Forecast, by Application (2017-2030)

13.1.8.5. Market Revenue and Forecast, by End-user (2017-2030)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Product (2017-2030)

13.2.2. Market Revenue and Forecast, by Type (2017-2030)

13.2.3. Market Revenue and Forecast, by Technology (2017-2030)

13.2.4. Market Revenue and Forecast, by Application (2017-2030)

13.2.5. Market Revenue and Forecast, by End-user (2017-2030)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

13.2.6.2. Market Revenue and Forecast, by Type (2017-2030)

13.2.6.3. Market Revenue and Forecast, by Technology (2017-2030)

13.2.7. Market Revenue and Forecast, by Application (2017-2030)

13.2.8. Market Revenue and Forecast, by End-user (2017-2030)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Product (2017-2030)

13.2.9.2. Market Revenue and Forecast, by Type (2017-2030)

13.2.9.3. Market Revenue and Forecast, by Technology (2017-2030)

13.2.10. Market Revenue and Forecast, by Application (2017-2030)

13.2.11. Market Revenue and Forecast, by End-user (2017-2030)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Product (2017-2030)

13.2.12.2. Market Revenue and Forecast, by Type (2017-2030)

13.2.12.3. Market Revenue and Forecast, by Technology (2017-2030)

13.2.12.4. Market Revenue and Forecast, by Application (2017-2030)

13.2.13. Market Revenue and Forecast, by End-user (2017-2030)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Product (2017-2030)

13.2.14.2. Market Revenue and Forecast, by Type (2017-2030)

13.2.14.3. Market Revenue and Forecast, by Technology (2017-2030)

13.2.14.4. Market Revenue and Forecast, by Application (2017-2030)

13.2.15. Market Revenue and Forecast, by End-user (2017-2030)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Product (2017-2030)

13.3.2. Market Revenue and Forecast, by Type (2017-2030)

13.3.3. Market Revenue and Forecast, by Technology (2017-2030)

13.3.4. Market Revenue and Forecast, by Application (2017-2030)

13.3.5. Market Revenue and Forecast, by End-user (2017-2030)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

13.3.6.2. Market Revenue and Forecast, by Type (2017-2030)

13.3.6.3. Market Revenue and Forecast, by Technology (2017-2030)

13.3.6.4. Market Revenue and Forecast, by Application (2017-2030)

13.3.7. Market Revenue and Forecast, by End-user (2017-2030)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Product (2017-2030)

13.3.8.2. Market Revenue and Forecast, by Type (2017-2030)

13.3.8.3. Market Revenue and Forecast, by Technology (2017-2030)

13.3.8.4. Market Revenue and Forecast, by Application (2017-2030)

13.3.9. Market Revenue and Forecast, by End-user (2017-2030)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Product (2017-2030)

13.3.10.2. Market Revenue and Forecast, by Type (2017-2030)

13.3.10.3. Market Revenue and Forecast, by Technology (2017-2030)

13.3.10.4. Market Revenue and Forecast, by Application (2017-2030)

13.3.10.5. Market Revenue and Forecast, by End-user (2017-2030)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Product (2017-2030)

13.3.11.2. Market Revenue and Forecast, by Type (2017-2030)

13.3.11.3. Market Revenue and Forecast, by Technology (2017-2030)

13.3.11.4. Market Revenue and Forecast, by Application (2017-2030)

13.3.11.5. Market Revenue and Forecast, by End-user (2017-2030)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Product (2017-2030)

13.4.2. Market Revenue and Forecast, by Type (2017-2030)

13.4.3. Market Revenue and Forecast, by Technology (2017-2030)

13.4.4. Market Revenue and Forecast, by Application (2017-2030)

13.4.5. Market Revenue and Forecast, by End-user (2017-2030)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

13.4.6.2. Market Revenue and Forecast, by Type (2017-2030)

13.4.6.3. Market Revenue and Forecast, by Technology (2017-2030)

13.4.6.4. Market Revenue and Forecast, by Application (2017-2030)

13.4.7. Market Revenue and Forecast, by End-user (2017-2030)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Product (2017-2030)

13.4.8.2. Market Revenue and Forecast, by Type (2017-2030)

13.4.8.3. Market Revenue and Forecast, by Technology (2017-2030)

13.4.8.4. Market Revenue and Forecast, by Application (2017-2030)

13.4.9. Market Revenue and Forecast, by End-user (2017-2030)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Product (2017-2030)

13.4.10.2. Market Revenue and Forecast, by Type (2017-2030)

13.4.10.3. Market Revenue and Forecast, by Technology (2017-2030)

13.4.10.4. Market Revenue and Forecast, by Application (2017-2030)

13.4.10.5. Market Revenue and Forecast, by End-user (2017-2030)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Product (2017-2030)

13.4.11.2. Market Revenue and Forecast, by Type (2017-2030)

13.4.11.3. Market Revenue and Forecast, by Technology (2017-2030)

13.4.11.4. Market Revenue and Forecast, by Application (2017-2030)

13.4.11.5. Market Revenue and Forecast, by End-user (2017-2030)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Product (2017-2030)

13.5.2. Market Revenue and Forecast, by Type (2017-2030)

13.5.3. Market Revenue and Forecast, by Technology (2017-2030)

13.5.4. Market Revenue and Forecast, by Application (2017-2030)

13.5.5. Market Revenue and Forecast, by End-user (2017-2030)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Product (2017-2030)

13.5.6.2. Market Revenue and Forecast, by Type (2017-2030)

13.5.6.3. Market Revenue and Forecast, by Technology (2017-2030)

13.5.6.4. Market Revenue and Forecast, by Application (2017-2030)

13.5.7. Market Revenue and Forecast, by End-user (2017-2030)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Product (2017-2030)

13.5.8.2. Market Revenue and Forecast, by Type (2017-2030)

13.5.8.3. Market Revenue and Forecast, by Technology (2017-2030)

13.5.8.4. Market Revenue and Forecast, by Application (2017-2030)

13.5.8.5. Market Revenue and Forecast, by End-user (2017-2030)

Chapter 14. Company Profiles

14.1. Luminex Corp.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Bio-Rad Laboratories, Inc.

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Abcam plc.

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Seegene Inc.

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Merck KGaA

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Assay Genie

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Promega Connections

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. QIAGEN N.V.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Thermo Fisher Scientific

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Perkin Elmer Inc.

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others