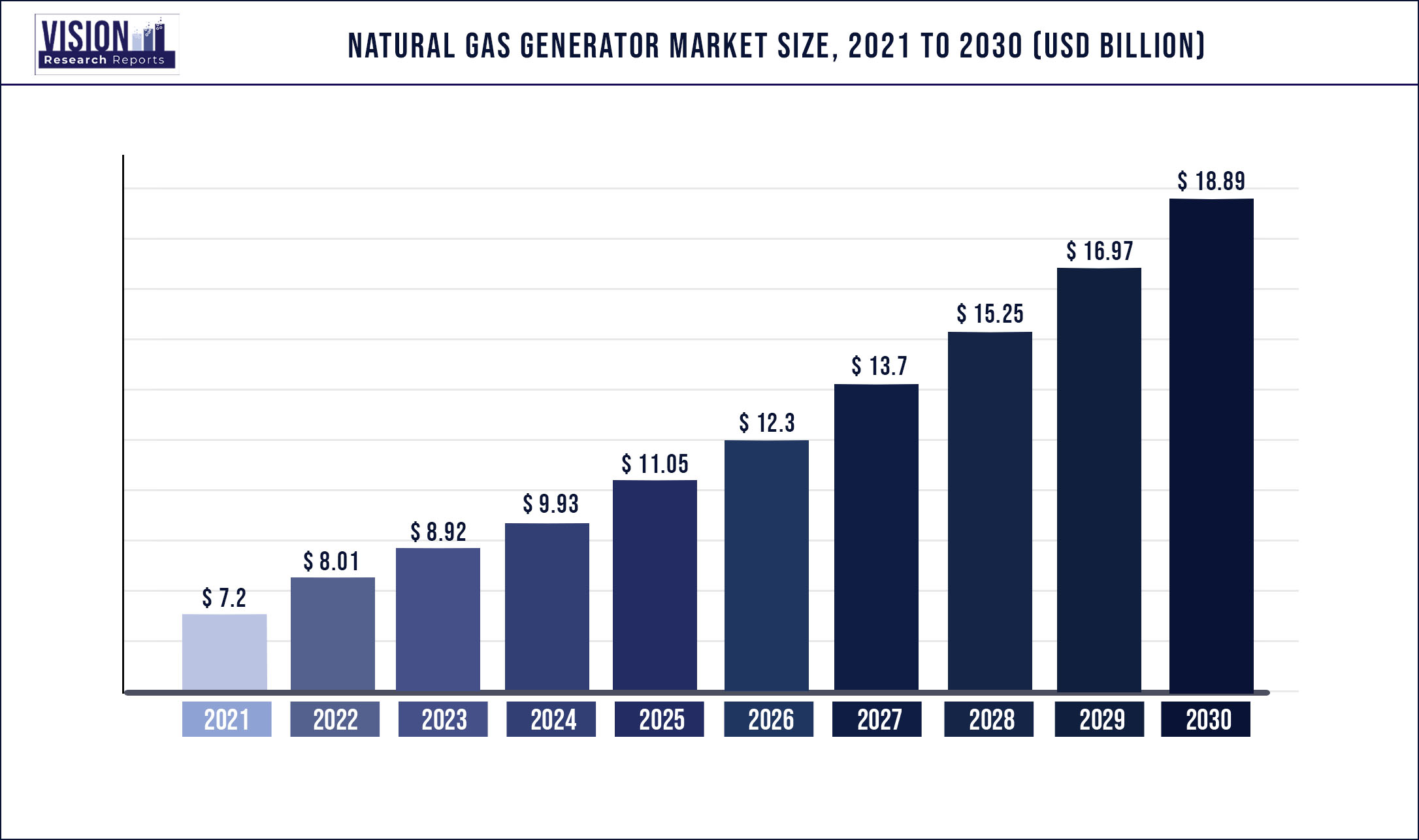

The global natural gas generator market was surpassed at USD 7.2 billion in 2021 and is expected to hit around USD 18.89 billion by 2030, growing at a CAGR of 11.31% from 2022 to 2030

Report Highlights

Growing demand for backup power coupled with increasing government regulation to reduce the carbon emission caused by diesel genset is likely to strengthen the growth of the market during the forecast period.

The global electricity demand is anticipated to witness an increase of nearly two-thirds of the current demand during the forecast period. The current availability of natural gas in large quantities and its relatively lower prices, especially in regions, such as North America and Europe, has led to an increase in power generation using natural gas. Increasing focus on electricity generation through cleaner sources and environmental concerns arising from diesel gensets are the factors anticipated to increase the share of natural gas generators set in the coming years.

Conventional gensets, such as diesel gensets, emit harmful gases, including nitrogen oxide, hydrocarbons, and carbon monoxide, due to the combustion of diesel. As a result, different regulatory bodies have imposed strict regulations and thus making it difficult for diesel generators to be used. This has led to the growth of eco-friendly alternatives to diesel gensets, such as natural gas gensets.

Emerging economies in the Asia-Pacific region, such as India, China, Japan, and others, have witnessed strong growth in their commercial sectors. The growth of demand for natural gensets over diesel gensets for backup power applications is owing to the increasingly stringent government regulations to curb greenhouse gas emissions caused by diesel gensets.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 7.2 billion |

| Revenue Forecast by 2030 | USD 18.89 billion |

| Growth rate from 2022 to 2030 | CAGR of 11.31% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Power rating, application, region |

| Companies Covered | Caterpillar Inc., Cummins Inc., Generac Power System, Mitsubishi Heavy Industries, Ltd., Kohler Co., Inc., General Electric, MTU-onsite Energy GMBH, Mahindra Powerol, Yanmar Co., Ltd., Coopercorp Generators |

Power Rating Insights

The low power genset segment was valued at USD 3.21 billion in 2021. Low power gensets are popular for residential and commercial power backup applications. Nowadays, people use various electrical appliances in their homes, such as geysers, water pumps, AC units, water purifiers, and others. These appliances require more power to function as in the case of washing machines, which might consume 750 watts but need about 2500 watts to start. As a result, many households choose to have only an 80 KW generator set as a standby power source.

The medium power genset segment accounted for the second-largest market share in 2021 and is anticipated to expand at the highest CAGR during the forecast period. Increasing demand for medium power gensets from emerging economies, such as China, India, and Brazil, for backup power systems, which use clean fuel for commercial and industrial applications, is a major driver for medium power gensets. 350 KW and above rating genset can power heavy machines and large equipment.

Rapid industrialization in emerging economies, including India, China, and Brazil, is expected to drive the demand for medium and high power gensets.High power gensets are majorly installed in large manufacturing facilities, power plants, and in the marine industry, where a continuous power supply is crucial. Moreover, they are also installed in a remote location for power generation and distribution where there is no grid connection.

Application insights

Based on the application of natural gas gensets, the market is segmented into residential, commercial, and industrial segments. The commercial segment was estimated as the largest natural gas generator market globally, with an estimated value of USD 3,224.7 million in 2021. The commercial segment is projected to expand at the highest CAGR of 12.34% during the forecast period, owing to the growing demand for cleaner and greener fuel-fired gensets for commercial applications.

Developing economies in Asia Pacific have witnessed strong growth in their commercial sectors. IT, telecom, and retail are some of the major sectors that are growing rapidly in developing countries in Asia Pacific, resulting in high demand for natural gas gensets as they are crucial for backup power in these facilities.

Hospitals and medical institutes are the main contributors to the commercial segment of the natural gas generator market. Medical facilities, along with the communities they support, depend heavily on emergency generator sets for critical power. The growing demand for gensets from healthcare facilities is expected to drive the demand for natural gas gensets for commercial applications during the forecast period.

Regional insights

The market in North America was valued at USD 2,181.96 million in 2021, wherein the U.S. was the major contributor to the natural gas generator market in the region. The presence of prominent gas genset OEMs and EPC players, large shale gas reserves, and developed infrastructure for transportation of natural gas has emerged as the primary driving factors for the North America natural gas generator set market. The U.S. accounted for the largest share in 2021 and is anticipated to progress at the fastest growth rate in North America during the forecast period, owing to various factors such as the presence of shale gas reserves and increasing government focus on developing clean energy sources.

Asia Pacific is estimated to be the fastest-growing region with a CAGR of 14.16% during the forecast period. Asia Pacific market is driven by the need for efficient backup power systems. The high growth of the industrial sector in China, India, Japan, and South Korea has triggered the demand for industrial generator sets in the region.

Furthermore, in India, government initiatives are encouraging industrial establishments in the country, which is anticipated to drive the demand for gas generator sets for industrial applications during the forecast period. The generator set industry in India is inclined toward diesel as a raw material. However, governmental regulations to curb carbon emissions caused by the burning of diesel coupled with the shifting focus of the government toward the use of cleaner sources for power generation are expected to drive the demand for natural gas gensets during the forecast period.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Natural Gas Generator Market

5.1. COVID-19 Landscape: Natural Gas Generator Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Natural Gas Generator Market, By Power Rating

8.1. Natural Gas Generator Market, by Power Rating, 2022-2030

8.1.1. Low Power Genset

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Medium Power Genset

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. High Power Genset

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Natural Gas Generator Market, By Application

9.1. Natural Gas Generator Market, by Application, 2022-2030

9.1.1. Industrial

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Commercial

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Residential

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Natural Gas Generator Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Power Rating (2017-2030)

10.1.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Power Rating (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Power Rating (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Power Rating (2017-2030)

10.2.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Power Rating (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Power Rating (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Power Rating (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Power Rating (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Power Rating (2017-2030)

10.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Power Rating (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Power Rating (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Power Rating (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Power Rating (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Power Rating (2017-2030)

10.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Power Rating (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Power Rating (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Power Rating (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Power Rating (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Power Rating (2017-2030)

10.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Power Rating (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Power Rating (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 11. Company Profiles

11.1. Caterpillar Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Cummins Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Generac Power System

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Mitsubishi Heavy Industries, Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Kohler Co., Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. General Electric

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. MTU-onsite Energy GMBH

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Mahindra Powerol

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Yanmar Co., Ltd.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Coopercorp Generators

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others