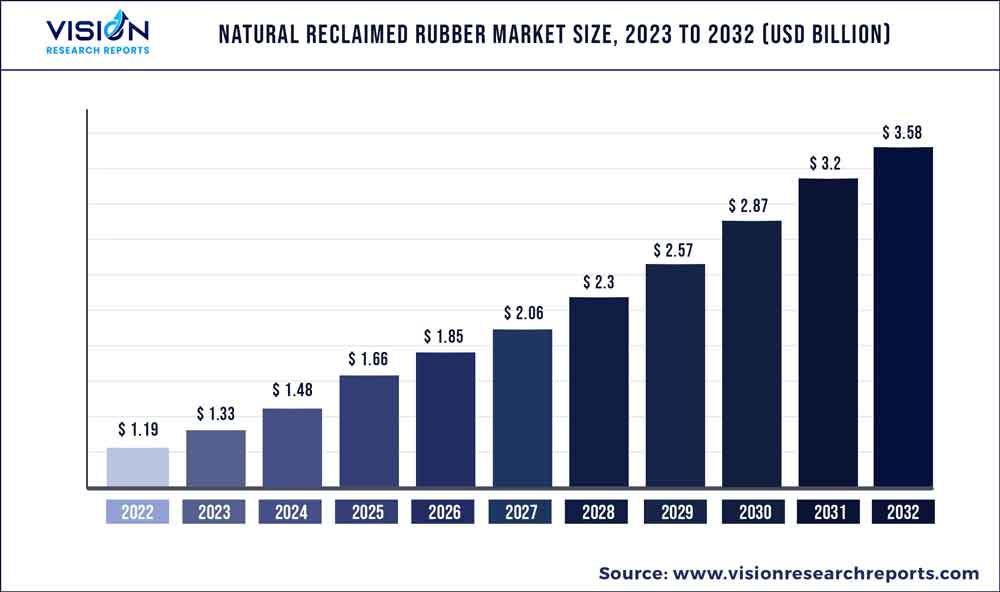

The global natural reclaimed rubber market was estimated at USD 1.19 billion in 2022 and it is expected to surpass around USD 3.58 billion by 2032, poised to grow at a CAGR of 11.63% from 2023 to 2032. The natural reclaimed rubber market in the United States was accounted for USD 90.7 million in 2022.

Key Pointers

Report Scope of the Natural Reclaimed Rubber Market

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2022 | 52.03% |

| Revenue Forecast by 2032 | USD 3.58 billion |

| Growth Rate from 2023 to 2032 | CAGR of 11.63% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | GRP LTD.; HUXAR; SRI Impex Pvt. Ltd.; Swani Rubber; Star Polymers Inc.; Valencia Rubber Tech LLP; SNR Reclamations Pvt. Ltd.; Minar Reclaimation Private Limited; Tianyu (Shandong) Rubber & Plastic Products Co., Ltd.; High Tech Reclaim Pvt. Ltd. |

The increased demand for natural reclaimed rubber from end-use industries including automotive & aircraft tires, footwear, belts and hoses, and retreading is driving market growth during the forecast period. Natural reclaimed rubber from full tire scrap, tread peelings, and natural rubber tubes are used for various tire and rubber goods applications. Furthermore, reclaimed rubber has several advantages, including precise dosage, ease of administration, and a lower risk of contamination.The rising per capita income will accelerate the growth rate of the recovered rubber sector. Furthermore, the rising vehicle industry is boosting interest in recycled rubber due to its attributes such as heat and strong light resistance, which will further drive market value growth.

The U.S dominated the market for natural reclaimed rubber in 2022 and accounted for over 47% of the market share, in terms of revenue. The rising demand for the product from several end-use industries, including automotive, aerospace, footwear, consumer goods, and others is anticipated to boost the concrete crack injection resin market in the region.

Rising consumer awareness of cost-effective and environmentally friendly alternatives to virgin rubber creates profitable opportunities for market participants during the forecast period. Hence, the rising demand for natural reclaimed rubber will drive future growth in the natural reclaimed rubber industry.

Furthermore, the growing usage of natural reclaimed rubber in the production of textile and consumer goods products, along with increased aspiration-based purchasing, are driving up product demand. Rising demand for whole tire reclaim (WTR) is likely to boost the market growth throughout the forecast period.

Product Type

Natural Tube Reclaim dominated the product segment in the market accounting for more than 46.03% of the total market share, in terms of revenue, in 2022. The rapid expansion rate of the automotive sector, along with expanding product use in the manufacturing of hoses, belts, and tires, will fuel the growth rate of the natural tube reclaimed rubber industry in the coming years.

The market is growing as ultra-high and high tensile natural reclaim is chosen in the automotive industry due to properties such as abrasion and temperature resistance. Furthermore, the increasing substitution of automotive tires, the increasing demand for durable rubber, the growing production scale of rubber manufacturers and their capital investment, and the proliferation of the automotive industry is expected to propel the market over the forecast period.

End-Use Insights

Automotive & aircraft tires dominated the market for natural reclaimed rubber and accounted for more than 61.04% of the total market share, in terms of revenue, in 2022. Increased natural rubber prices and technological advancements in rubber blends have increased the use of reclaimed rubber in tire and non-tire automobile applications.

Moreover, the rising international logistics sector and passenger travel as a result of regional and country-level travel limitations have boosted demand for airplane tires. Aircraft tires are made of conductive elastomer (natural rubber) and are subjected to extreme temperatures. They are augmented with strong and flexible materials like Kevlar to absorb more of the landing shock and support the natural rubber. Natural rubber has excellent abrasion resistance, tear resistance, and green strength and tack, allowing it to adhere to other materials.

In addition,the usage of natural reclaimed rubber in the manufacture of extruded items such as pump discharge hoses and drain tubes is further driving the market. Product demand is increasing due to the several uses of reclaimed rubber in the production of footwear, along with the rising aspiration-based purchasing, resulting in the growth of natural reclaimed rubber in the footwear and consumer goods industries.

Region Insights

Asia Pacific dominated the market and accounted for more than 52.03% share of regional revenue in 2022. The market is primarily driven owing to the notable rubber tire production in these countries. Furthermore, due to rising disposable income among the middle-class population and technology transfer from emerging markets, and the rapid growth in automotive production in China and India are expected to drive demand for natural reclaimed rubber in production of tires, and thus positively impacting the market for natural reclaimed rubber.

Europe is expected to grow at a significant rate in the coming years owing torising auto interest along with increased vehicle spending.The ban on landfills in the EU, as well as other favorable legal frameworks given by governments to encourage and assist recycling, have boosted product demand in developed countries, including France and Germany.

Due to the use of tires in the automobile industry in the region is likely to create demand for ultra-high and high tensile natural reclaim rubber in North America. Natural reclaimed rubber is widely used in the automotive, aviation, transportation, logistics, and shipping industries. The aforementioned factors are expected to expand the market during the forecast period.

Moreover, the increasing adoption of manufacturers for natural rubber is likely to fuel market growth in emerging economies, including Brazil, Argentina, and South Africa over the forecast period. Furthermore, increased demand for rubber in footwear and other molded goods is likely to fuel the market in the region.

Natural Reclaimed Rubber Market Segmentations:

By Product

By End-Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Natural Reclaimed Rubber Market

5.1. COVID-19 Landscape: Natural Reclaimed Rubber Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Natural Reclaimed Rubber Market, By Product

8.1. Natural Reclaimed Rubber Market, by Product, 2023-2032

8.1.1. High Tensile Natural Reclaim

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Ultra-High And High Tensile Natural Reclaim

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Natural Tube Reclaim

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Natural Reclaimed Rubber Market, By End-Use

9.1. Natural Reclaimed Rubber Market, by End-Use, 2023-2032

9.1.1. Automotive & Aircraft Tires

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Retreading

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Belts & Hoses

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Footwear

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Molded Rubber Goods

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Natural Reclaimed Rubber Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.3.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.4.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.3.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.4.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.5.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.6.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.3.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.4.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.5.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.6.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.3.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.4.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.5.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.6.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.3.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.4.2. Market Revenue and Forecast, by End-Use (2020-2032)

Chapter 11. Company Profiles

11.1. GRP LTD.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. HUXAR

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. SRI Impex Pvt. Ltd.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Swani Rubber

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Star Polymers Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Valencia Rubber Tech LLP

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. SNR Reclamations Pvt. Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Minar Reclaimation Private Limited

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Tianyu (Shandong) Rubber & Plastic Products Co., Ltd.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. High Tech Reclaim Pvt. Ltd.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others