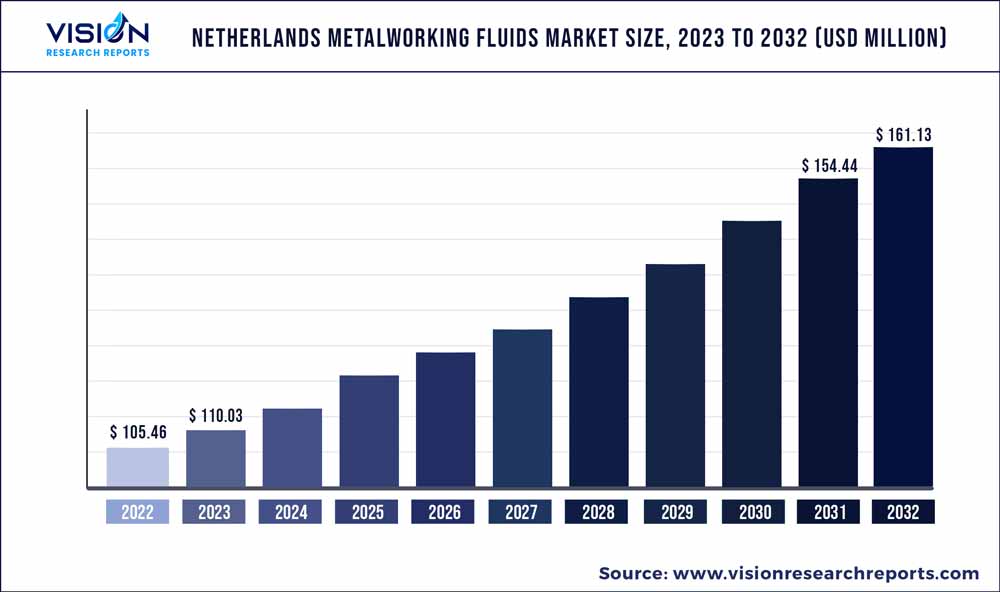

The Netherlands metalworking fluids market was valued at USD 105.46 million in 2022 and it is predicted to surpass around USD 161.13 million by 2032 with a CAGR of 4.33% from 2023 to 2032.

Key Pointers

Report Scope of the Netherlands Metalworking Fluids Market

| Report Coverage | Details |

| Market Size in 2022 | USD 105.46 million |

| Revenue Forecast by 2032 | USD 161.13 million |

| Growth rate from 2023 to 2032 | CAGR of 4.33% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | VALVOLINE; ExxonMobil Corporation; FUCHS; Perstorp; CIMCOOL EUROPE; Motul; Aimol; Quaker Chemical Corporation; Matrix Specialty Lubricants; Kuwait Petroleum |

The increasing application of these products in various application industries such as metalworking, metal fabrication, industrial equipment manufacturing, and manufacturing transportation equipment is projected to have a positive impact on the growth. Key players include VALVOLINE, ExxonMobil Corporation, Perstorp, Kuwait Corporation, Matrix Specialty Lubricants, CIMCOOL EUROPE, FUCHS, Motul, and Quaker Chemical Corporation, among others. These companies are involved in rapid research & development, product portfolio enhancement, geographical expansion, partnerships, and mergers & acquisitions to gain a competitive edge in the market space.

According to the Centers for Disease Control and Prevention (CDC), metalworking fluids (MWFs) are employed in industrial machining and grinding operations to decrease heat and friction while also eliminating metal particles. Furthermore, according to Canadian Center for Occupational Health and Safety (CCOHS), these lubricants encompass various oils and liquids utilized for cooling and lubricating metal workpieces during machining, grinding, milling, and similar processes.

These oils serve to diminish heat and friction between the cutting tool and the workpiece, thereby preventing burning and smoking. In addition, MWFs aid in enhancing the equipment’s quality by effectively eliminating fines, chips, and swarfs (swarfs refer to the tiny metal pieces removed from a workpiece by a cutting tool) from both the tool and the surface of the workpiece.

They are employed in various applications, including metal fabrication and metalworking activities. According to Atradius N.V., despite contributing only around 1% to the Dutch GDP, the steel and metals sector holds significant importance as a primary provider for the construction, automotive, and machinery industries. The success of the sector relies heavily on the performance of the domestic construction sector.

In addition, there are multiple companies engaged in metalworking and fabrication activities such as HVL Metaal & Techniek, Machinefabriek Geurtsen, VDS Rotterdam B.V., GB Steel Group, and Sheet Metal Connect, among others. To sum up, the presence of such large-scale metal fabricators and companies in the Netherlands may have a positive impact on the metalworking fluids market as it paves the way for increasing penetration of the product in multiple end-use industries.

According to UNIL, metalworking fluids consist of either pure oils, water, or oil-based products, each possessing its unique properties and components. Different types of products exhibit varying characteristics and compositions. These oils encompass a range of 10 to 30 different ingredients. It is worth noting that certain formulations may include irritating substances or allergens. Broadly, the raw materials used can be classified under three sections: base oils, emulsifiers, and additives.

Product Insights

Mineral-based products dominated the market with a revenue share of 43% in 2022. This is attributable to the wide range of benefits offered by the product such as their lubricating, cooling, and protective properties that make them ideal for numerous application areas. In addition, one of the key advantages of mineral oil-based products is their cost efficiency. They are considered one of the most economical options in terms of production cost. This cost-effectiveness makes them particularly attractive to small- and medium-scale producers who are conscious of their budget constraints.

Synthetic-based products are an important category of oils used in various metalworking processes. These fluids, specially formulated from synthetic base oils, offer distinct advantages over other types of metalworking fluids. Synthetic-based metalworking fluids are known for their superior performance compared to mineral oil-based fluids. They offer excellent lubrication properties, reducing friction and wear between the cutting tool and workpiece. This results in improved tool life, better surface finish, and increased machining accuracy.

Bio-based metalworking fluids refer to fluids used in metalworking processes that are derived from renewable sources such as vegetable oils, esters, or other bio-based compounds. These fluids offer a more sustainable and environmentally friendly alternative to traditional metalworking fluids. As a result, governments and regulatory bodies worldwide are promoting the use of bio-based products including metalworking fluids.

Application Insights

Neat cutting oils application dominated the market with a revenue share of 47% in 2022. This is attributable to the increasing usage of such oils due to their ability to reduce friction between the cutting tool and workpiece, minimizing tool wear and extending tool life. Furthermore, these oils have excellent cooling properties, dissipating heat generated by the cutting process.

Water-based cutting fluids are primarily composed of water, with various additives and chemicals incorporated to enhance their performance. These additives can include lubricants, corrosion inhibitors, biocides, emulsifiers, and pH stabilizers. According to HAI LU JYA HE CO., as of 2023, water-based cutting oils are widely preferred as cutting fluids due to their significant role in machining and grinding processes, offering numerous advantages.

Corrosion preventive oils, also known as rust preventive oils or anti-corrosion oils, are specialized lubricants designed to protect metal surfaces from corrosion. These oils form a thin, protective film on the metal surface, acting as a barrier against moisture, oxygen, and other corrosive elements. They are commonly used in various industries, including automotive, manufacturing, and transportation, to prevent rust and corrosion on metal parts and components.

End-use Insights

Machinery end-use dominated the market with a revenue share of 40% in 2022. This is attributable to the rising usage of metalworking fluids in various heavy industrial machinery such as mining equipment, manufacturing machines, and industrial equipment, devices, and parts.

Metalworking fluids are extensively used in metal fabrication processes to enhance performance, improve efficiency, and prolong tool life. MWFs are designed for use in cutting, grinding, drilling, milling, and turning operations. They provide several functions that contribute to the overall metalworking process. These attributes contribute to their widespread adoption in the metalworking industry in recent years. Moreover, the increasing demand for metal fabrication is expected to be propelled by the expansion of the construction, electrical & power, and agriculture industries. Given the intricacy involved in manufacturing diverse components, the utilization of metalworking fluids becomes necessary.

Metalworking fluids (MWFs) play a crucial role in the production of transportation equipment such as automobiles, aircraft, ships, and trains. They are used in various manufacturing processes throughout the production cycle. MWFs are extensively used in machining operations like milling, turning, drilling, and grinding during the fabrication of transportation equipment components. They provide lubrication to reduce friction and heat generation, improving tool life and surface finish. MWFs also aid in chip evacuation, ensuring efficient and clean cutting.

Industrial End-use Insights

Electric & power industrial end-use dominated the market with a revenue share of 26% in 2022. This is attributable to the rising applications of various critical metals to generate electricity. This in turn, is expected to boost the demand for metalworking fluids for the maintenance and production of such metal equipment that generates renewable as well as traditional electricity through heavy equipment like generators, alternators, and capacitors.

The demand for construction equipment is expected to showcase growth over the forecast period. This is because of the increase in spending from the government on public infrastructure through the National Growth Fund. The Netherlands construction equipment market is anticipated to receive a boost from the government's initiatives to stimulate investments in the development of public infrastructure. To sum up, the growth in the construction sector due to the rise in government investments in the sector coupled with increasing demand for construction equipment is anticipated to have a positive impact on the metalworking fluids market in the Netherlands.

The aviation industry imposes rigorous standards on components, necessitating precision, advanced technology, stability, and weight reduction. These demanding requirements extend to the production of parts, encompassing materials like aluminum, titanium, and composites, as well as the machinery and tools involved in machining processes. Maintaining a smooth manufacturing process is of utmost importance. As a result, there emerges a need for specially developed and approved metal working fluids (MWF) for the machining of aviation components.

Netherlands Metalworking Fluids Market Segmentations:

By Product

By Application

By End-use

By Industrial End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Netherlands Metalworking Fluids Market

5.1. COVID-19 Landscape: Netherlands Metalworking Fluids Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Netherlands Metalworking Fluids Market, By Product

8.1. Netherlands Metalworking Fluids Market, by Product, 2023-2032

8.1.1. Mineral

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Synthetic

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Bio-based

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Netherlands Metalworking Fluids Market, By Application

9.1. Netherlands Metalworking Fluids Market, by Application, 2023-2032

9.1.1. Neat Cutting Oils

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Water Cutting Oils

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Corrosion Preventive Oils

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Other Applications

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Netherlands Metalworking Fluids Market, By End-use

10.1. Netherlands Metalworking Fluids Market, by End-use, 2023-2032

10.1.1. Metal Fabrication

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Transportation Equipment

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Machinery

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Other End-uses

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Netherlands Metalworking Fluids Market, By Industrial End-use

11.1. Netherlands Metalworking Fluids Market, by Industrial End-use, 2023-2032

11.1.1. Construction

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Electrical & Power

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Agriculture

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Automobile

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Aerospace

11.1.5.1. Market Revenue and Forecast (2020-2032)

11.1.6. Rail

11.1.6.1. Market Revenue and Forecast (2020-2032)

11.1.7. Marine

11.1.7.1. Market Revenue and Forecast (2020-2032)

11.1.8. Telecommunication

11.1.8.1. Market Revenue and Forecast (2020-2032)

11.1.9. Healthcare

11.1.9.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Netherlands Metalworking Fluids Market, Regional Estimates and Trend Forecast

12.1. Netherlands

12.1.1. Market Revenue and Forecast, by Product (2020-2032)

12.1.2. Market Revenue and Forecast, by Application (2020-2032)

12.1.3. Market Revenue and Forecast, by End-use (2020-2032)

12.1.4. Market Revenue and Forecast, by Industrial End-use (2020-2032)

Chapter 13. Company Profiles

13.1. VALVOLINE

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. ExxonMobil Corporation

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. FUCHS

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Perstorp

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. CIMCOOL EUROPE

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Motul

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Aimol

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Quaker Chemical Corporation

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Matrix Specialty Lubricants

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Kuwait Petroleum

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others