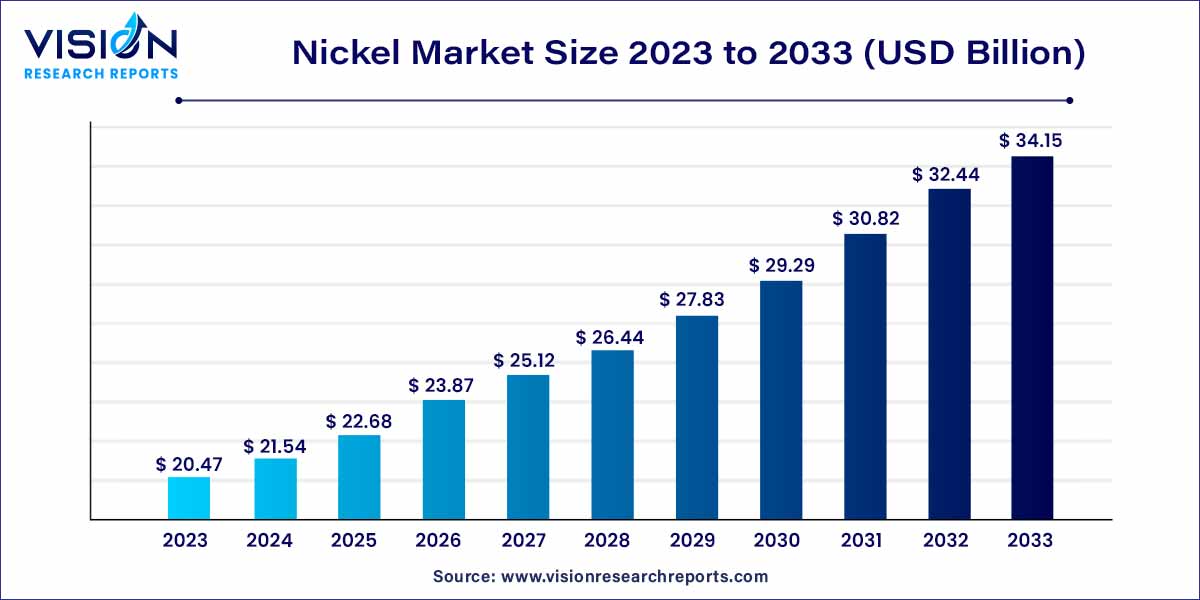

The global nickel market size was estimated at around USD 20.47 billion in 2023 and it is projected to hit around USD 34.15 billion by 2033, growing at a CAGR of 5.25% from 2024 to 2033.

The nickel market, a cornerstone of the global metal industry, is characterized by its widespread applications, economic significance, and complex supply-demand dynamics. This overview delves into the key aspects of the nickel market, shedding light on its production, consumption patterns, major players, and future trends.

The growth of the nickel market is propelled by several key factors. Firstly, the increasing demand for stainless steel in construction and infrastructure projects drives substantial nickel consumption, given its pivotal role in enhancing steel's corrosion resistance and durability. Secondly, the surge in electric vehicle (EV) production amplifies nickel demand, as nickel is a fundamental component in EV batteries, supporting the global shift toward sustainable transportation. Furthermore, the growing focus on renewable energy solutions, such as wind turbines and solar panels, further stimulates the nickel market. These technologies rely on nickel-containing alloys for their robustness and longevity, contributing to the metal's rising demand. Additionally, advancements in battery technology, particularly the development of nickel-rich cathodes, enhance the efficiency and energy density of batteries, fostering greater demand in both consumer electronics and energy storage sectors. Lastly, ongoing efforts toward sustainable mining practices and eco-friendly initiatives play a vital role, ensuring a responsible supply chain and fostering market growth. These factors collectively underpin the steady expansion of the nickel market, making it a key player in the global metal industry.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 34.15 billion |

| Growth Rate from 2024 to 2033 | CAGR of 5.25% |

| Revenue Share of Asia Pacific in 2023 | 73% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

Stainless steel was the largest application segment contributed the largest market share of 65% in 2023. Stainless steel production accounts for a significant portion of nickel consumption globally. Nickel's unique properties, including corrosion resistance and durability, make it an indispensable component in stainless steel alloys. This inclusion enhances stainless steel's structural integrity and ensures it remains impervious to rust and corrosion, making it ideal for applications in construction, automotive manufacturing, and aerospace engineering. As these sectors continue to expand, the demand for nickel in stainless steel production remains robust, driving growth in the global nickel market.

The plating application segment predicted to grow at the CAGR during the forecast period. Nickel plating offers exceptional corrosion resistance, making it a preferred choice for coating various metal substrates, including steel, brass, and copper. The plating industry relies on nickel to create aesthetically pleasing surfaces on consumer goods like kitchen appliances, furniture, and automotive components. Furthermore, nickel plating enhances the durability and longevity of these products, ensuring they withstand harsh environmental conditions and wear over time. This durability makes nickel-plated items not only visually appealing but also long-lasting, meeting the demands of discerning consumers and industries alike.

Asia Pacific dominated the global market with the largest market share of 73% in 2023. SS melt production drives the demand for nickel in the region. The region accounted for a share of nearly 70% of the world’s SS melt production. In 2022, China accounted for a share of 80% in Asia Pacific, as reported by the International Stainless Steel Forum. Moreover, China is also the largest consumer of SS products in the world, with more than half of the world’s demand. Investments associated with nickel metal and chemicals are projected to push the market demand in the Middle East & Africa region.

The group has signed an agreement with Saudi Arabia’s Royal Commission for Yanb to lease industrial land. Europe region has observed sluggish demand in the recent past, as it was highly impacted by the energy crisis and limited Russian supply of different materials, including nickel. This also impacted the operation costs of SS manufacturers leading to temporary and permanent shutdowns.

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Nickel Market

5.1. COVID-19 Landscape: Nickel Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Nickel Market, By Application

8.1.Nickel Market, by Application Type, 2024-2033

8.1.1. Stainless Steel

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Non-ferrous Alloys

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Plating

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Batteries

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Nickel Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Application (2021-2033)

Chapter 10. Company Profiles

10.1. Anglo American Plc

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. BHP

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Eramet

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Glencore

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. IGO Ltd.

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Metallurgical Corp. of China Ltd.

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Norlisk Nickel

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Rio Tinto

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. South32 Ltd.

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Vale

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others