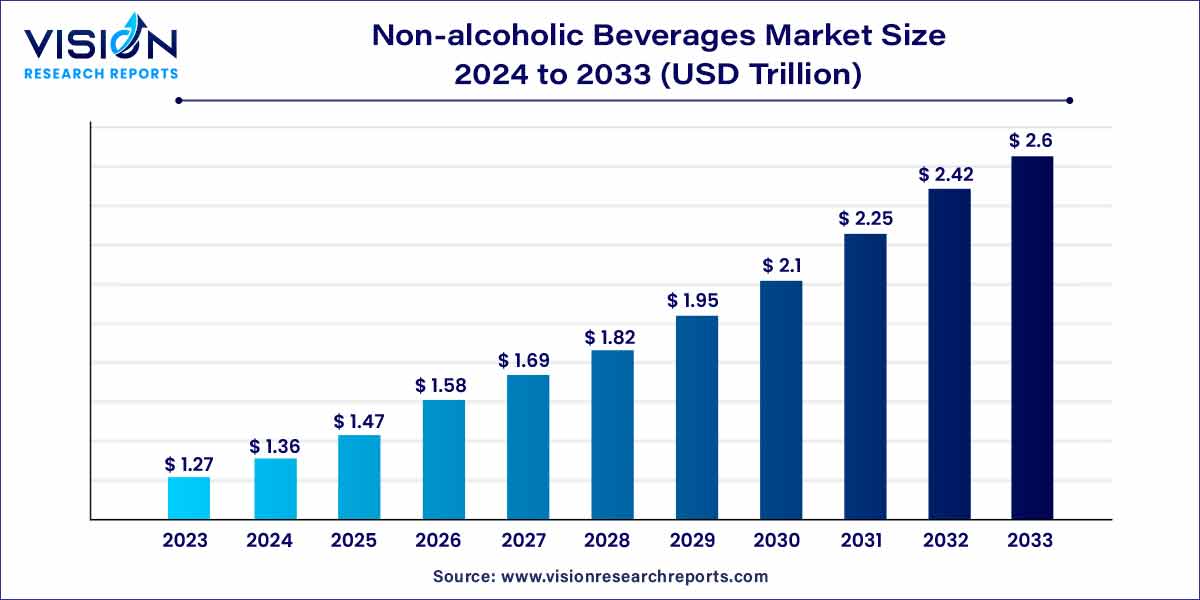

The global non-alcoholic beverages market size was estimated at around USD 1.27 trillion in 2023 and it is projected to hit around USD 2.6 trillion by 2033, growing at a CAGR of 7.44% from 2024 to 2033. The non-alcoholic beverages market is driven by the rising demand for non-alcoholic beer and wine, increasing awareness of health risks, and innovation in product offerings.

The non-alcoholic beverages market has witnessed significant growth and evolution in recent years, driven by changing consumer preferences, health-conscious trends, and innovative product offerings. This overview delves into key aspects of the non-alcoholic beverages market, highlighting its current landscape and future prospects.

The non-alcoholic beverages market is experiencing robust growth, driven by several key factors. A fundamental driver is the shifting consumer preferences towards healthier lifestyle choices. As awareness of the health risks associated with excessive alcohol consumption increases, there is a corresponding surge in demand for non-alcoholic alternatives. Moreover, the industry's commitment to innovation plays a pivotal role in this growth, with manufacturers introducing a diverse range of products that cater to evolving consumer tastes. From functional beverages to unique flavor profiles, the continuous exploration of novel offerings contributes significantly to market expansion. The rise of health and wellness trends is another influential factor, propelling the demand for beverages that offer nutritional benefits. As consumers seek alternatives that align with their well-being goals, the non-alcoholic beverages market is well-positioned for sustained growth in the foreseeable future.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 2.6 trillion |

| Growth Rate from 2024 to 2033 | CAGR of 7.44% |

| Revenue Share of Asia Pacific in 2023 | 34% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

In 2023, the carbonated soft drinks (CSDs) segment claimed the largest revenue share at 29%. Renowned for their effervescence and an extensive range of flavors catering to diverse taste preferences, CSDs have gained popularity. Their convenience and availability in various packaging sizes make them a preferred choice for consumers seeking a quick and satisfying thirst-quencher.

The functional beverages segment is predicted to grow at the remarkable CAGR in the forecast period. This surge is attributed to the increasing awareness and emphasis on health and wellness. As consumers become more health-conscious, there is a rising demand for beverages that provide not only refreshment but also functional benefits. Functional beverages, encompassing products enriched with vitamins, minerals, antioxidants, and other health-promoting ingredients, align with the contemporary focus on preventive healthcare and overall well-being

In 2023, the retail segment held the largest revenue share of 73% and is expected to continue expanding at the fastest CAGR throughout the forecast period. The retail channel encompasses supermarkets, hypermarkets, internet retailers, and other outlets. Among these, supermarkets and hypermarkets within this segment hold the largest market share due to the availability of a wide variety of brands and products under one roof. Notable players in this subcategory include Whole Foods, Target, Aldi, and Walmart, with several supermarkets expanding their offerings in the alcohol-free market.

The foodservice segment is anticipated to experience rapid growth in the forecast period, serving as a primary distribution channel for non-alcoholic beverages. The global trend of busy schedules and increased disposable income often prompts consumers to dine out. This has led to the emergence of new eateries catering to diverse tastes and beverage preferences. The growth in full-service restaurants adopting all-inclusive dining practices, wherein they analyze local dietary trends and innovate their offerings accordingly, has been a significant driver. This approach not only enhances the consumer experience but also increases the frequency of visits to these establishments.

In 2023, Asia Pacific region dominated the market with the largest market share of 34%. The region, fueled by increasing demand for alcohol-free beverages in developing countries such as China, India, Thailand, and Malaysia, is anticipated to drive market growth. Government initiatives aimed at boosting the manufacturing sector through tax cuts, subsidies, and elevated Foreign Direct Investment (FDI) limits have attracted key global players to expand their operations and distribution facilities in the region. Shifting beverage consumption patterns, with consumers preferring functional and flavored bottled water over high-sugar content carbonated drinks, further contribute to this trend.

China, as the leader in the Asia Pacific market in 2023, played a pivotal role, accounting for the largest share. The surge in health consciousness among Chinese consumers, driven by increased awareness of the health impacts of lifestyle choices, has led many to opt for non-alcoholic beverages as a healthier alternative to traditional sugary and alcoholic drinks. This trend is particularly prominent among the younger generation, actively seeking beverages that align with their desire for a balanced and nutritious diet.

North America is poised for significant growth during the forecast period. The U.S., home to many globally renowned beverage manufacturers, faces challenges such as the rising prevalence of obesity and government-imposed taxes on sugar products in both the U.S. and Mexico. These factors restrain the demand for Carbonated Soft Drinks (CSDs), a subset of non-alcoholic beverages, leading to an increased preference for low-calorie beverages containing non-nutritive sweeteners.

By Product

By Distribution channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Non-alcoholic Beverages Market

5.1. COVID-19 Landscape: Non-alcoholic Beverages Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Non-alcoholic Beverages Market, By Product

8.1. Non-alcoholic Beverages Market, by Product, 2024-2033

8.1.1. Carbonated Soft Drinks

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Bottled Water

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. RTD Tea & Coffee

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Functional Beverages

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Juices

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Dairy-based Beverages

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Non-alcoholic Beverages Market, By Distribution channel

9.1. Non-alcoholic Beverages Market, by Distribution channel, 2024-2033

9.1.1. Food Service

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Retail

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Non-alcoholic Beverages Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Distribution channel (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Distribution channel (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Distribution channel (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by Distribution channel (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Distribution channel (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Distribution channel (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Distribution channel (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Distribution channel (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by Distribution channel (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Distribution channel (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Distribution channel (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Distribution channel (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Distribution channel (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by Distribution channel (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Distribution channel (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Distribution channel (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Distribution channel (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Distribution channel (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by Distribution channel (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Distribution channel (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Distribution channel (2021-2033)

Chapter 11. Company Profiles

11.1. Nestlé

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. PepsiCo

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Keurig Dr. Pepper Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. The Coca-Cola Company

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Jones Soda Co.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Danone S.A

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Suntory Beverage & Food Ltd

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Asahi Group Holdings, Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Red Bull

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others