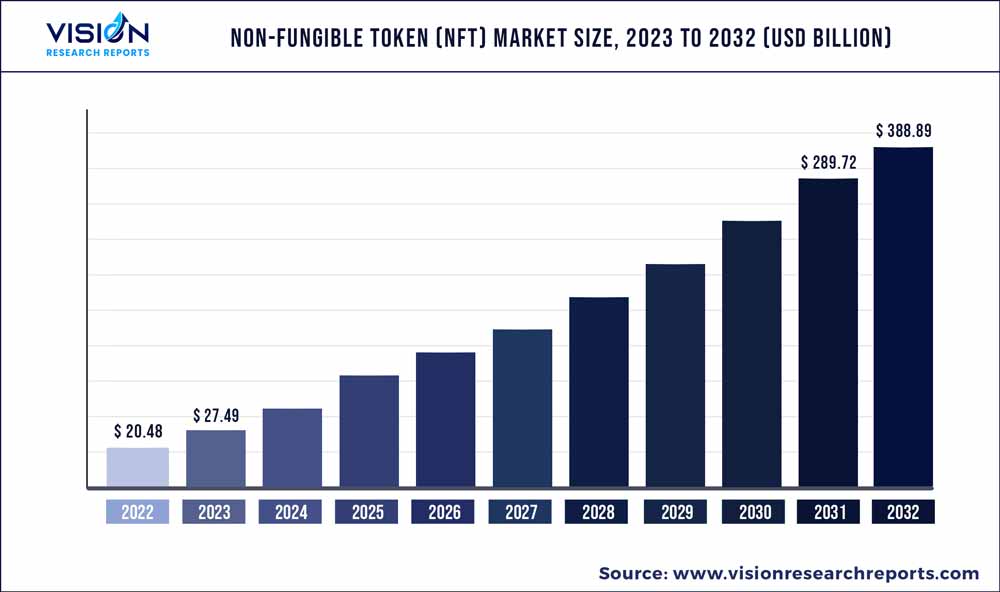

The global non-fungible token market size was estimated at around USD 20.48 billion in 2022 and it is projected to hit around USD 388.89 billion by 2032, growing at a CAGR of 34.23% from 2023 to 2032. The non-fungible token market in the United States was accounted for USD 8.18 billion in 2022.

Key Pointers

Report Scope of the Non-fungible Token (NFT) Market

| Report Coverage | Details |

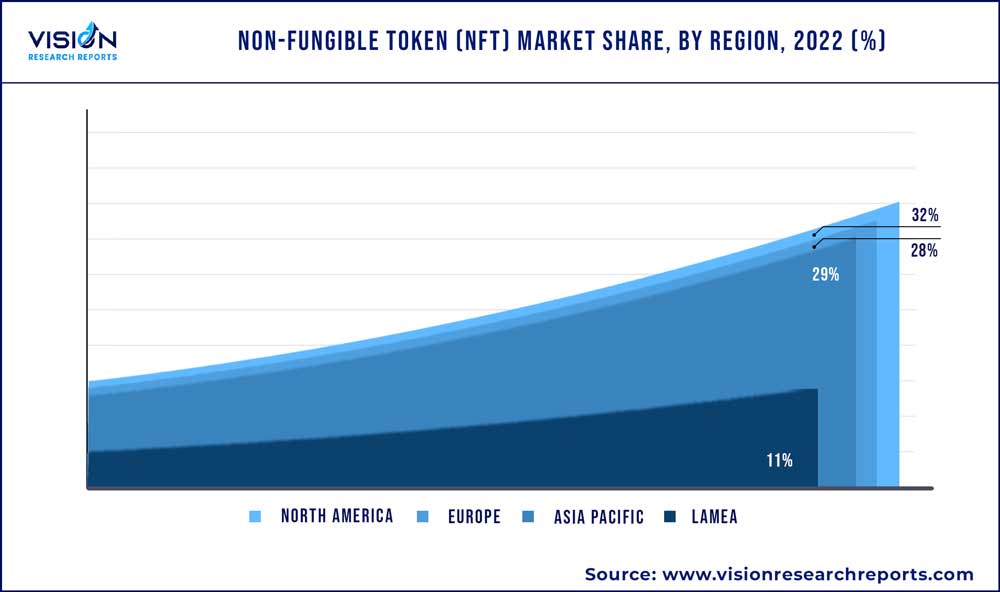

| Revenue Share of North America in 2022 | 32% |

| Revenue Forecast by 2032 | USD 388.89 billion |

| Growth Rate from 2023 to 2032 | CAGR of 34.23% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | YellowHeart, LLC.; Cloudflare, Inc.; PLBY Group, Inc.; Dolphin Entertainment, Inc.; Funko; Ozone Networks, Inc.; Takung Art Co., Ltd.; Dapper Labs, Inc.; Gemini Trust Company, LLC.; Onchain Labs, Inc. |

The market growth can be attributed to the rising demand for digital artworks. Furthermore, the expansion of the market is driven by the global surge in demand for NFTs, driven by their distinctiveness, transparency, and other notable characteristics. Unlike traditional assets, NFTs are indivisible and cannot be divided among multiple owners, ensuring the authenticity and security of ownership for buyers, protecting them from counterfeit NFTs. The increasing interest in digital ownership and the desire to establish unique digital identities have played a significant role.

NFTs provide a means to prove ownership and authenticity of digital assets, allowing individuals to truly possess and showcase their digital collectibles, artworks, and other unique creations. Moreover, the growing adoption of blockchain technology has driven the NFT market. Blockchain provides a decentralized and transparent platform for verifying and recording ownership of NFTs, ensuring their scarcity and provenance.

The rise of social media and digital platforms has created a global audience and marketplace for NFTs. Social media influencers, celebrities, and artists have leveraged their online presence to promote and sell NFTs directly to their followers, creating a direct connection between creators and buyers. This direct-to-consumer approach has expanded the reach and accessibility of NFTs, driving their adoption across various demographics. Moreover, the convergence of traditional industries with the NFT market has opened up new opportunities and drivers. Sectors such as sports, gaming, music, and fashion have embraced NFTs to offer unique experiences, limited edition digital assets, and exclusive content to their fans and customers.

The concept of digital scarcity has been a driving force behind the market. NFTs enable creators to establish scarcity in the digital realm, creating a sense of exclusivity and value. The limited supply and unique attributes of NFTs make them desirable and sought-after, driving up demand and prices. This scarcity factor and the ability to prove ownership and authenticity have attracted individuals and investors looking for new opportunities in the digital economy.

One significant restraint in the NFT market is the lack of mainstream adoption and understanding of NFTs among the general population. Many potential buyers and investors may not fully comprehend the concept of owning a digital asset or may have concerns about the value and authenticity of NFTs. To overcome this restraint, education and awareness campaigns are crucial. NFT platforms and creators can focus on educating the public about the benefits and unique features of NFTs, highlighting the scarcity, ownership rights, and potential for investment. Collaborations with established brands and celebrities can also help bring NFTs into the mainstream and increase trust and recognition among a wider audience. In addition, implementing robust verification systems and transparent marketplaces can instill confidence in buyers, ensuring the authenticity and provenance of NFTs.

Type Insights

The digital asset segment dominated the market in 2022 and accounted for more than 73% share of the global revenue. The increasing use of NFTs for securing ownership of digital assets by artists worldwide is expected to drive segment growth. Artists can earn profits from their content by keeping ownership via NFTs and are not required to give it to other platforms for promotions. At the same time, the rise in the use of NFTs to sell digital real estate in both the physical and virtual worlds is also expected to drive segment growth.

The physical asset segment is anticipated to witness significant growth over the forecast period. NFTs are tokens that can also be used for physical assets such as a house, painting, and vehicle. NFTs are presented on physical items in the form of a barcode or tag, which can be encoded and traded in the place of physical items. The demand for NFTs is also growing as they enable people to claim their ownership and authenticate the identity or fraudulent transactions that occur concerning their assets.

Application Insights

The collectibles segment dominated the market in 2022 and accounted for more than 54% share of the global revenue. Crypto collectibles are NFT tokens that can be minted in NFT marketplaces. The high demand for crypto collectibles can be attributed to their benefits such as independence and ease in handling assets. For instance, sports collectibles allow fans to connect with their idols directly, game collectibles enable gamers to trade and play, and collectibles for artists enable them to connect with potential customers and sell their work.

The sport segment is expected to witness steady growth over the forecast period. NFTs are gaining popularity in the sports sector worldwide as they allow athletes to promote their names and create opportunities to interact with fans by enhancing fan engagement. According to Deloitte Touche Tohmatsu Limited, up to five million sports fans are expected to be gifted or purchase an NFT in 2022, creating more than USD 2 billion in transactions, nearly double of 2021.

End-use Insights

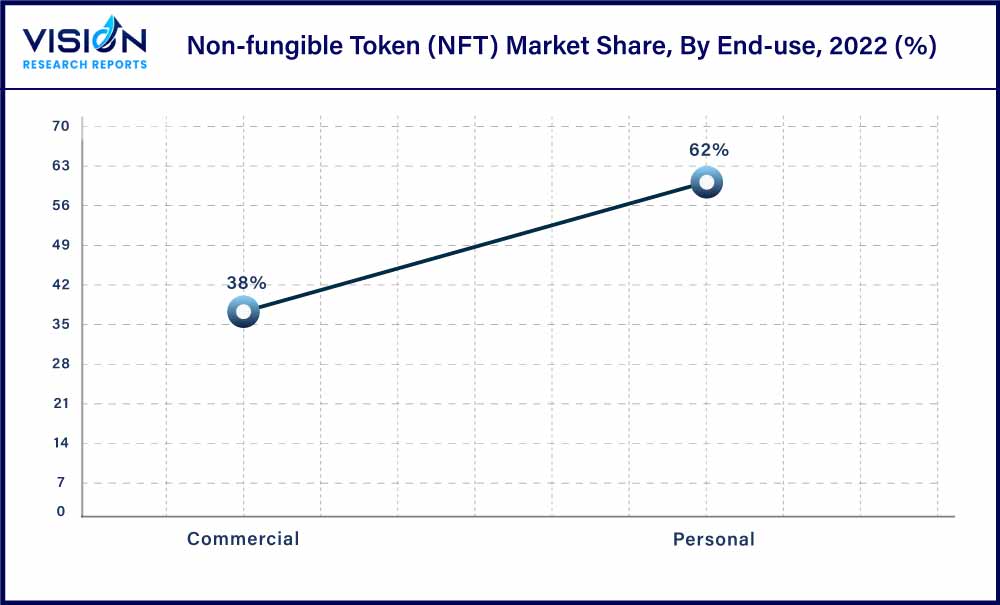

The personal segment dominated the market in 2022 and accounted for more than 62% share of the global revenue. The increasing spending on digital assets across the globe is one of the major factors driving the segment growth. According to CryptoSlam, an internet publishing company, in February 2021, people spent over USD 1 billion on digital assets. The growing valuation of NFTs is one of the major factors driving investments in digital assets.

The commercial segment is anticipated to expand at the highest CAGR over the forecast period. The growing use of NFTs for business purposes, such as innovating supply chain management and logistics, is expected to drive the segment growth. Logistic companies are increasingly integrating blockchain technology in their operations, creating new opportunities for the growth of the segment. For instance, in October 2021, VeChain, an enterprise-friendly blockchain project, announced a partnership with DHL, a logistics company, to issue NFTs on the VeChainThor blockchain.

Regional Insights

The North American region dominated the market in 2022 and accounted for over 32% share of the global revenue. The increasing adoption of NFTs by millennials in the region is driving the regional market growth. At the same time, the rise in the number of artists creating digital artwork in countries such as the U.S. and Canada is also expected to drive market growth in the region. Furthermore, the presence of major players operating in the blockchain industry in the region also bodes well for the regional market.

The Asia Pacific market is anticipated to expand at the highest CAGR over the forecast period. The rising adoption of cryptocurrency across Asia Pacific countries is expected to drive market growth in the region. An increase in the development of metaverse platforms by startups in the region is also expected to favor market growth. Additionally, the growing gaming industry in the region is also creating new opportunities for market growth.

Non-fungible Token (NFT) Market Segmentations:

BY Type

By Application

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Non-fungible Token (NFT) Market

5.1. COVID-19 Landscape: Non-fungible Token (NFT) Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Non-fungible Token (NFT) Market, By Type

8.1. Non-fungible Token (NFT) Market, by Type, 2023-2032

8.1.1 Physical Asset

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Digital Asset

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Non-fungible Token (NFT) Market, By Application

9.1. Non-fungible Token (NFT) Market, by Application, 2023-2032

9.1.1. Collectibles

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Art

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Gaming

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Utilities

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Metaverse

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Sport

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Non-fungible Token (NFT) Market, By End-use

10.1. Non-fungible Token (NFT) Market, by End-use, 2023-2032

10.1.1. Personal

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Commercial

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Non-fungible Token (NFT) Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 12. Company Profiles

12.1. YellowHeart, LLC.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Cloudflare, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. PLBY Group, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Dolphin Entertainment, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Funko

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Ozone Networks, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Takung Art Co., Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Dapper Labs, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Gemini Trust Company, LLC.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Onchain Labs, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others