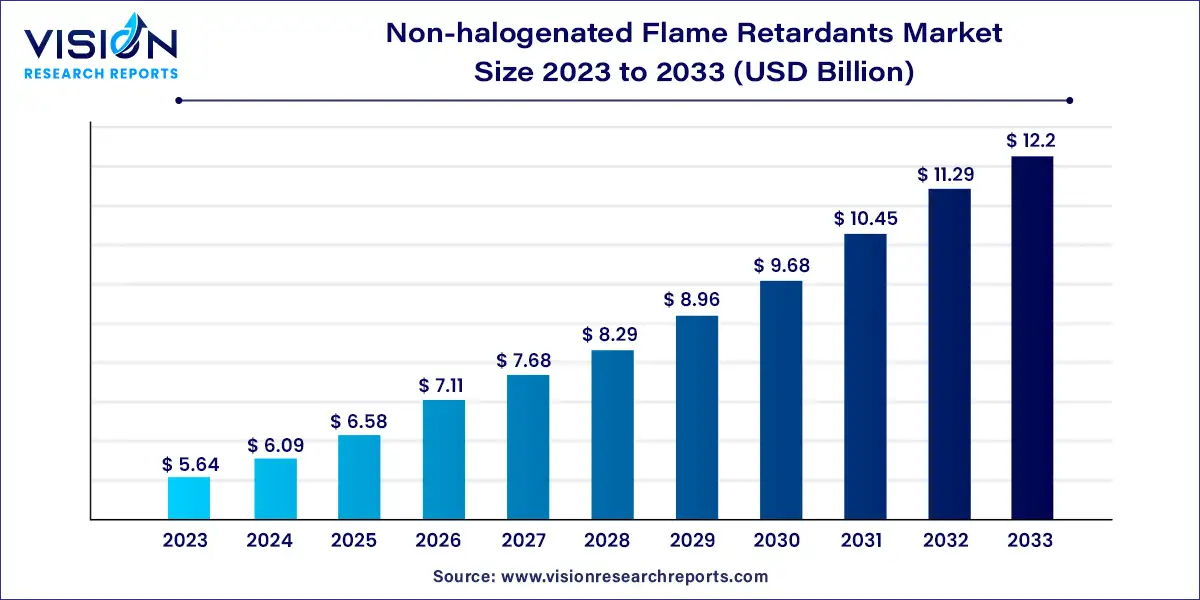

The global non-halogenated flame retardants market size was estimated at around USD 5.64 billion in 2023 and it is projected to hit around USD 12.2 billion by 2033, growing at a CAGR of 8.02% from 2024 to 2033.

The non-halogenated flame retardants market has gained significant traction in recent years, driven by a growing emphasis on fire safety and environmental concerns. Unlike traditional halogenated flame retardants, non-halogenated alternatives offer a safer and more eco-friendly solution for various industries.

The growth of the non-halogenated flame retardants market can be attributed to several key factors. Stringent regulations and standards concerning fire safety and environmental impact have significantly driven the demand for non-halogenated alternatives. Industries are increasingly adopting these flame retardants to comply with stringent regulatory requirements, ensuring both safety and environmental responsibility. Moreover, rising awareness among consumers and industries about the harmful effects of halogenated flame retardants has led to a shift towards more eco-friendly options. The versatility of non-halogenated flame retardants, catering to diverse applications in construction, electronics, automotive, and textiles, has further accelerated market growth. Additionally, the ongoing emphasis on sustainable practices and environmentally conscious choices in various sectors has fueled the adoption of non-halogenated flame retardants, making them a preferred choice for ensuring fire safety while aligning with environmental goals.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 12.2 billion |

| Growth Rate from 2024 to 2033 | CAGR of 8.02% |

| Revenue Share of Asia Pacific in 2023 | 48% |

| CAGR of Asia Pacific from 2024 to 2033 | 9.08% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The aluminum hydroxide segment accounted for the largest revenue share of 51% in 2023. Aluminum hydroxide, also known as alumina trihydrate (ATH), is a widely used flame retardant due to its ability to release water vapor when exposed to heat, thereby cooling the material and preventing the spread of fire. ATH-based flame retardants are commonly used in applications such as plastics, rubber, textiles, and coatings. Their non-toxic nature and effectiveness in enhancing fire safety have contributed to their popularity in various industries.

The phosphorus-based segment is expected to grow at the fastest CAGR of 8.16% during the forecast period. Phosphorous-based flame retardants are another essential category within the non-halogenated flame retardants market. These compounds work by disrupting the combustion process, forming a protective layer on the material's surface, and reducing the release of smoke and toxic gases during a fire. Phosphorous-based flame retardants are widely utilized in polymers, electronics, and construction materials. Their ability to provide excellent flame resistance without the environmental concerns associated with halogenated alternatives has driven their adoption across different sectors.

The epoxy resins segment captured the maximum market share of 26% in 2023. Epoxy resins, widely used in various industries such as electronics, automotive, and aerospace, require effective flame retardant solutions to meet safety standards. Non-halogenated flame retardants, specifically tailored for epoxy resins, have gained prominence due to their ability to enhance the fire resistance of these materials without compromising their structural integrity. These flame retardants work by interrupting the combustion process, preventing the spread of flames and reducing smoke emissions. The demand for non-halogenated flame retardants in epoxy resin applications is driven by stringent regulations, emphasizing the importance of fire safety in enclosed spaces and consumer products.

The polyolefins segment is anticipated to grow at the fastest CAGR of 8.65% over the forecast period. Polyolefins, including polyethylene and polypropylene, are widely used in packaging, construction, and automotive sectors. Non-halogenated flame retardants play a crucial role in enhancing the fire safety of polyolefin-based products. By incorporating these flame retardants, polyolefins can meet the necessary fire safety standards while maintaining their mechanical properties. The application of non-halogenated flame retardants in polyolefins ensures that these materials can withstand fire incidents, reducing the risk of rapid flame spread and enhancing escape time during emergencies. As regulations governing fire safety become more stringent across industries, the demand for non-halogenated flame retardants in polyolefin applications continues to rise.

The electrical & electronics segment held the largest revenue share of 40% in 2023. In the electrical & electronics industry, non-halogenated flame retardants have become indispensable components in ensuring the safety and reliability of electronic devices. These flame retardants are incorporated into circuit boards, connectors, and other electronic components to mitigate fire risks, preventing the rapid spread of flames and reducing the release of toxic gases. As the demand for electronic devices continues to rise, driven by technological advancements and consumer needs, the application of non-halogenated flame retardants in this sector has become increasingly vital.

The construction segment is expected to grow at the fastest CAGR of 10.15% over the forecast period. In the construction industry, non-halogenated flame retardants are extensively used in various materials and products to enhance fire safety. These flame retardants are incorporated into insulation materials, coatings, sealants, and structural elements of buildings, ensuring that structures meet stringent fire safety regulations. The use of non-halogenated alternatives is particularly crucial in densely populated urban areas, where fire safety in high-rise buildings and public spaces is paramount. By incorporating non-halogenated flame retardants, the construction industry can create structures that are not only aesthetically pleasing but also meet the highest safety standards, protecting occupants and valuable assets.

Asia Pacific dominated the market with the largest revenue share of 48% in 2023 and is expected to grow at the fastest CAGR of 9.08% during the forecast period. Asia-Pacific, with its burgeoning industrial sectors, represents a substantial market for non-halogenated flame retardants. Rapid urbanization and increasing investments in infrastructure development have led to a surge in demand, especially in countries like China and India. The electronics industry in Asia-Pacific has also contributed significantly to market growth, driven by the production of consumer electronics and technological devices.

By Product

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Non-halogenated Flame Retardants Market

5.1. COVID-19 Landscape: Non-halogenated Flame Retardants Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Non-halogenated Flame Retardants Market, By Product

8.1. Non-halogenated Flame Retardants Market, by Product, 2024-2033

8.1.1 Aluminum Hydroxide

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Magnesium Dihydroxide

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Phosphorous Based

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others (nitrogen, magnesium hydroxide, etc.)

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Non-halogenated Flame Retardants Market, By Application

9.1. Non-halogenated Flame Retardants Market, by Application, 2024-2033

9.1.1. Polyolefins

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Epoxy Resins

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. UPE

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. PVC

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. ETP

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Rubber

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Styrenics

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Other Applications

9.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Non-halogenated Flame Retardants Market, By End-use

10.1. Non-halogenated Flame Retardants Market, by End-use, 2024-2033

10.1.1. Electrical & Electronics

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Construction

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Transportation

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others (furniture, textiles, etc.)

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Non-halogenated Flame Retardants Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Albemarle Corporation.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. ICL.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Chemtura Corporation.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. CLARIANT.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Italmatch Chemicals S.p.A.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Huber Engineered Materials

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. BASF SE.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. THOR

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. LANXESS.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. DSM

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others