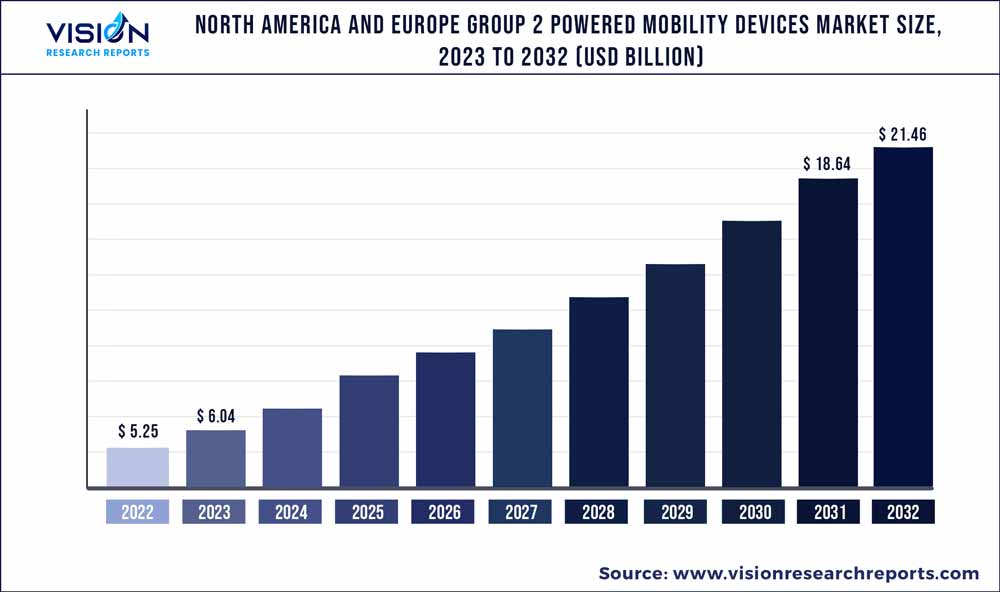

The North America and Europe group 2 powered mobility devices market was estimated at USD 5.25 billion in 2022 and it is expected to surpass around USD 21.46 billion by 2032, poised to grow at a CAGR of 15.12% from 2023 to 2032.

Key Pointers

Report Scope of the North America And Europe Group 2 Powered Mobility Devices Market

| Report Coverage | Details |

| Market Size in 2022 | USD 5.25 billion |

| evenue Forecast by 2032 | USD 21.46 billion |

| Growth rate from 2023 to 2032 | CAGR of 15.12% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Golden Technologies; National Seating & Mobility, Inc.; Numotion; 1800 Wheelchair.com; Wal-Mart Stores Inc.; Pride Mobility Products Corporation; Invacare Corporation |

The prevalence of disabilities is predicted to rise, and powered mobility devices are becoming more popular since they make it easier to drive and engage in outdoor activities. Moreover, it is anticipated that the demand for group 2 powered mobility devices will increase due to the established presence of various manufacturers and the constantly expanding senior population.

According to the U.S. Census Bureau, the most prevalent impairment among older Americans is mobility. 13.7% of the 61 million adults with disabilities in the US have mobility problems that make it challenging to walk or climb stairs. Medicare pays for electric wheelchairs for people with disabilities. 20% of the expense is covered by the patient, with the remaining 80% by Medicare. Such regulations may increase the use of powered wheelchairs across North America.

However, as a result of a labor scarcity and travel limitations, the covid-19 pandemic impacted supply chains for various medical equipment. In contrast to other industries, the impact on medical equipment and other necessities of the healthcare system was relatively mild because to supportive government initiatives. For instance, the Federal Food, Drug, and Cosmetic Act (FD&C Act) gained Section 506J in 2020 as a result of the CARES Act (Coronavirus Aid, Relief, and Economic Security Act), which gave the FDA the authority to stop or lessen the effects of medical equipment supply chain disruptions during public health emergencies like the COVID-19 pandemic.

Additionally, elderly individuals are more likely to fall, which can result in deadly or non-fatal injuries. One in four Americans aged 65 and over who fall each year, and more than 2.8 million injuries are treated in emergency rooms at hospitals, according to data from the National Council on Aging (NCOA). Growing older populations and a rise in fall-related anxiety may prevent them from engaging in physical activity, which is expected to increase demand for mobile devices during the projection period.

For patients with mobility impairments, new technologies or therapeutically complex solutions are expected to offer simple mobility options; as a result, product introductions from the current pipeline are predicted to increase. The LiNX technology developed by Invacare Corporation is the next-generation technology for controlling powered devices. This innovative technology enables gadgets to increase a user's mobility through wireless networking along with other cutting-edge capabilities. As new technology and innovative features are developed, acceptance and usage of mobility devices are projected to increase over the projection period.

Product Type Insights

The powered wheelchair segment dominated the market and accounted for the largest revenue share of 66% in 2022. The market is expected to grow at a lucrative rate during the forecasted period. By 2022, the segment's growth will be aided by the wide commercial accessibility of powered wheelchairs with their higher average selling prices when compared to scooters. Additionally, throughout the projection period, the segment's growth will be supported by the expanding consumer awareness of the benefits of battery-operated wheelchairs over scooters and the growing popularity of these products in the across North America and European region.

During the projection period, the prevalence of inherited and uninherited mobility abnormalities as well as mobility independence in outdoor as well as indoor environments is likely to increase demand for wheelchairs. Furthermore, the segment is anticipated to rise more rapidly during the forecast period due to the increasing accessibility and availability of wheelchairs in both middle- and low-income nations.

Payment Type Insights

The reimbursement segment dominated the market and held 51% of the revenue share in 2022. It is the reimbursement granted by a business for expenses incurred by an individual from their own pocket, such as expenses or insurance fees. The expenses associated with the purchase of the mobility aids may be covered by Medicare and other types of health insurance. In order to be reimbursed, the qualified user must fulfill all requirements. Thus, it will propel the market growth.

All powered wheelchairs, powered vehicles, and mobility aids are insured by Medicare. The user must receive a formal prescription from a physician attesting to their medical condition and need for utilizing a mobility equipment in order to submit an insurance claim. Doctors do an in-person examination of the patient and assess their requirement for a powered vehicle. Once a user satisfies all requirements for utilizing a mobility device, clinicians authorize the purchase of a mobility device.

Sales Channel Insights

The retail segment dominated the market and held 36% of the revenue share in 2022. As they offer personalization of items and the benefit of a personal touch. Users get the opportunity to directly examine the product & its features, and this personal interaction between the buyer and the product fosters confidence and trust during the purchasing process. Many older people who use powered wheelchairs along with other mobility aids are not familiar with online shopping. As a result, these demographic groups are likely to favor traditional retail establishments as their preferred method of product purchase. Thus, it will propel the market growth.

Due to better marketing and direct client interaction, the direct sales category held the second-highest revenue share in 2022. Direct sales are in-person transactions where things are bought and sold; no outside parties are involved. Sales take place in non-retail settings including offices, homes, online, etc. Due to the absence of middlemen, direct selling has a higher profit margin than other industries

North America And Europe Group 2 Powered Mobility Devices Market Segmentations:

By Product Type

By Payment Type

By Sales Channel

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America And Europe Group 2 Powered Mobility Devices Market

5.1. COVID-19 Landscape: North America And Europe Group 2 Powered Mobility Devices Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. North America And Europe Group 2 Powered Mobility Devices Market, By Product Type

8.1. North America And Europe Group 2 Powered Mobility Devices Market, by Product Type, 2023-2032

8.1.1 Powered Wheelchair

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Power Operated Vehicle

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. North America And Europe Group 2 Powered Mobility Devices Market, By Payment Type

9.1. North America And Europe Group 2 Powered Mobility Devices Market, by Payment Type, 2023-2032

9.1.1. Reimbursement

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Out-of-pocket

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. North America And Europe Group 2 Powered Mobility Devices Market, By Sales Channel

10.1. North America And Europe Group 2 Powered Mobility Devices Market, by Sales Channel, 2023-2032

10.1.1. Retail

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. E-commerce

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Direct Sales

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Veteran Affairs

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. North America And Europe Group 2 Powered Mobility Devices Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Payment Type (2020-2032)

11.1.3. Market Revenue and Forecast, by Sales Channel (2020-2032)

Chapter 12. Company Profiles

12.1. Golden Technologies

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. National Seating & Mobility, Inc..

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Numotion.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. 1800 Wheelchair.com.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Wal-Mart Stores Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Pride Mobility Products Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Invacare Corporation.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others