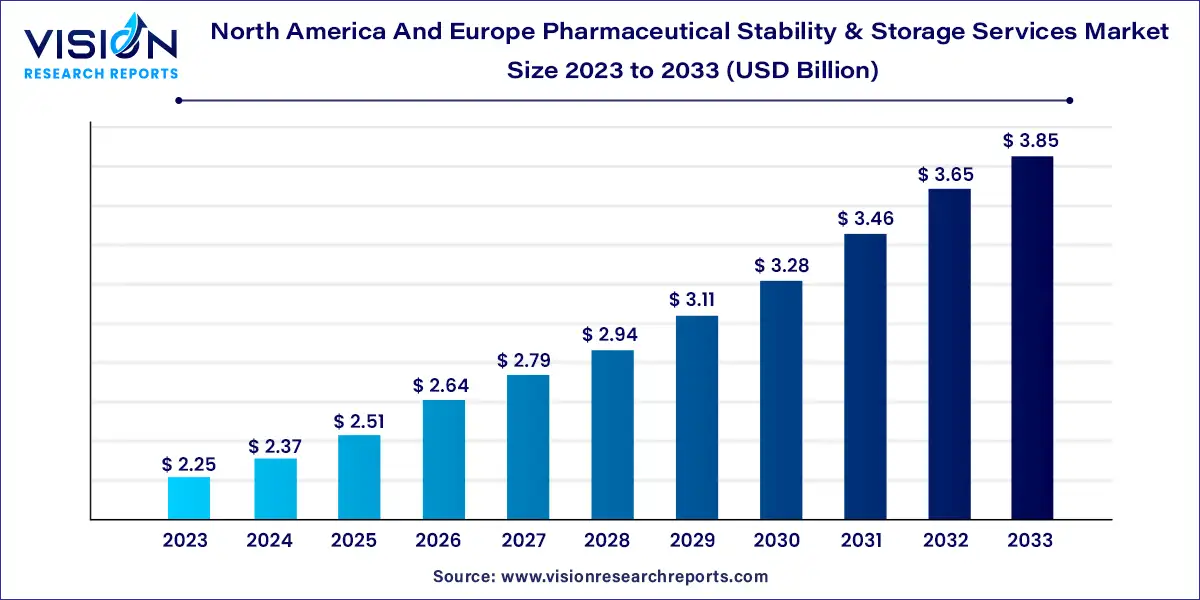

The North America and Europe pharmaceutical stability & storage services market was surpassed at USD 2.25 billion in 2023 and is expected to hit around USD 3.85 billion by 2033, growing at a CAGR of 5.53% from 2024 to 2033.

The pharmaceutical industry is highly regulated and demands stringent adherence to stability and storage standards to ensure the safety and efficacy of drugs. Pharmaceutical stability and storage services play a crucial role in maintaining product quality throughout the drug development and distribution process. This overview delves into the North America and Europe pharmaceutical stability & storage services market, providing insights into its dynamics, trends, and key players.

The growth of the North America and Europe pharmaceutical stability & storage services market is propelled by various factors. Firstly, the increasing complexity of drug formulations necessitates precise stability testing and storage conditions, driving demand for specialized services. Additionally, stringent regulatory requirements in these regions mandate adherence to strict quality standards, creating a need for reliable stability and storage solutions. Moreover, the rising trend of outsourcing among pharmaceutical companies seeking cost-efficiency and expertise further fuels market growth. Technological advancements in monitoring systems and a growing emphasis on sustainable practices also contribute to the expansion of this market segment. Overall, these factors collectively drive the growth of the pharmaceutical stability & storage services market in North America and Europe, presenting opportunities for providers to meet the evolving needs of the industry.

| Report Coverage | Details |

| Market Size in 2023 | USD 2.25 billion |

| Revenue Forecast by 2033 | USD 3.85 billion |

| Growth rate from 2024 to 2033 | CAGR of 5.53% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The stability testing services segment dominated the pharmaceutical stability & storage services market in North America and Europe, accounting for 74% of the overall revenue share in 2023. Stability testing provides data on the changes in the quality of a drug product or drug substance over time, as influenced by various environmental factors including temperature, humidity, and light. Its objective is to determine a re-test period for the drug substance or shelf life for the drug product, along with the recommended storage conditions for it.

On the other hand, the storage segment is expected to witness a higher CAGR of 6.14% over the forecast period. Most players outsource their drug stability and storage management function, as it offers several advantages such as cost reduction, risk mitigation, and operational efficiency, which can drive segment growth. By partnering with companies with GMP-compliant facilities and experienced staff, organizations can streamline their stability studies and focus on their core competencies.

The small molecules segment dominated the North America and Europe pharmaceutical stability & storage services market, with 65% of the revenue share in 2023. Most pharmaceutical medications comprise small molecules, amounting to about 90% of all drugs. These medications treat fever, migraines, cancer, diabetes, and other common disorders. Small-molecule medications are used to treat numerous illnesses and disorders, which increases the need for stable testing and storage.

On the other hand, the large molecules segment is expected to show significant growth during the forecast period. The increasing demand for biological products such as tissues, recombinant therapeutic proteins, blood & blood components, allergens, somatic cells, and vaccinations drives segment growth. FDA states that biologics, despite being difficult and time-consuming to develop, may eventually prove to be the most effective means of treating a variety of medical illnesses and diseases for which no other medicines are available.

The in-house segment led the North America and Europe market for pharmaceutical stability & storage services, accounting for 62% of the revenue share in 2023. Conducting stability testing in-house can be more cost-effective than outsourcing it to external laboratories. It gives companies greater control over the testing process, reduces turnaround times, and allows for more efficient resource allocation. These factors collectively drive the need for in-house stability testing, enabling companies to meet regulatory requirements, ensure product quality & safety, optimize formulations, and enhance customer satisfaction.

On the other hand, the outsourcing segment is expected to show significant market growth in the coming years. Stability testing is crucial to product development and quality control, especially in the pharmaceutical & healthcare industries. Outsourcing allows access to specialized expertise and experience in stability testing. External laboratories or CROs often have dedicated teams with in-depth knowledge of regulatory requirements, testing methodologies, and data analysis techniques, which drives their demand.

By Service

By Molecules

By Mode

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Service Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America And Europe Pharmaceutical Stability & Storage Services Market

5.1. COVID-19 Landscape: North America And Europe Pharmaceutical Stability & Storage Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. North America And Europe Pharmaceutical Stability & Storage Services Market, By Service

8.1. North America And Europe Pharmaceutical Stability & Storage Services Market, by Service, 2024-2033

8.1.1 Stability

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Storage

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. North America And Europe Pharmaceutical Stability & Storage Services Market, By Molecules

9.1. North America And Europe Pharmaceutical Stability & Storage Services Market, by Molecules, 2024-2033

9.1.1. Small Molecule

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Large Molecule

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. North America And Europe Pharmaceutical Stability & Storage Services Market, By Mode

10.1. North America And Europe Pharmaceutical Stability & Storage Services Market, by Mode, 2024-2033

10.1.1. In-house

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Outsourcing

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. North America And Europe Pharmaceutical Stability & Storage Services Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Service (2021-2033)

11.1.2. Market Revenue and Forecast, by Molecules (2021-2033)

11.1.3. Market Revenue and Forecast, by Mode (2021-2033)

Chapter 12. Company Profiles

12.1. Eurofins Scientific.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Intertek Group plc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Lucideon Limited.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Element Materials Technology.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Q1 Scientific.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Reading Scientific Services Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Catalent, Inc..

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Quotient Sciences

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Recipharm AB.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Almac Group

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others