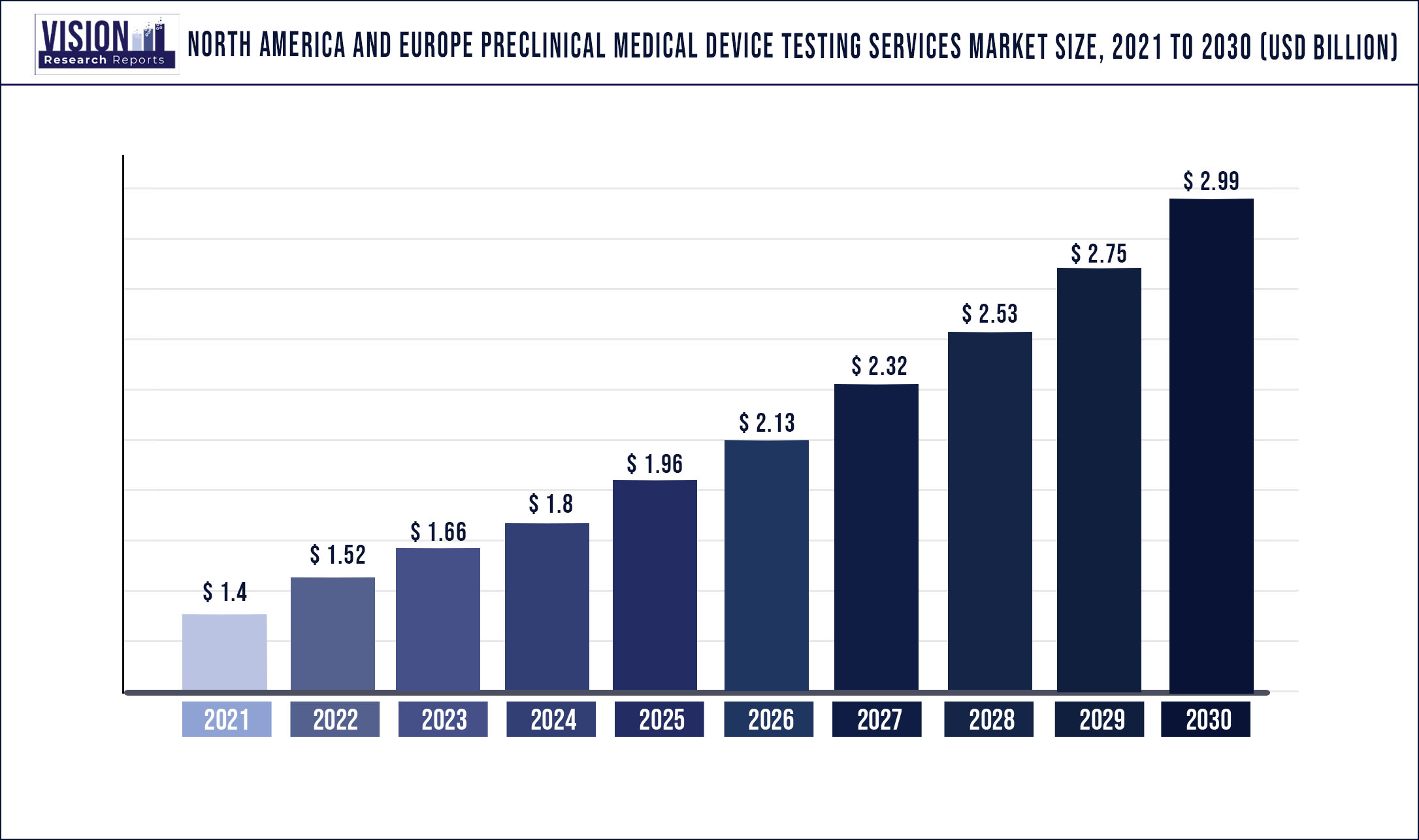

The North America and Europe preclinical medical device testing services market was surpassed at USD 1.4 billion in 2021 and is expected to hit around USD 2.99 billion by 2030, growing at a CAGR of 8.8% from 2022 to 2030

Report Highlights

The increase in the number of small medical devices lacking in-house testing capabilities and complexity in product design are the major factors driving the growth of the market.

There has been an increase in the number of players operating in the market over the last decade. Due to this large number, it has witnessed fierce competition. To sustain the market, a mix of defensive and offensive marketing strategies is used. For instance, extensive R&D, competitive pricing, new product launches, collaborative development, regional expansion, and mergers and acquisitions.

The COVID-19 pandemic has created a huge demand for these services. The rise was not significant in the first half, but it became more significant in the second as the industry adapted to operating during the pandemic. There has been an increase in the production and testing of personal protective equipment, and several projects that were put on hold because of COVID have resumed personal protective equipment. The epidemic has increased demand for a wide range of medical gadgets, diverting attention from those needed for surgery. COVID-19 vaccinations, ventilators, and pulse oximeters are the main goods seeing an increase in demand.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 1.4 billion |

| Revenue Forecast by 2030 | USD 2.99 billion |

| Growth rate from 2022 to 2030 | CAGR of 8.8% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Service, Region |

| Companies Covered | SGS SA, Toxikon, Inc.; Eurofins Scientific; Pace Analytical Services LLC; Intertek Group Plc; WUXI APPTEC; TÜV SÜD AG; Sterigenics International LLC; Nelson Labs; North American Science Associates, Inc.; American Preclinical Services; Charles River Laboratories International, Inc. |

Services Insights

The Microbiology & sterility testing segment accounted for the maximum revenue share of 34.4% in 2021. It is one of the major tests included in pre-clinical medical device testing. Manufacturing safe and effective goods is a top priority for medical device manufacturers, and sterility assurance is a crucial step in accomplishing this aim. By using radiation techniques like e-beam or gamma rays, many single-use medical devices are terminally sterilized. Additionally, confirmation of the sterilization procedure is required by the FDA and other regulatory agencies, which typically call for sterility testing.

The chemistry test segment is anticipated to exhibit the fastest CAGR of 8.96% during the forecast period. Medical devices are also subjected to chemistry tests, along with pharmaceutical formulations. Testing is performed to check if medical devices contain any solutes or chemicals that may leach into the surrounding environment when used with the intended liquid. These tests help investigate the safety parameters of medical devices. Hence, the FDA is also facilitating additional data analysis, such as polymer and colorant examinations, to provide a more holistic view of the safety of these tests. This is expected to positively impact the segment growth during the forecast period.

Regional Insights

North America led the market for preclinical medical device testing services, with the largest revenue share of 63.6% in 2021. This is largely due to the presence of a large number of players in this region. It is also the top manufacturing hub for complex, highly reliable, and high-end medical devices. There is a rapid increase in the manufacturing of medical devices to meet the rising demand for efficient and cost-effective healthcare in this region. Besides this, the presence of the FDA is fueling the growth of the market for medical device testing services.

In Europe, the preclinical medical device testing service is expected to witness a CAGR of 8.7% during the forecast period. This is due to the rising demand for cost-cutting and increasing complexity in product design, which has a high impact on the rendering drivers for the medical device analytical testing outsourcing market in European nations. A steady increase in the outsourcing of services for contract manufacturers and component suppliers has been observed in the last two decades. However, notified bodies such as the European Medical Device Regulation (EMDR) are also involved in the scrutiny of outsourced medical devices.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on North America And Europe Preclinical Medical Device Testing Services Market

5.1. COVID-19 Landscape: North America And Europe Preclinical Medical Device Testing Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Global North America And Europe Preclinical Medical Device Testing Services Market, By Service

8.1.North America And Europe Preclinical Medical Device Testing Services Market, by Service Type, 2020-2027

8.1.1. Biocompatibility Tests

8.1.1.1.Market Revenue and Forecast (2016-2027)

8.1.2. Chemistry Test

8.1.2.1.Market Revenue and Forecast (2016-2027)

8.1.3. Microbiology & Sterility Testing

8.1.3.1.Market Revenue and Forecast (2016-2027)

8.1.4. Package Validation

8.1.4.1.Market Revenue and Forecast (2016-2027)

Chapter 9. Global North America And Europe Preclinical Medical Device Testing Services Market, Regional Estimates and Trend Forecast

9.1.North America

9.1.1. Market Revenue and Forecast, by Service (2016-2027)

9.1.2. U.S.

9.1.3. Rest of North America

9.1.3.1.Market Revenue and Forecast, by Service (2016-2027)

9.2.Europe

9.2.1. Market Revenue and Forecast, by Service (2016-2027)

9.2.2. UK

9.2.2.1.Market Revenue and Forecast, by Service (2016-2027)

9.2.3. France

9.2.3.1.Market Revenue and Forecast, by Service (2016-2027)

9.2.4. Rest of Europe

9.2.4.1.Market Revenue and Forecast, by Service (2016-2027)

Chapter 10.Company Profiles

10.1.SGS SA

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2.Toxikon, Inc.

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3.Eurofins Scientific

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4.Pace Analytical Services LLC

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5.Intertek Group Plc

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6.WUXI APPTEC

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7.TÜV SÜD AG

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8.Sterigenics International LLC

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9.Nelson Labs

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10.North American Science Associates, Inc.

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1.About Us

12.2.Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others