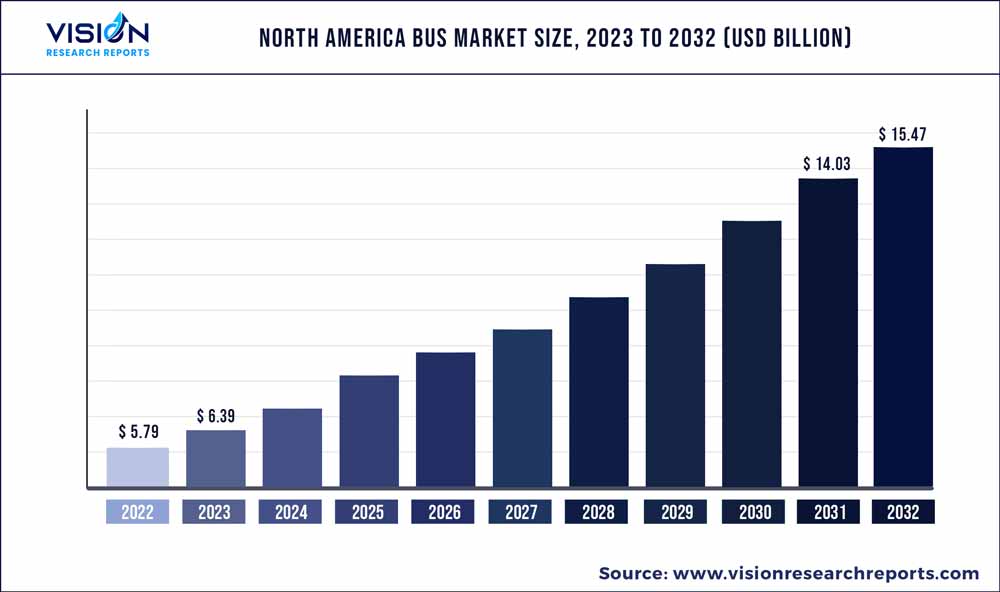

The North America bus market was surpassed at USD 5.79 billion in 2022 and is expected to hit around USD 15.47 billion by 2032, growing at a CAGR of 10.33% from 2023 to 2032.

Key Pointers

Report Scope of the North America Bus Market

| Report Coverage | Details |

| Market Size in 2022 | USD 5.79 billion |

| Revenue Forecast by 2032 | USD 15.47 billion |

| Growth rate from 2023 to 2032 | CAGR of 10.33% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | AB Volvo; Anhui Ankai Automobile Co., Ltd.; Blue Bird Corporation; BYD Company Limited Daimler AG (Mercedes-Benz Group AG ); Iveco SpA; NAVISTAR (Traton Group); NFI Group; Proterra Inc.; REV Group; Proterra Inc |

The replacement of the public diesel-powered transit bus fleet with battery-powered or hydrogen fuel cell-powered buses is expected to drive the growth of the North America buses market growth. The growing popularity of electric buses for intracity travel and school commuting is expected to propel the growth of the market. Increasing usage of buses in airports, government facilities, and luxury tourism is further anticipated to positively impact the growth of the North American bus market.

Growing concerns regarding the increasing concentration of greenhouse gases and pollution level is encouraging American and Canadian government organizations to undertake several initiatives to reduce carbon emission levels. One such initiative includes electrifying the public transport fleet by procuring electric buses through bus manufacturers. For instance, on May 2023, the Canadian government announced the procurement of 1,299 electric buses to enhance the electric public transportation network in the eastern province of Quebec, Canada. Additionally, Canada's Federal and provincial government is said to invest USD 585 million and USD 823.2 million, respectively, to purchase 1,229 electric buses for Quebec.

Moreover, the ongoing transition from conventional buses to battery-powered and hydrogen-fuel-powered buses is driving the demand in the region. The U.S. Federal government, schools, automobile manufacturers & suppliers, and regional public transport providers to install efficient charging infrastructure are partnering to reduce the challenge faced by fleet operators in the electric bus market. They are working on the development of battery charging infrastructure and hydrogen fuel stations in the region. For instance, in April 2023, BorgWarner Inc., an automotive supplier, announced its partnership with Pontiac City School District, Michigan, for providing proprietary charging with direct current fast chargers enabling vehicle-to-grid charging for 25 IC electric buses.

Moreover, prominent players in the North America bus market investing in developing low-emission diesel engines. These engines are integrated with clean diesel technology, require lesser fuel, and have lower operating costs, thereby buses integrated with clean diesel engine technology are widely used for transit buses. For instance, in April 2023, New Flyer, a subsidiary of NFI Group Inc., announced that they had received the order for an additional 116 Xcelsior heavy-duty transit buses on behalf of the New York City Transit Authority. The Xcelsior buses are equipped with a diesel engine that complies with the Heavy-Duty National Program standards set by the United States Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA). This engine, when used with ultra-low-sulfur diesel fuel, emits 95% fewer nitrogen oxides compared to regular emissions.

Type Insights

The single deck segment accounted for the largest market share of more than 93% in 2022 and is expected to exhibit the fastest CAGR over the forecast. The aggressive investments being made across the U.S. and Canada to enhance the road transportation network have increased the accessibility of single-deck buses for interstate travel for passengers. Several city administrations are pursuing plans to convert their entire bus fleets to all electric vehicles. For instance, the Metropolitan Transportation Authority (MTA) is contemplating replacing its entire bus fleet with zero-emission vehicles by 2040.

Many cities are pursuing plans to convert their public transport fleets to electric bus fleets. For instance, the Metropolitan Transportation Authority is planning to convert its ICE buses to zero-emission buses by 2040. Similarly, in January 2023, Federal Transit Administration (FTA) U.S. announced funding worth approximately USD 1.7 million for state authorities to upgrade or purchase buses and improve bus facilities. Such initiatives encourage manufacturers to produce single-deck electric buses, thereby opening new opportunities for market growth.

Fuel Type Insights

The diesel segment accounted for the largest market share of more than 74% in 2022. Diesel tends to be relatively cheaper as compared to other vehicle fuels. Hence, diesel-fired buses are largely preferred owing to their lesser operating costs. Diesel engines are also considered rigid, and safe. Hence, diesel engines power 95% of all school buses in North America. Among these, the cleanest, nearly emission-free diesel engine technology is used by 58% of consumers. While most schools are being encouraged to utilize blends of high-quality biodiesel and renewable fuel to power their school buses and several schemes are also being launched to encourage the electrification of buses, the high initial costs and investments are compelling local agencies to continue using diesel buses.

The electric and hybrid segment accounted for a significant market share in 2022 and is poised for rapid growth over the forecast period. The growth of the segment can be attributed to the continued electrification of public fleets and the aggressive adoption of hybrid buses by public fleet operators in the U.S. A myriad of incentives, subsidiaries, and rebates are offered to electrify the existing bus fleet. For instance, the City of Jonesboro in the U.S. state of Arkansas received funding worth USD 878,584 to buy hybrid buses. These buses would replace older diesel buses and subsequently help in improving air quality throughout the city.

Seat Capacity Insights

The 31-50 seat segment accounted for the largest market share of more than 50% in 2022and is expected to exhibit the fastest CAGR of around 11.25% over the forecast period. Buses with a capacity of 30-50 seats are utilized for scheduled travel, tourism, and student transportation. Traffic congestion in particular makes these buses an preferable alternative to public transport.

Electrification is also emerging as a popular trend, particularly when it comes to buses with a capacity of 31-50 seats. Several initiatives are being pursued to curb pollution and protect school-going children from vehicular pollution. For instance, the U.S. government’s Clean School Bus program envisages the U.S. Environmental Protection Agency (EPA) covering up to 100% of the cost of replacing incumbent school buses with zero-emission school buses, including the cost of vehicles and the charging infrastructure.

Moreover, prominent manufacturers in the bus market, including Volvo, and Daimler AG, among others, are proactively following the electrification trend. For instance, in February 2022, the Metropolitan Transit Authority of Harris County (METRO) ordered 20 LFSe+ along with an option for 20 more units, totaling 40 electric buses, from Nova Bus, a Volvo group member, as part of the former’s sustainability initiatives.

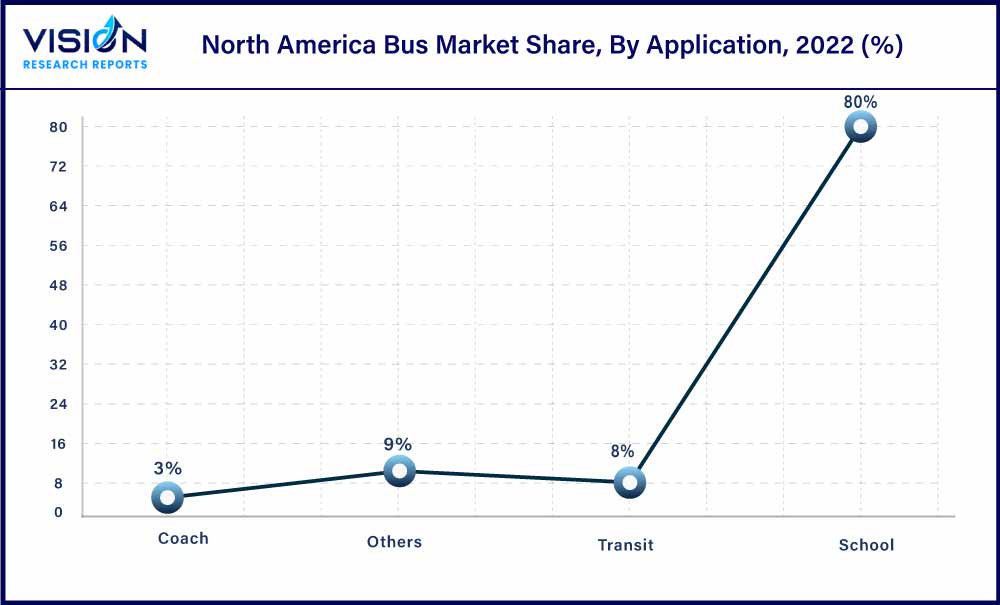

Application Insights

The school segment accounted for the largest market share of over 80% in 2022 and is expected to exhibit the fastest growth rate of 10.84% over the forecast period. Factors such as refurbishment and replacing existing fossil fuel-powered bus fleets with electric are expected to support the segmental growth over the forecast period. According to the New York School Bus Contractors Association. Inc., more than 480,000 school buses are operating in the U.S., of which the majority are powered by fossil fuels such as diesel and petrol.

Diesel-powered buses produce diesel exhaust, known as a carcinogen, associated with severe health problems ranging from asthma to cognitive impairment. Government authorities in the U.S. and Canada have introduced initiatives to replace fossil fuel-based buses with electric buses. For instance, the under the Bipartisan Infrastructure Law, the United States Environmental Protection Agency’s Clean School Bus Program aims to invest USD 5 million in existing school buses with low or zero-emission school buses. In April 2023, under the Clean School Bus Program, the U.S. government announced the release of USD 400 million in grants for electric school buses. Until now, the government has awarded about USD 1 million, which is said to support the purchase of 2,463 buses, of which 95 % are electric buses.

North America Bus Market Segmentations:

By Type

By Fuel Type

By Seat Capacity

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America Bus Market

5.1. COVID-19 Landscape: North America Bus Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. North America Bus Market, By Type

8.1. North America Bus Market, by Type, 2023-2032

8.1.1. Single Deck

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Double Deck

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. North America Bus Market, By Fuel Type

9.1. North America Bus Market, by Fuel Type, 2023-2032

9.1.1. Diesel

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Electric and Hybrid

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Other Fuel Type

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. North America Bus Market, By Seat Capacity

10.1. North America Bus Market, by Seat Capacity, 2023-2032

10.1.1. 15-30 Seats

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. 31-50 Seats

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. More Than 50 Seats

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. North America Bus Market, By Application

11.1. North America Bus Market, by Application, 2023-2032

11.1.1. Transit

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. School

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Coach

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 12. North America Bus Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type (2020-2032)

12.1.2. Market Revenue and Forecast, by Fuel Type (2020-2032)

12.1.3. Market Revenue and Forecast, by Seat Capacity (2020-2032)

12.1.4. Market Revenue and Forecast, by Application (2020-2032)

Chapter 13. Company Profiles

13.1. AB Volvo

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Anhui Ankai Automobile Co., Ltd.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Blue Bird Corporation

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. BYD Company Limited Daimler AG (Mercedes-Benz Group AG )

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Iveco SpA

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. NAVISTAR (Traton Group)

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. NFI Group

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Proterra Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. REV Group

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Proterra Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others