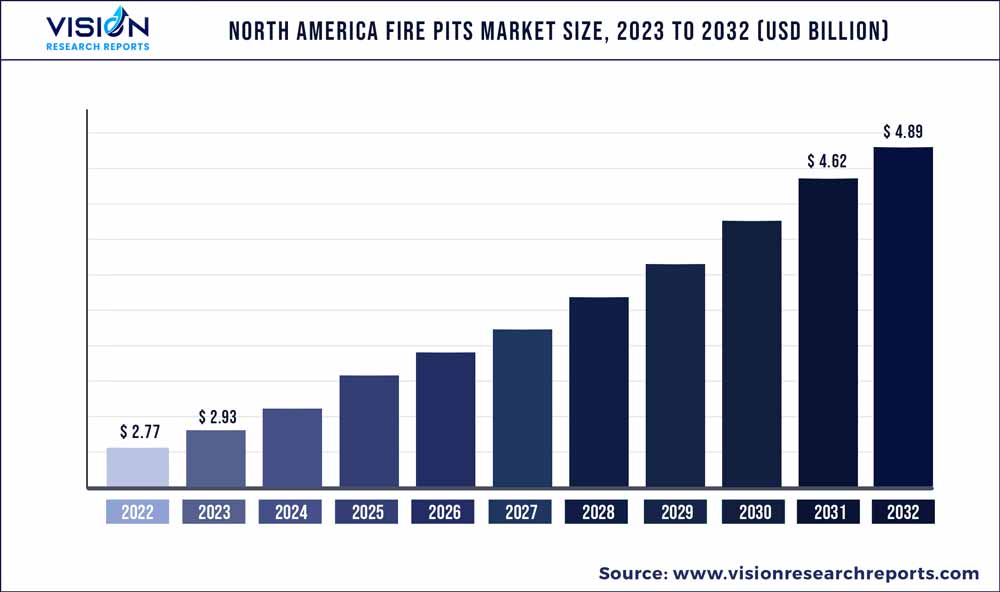

The North America fire pits market was surpassed at USD 2.77 billion in 2022 and is expected to hit around USD 4.89 billion by 2032, growing at a CAGR of 5.84% from 2023 to 2032.

Key Pointers

Report Scope of the North America Fire Pits Market

| Report Coverage | Details |

| Market Size in 2022 | USD 2.77 billion |

| Revenue Forecast by 2032 | USD 4.89 billion |

| Growth rate from 2023 to 2032 | CAGR of 5.84% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | The Outdoor GreatRoom Company LLC; Fire Pit Art; Breeo Industries LLC; Solo Stove (Solo Brands); Tropitone Furniture Co., Inc.; The Blue Rooster Company; Prism Hardscapes; Ohio Flame, Inc.; Camp Chef (Vista Outdoor Operations LLC); Paloform |

Fire pits are among the most popular ways of improving outdoor living areas among homeowners across North America, as indicated by the American Society of Landscape Architects (ASLA). In several parts of the U.S. and Canada, builders are compelled to create outdoor living spaces that provide homeowners with the most usable square footage possible. This situation is predicted to drive the demand for fire pits in North America. The market is also boosted by rising property sales, a shift toward urban lifestyles, and increasing demand for fire pits.

The increasing demand for differentiated products and services leads to more research and development (R&D) spending. R&D is also a technique used by key market players to make financial profits while addressing environmental and social challenges through technologies and products. The global optimization for manufacturing and modularization has unlocked resources for investments in design, product development, and marketing in the decorative appliance industry. For instance, in April 2021, Breeo, a brand of Warming Trends, launched the world’s largest smokeless fire pit - Breeo X30, with new customizable options; this makes it the ultimate experience in backyard cooking and entertainment.

The distribution business strategy for fire pit decorative appliances is a critical indicator that influences the performance of the industry in the future. The majority of businesses in this sector offer their goods through channels that include retail stores, individual or corporate dealers, and B2B channels such as distributors and contractors. In addition, maintaining exclusive channel partners and distributors is a convenient strategy for higher penetration of products in the market. Thus, manufacturers primarily opt for this distribution channel across regions and countries. For instance, in November 2020, True Value Hardware, a wholesaler that supplies over 4,500 independently owned stores, stated that the sale of wood-burning fire pits increased by 300%.

The pandemic had a significant impact on work culture, and many people still prefer the flexibility of working from the comfort of their homes. Being at home most of the day is more likely to encourage the purchase of home amenities. The International Casual Furnishings Association (ICFA) reported that 71% of Americans spent up to seven hours per week outside in 2022, much more time than they did the year before. In addition, approximately 78% of respondents said they have improved their outdoor living areas in 2021, according to the same research.

Product Type Insights

In 2022, the wood-burning fire pits segment dominated the market in North America with a revenue share of approximately 49%. These wood-burning fire pits serve as homemade camping-style fire pits that are typically located away from the primary house site for safety. Market players have been engaging in product launches due to the increasing demand for such fire pits. In November 2021, for instance, TIKI, a Wisconsin-based brand, introduced a new product to its lineup: the Portable Fire Pit. This innovative product offers the advantages of its Patio Fire Pit, as well as other benefits such as a low-smoke experience and an ash pan for easy clean-up. It can be used with TIKI Wood Packs for a quick and consistent fire or with real wood.

The propane fire pits segment is anticipated to register a CAGR of about 9.24% during the forecast period. Homeowners prefer propane-based fire pits instead of raw materials such as wood because propane-based fire pits are available in different sizes, appeal, and price ranges. In addition, propane burns cleaner without generating sparks or ash, which may cause inconvenience or safety concerns for individuals. Unlike conventional log fires, which leave coals burning for hours, the flames of a propane fire pit can be easily extinguished. In addition, propane fire pits can be safely positioned on open porches with overhead roofs, making them suitable for a wider range of outdoor spaces.

Type Insights

The classic fire pits segment dominated the North America market in 2022 with a revenue share of approximately 41%. Classic fire pit designs are commonly available for purchase at retail stores or can be customized and manufactured according to specific preferences. For instance, Hayneedle Inc., an e-commerce site based in Nebraska, U.S. offers a traditional and classic fire pit collection of various brands. The fire pits come in different features such as grills, free cover, and various product types such as wood burning and gas.

The tabletop fire pits segment is set to grow at the fastest CAGR of 9.74% over the forecast period. These pits utilize gas power, sourced either from a propane tank or an underground gas connection. In September 2022, Solo Stove launched a new collection of tabletop fire pits known as Mesa. Irrespective of the outside space a user has access to, a tabletop fire pit enhances the appearance of any setting and enables anybody to enjoy the sound of a crackling fire. By offering new options that cater to evolving customer preferences and addressing specific needs, market players have been stimulating consumer interest and creating a sense of novelty towards tabletop fire pits.

End-use Insights

Outdoor use of fire held the largest revenue share of approximately 68% in 2022. The trend of smokeless fire pits is encouraging more outdoor use by minimizing smoke and providing a cleaner and more enjoyable fire experience. In August 2022, Solo Stove introduced the Fire Pit 2.0 version, an upgraded iteration of its smokeless fire pit line. This update includes patented features such as a removable fuel grate and ash pan, enhancing the fire pit's versatility as a centerpiece on outdoor tables or an ambient addition to the surroundings.

Indoor usage of fire pits is projected to register a CAGR of approximately 6.54% during the forecast period. Indoor fire pits are surging in popularity due to their appealing aesthetics and ability to provide a similar level of comfort as outdoor fireplaces. Portable indoor fire pits eliminate the need for the construction of a campfire or a dedicated fire pit space. One notable example is the Stix Portable Fire Pit by EcoSmart Fire, a U.S.-based company that offers a stainless-steel twist on the traditional campfire.

Sales Channel Insights

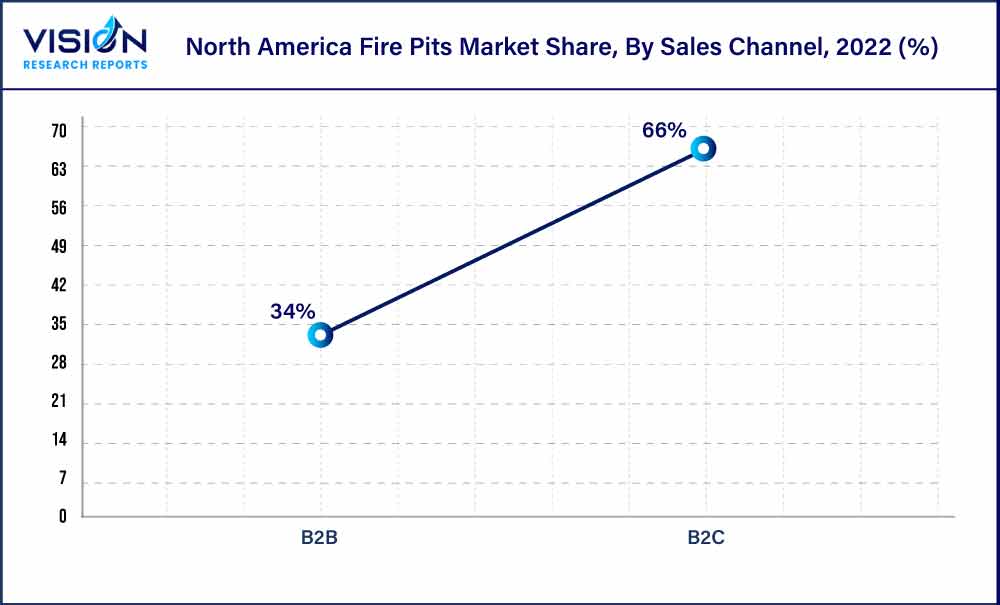

In North America, the B2C channel dominated the market with a revenue share of approximately 66% in 2022. According to ICFA, in March 2021, 90% of Americans agreed that their outdoor living space is more valuable than ever, with 78% making exterior upgrades during COVID-19. Fire pits have risen to the top on the list of additions as more people choose to stay indoors and yearn to spend more time outside. This scenario is expected to drive the demand for the incorporation of fire pits, specifically fire tables, and bowls.

The B2B channel is projected to register the fastest CAGR of approximately 6.43% from 2023 to 2032. An advanced way of life with an increase in the appropriation of Western traditions and quick socializing trends like dining outdoors in gardens, social events, and grilling & barbecue activities in the patio area are factors creating various opportunities for the fire pit market at hotels, cafés, pools, and other locations. Fire features, such as a torch, a fire table with chairs around it, or a huge fire bowl on a high pedestal, add decorative components to enhance outdoor spaces.

North America Fire Pits Market Segmentations:

By Product Type

By Type

By End-use

By Sales Channel

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America Fire Pits Market

5.1. COVID-19 Landscape: North America Fire Pits Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. North America Fire Pits Market, By Product Type

8.1. North America Fire Pits Market, by Product Type, 2023-2032

8.1.1. Wood Burning

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Propane

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Propane

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Gas

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Gas

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. North America Fire Pits Market, By Type

9.1. North America Fire Pits Market, by Type, 2023-2032

9.1.1. Classic Fire Pit

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Fire Table

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Fire Pit Bowls

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Tabletop Fire Pits

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Chiminea

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 10. North America Fire Pits Market, By End-use

10.1. North America Fire Pits Market, by End-use, 2023-2032

10.1.1. Indoor

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Outdoor

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. North America Fire Pits Market, By Sales Channel

11.1. North America Fire Pits Market, by Sales Channel, 2023-2032

11.1.1. B2B

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. B2C

11.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 12. North America Fire Pits Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product Type (2020-2032)

12.1.2. Market Revenue and Forecast, by Type (2020-2032)

12.1.3. Market Revenue and Forecast, by End-use (2020-2032)

12.1.4. Market Revenue and Forecast, by Sales Channel (2020-2032)

Chapter 13. Company Profiles

13.1. The Outdoor GreatRoom Company LLC

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Fire Pit Art

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Breeo Industries LLC

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Solo Stove (Solo Brands)

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Tropitone Furniture Co., Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. The Blue Rooster Company

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Prism Hardscapes

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Ohio Flame, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Camp Chef (Vista Outdoor Operations LLC)

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Paloform

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others