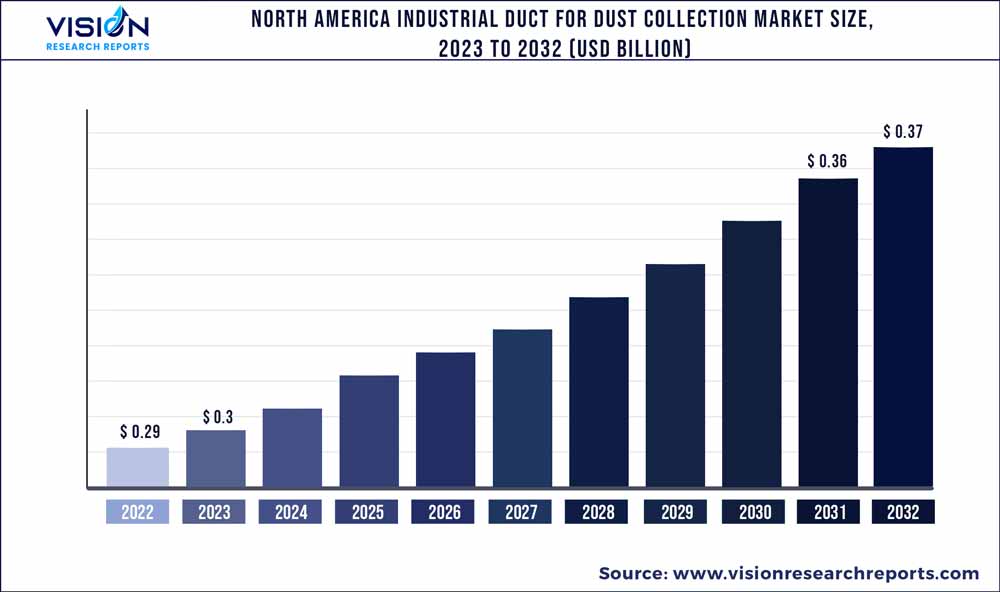

The North America industrial duct for dust collection market size was estimated at around USD 0.29 billion in 2022 and it is projected to hit around USD 0.37 billion by 2032, growing at a CAGR of 2.55% from 2023 to 2032.

Key Pointers

Report Scope of the North America Industrial Duct For Dust Collection Market

| Report Coverage | Details |

| Market Size in 2022 | USD 0.29 billion |

| Revenue Forecast by 2032 | USD 0.37 billion |

| Growth rate from 2023 to 2032 | CAGR of 2.55% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Spiral MFG; US Duct; Nordfab; Carolina Air Systems; Donaldson Company, Inc.; Penn American Inc.; Oneida Air Systems, Inc.; Imperial Systems, Inc.; The Blastgate Co.; Fab-Tech Inc.; Air Handling Systems; Sisneros Bros. Mfg.; CaptiveAire; Boss Products LLC.; LaPine Metal Products; US Metal Crafters; Flexaust; Superior Duct Fabrication |

The increasing fire incidents related to wood dust and the growing stringency of regulations such as NFPA and OSHA are expected to propel the demand for industrial ducts for the dust collection market in the coming years. The industrial duct for dust collection is crucial for various industries for worker safety. Uncontrolled dust from the machinery can cause a variety of issues, including sanitation concerns, microbial contamination, worker health issues, and slip-and-fall incidents. These factors are expected to drive the demand for North America industrial ducts for the dust collection market over the forecast period.

In 2020, Quebec, British Columbia, and Alberta generated 81% of Canada's softwood timber. While Alberta gained 8 percentage points of the Canadian market, British Columbia lost 13 percentage points, which can be seen from 2023. Similarly, sawmill manufacturing was the largest manufacturing industry in British Columbia in 2020, accounting for 12% of the overall income from goods manufactured in the province, whereas Ontario became the largest sawmill manufacturer by April 2023 as per Statistics Canada.

Furthermore, woodworking facilities are particularly vulnerable to fire because they produce a lot of sawdust, which burns much more readily than full pieces of timber. Also, the majority of wood dust is flammable and explosive. Controlling and managing airborne pollutants in the woodworking application is expected to decrease fire-related risks and prevent loss of life and property damage. Thus, the increasing fire incidents related to wood dust and growing stringent regulations such as NFPA and OSHA are expected to propel the industrial duct for dust collection market demand in Canada in the coming years.

The growing food manufacturing facilities and rising government initiatives taken by the Canadian government necessitate the demand for industrial ducts for dust collection. For instance, in January 2023, the Canadian Food Innovation Network (CFIN) invested USD 2,545,030 in eight projects totaling more than USD 5 million through food innovation challenges and innovation booster programs. Thus, rising food manufacturing facilities are anticipated to drive the North America industrial duct for dust collection market over the forecast period.

Diameter Insights

The 24” to 48” diameter segment dominated the market in 2022 with a revenue share of 41%. The demand for 24" to 48" diameter industrial ducts for dust collection is rising owing to their increased demand for handling high-pressure, low-pressure loss, and effective airflow. In the recycling industry, where the material being carried is likely to be very abrasive, an industrial duct for dust collection in diameters ranging from 24" to 48" duct offers an ideal solution for dust collection. These aforementioned factors are anticipated to propel the demand for 24" to 48" diameter ducts for dust collection in the coming years.

The up to 24” diameter segment is expected to grow at a CAGR of 2.85% from 2023 to 2032. Diameter of up to 24" can be advantageous for industrial operations that involve the grinding of metals, processing of wood, handling of chemicals, or food preparation. A correctly sized duct system is useful for any procedure that generates dust in a closed space. Furthermore, improperly sized duct systems might impair dust-collecting systems and airflow levels. Generic systems may cost less upfront, but they degrade more quickly than systems that are appropriately sized and well-made. These factors are anticipated to drive the demand for industrial ducts for dust collection applications in the coming years.

Application Insights

The woodworking segment dominated the market in 2022 with a revenue share of 15%. Woodworking facilities are particularly vulnerable to fire because they produce a lot of sawdust, which burns much more readily than full pieces of timber. Sanders, routers, and shapers produce particularly significant volumes of fine dust.In addition, the majority of wood dust is flammable and explosive. Controlling and managing airborne pollutants in woodworking applications is expected to decrease fire-related risks and prevent loss of life and property damage. Thus, the increasing fire incidents related to wood dust and growing stringent regulations such as NFPA and OSHA are expected to propel the demand for industrial ducts for the dust collection market in the coming years.

The food segment was valued at USD 34.7 million in 2022. Industrial ducts for dust collection in the food industry prevent cross-contamination in food, as the food industry transports huge volumes of grains, sugar, and dairy products. Furthermore, the food industry necessitates a hygienic environment, for which, industrial ducts for dust collectors play a significant role in food industry hygiene. In addition, industrial ducts for dust collection in the food industry are commonly utilized at the sites of bulk and material handling, transportation, and packing. This is expected to drive the demand for Industrial ducts for dust collection in the food industry.

The semi-conductors segment is likely to grow at a CAGR of 3.53% over the forecast period. Grinding dust can increase the chance of an electrical discharge in sectors that utilize electrical components, such as semiconductors or electronics manufacturing. Dust that contains conductive particles can cause a short circuit or harm delicate components, resulting in subpar goods or equipment failure. The need for industrial ducts for dust collection in semiconductor application is anticipated to increase due to the expansion of the semiconductor manufacturing industries and the need to prevent rising amount of dust.

North America Industrial Duct For Dust Collection Market Segmentations:

By Diameter

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America Industrial Duct For Dust Collection Market

5.1. COVID-19 Landscape: North America Industrial Duct For Dust Collection Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. North America Industrial Duct For Dust Collection Market, By Diameter

8.1. North America Industrial Duct For Dust Collection Market, by Diameter, 2023-2032

8.1.1. Up to 24”

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. 24” to 48”

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. 48” to 72”

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. North America Industrial Duct For Dust Collection Market, By Application

9.1. North America Industrial Duct For Dust Collection Market, by Application, 2023-2032

9.1.1. Food

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Pharmaceutical

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Cement

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Welding

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Woodworking

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Steel

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Semi-conductors

9.1.7.1. Market Revenue and Forecast (2020-2032)

9.1.8. Batteries

9.1.8.1. Market Revenue and Forecast (2020-2032)

9.1.9. Asphalt

9.1.9.1. Market Revenue and Forecast (2020-2032)

9.1.10. Chemical

9.1.10.1. Market Revenue and Forecast (2020-2032)

9.1.11. Others

9.1.11.1. Market Revenue and Forecast (2020-2032)

Chapter 10. North America Industrial Duct For Dust Collection Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Diameter (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Spiral MFG

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. US Duct

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Nordfab

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Carolina Air Systems

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Donaldson Company, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Penn American Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Oneida Air Systems, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Imperial Systems, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. The Blastgate Co.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Fab-Tech Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others