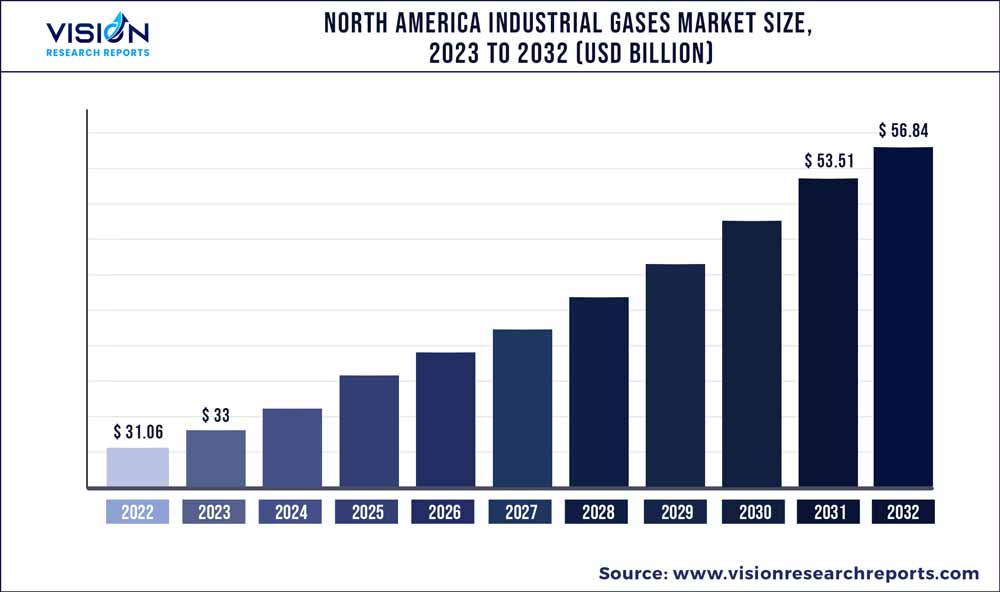

The North America industrial gases market size was estimated at around USD 31.06 billion in 2022 and it is projected to hit around USD 56.84 billion by 2032, growing at a CAGR of 6.23% from 2023 to 2032.

Key Pointers

Report Scope of the North America Industrial Gases Market

| Report Coverage | Details |

| Market Size in 2022 | USD 31.06 billion |

| Revenue Forecast by 2032 | USD 56.84 billion |

| Growth rate from 2023 to 2032 | CAGR of 6.23% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Messer North America, Inc.; Air Products and Chemicals, Inc.; Linde plc; Air Liquide; Matheson Tri-Gas, Inc.; BASF SE; MESA Specialty Gases & Equipment; Universal Industrial Gases, Inc |

This is attributed to ongoing industrialization and the increasing application of these gases in various industries such as healthcare, manufacturing, metallurgy, and food & beverages in North America. Industrial gases are increasingly consumed in the healthcare sector owing to their surging applicability in medical applications. Oxygen is the largest and most commonly used industrial gas in medical applications. It is utilized in respiratory therapy. Oxygen is also used in anesthesia and life support systems. This trend is driving the growth of the product market in the region.

Moreover, industrial gases are used in the food & beverages industry for multiple applications such as modified atmosphere packaging (MAP), carbonizing, freezing, and chilling food products and beverages. Modified atmosphere packaging (MAP) uses industrial gases such as nitrogen, carbon dioxide, and oxygen to preserve food products and beverages for a long period. Industrial gases like nitrogen and oxygen find application in the electronics industry. For example, gases like nitrogen and argon gases are used in the production of plasma screens, while helium is mostly used for the development of hard disk drives.

The leading industrial gas companies such as Linde plc, Air Liquide, and Messer constitute a majority of the share of the market in the region owing to these players having multiple production plants in different counties across the region. For instance, Linde plc has its production facilities primarily in the U.S., Canada, and Mexico in North America. The presence of different laws and regulations related to the storage and transportation of industrial gases in North America that manufacturers and distributors of these gases are required to abide by restricts the growth of the product market.

Product Insights

Oxygen dominated the market with the highest revenue share of 39% in 2022, owing to the versatility and essentiality of oxygen making it a vital component in the chemicals and healthcare industries. Medical oxygen is essential in hospitals and health clinics for carrying out therapies and various surgeries. Moreover, oxygen is also used for metal cutting, welding, cleaning, and melting applications. In the food industry, it is used to maintain the fresh and natural color of red meat.

Liquid oxygen is commonly used in the pharmaceutical industry for the production of antibiotics, anesthetics, heart medications, etc. Moreover, it is widely used in the chemicals industry for various applications. Oxygen is used as a reactant in a number of chemical reactions for producing acetylene, ethylene oxide, and methanol by carrying out partial oxidation of hydrocarbons. It is also used in combination with acetylene and other fuel gases in metal manufacturing plants for scarfing, metal cutting, hardening, welding cleaning, and melting applications.

The cryogenic form of nitrogen is used in cooling, food freezing, and metal treating applications. It is also used in biological sample preservation and other temperature-related applications. The compressed form of nitrogen is employed in propellants, as well as in pneumatic applications.

In the energy industry, cryogenic hydrogen gas serves as a potential transport fuel and a low-carbon alternative to natural gas and refined oil. Hydrogen is converted to synthetic liquid fuels, ammonia, methanol, and synthetic methane for transportation purposes. In addition, hydrogen fuel cell electric vehicles (FCEVs) are witnessing increased sales owing to zero tailpipe emissions of pollutants.

Application Insights

The healthcare segment dominated the market with the highest revenue share of 27% in 2022, owing to their increasing application of industrial gases like oxygen and nitrogen in the healthcare industry. Industrial gases are increasingly used in North America because of the surged government spending for providing improved healthcare and medical technologies to the masses.

Gases, such as nitrogen, helium, and carbon dioxide are also used in various medical processes and therapies for sedation and treatment of respiratory diseases such as chronic obstructive pulmonary disease (COPD), as well as for offering respiratory support to newborn infants. With a focus on developing innovative gas-based therapies to meet the evolving medical requirements of patients, the market for industrial gases used in the healthcare sector is expected to experience significant growth in North America in the coming years.

Industrial gases such as nitrogen, oxygen, hydrogen, and carbon dioxide are extensively used in the chemicals & energy industry for various applications. Nitrogen is a versatile gas widely used for pressurizing chemical liquids in pipelines. It also serves as a protective medium for oxygen-sensitive materials and helps eliminate volatile organic chemicals (VOCs) from process streams. Nitrogen is increasingly used as an inert gas in energy generation plants. It acts as a blanket to isolate critical products from the air.

North America Industrial Gases Market Segmentations:

By Product

By Application

By Application by Product

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America Industrial Gases Market

5.1. COVID-19 Landscape: North America Industrial Gases Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. North America Industrial Gases Market, By Product

8.1. North America Industrial Gases Market, by Product, 2023-2032

8.1.1. Nitrogen

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Hydrogen

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Carbon Dioxide

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Oxygen

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Argon

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Acetylene

8.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 9. North America Industrial Gases Market, By Application

9.1. North America Industrial Gases Market, by Application, 2023-2032

9.1.1. Healthcare

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Manufacturing

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Metallurgy & Glass

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Food & Beverages

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Retail

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Chemicals & Energy

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 10. North America Industrial Gases Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Messer North America, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Air Products and Chemicals, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Linde plc

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Air Liquide

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Matheson Tri-Gas, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. BASF SE

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. MESA Specialty Gases & Equipment

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Universal Industrial Gases, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others