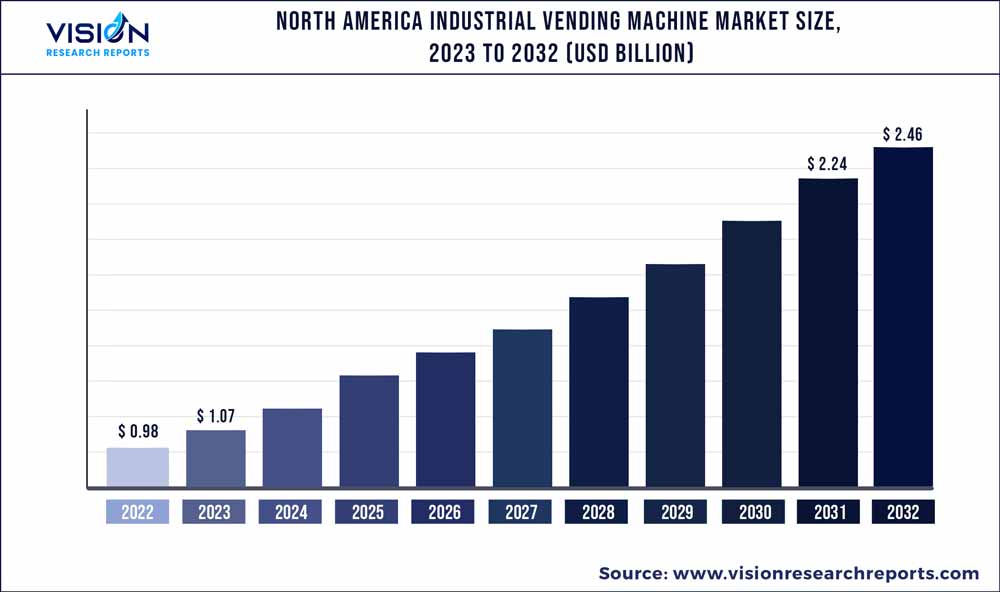

The North America industrial vending machine market size was estimated at around USD 0.98 billion in 2022 and it is projected to hit around USD 2.46 billion by 2032, growing at a CAGR of 9.64% from 2023 to 2032.

Key Pointers

Report Scope of the North America Industrial Vending Machine Market

| Report Coverage | Details |

| Market Size in 2022 | USD 0.98 billion |

| Revenue Forecast by 2032 | USD 2.46 billion |

| Growth rate from 2023 to 2032 | CAGR of 9.64% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Airgas, Inc.; Apex Industrial Technologies, LLC.; AutoCrib; CRIBMASTER; Fastenal Company; IMC Companies; MSC Industrial Direct Co., Inc.; SECURASTOCK; SupplyPro, Inc. |

Industrial vending machines have grown in popularity in North America, where they can be found in diverse locations such as manufacturing factories, warehouses, and distribution centers. These machines let staff easily access equipment and supplies while allowing management to check usage and limit expenditures. Furthermore, the need for improved inventory management, cost control, and increased safety measures is driving the adoption of North America industrial vending machines. As technology advances, the market for industrial vending machines is projected to witness more inventive applications in the forthcoming years.

One of the primary factors driving the North America industrial vending machine market is the increasing demand for vending machines for manufacturing organizations to improve their inventory management operations. Inventory management is a challenge for numerous enterprises, often resulting in insufficient stocks and production setbacks. Industrial vending machines present a viable solution to this issue by enabling live inventory monitoring and automated restocking. Furthermore, industrial vending machines provide industrial workers with 24-hour access to tools and supplies and reduce the time and effort required to acquire supplies. This is anticipated to drive the demand for industrial vending machines.

Additionally, the need to reduce waste and control production costs is anticipated to drive the growth of the North America industrial vending machines market. Businesses can avoid waste and save money on unwanted purchases by tracking inventory levels and distributing only the amount of goods required. Smart industrial vending machines tend to be more beneficial to companies as they offer data analytics solutions that help companies observe & track product usage patterns and maintain the inventory accordingly. For instance, in September 2021, Silkron, a vending machine manufacturer, announced the launch of new industrial vending machines. This machine avoids critical stock-outs by alerting the operator to restock in time and avoids overstocking by analyzing consumption trends.

Moreover, COVID-19 has increased the demand for PPE and other safety equipment, such as eTools and MROs, which can be efficiently distributed through industrial vending machines. These machines provide a contactless and convenient method of obtaining vital supplies while reducing the risk of transmission. Workers can rapidly get the components and supplies they need to keep production operations smooth via the placement of vending machines on the shop floor. This saves time and contributes to better inventory management. These machines aid in managing consumable spending while providing workers access to a large range of goods and services that are frequently used.

Furthermore, hospitals and other healthcare facilities focus on adopting industrial vending machines to streamline the supply chain and eliminate waste. Hence, such industries provide lucrative opportunities for the growth of the market. For instance, in June 2021, Chula Med, in collaboration with Sun Vending Technology Public Company Limited, a provider of intelligent vending machines, announced the launch of automatic vending machines to sell medical products from the researchers of King Chulalongkorn Memorial Hospital and Chula Med.

Type Insights

The coil vending machine segment dominated the market and accounted for nearly 38% of revenue share in 2022. These machines store more inventory than other machines, such as vertical lift machines and cabinet vending machines. The coil vending machine also consumes less power and has low maintenance costs. These machines allow goods to be stacked from front to back and offer high storage density, but they are only suitable for smaller items.

The carousel vending machine segment is expected to register a 10.13% CAGR over the forecast period. Carousel vending machines use intelligent software that analyzes data on customer preferences, product demand, and sales trends. This data is then used to optimize product offerings, prices, and even the layout of the machine to maximize sales and profits. To personalize the user experience, they are integrated with touch screens, cashless payment systems, and even facial recognition technologies. These mentioned factors are expected to support the segment’s growth.

Product Insights

The personal protective equipment (PPE) segment dominated the market and accounted for approximately 42% share of revenues in 2022. Technological advancements have resulted in the development of more effective PPE, such as respirators, gloves, protective gear, and footwear. These improvements have increased the comfort, durability, and effectiveness of PPE, making it more attractive to workers. The demand for these PPE machines is also anticipated to rise due to strictrules regarding worker safety.

The maintenance, repair, and operations (MRO) segment is estimated to register a CAGR over the forecast period. MRO supplies such as tools, spare parts, sealants, coatings, tool kits, and testing equipment are required the most during downtime. Hence, MRO equipment is stocked as well as maintained on a large scale in industries with high downtime costs. MRO tools are one of the most important components of inventory and tracking them is critical for a variety of end-use industries, including oil and gas, manufacturing, and aviation. Industrial vending machines make tracking and maintaining MRO supplies simple, which drives segment growth.

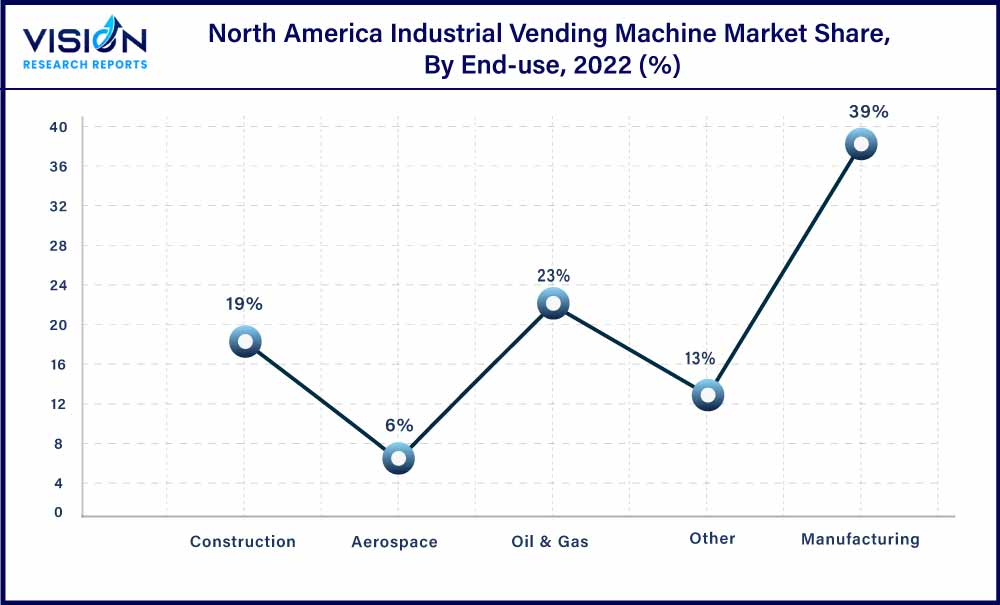

End-use Insights

The manufacturing segment accounted for approximately 39% market share in 2022. Cost reduction is a primary factor expected to increase the adoption of industrial vending machines among end-users. The approach of companies toward lowering labor costs associated with inventory management is resulting in the increasing deployment of industrial vending machines at work sites. These machines aid in automating the inventory management process with advanced features such as real-time inventory tracking. Industrial vending machines can help in minimizing the occurrence of stock-outs and overstocking. These advantages of industrial vending are expected to support market growth.

Industrial vending machines are widely used in manufacturing to reduce operational downtime and speed up maintenance and repair. Industrial vending machines also help to improve operational efficiency and maintain track of inventory availability. Furthermore, growing urbanization and rising industrialization have fuelled the growth of the North America industrial vending machine industry.

The aerospace segment is expected to register the highest CAGR over the forecast period of 2023-2032. Industrial vending machines help boost productivity and reduce downtime by providing 24/7 access to the tools and consumables required for the manufacturing process. Workers may simply obtain the resources they require without having to wait for authorization or seek things. Hence, such factors drive the segment’s North America industrial vending machine industry growth.

North America Industrial Vending Machine Market Segmentations:

By Type

By Product

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America Industrial Vending Machine Market

5.1. COVID-19 Landscape: North America Industrial Vending Machine Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. North America Industrial Vending Machine Market, By Type

8.1. North America Industrial Vending Machine Market, by Type, 2023-2032

8.1.1 Carousel Vending Machine

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Coil Vending Machine

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Cabinet Vending Machine

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. North America Industrial Vending Machine Market, By Product

9.1. North America Industrial Vending Machine Market, by Product, 2023-2032

9.1.1. MRO Tools

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. PPE

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. North America Industrial Vending Machine Market, By End-use

10.1. North America Industrial Vending Machine Market, by End-use, 2023-2032

10.1.1. Manufacturing

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Oil & Gas

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Construction

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Aerospace

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Other

10.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 11. North America Industrial Vending Machine Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Product (2020-2032)

11.1.3. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 12. Company Profiles

12.1. Airgas, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Apex Industrial Technologies, LLC.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. AutoCrib.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. CRIBMASTER.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Fastenal Company

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. IMC Companies

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. MSC Industrial Direct Co., Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. SECURASTOCK

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. SupplyPro, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others