The North America mini and midi horizontal directional drilling market size was estimated at around USD 3.78 billion in 2023 and it is projected to hit around USD 6.72 billion by 2033, growing at a CAGR of 5.93% from 2024 to 2033. The North American market for mini and midi horizontal directional drilling (HDD) is experiencing significant growth, driven by the increasing demand for efficient underground construction solutions. HDD technology has become a critical method for installing underground utilities, such as pipelines and cables, with minimal disruption to the surface environment.

The growth of the North America mini and midi horizontal directional drilling (HDD) market is primarily driven by the rising demand for efficient and minimally invasive underground construction techniques. As urbanization intensifies and infrastructure projects increase, there is a growing need for technologies that can install utilities such as water pipelines, gas lines, and telecommunication cables without disrupting existing structures. Mini and midi HDD equipment, known for their precision and adaptability in confined spaces, are increasingly preferred in urban environments where traditional trenching methods are impractical. Additionally, the push for upgrading aging infrastructure and expanding broadband networks further fuels the demand for these drilling technologies across the region.

| Report Coverage | Details |

| Market Size in 2023 | USD 3.78 billion |

| Revenue Forecast by 2033 | USD 6.72 billion |

| Growth rate from 2024 to 2033 | CAGR of 5.93% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Barbco, Inc.; Creighton Rock Drill Ltd.; Direct Horizontal Drilling, Inc.; Ellingson Companies; Ferguson Michiana Inc.; Horizontal Technology, Inc.; Inrock Drilling Systems, Incorporated; Kondex Corporation U.S.A.; Laney Directional Drilling Co.; Mccloskey International; Mclaughlin Group; Inc.; Midwest Underground Technology, Inc.; Prime Horizontal; The Charles Machines Works, Inc. (Ditch Witch); The Toro Company; Vector Magnetics LLC; Vermeer Corporation; Vision Directional Drilling; Vmt Gmbh Gesellschaft Für Vermessungstechnik |

Based on machine type, the North America mini and midi horizontal directional drilling market has been segmented into utility vibratory plow, utility tractor, pile driver, foundation machine, boring machine, and others. In 2023, the utility vibratory plow segment held the largest revenue share of 28%. This machine drills underground to install flexible conduits at an appropriate depth, creating a path to pull pipeline or fiber cable through. These machines are used in the telecommunication industry for fiber cable installation and in the O&G industry for pipeline installation. The growth of the sectors, as mentioned earlier, is expected to drive the demand for utility vibrator plow HDD machines of mid and mini-types in North America.

The pile driver held the second-largest revenue share in 2023 owing to the demand in the telecommunication and O&G industries for pipeline and cable installations. Companies such as STARKE and others are involved in the manufacturing of pile drivers offering strong power, automatic anchoring, and other advantages.

The market for mini and midi HDD machines has been divided based on machine size. Among these segments, the midi segment held the largest revenue share of 80% in 2023. This dominance can be attributed to the widespread adoption of midi HDD machines in the telecommunications industry, specifically for underground fiber cable installation projects.

In recent years, there has been a surge in infrastructure development in North America, resulting in improved availability of broadband services to households. This has led to an increased demand for fiber cable installation projects in the region. The midi HDD machines have played a crucial role in meeting this demand, thereby solidifying their market position.

Furthermore, significant companies are involved in manufacturing mini-HDD machines specifically designed for smaller conduits and pipeline installations. For instance, on May 16, 2023, AT&T Intellectual Property collaborated with BlackRock, Inc. to install fiber optic internet cables in Florida metro areas. This project necessitated the use of mini HDD machines and aimed to expand their 5G wireless networks across the United States.

Based on parts type, the North America mini & midi HDD market has been segmented into rigs, pipes, bits, and reamers. The rigs segment held the largest revenue share of 34% in 2023 owing to the application of underground utility installation, which includes installation of pipelines, cables, and conduits without disturbing the surface in industries such as construction and telecommunication for infrastructural development.

Reamers held the second largest revenue share in 2023 due to the large-scale adoption of reamers in HDD. Reamers are widely used in HDD operations in the oil and gas industry. Reamers are used to enlarge the pilot hole and create a suitable bore path for oil and gas pipeline installation. As the demand for energy resources grows, so does the need for reamers in HDD for oil and gas infrastructure.

Based on tooling, the mini and mid-sized HDD market has been segmented into transition rods, HDD drill pipes, HDD drive collars, chucks and subs, HDD paddle bits, HDD rotary and pulling equipment, and others. The transition rod segment held the largest revenue share of 29% in 2023 due to its ability to effectively manage the lateral and torsional stresses generated during deep-hole RC drilling. Transition bars are used under the stress of HDD projects for stress redistribution. Stress redistribution increases drill string life, reducing the risk of failure during drilling operations.

In terms of end-use, the mini & midi HDD market has been segmented into oil & gas extraction, utility, telecommunication, and others. The oil & gas extraction segment held the largest revenue share of 35% in 2023. This growth is attributed to the application of HDD in oil and gas exploration and production from onshore fields for various exploration and production activities carried out in the region. The presence of extensive unconventional resources in North America has boosted the demand for HDD in the oil & gas extraction process.

In January 2023, the Mexican Treasury announced an investment of USD 20 billion in oil exploration and production through its state-owned oil production company, Pemex. Substantial government investment in oil & gas exploration and production over the forecast period is expected to result in a surge in drilling activity in Mexico over the coming years.

Telecommunication held the second-largest revenue share in 2023. Increasing adoption of work-from-home culture and remote learning post-COVID-19 have prompted the installation of optical fiber projects in North America. These factors have attracted several investors in the telecommunication industry in the region.

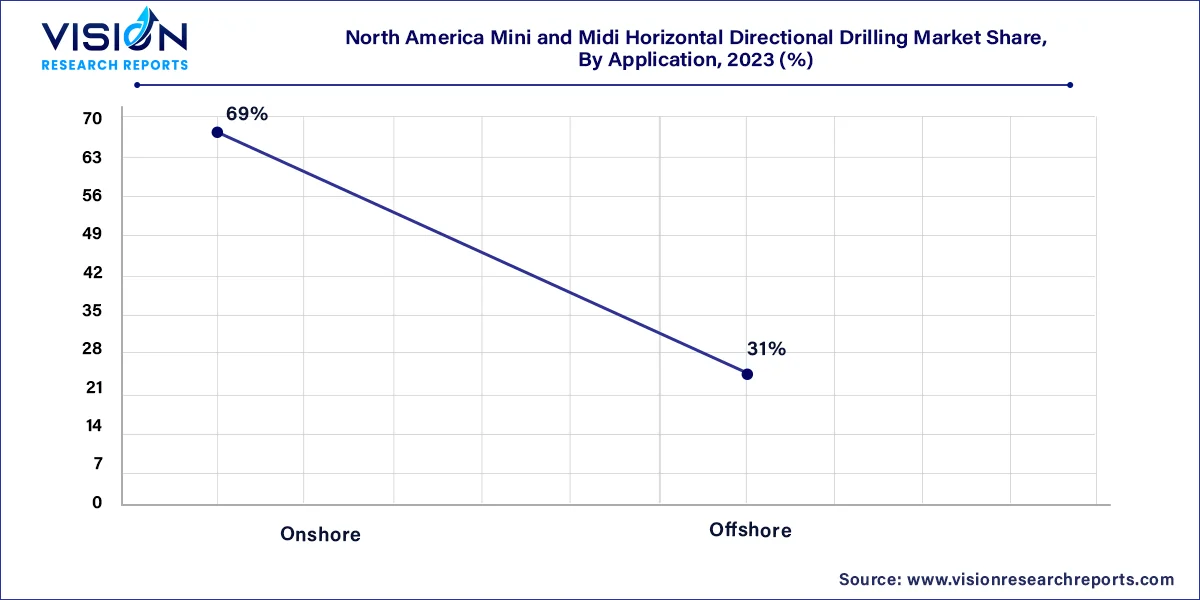

The offshore segment held the largest revenue share of 69% in 2023, owing to the increasing exploration and production of oil and gas from offshore fields. For sustainable development in the future, it is expected to drive the need for horizontal directional drilling. For instance, on May 1, 2023, QatarEnergy announced an expansion in its offshore oil exploration activities, which necessitated the demand for HDD machines in Canada in collaboration with Exxon Mobil Corporation.

Application of HDD machines for oil and gas exploration & production in onshore fields held the second largest share, as many E&P activities are being carried out in the onshore fields compared to that in offshore. The presence of extensive unconventional resources in onshore fields in North America is expected to boost the demand for HDD in the onshore segment.

By Machine Type

By Application

By Machine Size

By Parts Type

By Tooling

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. End-use Procurement Analysis

4.3.2. Sales and Distribution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America Mini And Midi Horizontal Directional Drilling Market

5.1. COVID-19 Landscape: North America Mini And Midi Horizontal Directional Drilling Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. North America Mini And Midi Horizontal Directional Drilling Market, By Machine Type

8.1. North America Mini And Midi Horizontal Directional Drilling Market, by Machine Type, 2024-2033

8.1.1. Utility Vibratory Plow

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Utility Tractor

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Pile Driver

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Pile Driver

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Boring Machine

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. North America Mini And Midi Horizontal Directional Drilling Market, By Application

9.1. North America Mini And Midi Horizontal Directional Drilling Market, by Application, 2024-2033

9.1.1. Onshore

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Offshore

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. North America Mini And Midi Horizontal Directional Drilling Market, By Machine Size

10.1. North America Mini And Midi Horizontal Directional Drilling Market, by Machine Size, 2024-2033

10.1.1. Mini

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Midi

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. North America Mini And Midi Horizontal Directional Drilling Market, By Parts Type

11.1. North America Mini And Midi Horizontal Directional Drilling Market, by Parts Type, 2024-2033

11.1.1. Rigs

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Pipes

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Bits

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Reamers

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. North America Mini And Midi Horizontal Directional Drilling Market, By Tooling

12.1. North America Mini And Midi Horizontal Directional Drilling Market, by Tooling, 2024-2033

12.1.1. Transition Rods

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. HDD Drill Rods

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. HDD Paddle Bits

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. HDD Drive Collars, Chucks, and Subs

12.1.4.1. Market Revenue and Forecast (2021-2033)

12.1.5. HDD Swivels & Pulling Equipment

12.1.5.1. Market Revenue and Forecast (2021-2033)

12.1.6. Others

12.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 13. North America Mini And Midi Horizontal Directional Drilling Market, By End-use

13.1. North America Mini And Midi Horizontal Directional Drilling Market, by End-use, 2024-2033

13.1.1. Oil & Gas Extraction

13.1.1.1. Market Revenue and Forecast (2021-2033)

13.1.2. Utility

13.1.2.1. Market Revenue and Forecast (2021-2033)

13.1.3. Telecommunication

13.1.3.1. Market Revenue and Forecast (2021-2033)

13.1.4. Others

13.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 14. North America Mini And Midi Horizontal Directional Drilling Market, Regional Estimates and Trend Forecast

14.1. North America

14.1.1. Market Revenue and Forecast, by Machine Type (2021-2033)

14.1.2. Market Revenue and Forecast, by Application (2021-2033)

14.1.3. Market Revenue and Forecast, by Machine Size (2021-2033)

14.1.4. Market Revenue and Forecast, by Parts Type (2021-2033)

14.1.5. Market Revenue and Forecast, by Tooling (2021-2033)

14.1.6. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 15. Company Profiles

15.1. Barbco, Inc.

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. Creighton Rock Drill Ltd.

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. Direct Horizontal Drilling, Inc.

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. Ellingson Companies

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. Ferguson Michiana Inc.

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. Horizontal Technology, Inc.

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. Inrock Drilling Systems, Incorporated

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. Kondex Corporation U.S.A.

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. Laney Directional Drilling Co.

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. Mccloskey International

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others